Seventy-five percent of respondents fr om Russian companies indicated that their digitalization budgets for 2022‒2023 will be either maintained or expanded, despite the sanction pressure, while some companies have embarked on in-house software development for critical functions. These are the insights of analysts from Yakov & Partners and Zyfra Group based on the findings of the study prepared specifically for the MiningWorld Russia conference attendees.

Now and in the next three to four years, for Russian companies production is a key focus area in which to implement digital solutions. More than 70% of the survey respondents are implementing various projects in this area. Geology and maintenance rank second and third, respectively. At the same time, only every fourth respondent mentioned digital projects in procurement and logistics, wh ere the impact can reach 4% of EBITDA, based on the experience of Western companies.

"The most popular solutions are those representing the most mature technologies with a proven track record. Among them are, for example, control systems for mining and conveyor equipment. Yet, less than 20% of study participants are investing in such disruptive technologies as autonomous driving, 3D printing, robotics, AR/VR, digital warehouse and business process robotization. Very often their benefits are not so evident in early stages, but there is little doubt that in the long term such solutions as autonomous driving may become the most effective tool for developing hard-to-reach deposits, and AR/VR technologies will eventually be more actively used for simulating production processes and personnel training" says Sergei Emelchenkov, CEO of Zyfra Group and a co-author of the report.

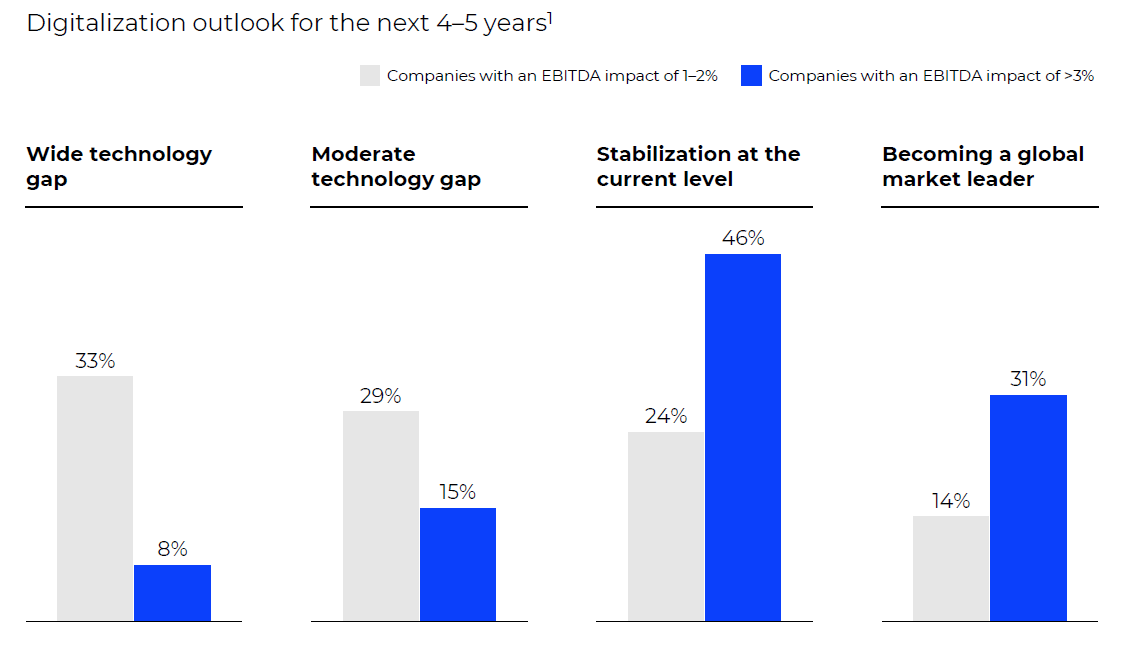

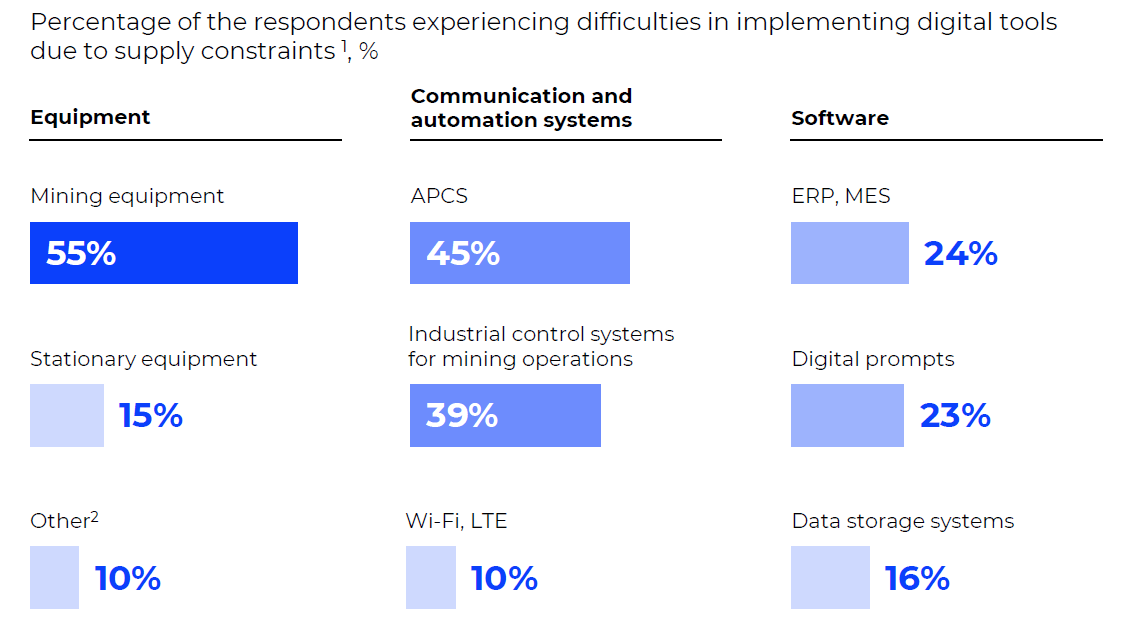

More than half of the respondents expect that a technology gap with companies from unfriendly countries will emerge in 4 to 5 years. At the same time, respondents from companies with a >3% EBITDA impact from digitalization, on the contrary, expect that the situation will stabilize at the current level (46%) or that they will even become a global market leader (31%). The most serious challenge for domestic producers was the departure of Western vendors of mining equipment (and embedded systems), with Russian companies having replaced or intending to replace other types of equipment, communication systems, and software in the near future.

"Roughly one in two study participants plans to switch to Russian solutions or equivalents from friendly countries in the next 2 to 3 years, and a quarter plans to start developing their own solutions. Given these efforts, as well as the fact that most high-impact, low-cost projects have already been implemented, most market players are building up their portfolios of digitalization initiatives, budgets, and staffing levels. Representatives of companies with a high impact of digitalization on EBITDA have invested more than others in their in-house digital teams. This suggests that successful companies rely on the development of internal capabilities. For example, as many as 46% of the respondents indicated having either an in-house development or competence center for implementation and support" says Nikita Natrusov, a Partner at Yakov & Partners.

According to Sergey Emelchenkov, reliance on the development of in-house teams and products may not bring the desired effects for mining companies, because, firstly, clean-sheet development of some solutions requires significant investment, and also carries risks, including those associated with a change of team and lack of necessary expertise within the team in charge of project implementation. Moreover, such solutions, as practice shows, do not go to market, which means they do not contribute to the development of Russian industrial software. The use of existing Russian software products or the industry’s collaboration with leading development companies to create new solutions appears to be the most efficient approach.

The mining industry has not been spared from the talent issue either. Sixty-three percent of the respondents experience a shortage of human resources for digital projects, which is on a par with the overall situation nationally and across industries.

At the same time, as the study authors point out, companies do not have to be pioneers to achieve a significant economic impact from digitalization, with the quality of project implementation and ambition being of greater importance. "Seventy-five percent of the respondents from companies with an EBITDA impact of 3‒5% and half of the respondents from companies with an impact of more than 5% were not the first to implement digital initiatives, but they quickly built up their capabilities. One in five respondents indicated that their employer achieved a 5% or higher EBITDA impact through focus, a balanced approach to project selection, and a commitment to building in-house capabilities. Nevertheless, it should be noted that only 15% of study participants aim to increase the level of ambition vs. the impact already achieved by digitalization. "We know from the experience of Western companies that high ambition and a willingness to take risks are fundamental to success. According to our estimates, more aggressive targets for companies with a turnover of circa RUB 100 bn can potentially generate an incremental EBITDA of RUB 1 to 3 bn, and RUB 6 to10 bn for companies with a turnover of RUB 500+ bn," summarizes Ilya Sadardinov, a Partner at Yakov & Partners.