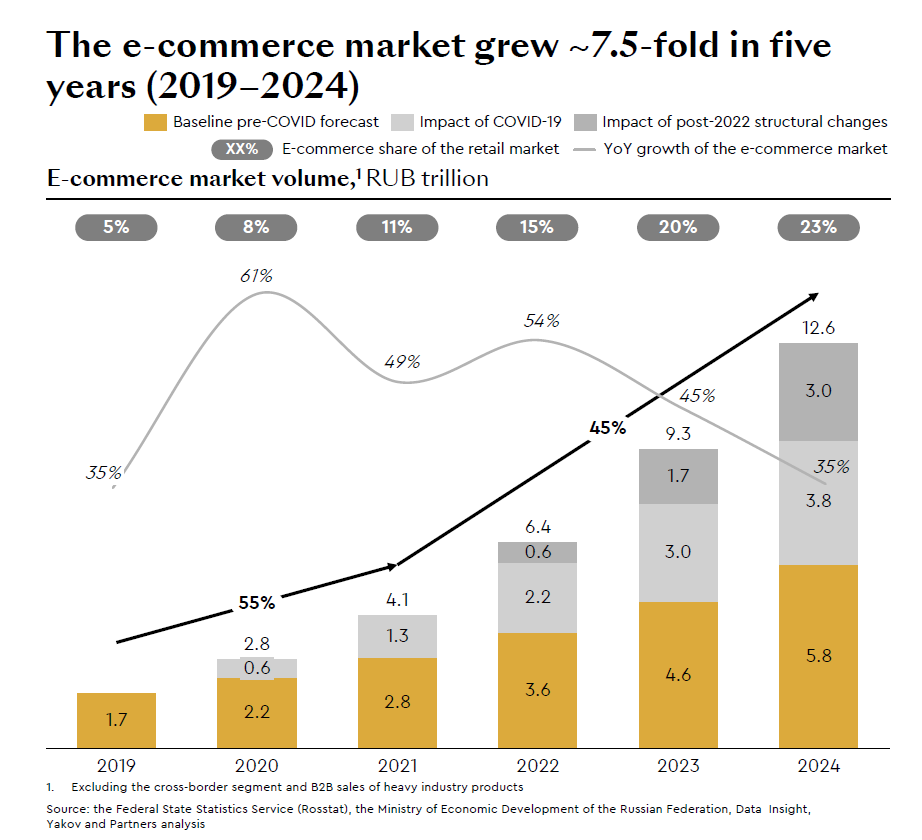

Yakov and Partners experts have looked into what the Russian e-commerce market is like today and examined its prospects. According to the study “E-commerce development in Russia,” the Russian e-commerce market grew about 7.5-fold in 2019–2024, fr om RUB 1.7 trillion to RUB 12.6 trillion. General online marketplaces played an important role in this advancement: their total GMV soared 20-fold, and their share of the e-commerce market increased by 2.8 times, from 23% to 64%. Annual GMV growth of the key players exceeded 100%; however, it started to slow down in 2024: YoY growth in 2023–2024 was about 54%.

Independent e-commerce – online sales through proprietary channels, including omnichannel retailers, direct-to-consumer brands, and niche marketplaces – grew much slower than the booming online marketplaces, the report says. The segment’s CAGR was about 28% between 2019 and 2024.

E-commerce share of the total retail market grew from 5% in 2019 to 23% in 2024. In 2024, fashion and home appliances & electronics accounted for more than 50% of the e-commerce market’s GMV, with FMCG, auto parts & accessories, and e-pharma taking the lead in terms of growth rates. Niche marketplaces and large independent online stores managed to maintain their positions in selected categories with a large share of specialty goods (DIY, auto parts & accessories, premium clothing and footwear).

International benchmarks show that despite the substantial increase in e-commerce share of the retail market, there is still a significant upside potential, the experts say. In mature economies (USA, UK, South Korea), the share of e-commerce is 30%–50%, and in rapidly developing countries with high-speed digitalization (China, Indonesia), 35%–40%. In terms of its structure, the Russian e-commerce market is similar to the one in the US, wh ere the share of omnichannel and D2C models is high despite Amazon’s dominance (~30%). Thus, independent e-commerce may significantly strengthen its position in the long term, the experts say.

Experts believe that the development of the Russian e-commerce until 2029 will depend on the pace of digitalization and the strategies adopted by market players. In the baseline scenario, Russia’s e-commerce market will grow 2.6-fold, reaching approximately RUB 32.3 trillion, with independent e-commerce at about 28%. In the “American” scenario, the market will grow to the same level (RUB 32.3 trillion), but independent e-commerce will have a larger share (about 35%) due to slower online marketplace growth and aggressive expansion of D2C brands.

“In the optimistic scenario, the market may grow 2.8-fold to hit RUB 35.2 trillion, while independent e-commerce will maintain a share of about 35% thanks to customer migration from offline channels”

Maksim Bolotskikh, Partner at Yakov and Partners

The main challenges faced by independent e-commerce are severe competition and the complexity of launching a proprietary online sales channel, the experts say. There are 2.5 times less new online shops than new online marketplace sellers, but the share of sellers who manage to exceed RUB 2 million in monthly GMV is below 3%. This is due to the fact that a company willing to get a new online shop up and going needs to integrate over 10 different systems: CMS, data analytics, acquiring, fulfillment, CRM, an online cash register, OMS, ERP, PIM, and WMS, as well as marketing platforms and loyalty programs for integrated management of all e-commerce processes. Although a great variety of tools are available in Russia, there is no end-to-end solution, which makes the market entry much more complicated, the experts say.

“Even among sellers with an annual GMV exceeding RUB 250 million, about 50% still do not have their own e-commerce platform. Nevertheless, over 20% of the companies (and about 80% of the large ones) sell on two or more online marketplaces. The next step for them would be to launch an independent sales channel to consolidate their market position”

Marina Dorokhova, Director at Yakov and Partners

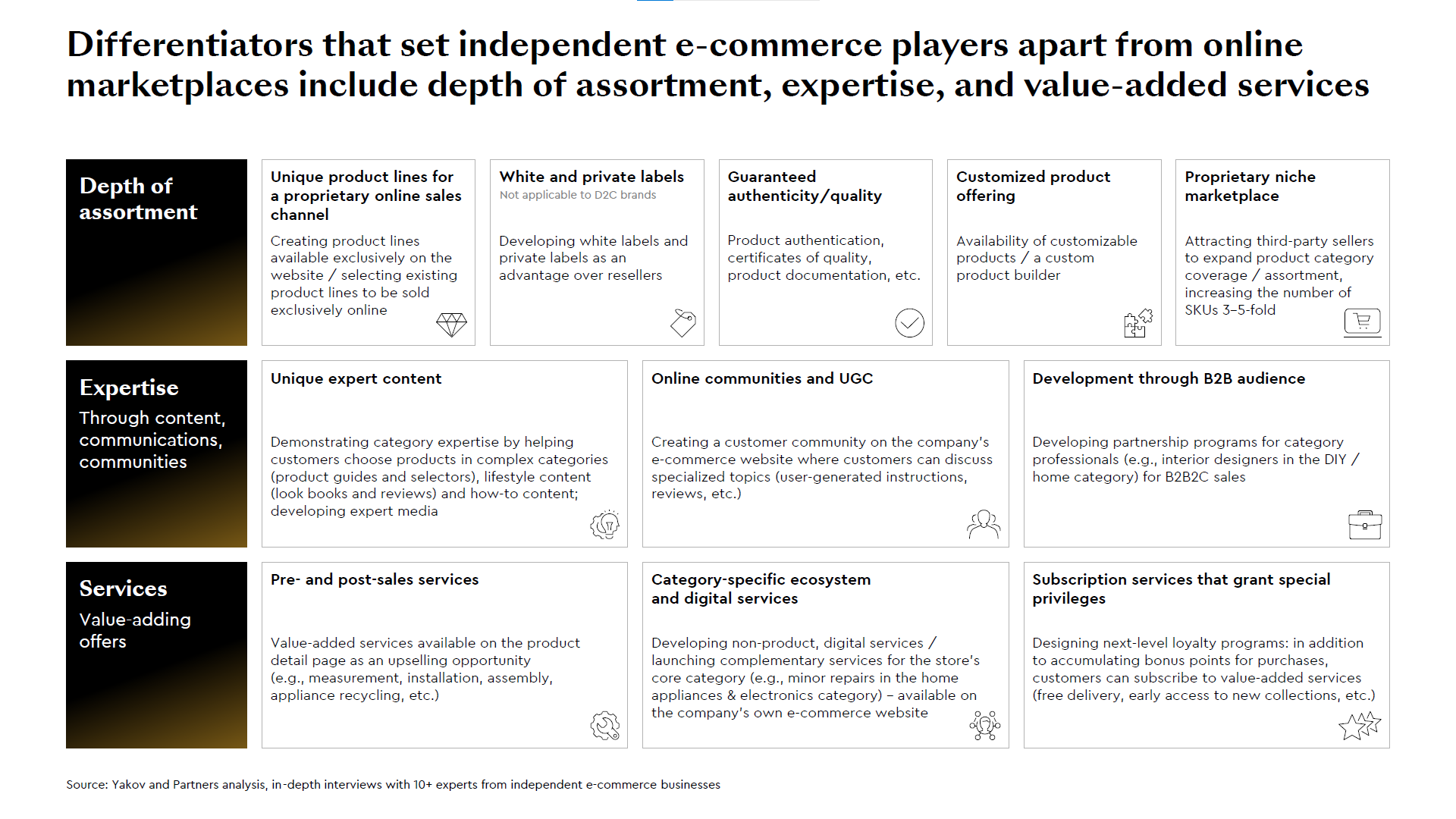

In the long run, companies can derive significant benefits from their own online sales channel. Experts believe that it unlocks new opportunities for acquiring customers, managing loyalty, and boosting LTV. Also, independent e-commerce platforms provide direct access to customer data, which is crucial for pricing and marketing optimization. Independent players can compete with online marketplaces through differentiation, by offering a deep assortment, expertise, and a high level of service. In addition, they seek to provide marketplace-level customer experience: convenient delivery options (pick-up points, etc.) and flexible payment methods (installment plans, BNPL tools).

“Despite the dominance of online marketplaces, independent e-commerce players still have a potential for growth, particularly if they have a sound strategy based on differentiation, a high level of service, and efficient customer data management. By adopting this approach, businesses are empowered to amplify their growth opportunities and improve their control over unit economics”

Anna Larionova, Associate at Yakov and Partners