Although coal remains as important as ever for the energy and metallurgical industries, the attitudes towards this fuel in the modern global economy are mixed. Developed countries are doing their best to find an alternative with a smaller carbon footprint:

- Energy industry players are actively developing renewable sources of energy (RES), as well as storage and redistribution technologies.

- In metallurgy, a carbon tax is being introduced, discouraging the use of metallurgical coal for blast furnace steelmaking.

Yet developing countries, including China and India, the world’s two most populous countries, are still heavily reliant on coal as the cheapest and most affordable source of energy. Interestingly, although China and India lead the way in fossil fuel consumption, both countries have set ambitious goals to increase the share of renewables in the energy mix.

In this review that comes second in a series of three studies, we analyzed the current state and prospects of the global coal industry through 2050, focusing on the markets of China, India, and the European Union (EU).

Global trends: each country chooses its own path

As with our previous study, «Coal Industry Overview: Prospects of the Russian Market Through 2050», we considered three scenarios when analyzing the development trends in the global coal market: Base case, Accelerated Transition, and Recession. Based on our estimates, the Base case scenario is deemed the most probable. Although all the forecasts featured in this study will be based on this scenario, the situation in the coal markets of China, India, and the EU will be markedly different.

China

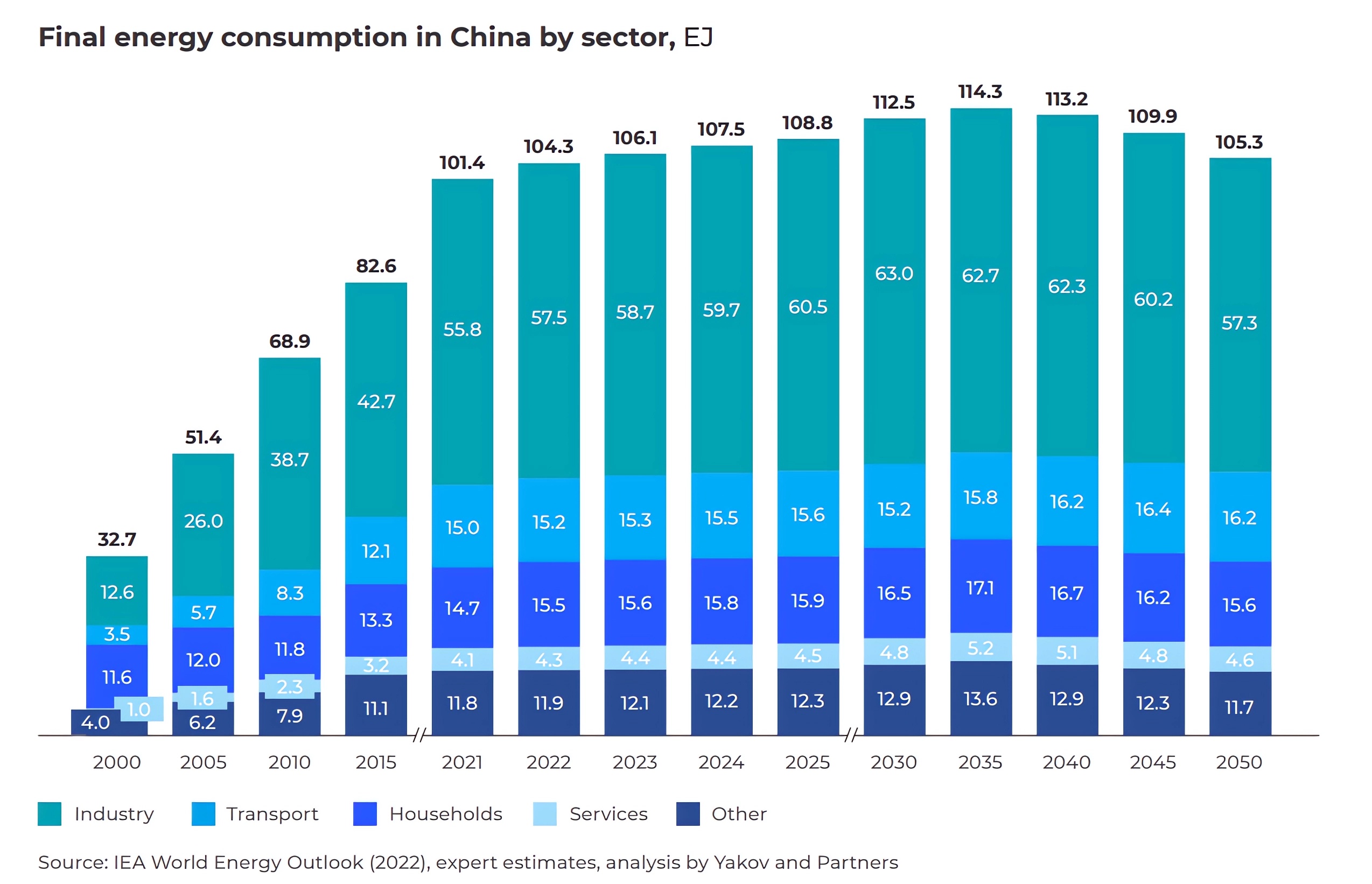

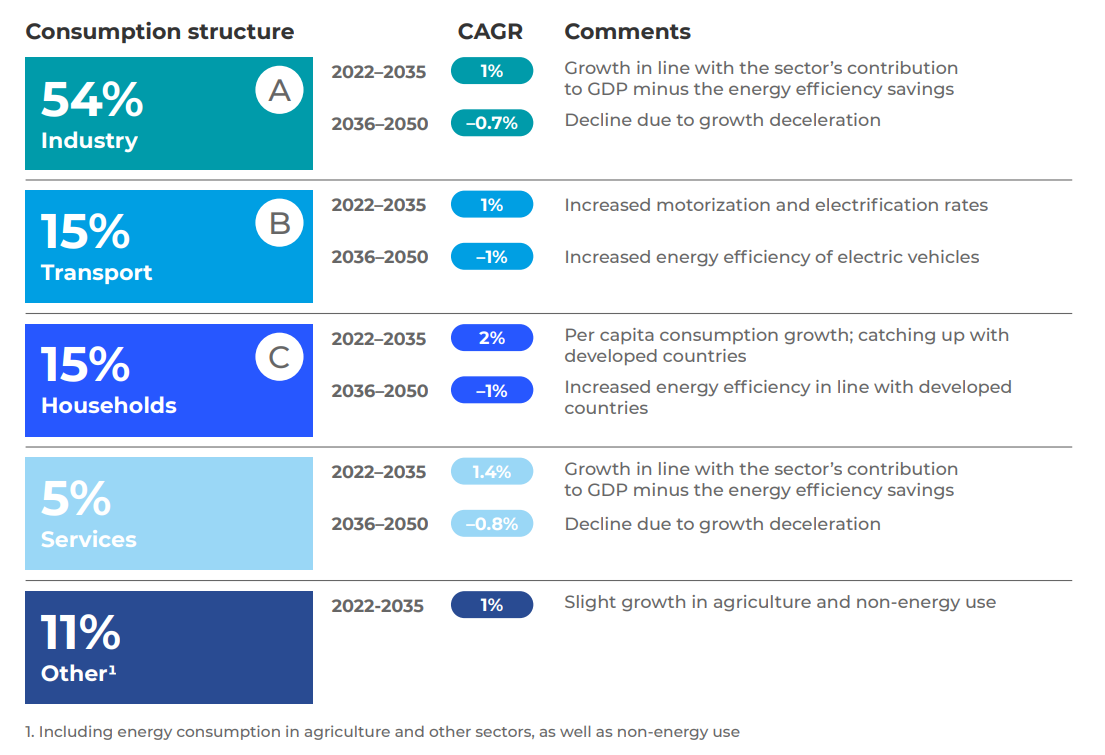

Consumption which determines the demand for thermal coal in China is expected to grow until 2035, i.e. until the country makes the transition fr om a developing to a developed economy. At its peak, final energy consumption will reach 114 exajoules (EJ).

From 2035 on, industrial consumption will start to decline, while the historical trend towards greater energy efficiency will continue. The share of the industrial sector in China’s GDP will drop from 33% to 24% by 2050.

Energy consumption in China is expected to peak at 114 EJ by 2035 and steadily decline afterwards

We estimate that China’s energy consumption in transport will increase from 15 to 16.2 EJ by 2050. This moderate growth can be explained by two trends:

- China will continue to ramp up its transport infrastructure, significantly increasing both the spread of railroads and freeways and the size of its transport fleet.

- Transport will become more energy efficient due to electrification, while the share of electric vehicles in China’s fleet will grow from 3% in 2022 to 40% by 2050.

Household consumption in China will keep growing until 2035, only to start declining afterwards and basically return to the 2023 levels. It should be mentioned that the Chinese population started to decline in 2022, and the negative trend will only intensify after 2035. However, this decline will be partially offset by an increase in per capita household consumption. By 2032–2033, it could rise to the current levels of Japan’s consumption, amounting to an annual 3,5 MWth per person.

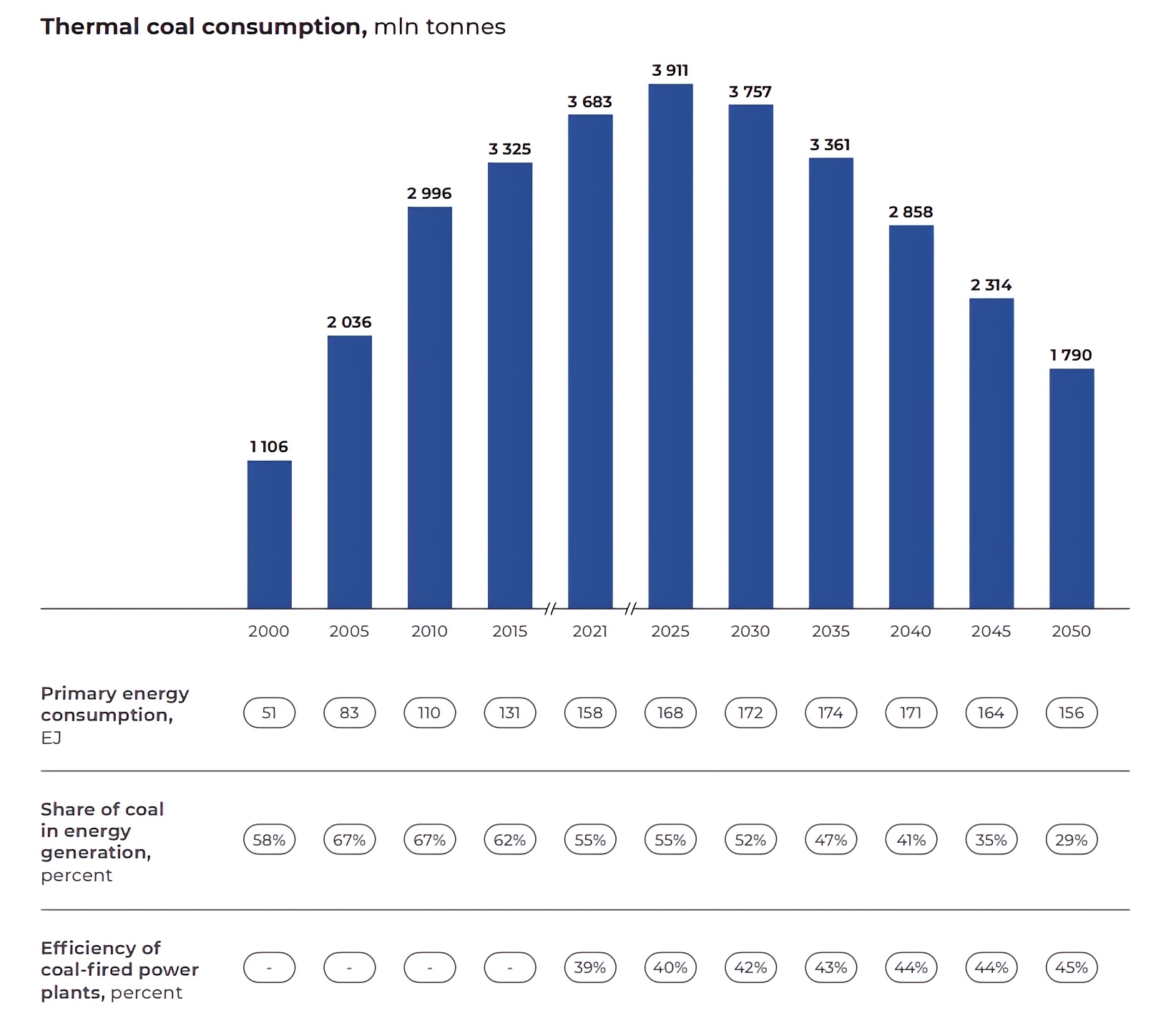

According to our estimates, thermal coal consumption in China will peak in 2025, which is much earlier than the peak of energy consumption projected for 2035.

The Chinese government set ambitious goals for transformation of the energy sector, including plans to boost renewable energy capacity by 50% (from 680 mln tonnes to 1 bn tonnes in coal equivalent) by 2025 and reduce the share of fossil fuels to 75% by 2030.

We expect that these targets will be achieved. China already accounts for about 33% of the global renewable generation and more than half of the global energy storage capacity. By 2050, the cost of electricity from renewable sources will drop below USD 40 per MWh, while the cost of coal-fired generation will range from USD 70 to 80 per MWth.

The limited commissioning of new coal-fired capacity in China is aimed at replacing the low-efficient «dirty» coal power plants that are to be retired. The installed coal-fired capacity is already approaching its half-way mark as the combined average age of such power plants stands at 13 years, while the average operating life is about 30 years (by comparison, the global average lifetime is 40 years). As a result, the contribution of coal to primary energy consumption will peak in 2025 and then begin to decline. By 2050, thermal coal consumption will fall by more than half compared to 2021 – to 1.79 bn tonnes. By the same time, the share of coal in the energy mix will also be almost twice as low, standing at 44 EJ.

Metallurgical coal consumption in China’s steel industry will come under pressure from falling demand for steel. It will start shrinking after 2025, mainly due to a declining demand for steel in housing and infrastructure construction. China’s construction sector will shrink by 2–4% after 2025–2030 on the back of declining population and urbanization rates. Other steel-consuming industries, e.g. machine building, automotive industry, etc., will continue to grow at a moderate pace. By 2050, the volume of steel production in the country will decrease by about 5%, to 982 mln tonnes.

Yet another important factor affecting coal consumption in China’s metals industry is the decreasing share of basic oxygen steelmaking (BOF) and wider use of electric arc furnaces (EAF). The share of BOF is expected to drop from 90% to 70% by 2050, while the share of EAF will grow from 10% to 30%. We should mention that, according to our forecast, the transition to «green» steel in China will not be as fast as presented in the findings of most international agencies. The rise of EAF technology will be limited by several factors, including lack of plans to introduce carbon tax (without this tax BOF production costs will not exceed EAF production costs long before 2050), insufficient volumes of scrap and the fact that China’s blast furnaces are relatively new (their average age stands at just 12 years). At the same time, according to our estimates, improved BOF efficiency will help reduce coal consumption in blast furnaces by 10% by 2030.

As a result, metallurgical coal consumption in China will keep declining by 1.2% each year and will fall by 30%, or 389 mln tonnes, by 2050.

Thus, by 2050 aggregate demand for both metallurgical and thermal coal in China will drop almost by half (to 2.18 bn tonnes) vs. the 2021 levels.

Despite this decline, these figures are still considerably higher than the existing forecasts by IEA and other international analytics agencies.

India

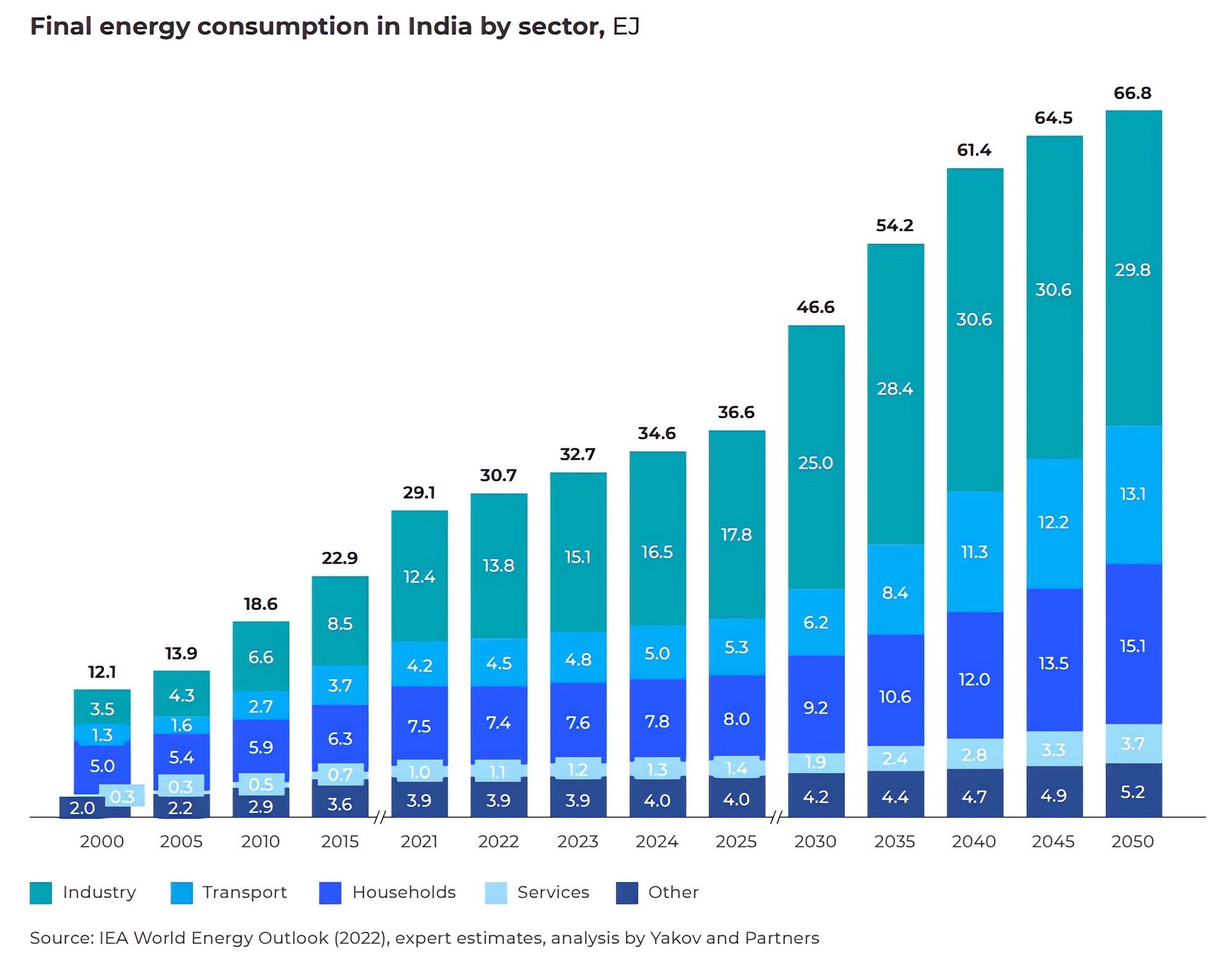

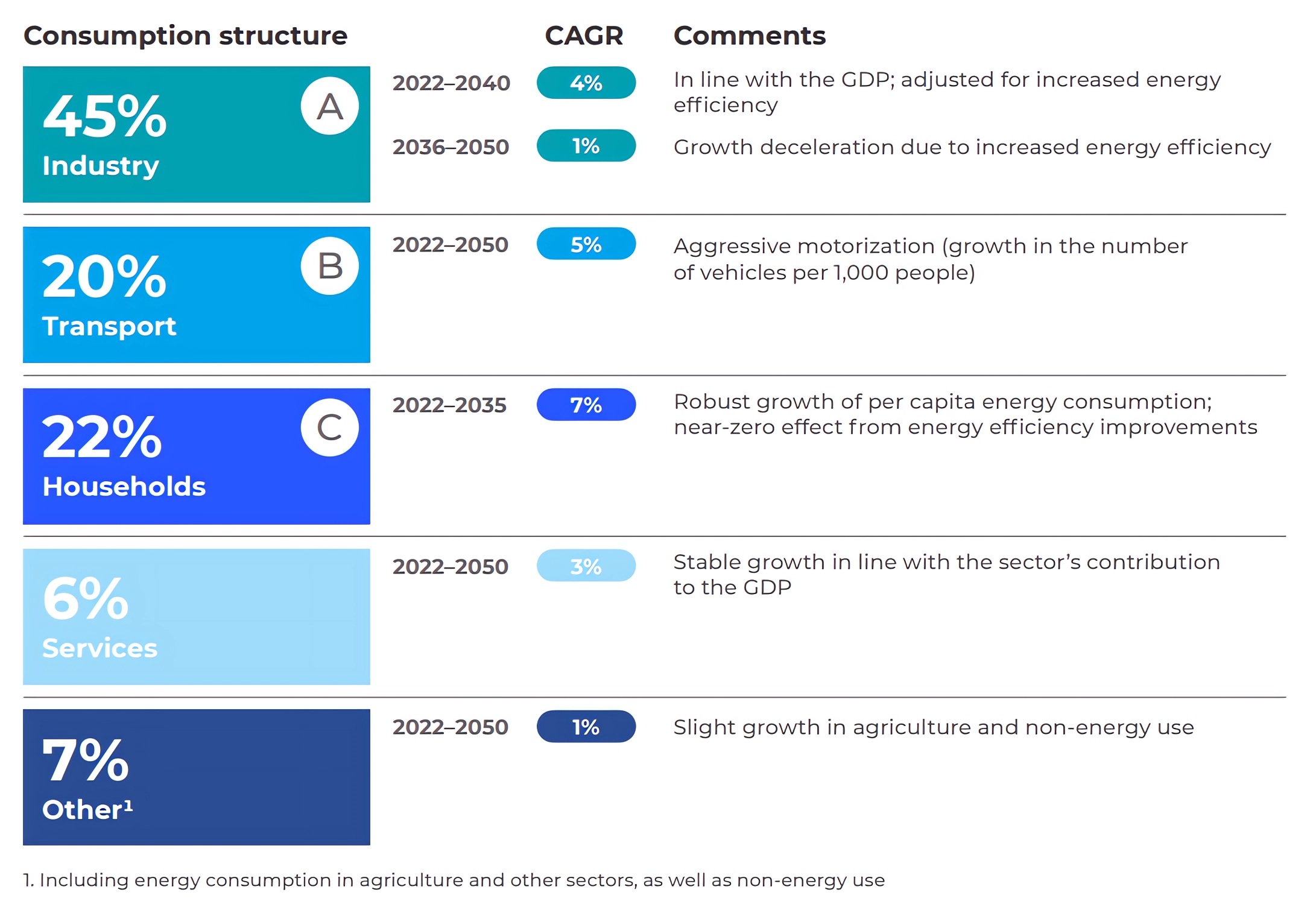

According to our estimates, final energy consumption in India will keep growing throughout the entire period under consideration and will reach 47 EJ (+52% vs. 2022) in 2030 and 67 EJ (+116% vs. 2022) in 2050. At the same time, the trend for a decline in industrial coal consumption will take shape in the late 2030s or early 2040s.

Energy consumption in the transport sector will grow throughout the entire period under consideration, up to 2050, driven by a continuous increase in the population and higher levels of motorization (an increase in the number of vehicles per capita).

The share of electric vehicles in India’s total fleet could rise to 40% by 2050, compared to 3% in 2022.

Household consumption will also continue to grow. In addition to the population numbers, higher standards of living will also contribute to the positive dynamics. But even with a 2% average annual increase in per capita energy consumption, India is unlikely to match China’s current level of consumption (or that of the developed economies of the Asia-Pacific Region) by 2050.

Final energy consumption in India will more than double by 2050 to reach 67 EJ

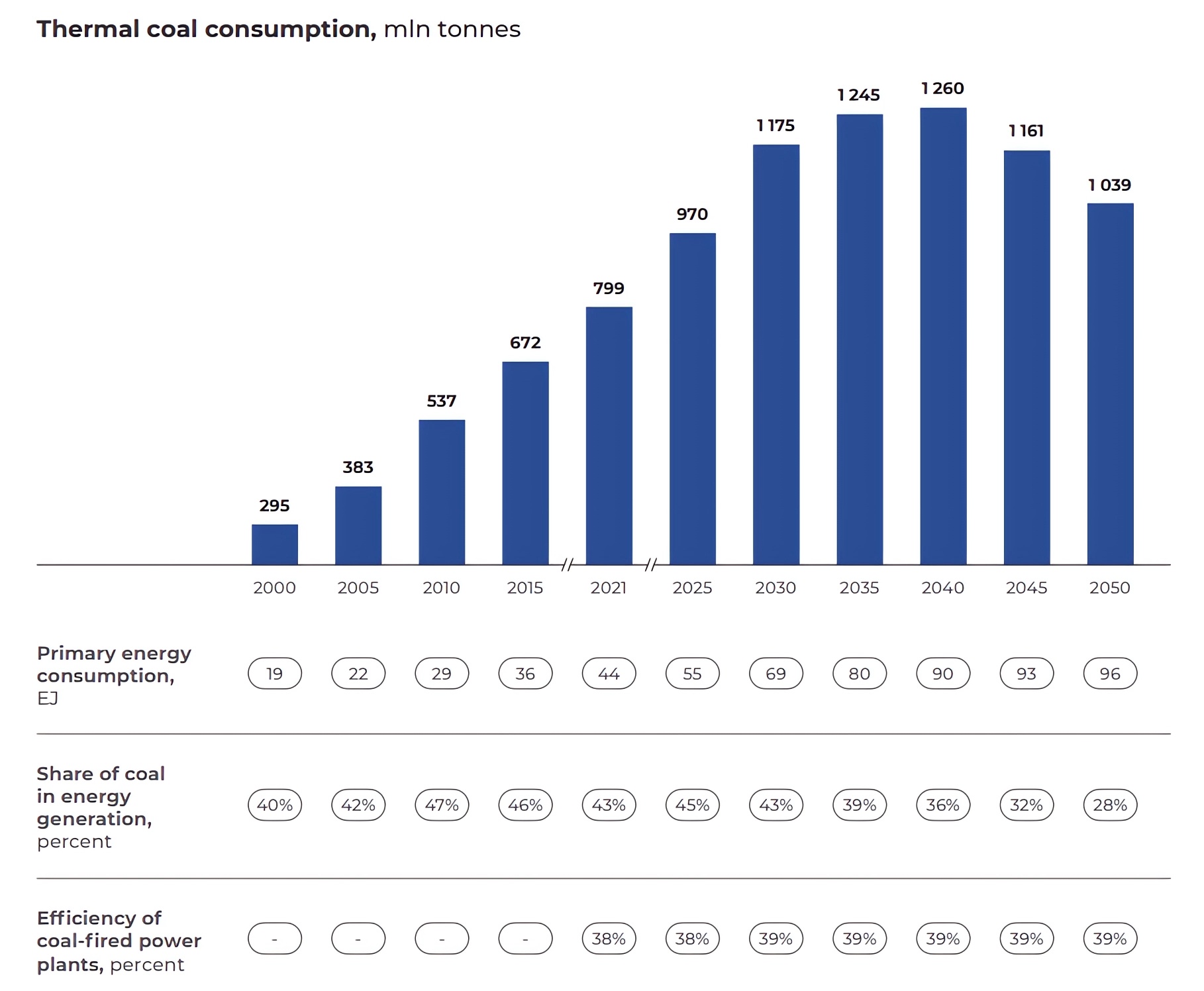

According to our forecasts, India’s thermal coal consumption will peak before 2040.

The Indian government has declared energy security – an uninterrupted supply of energy at favorable prices for consumers and suppliers – a priority. This explains the plans to increase coal-fired capacity by about 20% in the early 2030s: due to the low cost of generation, coal will remain a priority fuel during the most active period of growth of the Indian economy.

As in the case with China, coal’s contribution to India’s energy balance will peak much earlier than the country reaches its peak energy consumption. We expect the share of coal generation in the energy balance to drop to 28% by 2050 (vs. 45% in 2021).

This process will be accelerated by the gradual transition to renewables, which will become more prominent in India by 2040, driven by cheaper «green» technologies and a ramping-up of domestic production of the necessary components. To some extent, coal will be able to compete with renewables in terms of production costs, if the carbon prices remain at the level of about USD 15 per tonne. Although India has ambitious «green» energy goals (reducing CO2 emissions by a factor of 1.8 by 2030 and carbon neutrality by 2070; six times more powerful solar farms and 3.3 times more powerful wind farms by 2032), its efforts may fall short. As a result, according to our estimates, by 2050 India’s coal consumption will increase by 30% vs. 2021 and will reach 1.04 bn tonnes, peaking in 2040 at 1.26 bn tonnes (+58%).

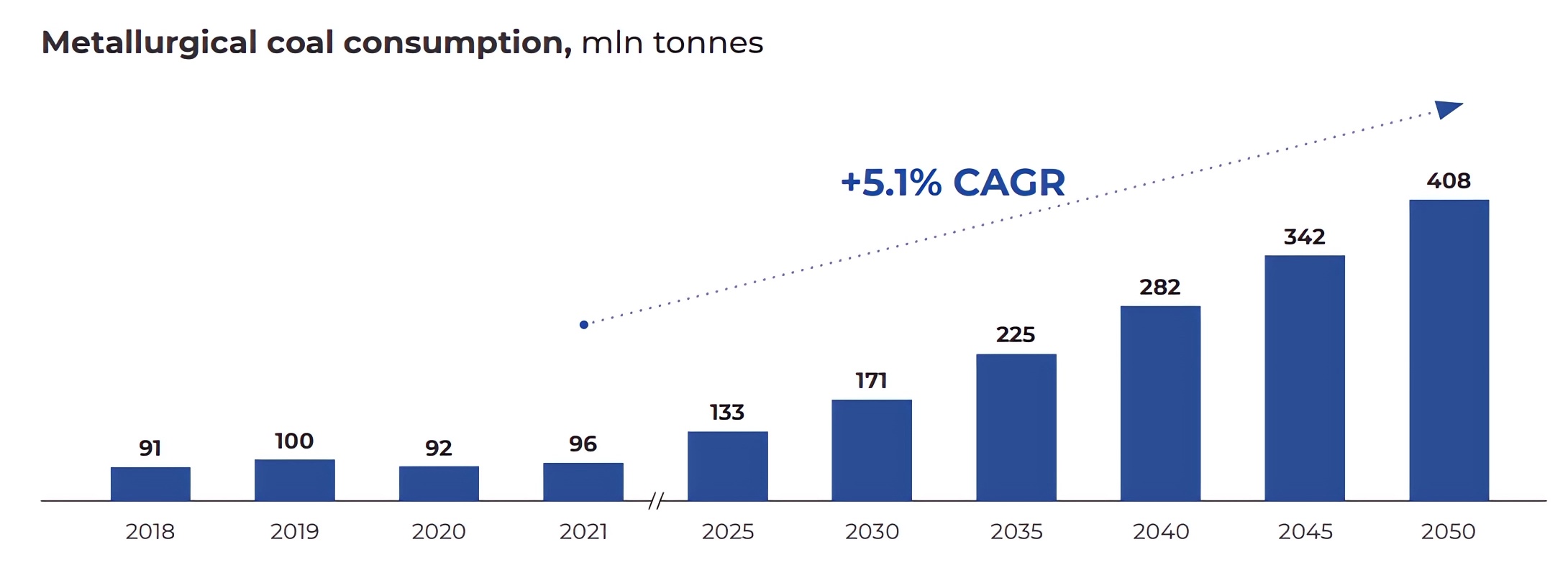

The dynamics of India’s metallurgical coal consumption between now and 2050 will largely depend on the domestic demand for steel. According to our estimates, it will grow rapidly, spurred mainly by a rise in infrastructure (+10% annually through 2030 and +5% annually through 2050) and construction projects (+7% and +3% respectively), which is expected due to high economic growth rates. The level of steel production will quadruple by 2050, to 470 mln tonnes per year.

Instead of declining, the share of BOF in Indian metallurgy is expected to grow from 45% to 55% by 2050 due to the commissioning of new blast furnaces. Fueled by the strong growth of demand, production capacity will have to be quickly ramped up, and the fastest and cheapest way to do so is to build new blast furnaces. Production costs in the BOF process will remain lower than those for EAF steel production until about 2040, providing the cost of carbon credits for CO2 emissions stays the same. Moreover, while India currently imports 8-10 mln tonnes of scrap each year, given the projected dynamics, in 10 years it could become self-sufficient.

As a result, consumption of metallurgical coal in India will more than quadruple by 2050 vs. 2021, to 408 mln tonnes per year.

India’s aggregate demand for thermal and metallurgical coal will grow 1.6 times by 2050 vs. 2021 to reach 1.45 bn tonnes.

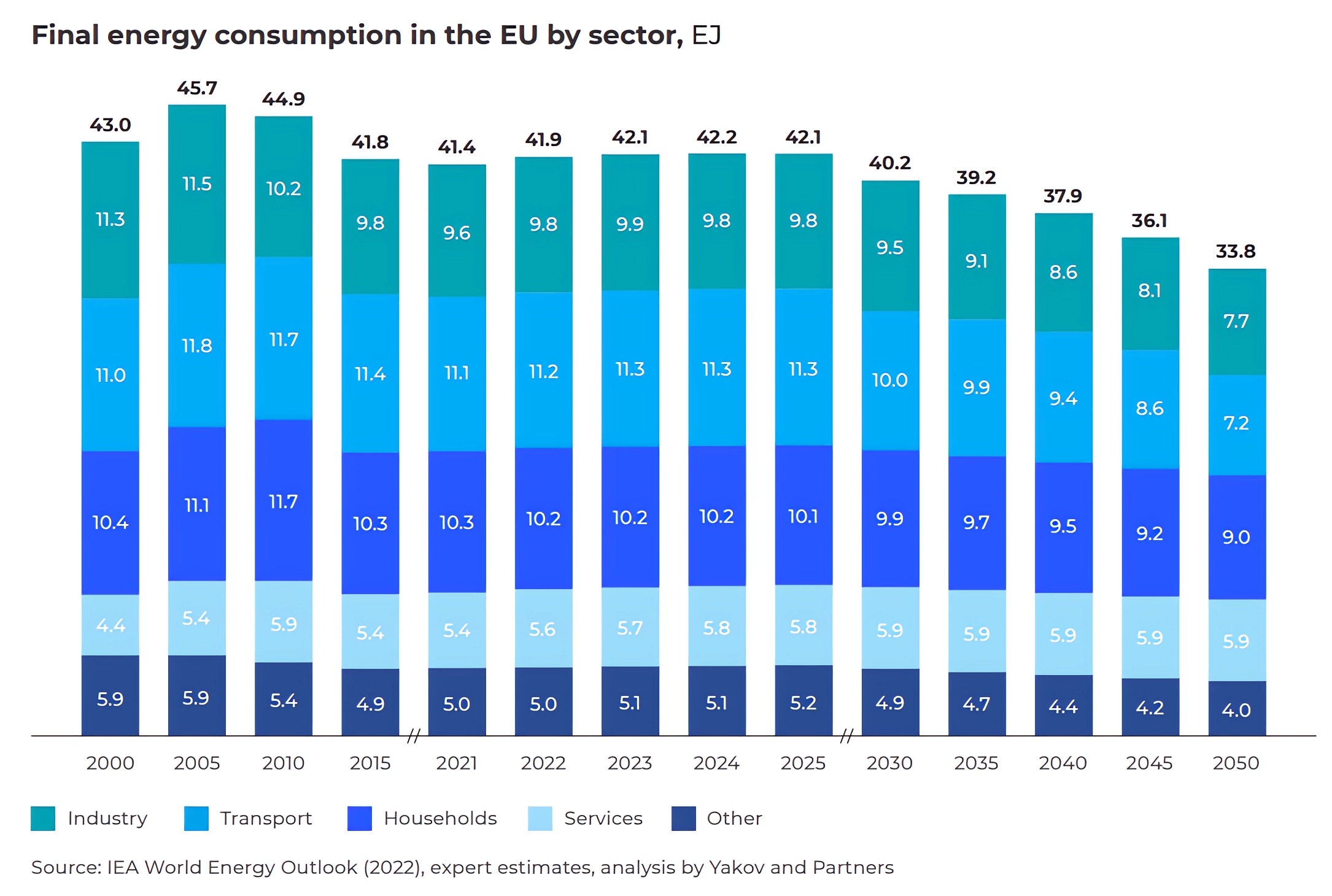

The EU

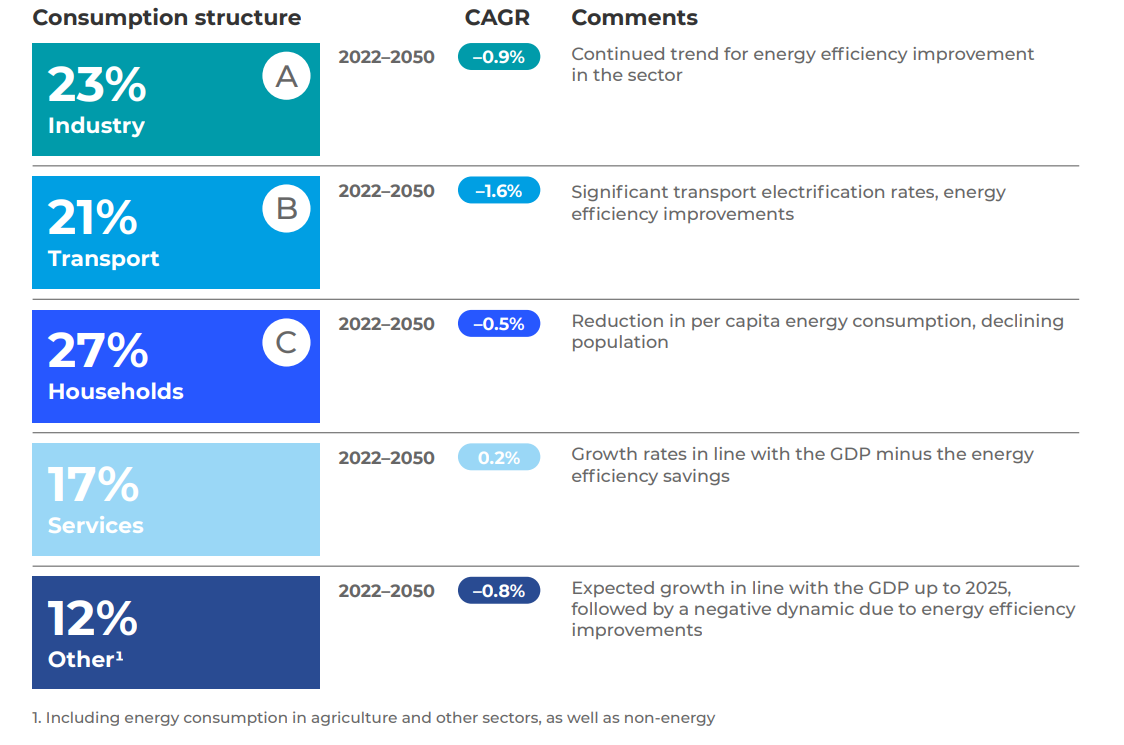

The forecast of energy consumption in the EU significantly differs from the forecasts for India and China. Final energy consumption will drop by 4% (compared to 2022), to 40 EJ, as soon as by 2030, and by 19% – to 34 EJ – by 2050.

If the energy efficiency trends hold, combined final energy consumption in the EU will drop to 33.8 EJ by 2050

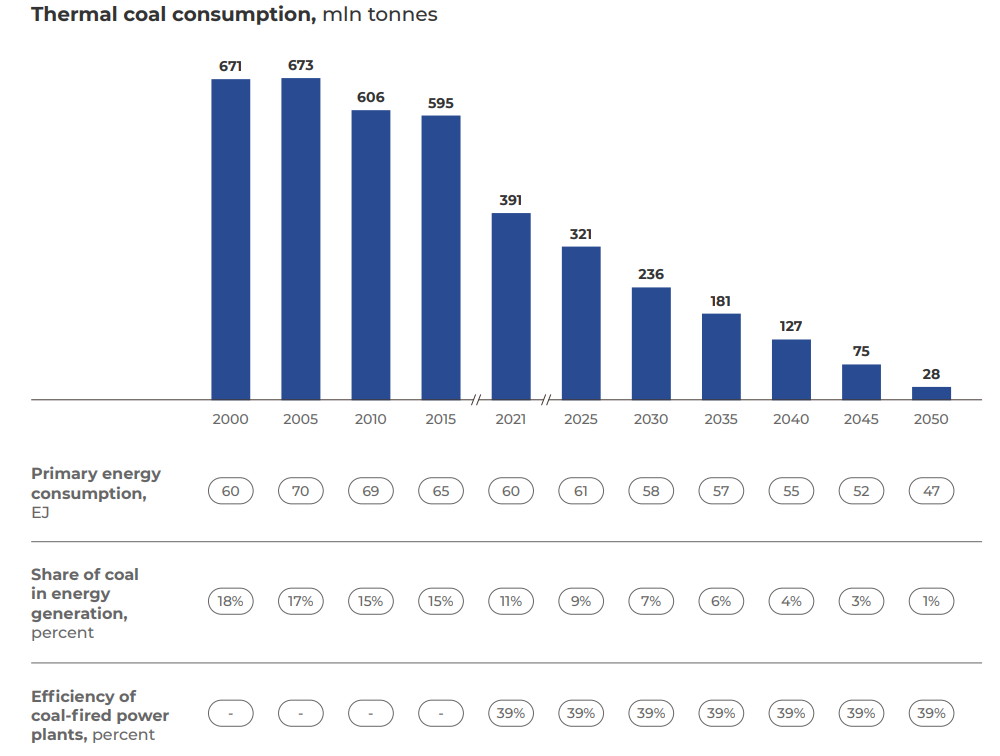

The use of coal in energy generation will be virtually non-existent as its share will drop from today’s 11% to just 1%.

The cost of renewable energy generation in the EU is already lower than that of traditional generation by an average of USD 50–60 / MWth. Meanwhile the rise in energy prices in Europe in 2021–2022 increased the push for carbon neutrality. The EU maintains plans for zero CO2 emissions by 2050. By now, 14 countries have introduced carbon tax (from USD 0.1 to 129.9 per tonne of CO2 equivalent); the carbon credits market has been operating since 2005, and a carbon border adjustment mechanism is to be introduced this year. Discussions are under way to increase the target share of renewable energy from 40% to 45% by 2030.

The plans to shut off Russian gas will slow down the pace of retiring coal power plants and reducing coal’s share in the energy mix.

Now the EU is discussing the possibility of a slower phase-out of coal (most member states previously planned to do so in 2023– 2038) and changing the target volumes of coal-fired generation from 168 to 273 TWh per year. In 2022, the governments of Germany, Austria, France, and the Netherlands announced plans to re-commission the previously mothballed coal-fired power plants. Therefore, coal consumption may even increase in the next 3-4 years.

However, this will not change the long-term agenda to abandon coal-fired generation in the EU, so after this short pause the decline will continue.

We estimate that should the stated goals on carbon emissions be achieved, by 2050 the demand for thermal coal in the EU will drop 14-fold, to 28 mln tonnes per year.

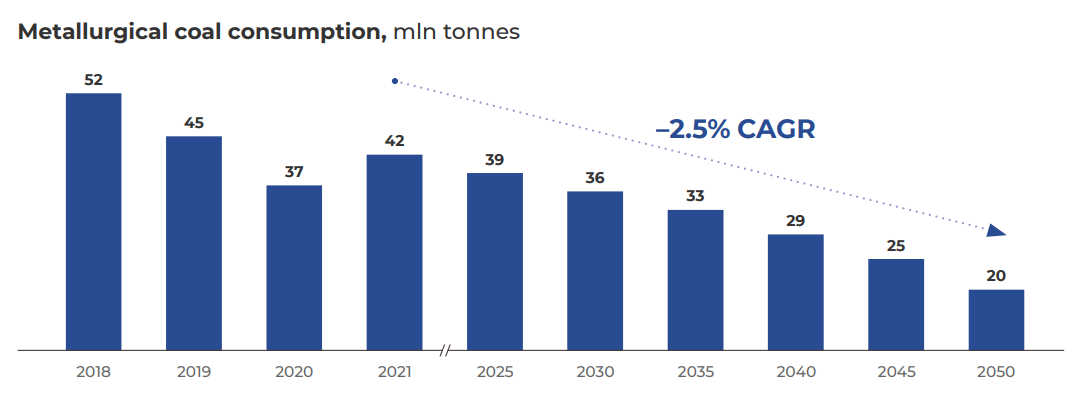

Production of steel in the EU will decrease by 16% by 2050 due to lower demand for steel in the automotive industry (-40%, a drop to 23 mln tonnes) and construction (-25%, a drop to 41 mln tonnes). Among the main drivers will be the introduction of lightweight technologies and the general reduction of the EU’s population.

The share of blast furnaces in steelmaking in the EU is expected to fall from today’s 56% to 25% by 2050. This rapid change will be mostly driven by the need to revamp production facilities, as most of the available furnaces will have to be replaced within the next 10–20 years. Besides, in those EU countries wh ere the carbon tax is high, BOF steel production already is significantly more expensive than EAF production. On average, the carbon tax in the EU stands at about USD 47 per tonne of CO2 equivalent, accounting for about 12% of the cost of steel.

As a result, annual consumption of metallurgical coal in the EU will fall by 52% by 2050, to 20 mln tonnes. Aggregate demand for thermal and metallurgical coal in the EU by 2050 will decrease 9 times vs. the 2021 levels, to 48 mln tonnes.

Other countries

In Japan, demand for thermal coal is expected to fall to 115 mln tonnes by 2030 and to 43 mln tonnes by 2050, which is three times as low as in 2021. Consumption of metallurgical coal during the same period will decrease by 28%, to 31 mln tonnes, due to lower demand for steel and a declining share of BOF in steelmaking. By 2050, total consumption of coal in the country will fall by 2.5 times, to 73 mln tonnes.

South Korea’s demand for thermal coal will drop to 76 mln tonnes by 2030, and to 16 mlntonnes by 2050, which is almost six times as low as the 2021 levels. Consumption of metallurgical coal in the country will drop by 28%, to 26 mln tonnes, on the back of a declining steel output and a lower share of BOF process. Total coal consumption in South Korea will be three times as low by 2050, standing at 42 mln tonnes.

In Indonesia, one of the major thermal coal suppliers, demand is projected to grow to 195 mln tonnes by 2030, then drop to 115 mln tonnes by 2050. The positive dynamics is underpinned by the rapid economic growth and the need for cheap energy, while the subsequent decline is due to the substitution resulting from the implementation of gasification programs and RES development. Consumption of metallurgical coal will increase to 14 mln tonnes (+40%) by 2030 and then to 32 mln tonnes (+220%) by 2050. By 2050, aggregate coal consumption will decrease by a mere 2% – to 147 mln tonnes.

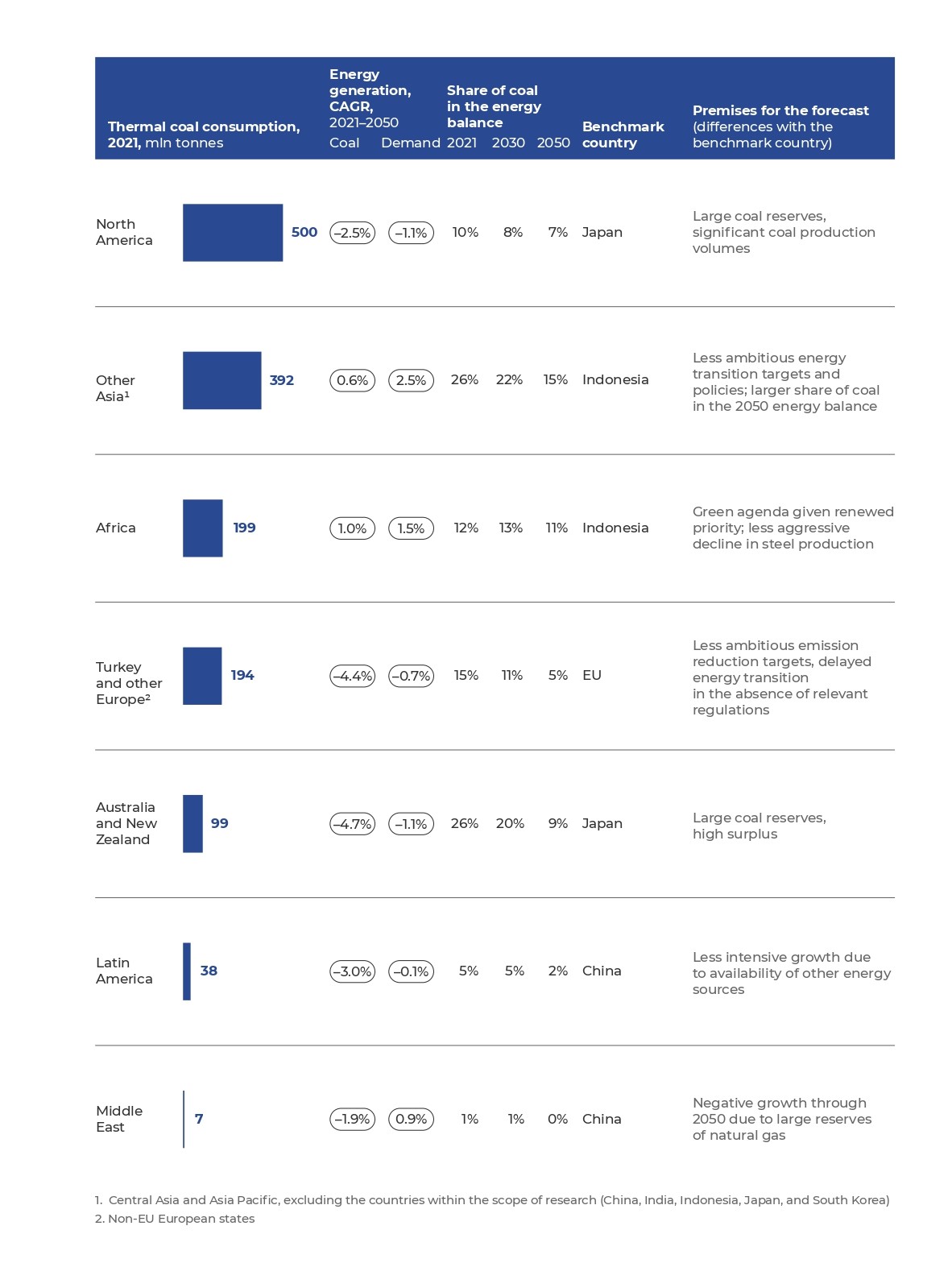

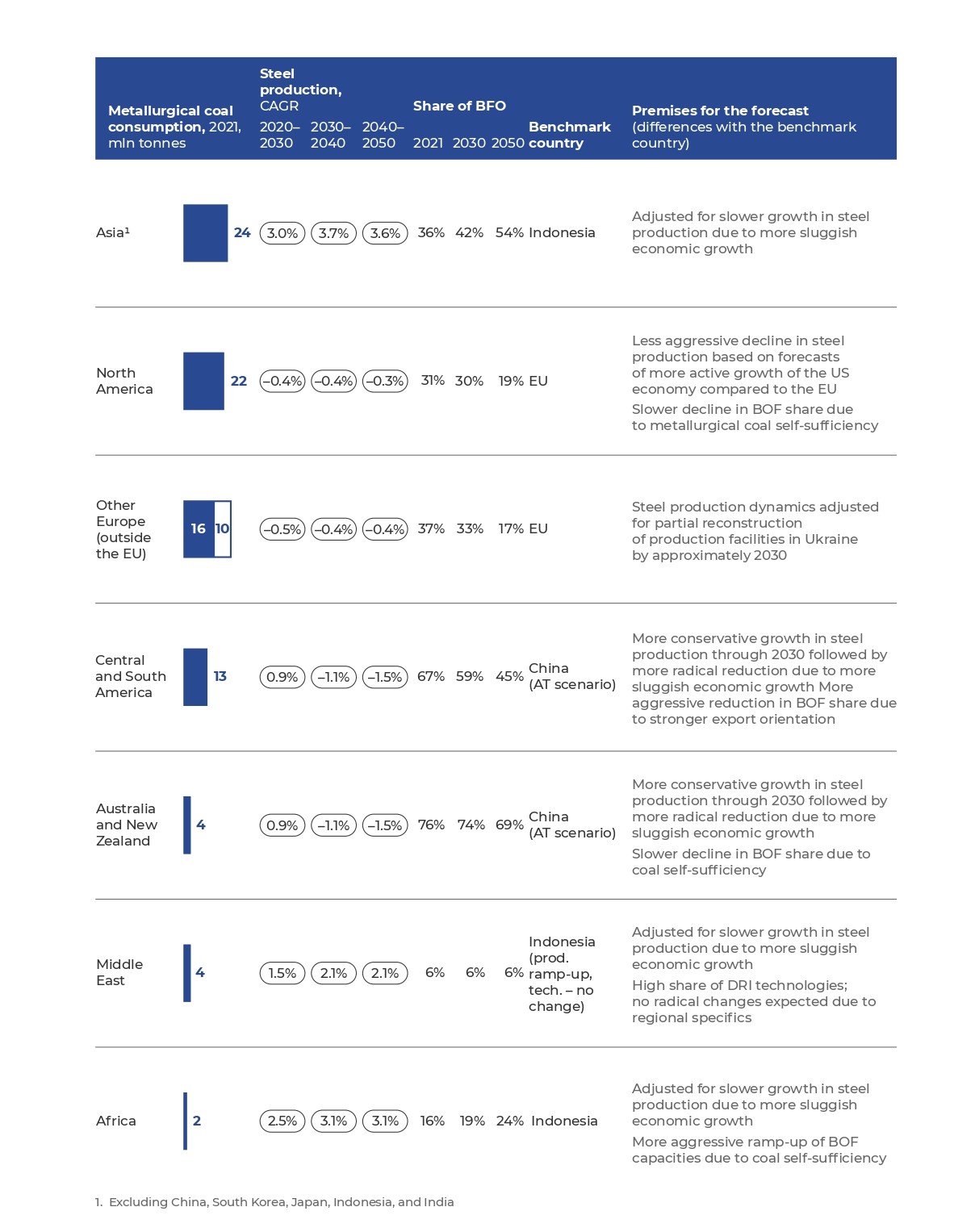

Demand for coal in other markets was estimated on the basis of analogy with the trends observed in the regions that can be considered similar in terms of economic growth.

Conclusion

To analyze the situation in the coal industry, we have built three development scenarios: Base Case, Accelerated Transition, and Recession

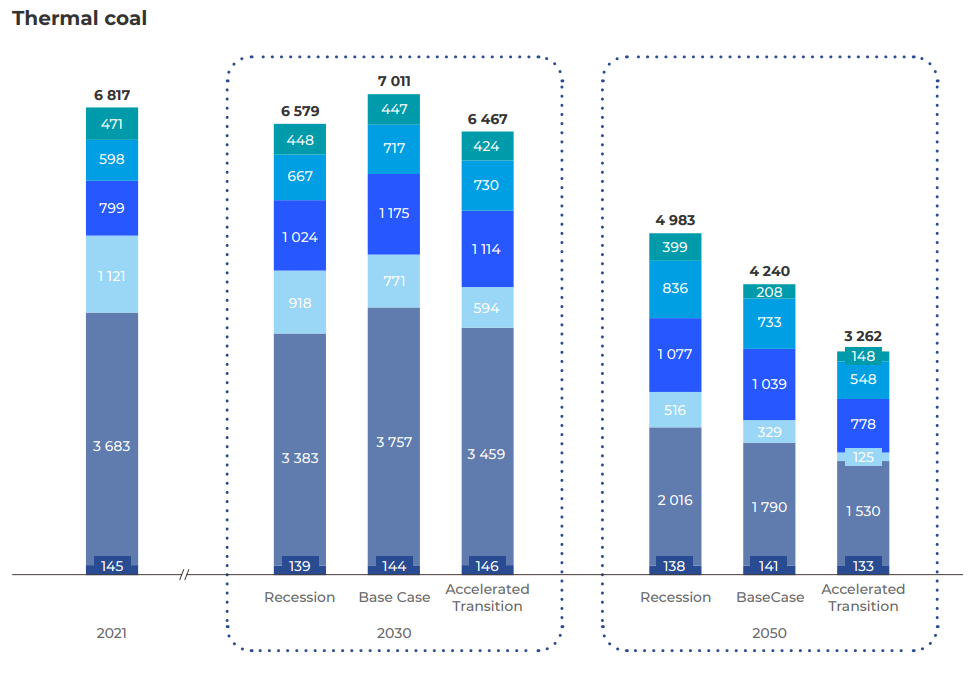

We estimate that under the Base Case scenario, global thermal coal consumption will grow by 3% by 2030, from 6.8 bn tonnes in 2021 to 7 bn tonnes. But by 2050, the trend will be reversed, and consumption will decrease by 38%, to 4.2 bn tonnes. Under the Accelerated Transition scenario demand will drop to 3.3 bn tonnes (-52% vs. 2021), under the Recession scenario it will drop to 5 bn tonnes (-27% vs. 2021).

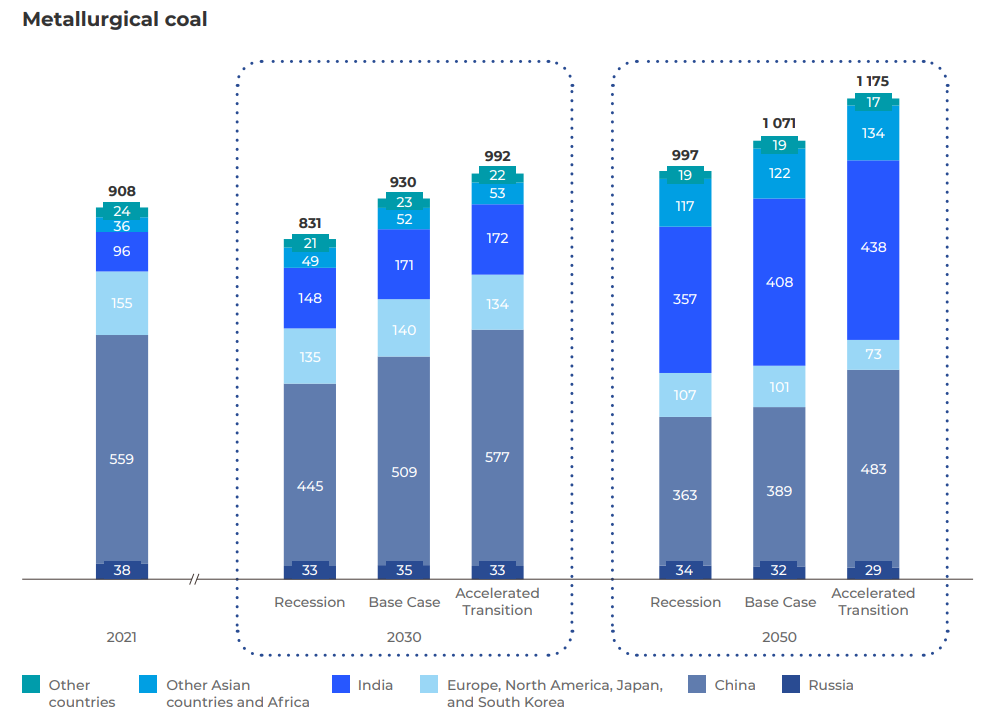

In contrast, global metallurgical coal consumption will keep growing under any scenario during the entire period under consideration, propelled by the active demand growth in India and other developing Asian regions. By 2050, it is projected to reach 1.1 bn tonnes (+18%) in the Base Case scenario, 1 bn tonnes (+10%) in the Recession scenario, and 1.2 bn tonnes (+29%) in the Accelerated Transition scenario.

We estimate that aggregate demand for thermal and metallurgical coal will increase by 3% (to 7.9 bn tonnes) by 2030, only to fall by almost a third (to 5.3 bn tonnes) by 2050.

Growth in demand for coal will be observed mostly in the rapidly growing economies of India and other developing countries in Asia (mainly in Asia-Pacific) and Africa. China will demonstrate the most significant decline in coal consumption, followed by the EU, North America, and developed Asian-Pacific nations.

The dynamics of coal demand under the less probable Accelerated Transition and Recession scenarios are shown below.

Conclusion

Our forecasts diverge from the widely accepted estimates provided, for example, by the IEA or BP (Energy Outlook). Our Accelerated Transition scenario is the closest to the estimates of these organizations, yet even under this scenario, coal consumption will peak later and then decline more slowly. To put this into perspective, the IEA predicts a downward trend in consumption to emerge around 2025, while according to our estimates that will not happen until late 2020s or early 2030s.

It should be noted that in the current environment this scenario does not look like the most probable one. Under the Base Case scenario, in 2030 and 2050 coal consumption will be higher than in the conservative forecast of the IEA Stated Policies by almost 1 bn and 0.5 bn tonnes, respectively.

This could be attributed to the fact that the forecasts of international agencies tend to be motivational in nature. We, by contrast, focused primarily on detailed projections for individual countries and their own plans for meeting energy needs, sustaining economic growth, and attaining social goals. We «adjusted» these plans based on our assessment of their feasibility. Thus, we believe the results of the analysis presented here show a more substantiated view of future coal consumption.