Every other player in Russia expects to increase impact fr om going digital in manufacturing, which indicates that the market for digital solutions has successfully adapted to the current geopolitical landscape. These were the conclusions of a study carried out by Yakov and Partners and Zyfra specifically for the business program of MiningWorld Russia 2024, a forum that brought together leaders of the mining industry.

Despite continuing restrictions, the number of respondents who reported a larger technology gap has decreased, and the number of those expecting Russia to become a global leader in digital technology has grown significantly.

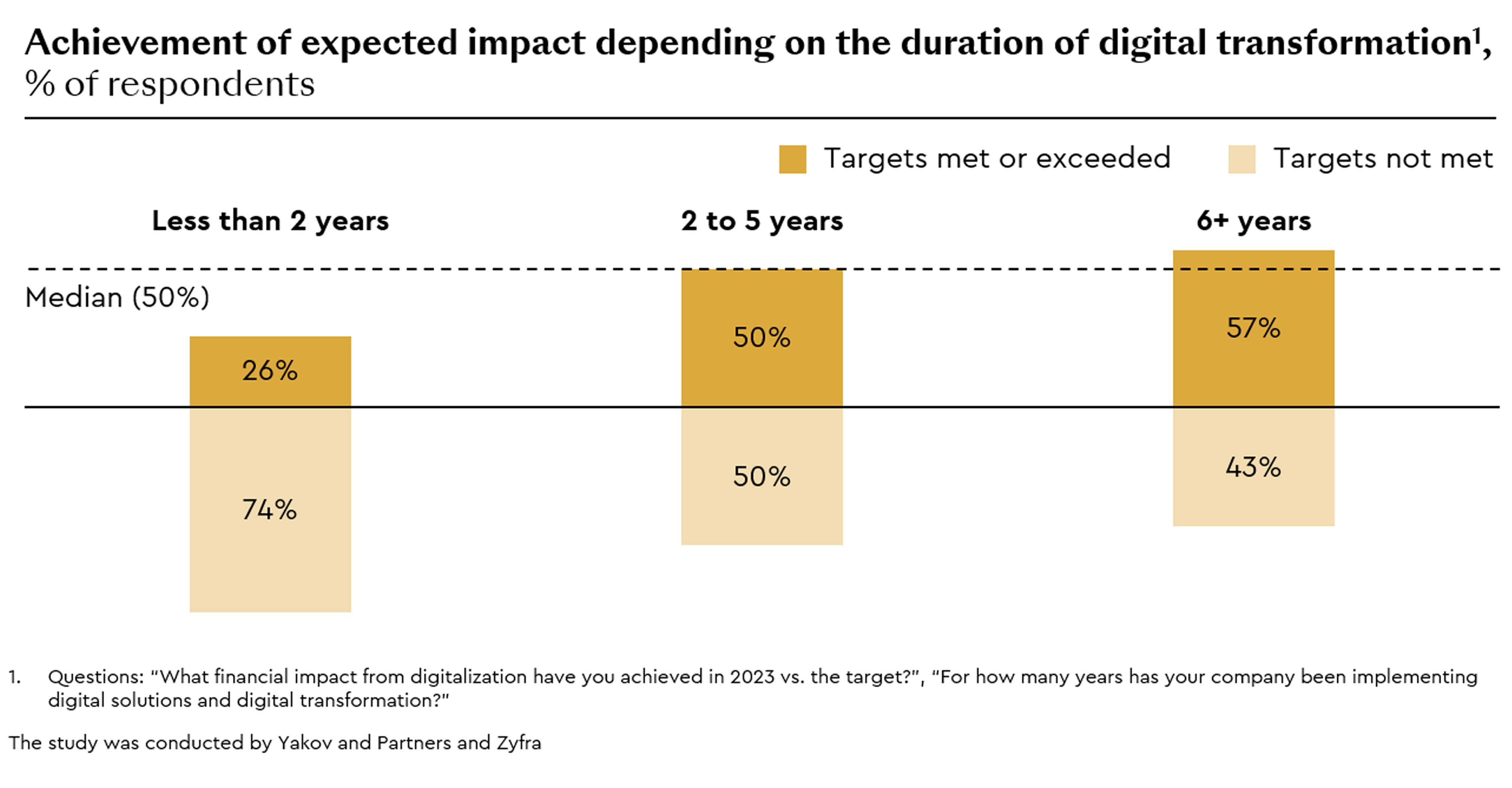

On average, every other respondent reported meeting its digitalization targets. However, authors of the study noted that IT projects implemented by companies with long-standing expertise in digitalization were twice as successful as those of first-timers.

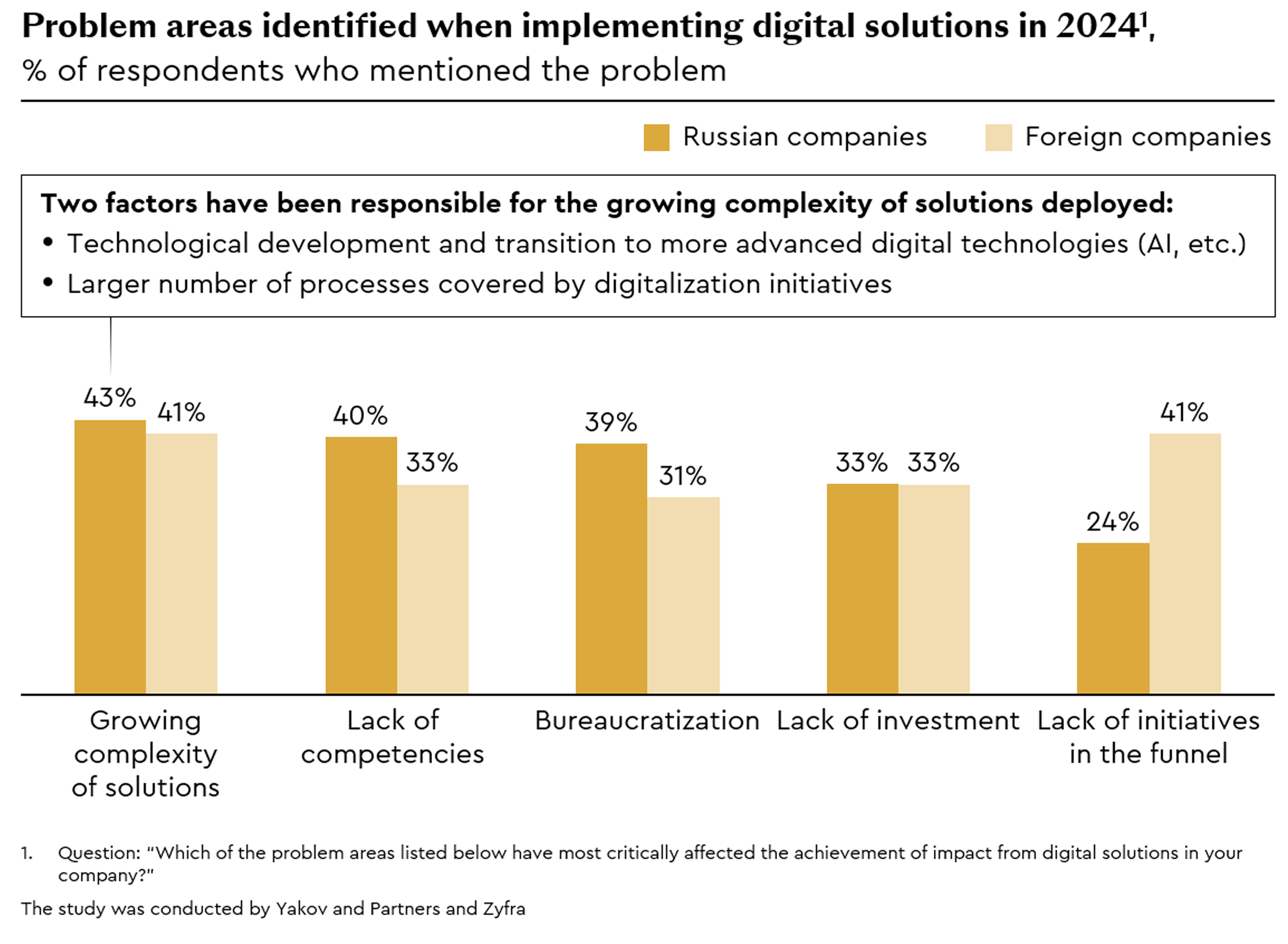

The key problem areas identified by the respondents were the growing complexity of solutions, lack of competencies, and red tape: bureaucratization is the domain wh ere Russian players are most seriously lagging behind the foreign benchmarks. Only a quarter of those surveyed complained about the lack of initiatives, while 41% of players in other countries said this was an issue.

Almost half of respondents said short-term initiatives in their key industrial operations have already been utilized to their maximum potential, citing this as one of the key reasons for a failure to meet their targets. Opportunities for improving performance can be seized by ensuring transition to long-term impact planning and including support functions in the implementation scope. For instance, digitalization projects in supply chain management, repair and maintenance, and corporate and commercial functions contribute 60 to 75% of the impact achieved by foreign companies, and in manufacturing they implement technologies with a long payback period. Also, Russian players should put a greater emphasis on building organizational flexibility, which requires a change in internal processes, and enhancing digital competencies, which have become even scarcer over the past year

Nikita Natrusov, Partner at Yakov and Partners

When putting digital technology to work, we’ve noticed that manufacturing execution systems are becoming a real trendsetter that shapes the future of the mining industry. Most major players have been successfully implementing basic communication, dispatch, and process automation systems. The next step is to digitalize more intelligent processes such as planning, tracking, geometallurgy, material balancing, etc. And that requires organizing transparent end-to-end processes across all industrial operations. This is wh ere more potential impact from digitalization is hidden. Now, we are actively working on solutions that will bring together all management processes of a mining project into a single system. Our efforts in this area are supported by the industry’s opinion, which is reflected in the findings of the study

Sergey Yemelchenkov, CEO of Zyfra

Many experts cite staff shortage and higher competition with technology companies as one of the reasons behind the complexity of the digitalization process. Respondents said searching for project managers, developers, and IT architects has become harder than last year.

Although digitalization in manufacturing will remain a number one priority for Russian players in the mid-term, companies have become more ambitious about the entire range of digital solutions and started to shift their focus to industrial safety and geology.

Despite the rapidly rising generative AI trend, GenAI has so far been used for big data organization, synthesis, and analytics only. According to those surveyed, there is a sense that expectations from GenAI are too high, but it does not mean that it should be ignored; some companies have set the goal of launching up to 15 pilot projects to study impact and accelerate cultural transformations.

The study is based on a series of interviews with top managers, as well as on the results of a survey of 130 respondents from 50 companies representing more than 50% of the Russian mining and metals market. Media support to the survey was provided by the Metal Supply and Sales Magazine.