Russia’s retail media market to triple and reach a record-breaking RUB 900 billion by 2029.

By this time, the country will be able to consolidate its global retail media leadership, staying ahead of Europe and the US in the segment’s share of the advertising market and second only to China.

Yakov and Partners experts together with analysts from Retail Rocket Group and Yandex have looked into the present and future of retailers’ advertising capabilities in Russia. According to the study “From shelf to screen: retail media market in Russia,” the industry is experiencing rapid growth: in 2024, it accounted for over 20% of the total advertising market, which is 6 p.p. above the global average.

According to the experts, when analyzing retail media, one should look at all players offering products and services on their platforms, both online and offline, while facilitating outreach- and performance-based promotion on proprietary and partner platforms through unique inventory and digital technologies, enhanced by big data insights. Thus, retail media platforms may include online marketplaces, e-commerce venues, traditional retailers with both online and offline presence, service providers, aggregators, and classifieds. However, cobranding formats in third-party channels (TV, outdoor advertising, etc.), and marketing services (e.g., placements on retail data on third-party platforms) should be excluded from the scope.

“Over the past five years, the retail media market in Russia with retail platforms offering their digital advertising services has surged by 300 times, hitting a record-breaking RUB 300 billion in 2024. According to our estimates, the Russian retail media market will continue to steadily grow, and its volume could triple again by 2029, reaching RUB 900 billion"

Denis Dovganich, Partner at Yakov and Partners

One of the key market growth drivers were shifting consumer behaviors. The COVID-19 pandemic catalyzed the transition to online media consumption, and internet shopping became one of the digital leisure activities rather than simply being a convenient way of buying things. The changes also affected the advertising market: the exodus of international media companies produced a shift in budgets from foreign to Russian platforms, and the shortage of advertising inventory fueled an increase in retail media share from 5% in 2022 to 20% in 2024. As the profitability rates of traditional retail continued to decline, retail media became one of the most effective monetization tools with a net margin of up to 90%.

About two-thirds of traditional retailers in Russia have already implemented retail media technologies and are receiving an income from them. Also, a quarter of players plan to invest substantially in the segment in the upcoming years, as evidenced by surveys conducted by Yakov and Partners. Specialist retailers expect their retail media earnings to double over the next five years, while the retail media share may reach about 5% of their GMV.

Experts believe that in this context, it is highly likely that Russia will be able to consolidate its global retail media leadership, staying ahead of Europe and the US and second only to China, wh ere the retail media share may reach 40% by 2029. To put that into perspective, its share in Russia could soar to 30% within the next five years.

One of the key trends in the upcoming years is small and niche players merging into multi-retail platforms and using third-party technology to launch their own retail media platforms. Although the retail media revenue share earned by retailers using third-party solutions in Russia remains below 5%, it keeps growing quickly as new players come aboard and expand their presence: more than 20 retailers sealed partnerships with external retail media networks (RMN) and tech platforms for retail media development in 2024.

“For retailers, retail media effectiveness directly depends on how deeply technology and data are integrated with advertising platforms. First-party data analysis, AI analytics, and machine learning make it possible to improve targeting precision, automate advertising purchasing, personalize customer communications, and optimize budgets in real time. Those who are able to create a scalable ecosystem with one-stop-shop campaign management capabilities, transparent analytics, and predictive performance models will take the lead in the market”

Pavel Mysin, CEO of Retail Rocket Group

Online marketplaces will remain the key retail media segment, although in Russia their share (currently standing at 96%) will be declining in the next five years until it matches that of leading nations (79%–92%). In contrast, food retail holds significant growth potential, experts say.

“Yet, despite their size, even major online marketplaces have yet to fully tap into the retail media potential: its share in Russian players’ GMV stands at 3.1%, compared to 7% for their international counterparts”

Maksim Bolotskikh, Partner at Yakov and Partners

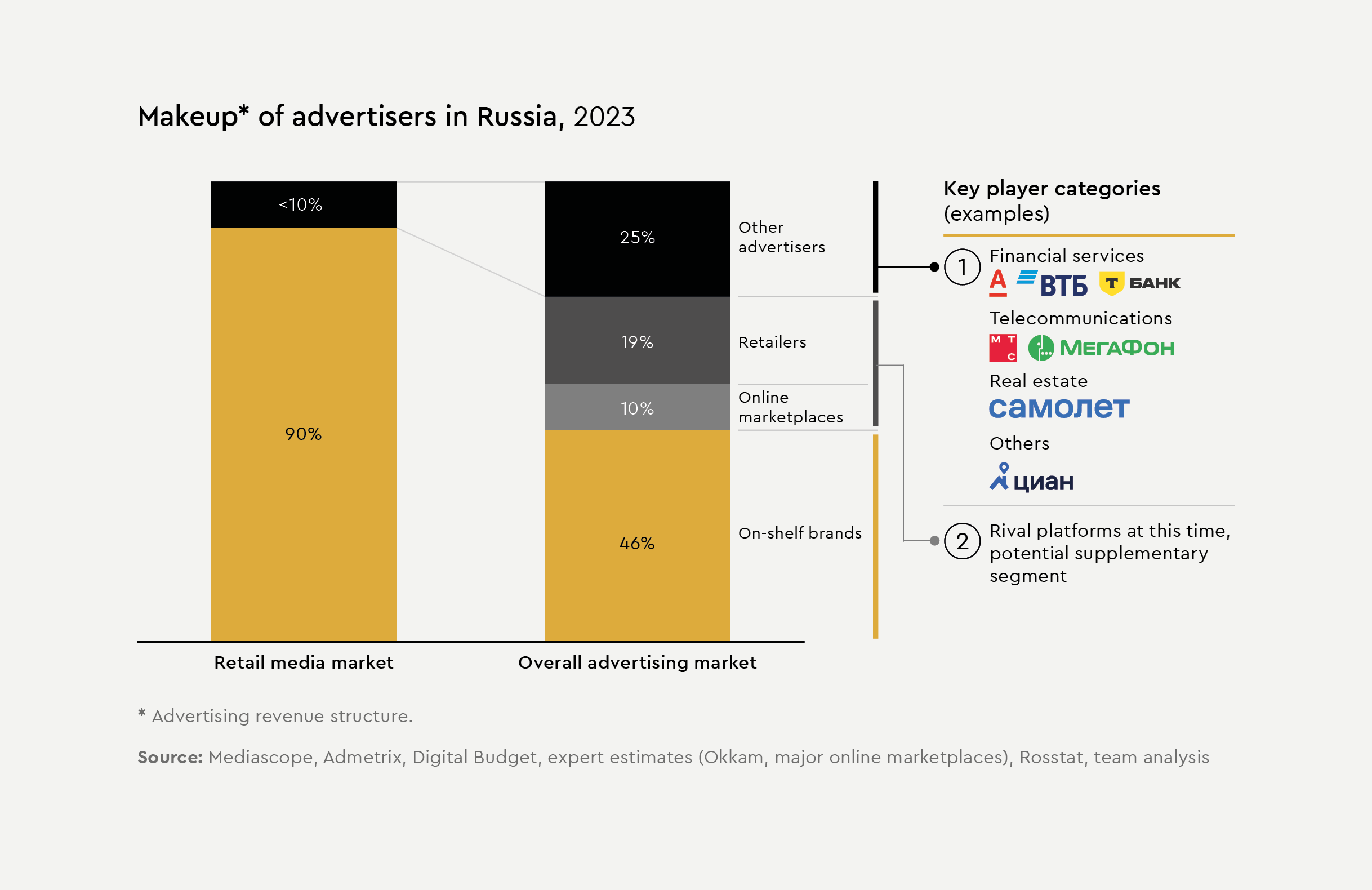

Retailers can achieve growth by attracting new advertisers and refining their offerings. Currently, 90% of advertisers are brands on shelves, which represent only half of the total advertising market. Attracting technology and service companies, which currently account for a quarter of the advertising market, may become an important growth driver.

The key areas of development include integrating on-site, off-site, and in-store inventory for transparent performance measurement, deploying advanced AI- and ML-driven analytics to boost targeting accuracy, and creating platforms with one-stop-shop campaign management capabilities.

“The retail media market will be rapidly growing largely due to traditional and online retailers specializing in premium inventory and omnichannel solutions and able to leverage data for precision targeting. Success of this segment will hinge on companies’ willingness to invest in technology, collaborate with tech platforms, swiftly adapt to changes, and offer advertisers the most user-friendly and effective promotion tools and advanced analytics”

Yulia Lazareva, Head of Strategic E-Commerce Partnerships at Yandex Ads