Every year about a quarter of Russians citizens, or 21% to 26%, gear up to reduce their spending on luxury items and international travel, and another 7% to 8% intend to give up tobacco. And yet the share of those who use the above products and services has hardly changed over the past year. At the same time, the majority are satisfied with the replacements for those brands that exited the Russian market. Such are the conclusions presented by the experts of Yakov and Partners consultancy and ROMIR Holding, “The New Russian Society: Consumer Spending and Brands”.

The survey was carried out in May 2024 using the ROMIR Longitudinal System, a social measurement system that helps analyze public sentiment as it evolves, taking into account all the specifics and segmentation by socio-demographic characteristics, lifestyle, values, and other criteria.

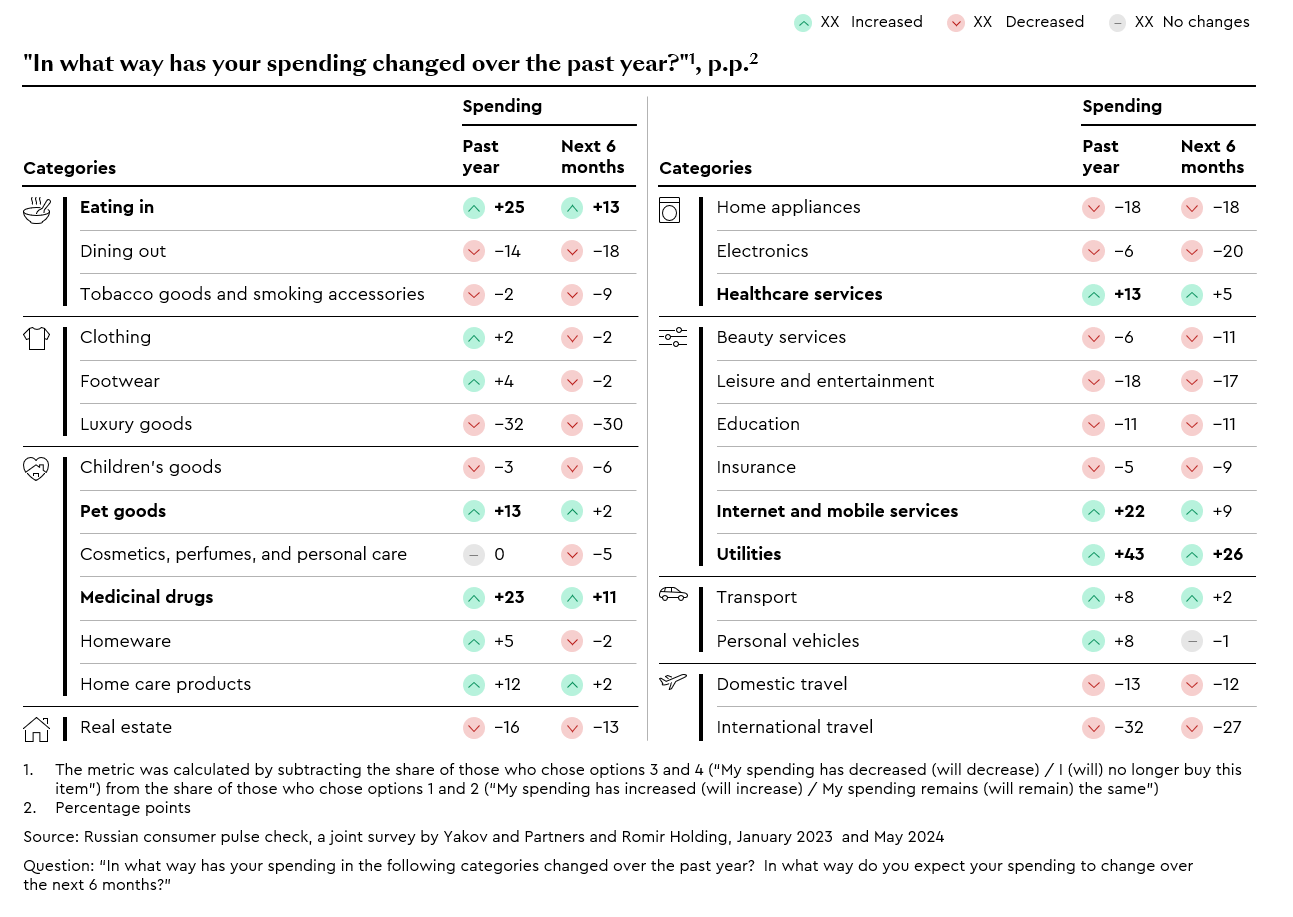

The survey reveals that most often respondents plan to save on luxury goods, travel abroad, entertainment, and home appliances. At the same time, respondents expect an increase in essential spending on utilities, mobile and internet services, eating in, healthcare services, and medicinal drugs. The only category of non-essential spending where respondents are not ready to cut corners is pet goods.

It is not the first time that survey participants have reported plans to tighten their belts. Both this and the previous year, 26% of our respondents intended to dial back their spending on international travel, 21% to 23% on luxury items, and 11% to 13% on leisure and entertainment. And yet the next year the share of those who keep buying items in the respective categories remains virtually unchanged. This year, for instance, the proportions of the respondents who admitted to spending money on luxury goods and leisure and entertainment yet again stand at 53% and 85%, respectively.

“Global surveys reveal that the strategy to cut back on non-essential spending, for instance luxury items and dining out, is shared by consumers across different countries, including Russia, China, Brazil, Germany, and the UK. In general, we observe that consumers have followed a more 'cautious' consumption model for the second consecutive year, trying to be circumspect in their spending and minimizing optional expenses”

Denis Dovganich, partner at Yakov and Partners

While consumer spending drives the development of multiple industries, a total austerity regime would lead to a recession. This inconsistency between the intentions and actions may be attributed to the fact that respondents’ actual income levels turn out to be higher than expected. Uncertainty spurs more people to be frugal, yet they tend to indulge each time they have some money to spare.”

Elena Kuznetsova, director of the Yakov and Partners Institute

In terms of age groups, the survey shows that zoomers seem to be the least frugal generation, while senior citizens tend to economize. Most zoomers increased their spending on restaurants, electronics, and trips abroad. The older the respondents, the more likely they are to report cutting spending on dining out and increasing their spending on eating in.

Up to half of the respondents (40% to 49%) have not noticed any changes to their consumer basket compared to 2021, while another 33% to 43% believe that the mix of brands has changed only slightly. Senior respondents were the least likely to have noticed any changes, while zoomers were the most likely to report changes to their shopping basket, especially in such categories as clothing and footwear, food and non-alcoholic beverages, cosmetics, perfumes, and personal care (63% to 69%).

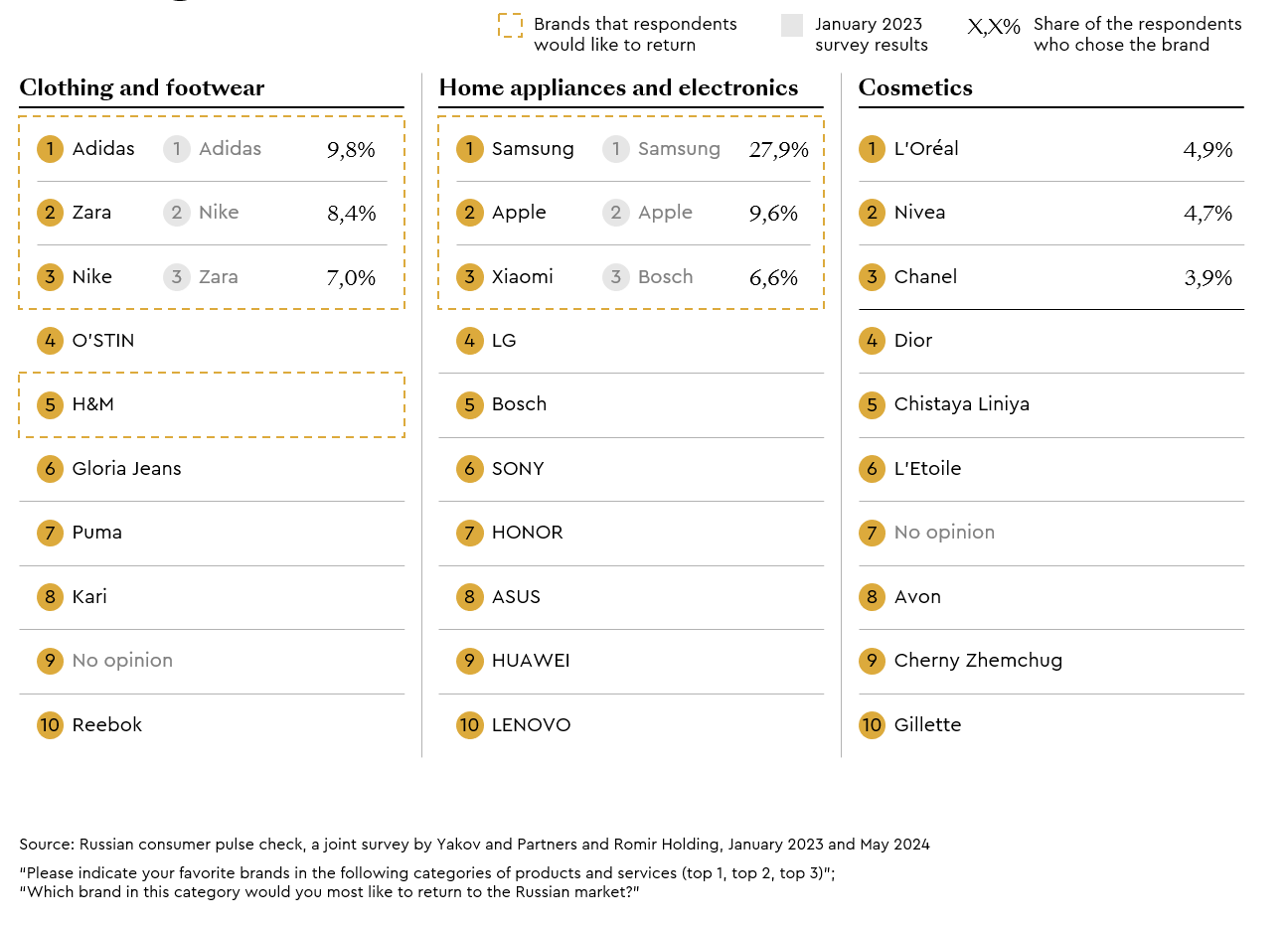

All in all, respondents tend to be satisfied with the replacements for their favorite foreign brands; the proportion of those who are happy with the substitutes outnumbers those who are dissatisfied across all categories. The level of satisfaction is the highest in food and non-alcoholic beverages, and the lowest in the transport and home appliances and electronics categories.

“Our study shows that the assortment of high-tech products, such as cars, gadgets, or home appliances, has undergone a tangible transformation. As to food products and soft drinks, many ‘runaway’ brands have been successfully localized, so consumers have hardly felt any changes in their assortment. Besides, the rapid growth of marketplaces gave an impetus to the development of local niche brands. Just as last year, the top three in the food category consists solely of Russian brands. Of all foreign brands, only Martini and Coca-Cola remained in the top three in their respective categories of alcoholic and non-alcoholic beverages. High-income consumers are particularly happy with the current assortment of food and soft drinks brands"

Inna Karaeva, executive director of ROMIR

As for clothing, electronics, and cosmetics, respondents still have a soft spot for foreign brands. Such categories as clothing and home appliances and electronics have the greatest numbers of brands that consumers would like to return. Korea’s Samsung and LG and China’s Xiaomi, HONOR, HUAWEI, and LENOVO are the most popular brands of electronics and home appliances (Samsung was chosen by nearly every third respondent, or 27.9%). In the clothing category, Germany’s Adidas tops the ranking (9.8%), but when it comes to cosmetics brands, there are no such distinctive preferences.

And last but not least, Russian citizens still have a strong preference for Japanese and German cars. There has been some minor reshuffling on the leaderboard, with Mercedes dropping to the fourth spot and LADA climbing up to the top three. Toyota topped the list of the most popular car brands, while in financial services the top spot was claimed by Sber.