According to Rosstat (the Russian statistics agency), last year its grain production in net weight totaled 153.8 million tons, which is 26.8% more than the 2021 results and an absolute record. But does that mean agricultural companies stand to turn a nice profit? Unfortunately, it could be maintained with a fair degree of confidence that some of them will fail to turn even a small one.

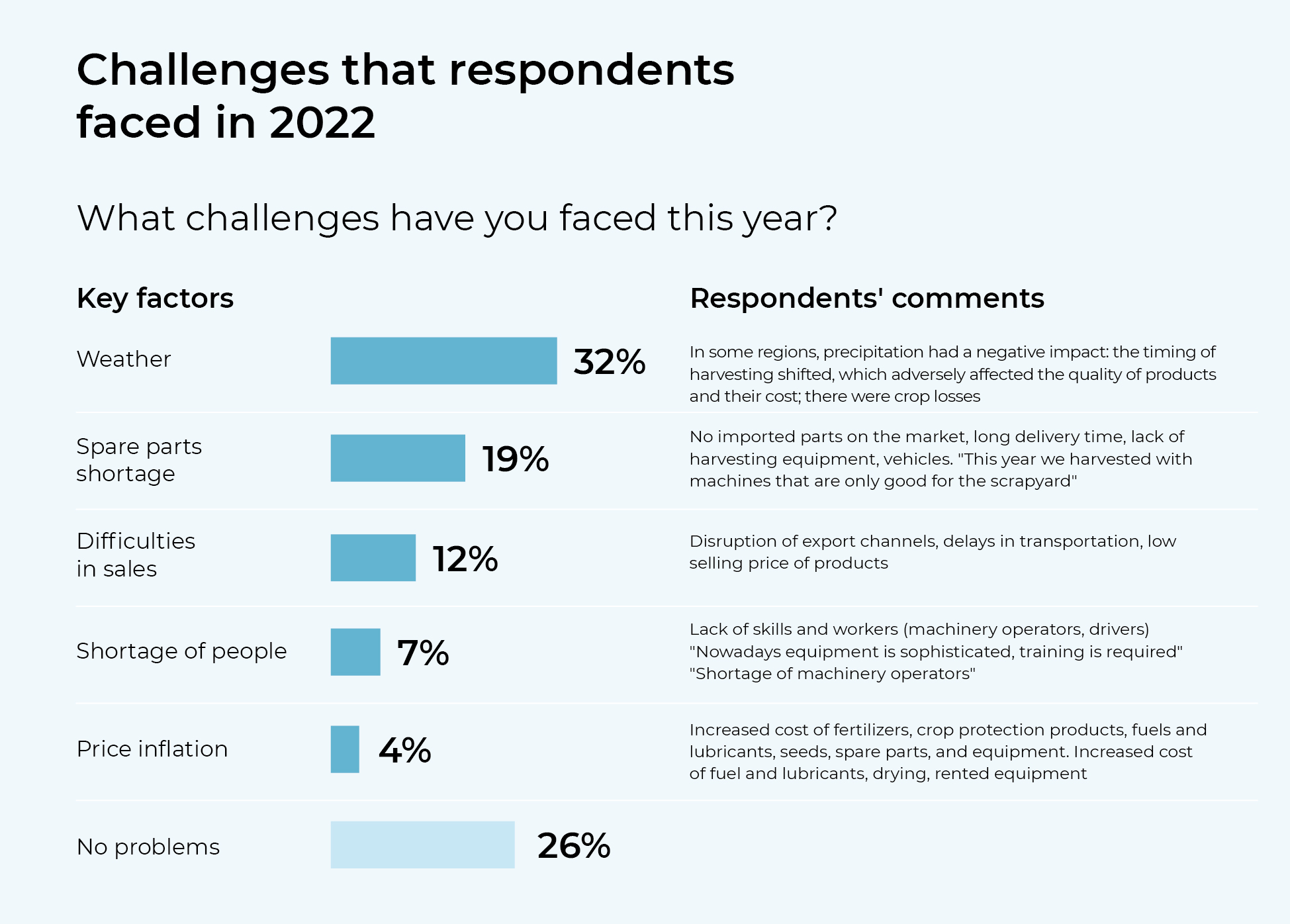

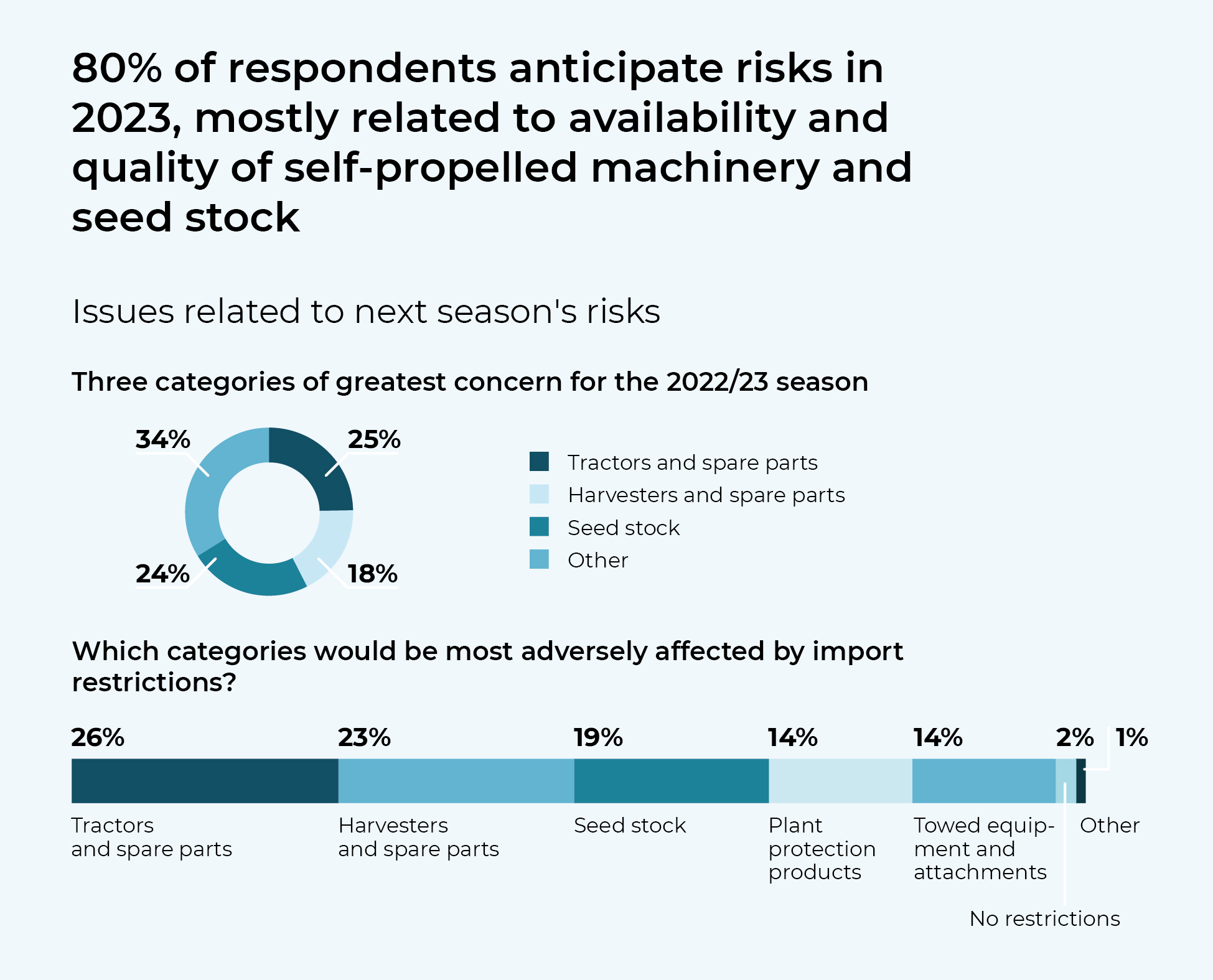

The industry is faced with unprecedented risks which may wipe out all the successes of the previous year. They may be divided into four categories: logistics and storage, shortage of seeds, low availability of machinery and equipment, and lack of qualified personnel. This is evidenced by the results of the survey of agribusiness professionals and executives we completed in December 2022.

To sell, or not to sell, that is the question

The first risk highlighted by 12% of the respondents was logistics and difficulties in selling their products. This problem mostly hit exporters, as throughout 2022 the volume of export flows lagged behind the annual average, catching up with the 2021 figures as late as November, the Federal Customs Service reports. While traditionally most of the products intended for export (up to 70%) are shipped out during the first half of the agricultural season, grain exports are expected to reach just 50-56% in the first half of the 2022/23 season due to problems related to vessel chartering and partners’ concerns regarding secondary sanctions, among other things.

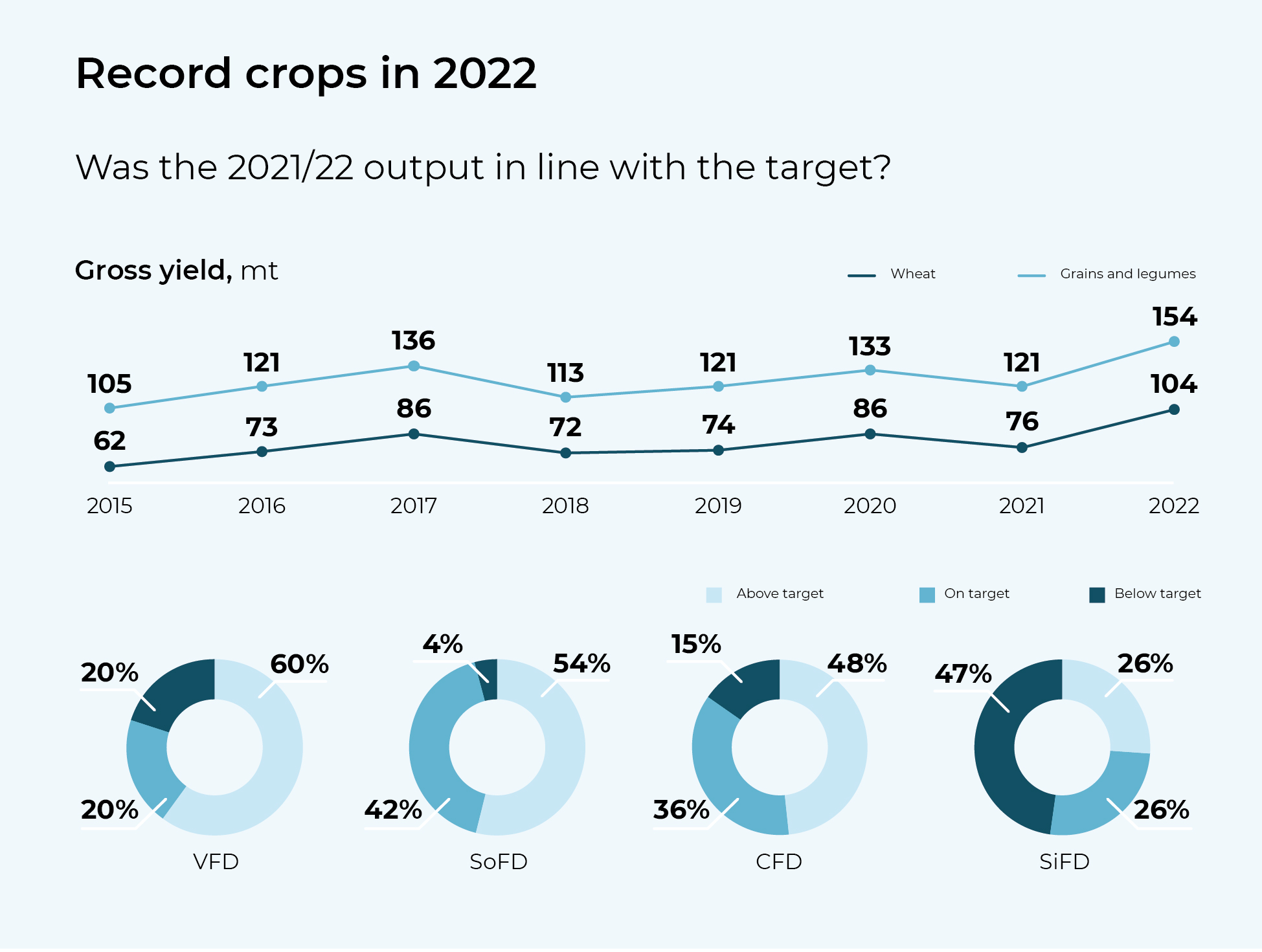

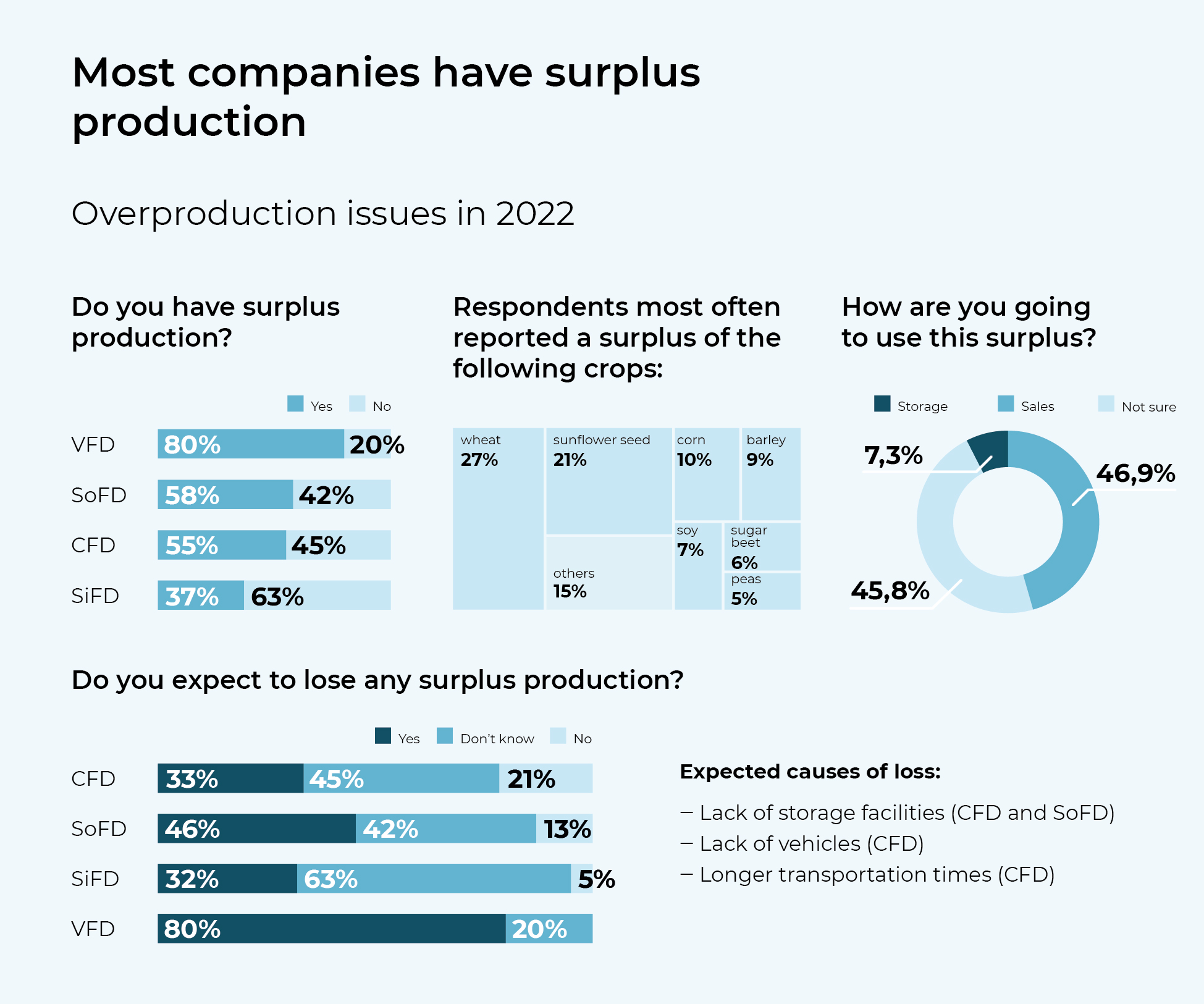

Many agriculture players had a record-breaking 2021/22 season: for example, grain production targets were exceeded in the Volga Federal District (54% of the respondents) and Southern Federal District (60%). But the record harvests combined with logistical constraints mean dozens of millions of tons of grain are likely to remain in storage going into the next season. According to the Rosstat data, as of January 1 there were 35.4 million tons of grain and pulse crops accumulated in the reserves of Russian agricultural organizations, which is 43.6% more than during the same period of the previous year. In addition, almost 18 million tons of grain were in procurement and processing organizations at the end of Q3, 2022 (+30% over the same period last year).

While production surpluses were mentioned by 37 to 80% of the respondents, what is even more concerning is that almost 46% of them do not know what to do with those surpluses. At the same time, according to our forecasts, final grain stock levels in the 2022/23 season could total 26 million tons, including about 17 million tons of wheat. Based on current prices, the value of stocks exposed to risks which are usually associated with long-term storage of grain, could climb to RUB 260 billion. To keep this figure from growing even higher, Russia would need to export near-record volumes of grain (more than 4 million tons) every month.

It is likely that export flows and farming profits could increase if current export duties – which exporters call nothing short of "draconian" – were reduced. Yet it is important to keep in mind that this measure could hamper the regulator's ability to keep domestic prices for food and animal feed in check.

Companies’ economics also speak in favor of easing up on the rates. For instance, this season is seeing a decline in margins across all major crops. According to the estimates by the Institute for Agricultural Market Studies, wheat production margin in the Central Black Earth region will reach about RUB 10,000 (without VAT) per hectare, providing the marketable output is sold in full. This is 1.6 times less than in the 2021/22 season and three times less than the year before. A similar situation, profitability-wise, is observed with corn and sunflower crops. This season, the margin of sunflower seed production in the Central Black Earth region will average about RUB 24,000 (without VAT) per hectare. In the previous season, it was equal to about RUB 36,000 (without VAT) per hectare, and in the 2020/21 season it reached RUB 72,000 (without VAT) per hectare.

The current situation is likely to lead to a 13-19% decline in grain production, particularly wheat, as soon as the 2023/24 season. Nevertheless, gross yields will remain historically high. This means the risks that some of the unsold crops could be lost or decline in quality during storage remain high.

However, despite the unprecedented accumulation of stocks, only one in ten companies we surveyed admitted that significant losses of agricultural produce would be inevitable. All the rest, apparently, count on the availability of facilities for drying and storing unsold grain. But so far, instead of profits, farms have been making losses.

Sunflowers are at risk

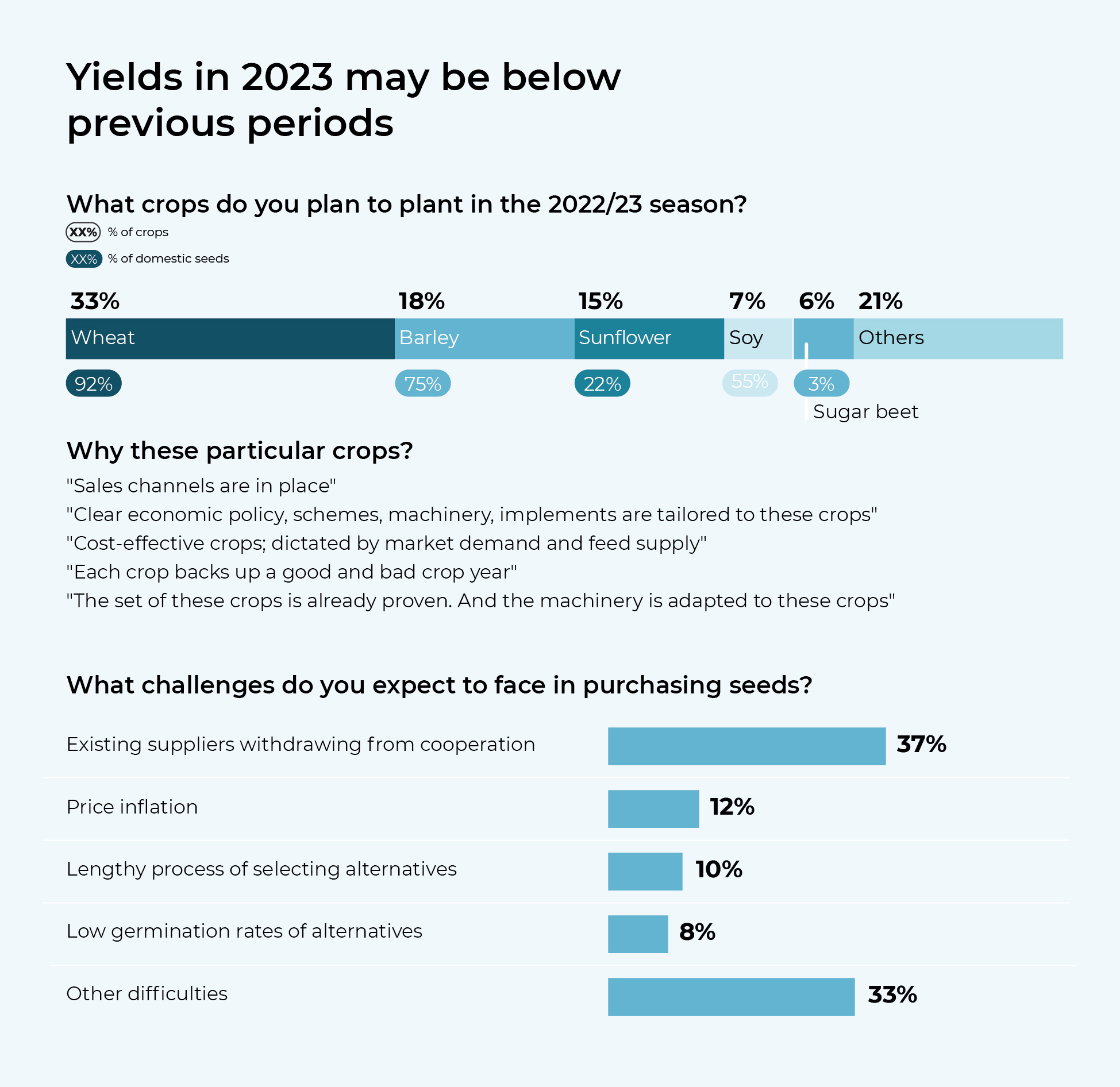

Yet another issue is the quality of seeds, and as the majority of respondents agree, it falls in the Top 3 problems. The answers we received suggest that western sanctions and limited supplies may lead to shortages of imported seeds. Industry experts regretfully acknowledge that supplies of quality imported seeds are already declining.

At the same time some respondents mentioned inadequate quality and quantities of domestic alternatives, and soybean, sunflower, and sugar beet producers seem to be hit the worst. Some executives commented that they are “yet to see high-yield domestic varieties of wheat or barley”. What is worse, it is not possible to find acceptable alternatives for all crops: "We won’t find good alternatives for sunflower seeds and will have to reduce the acreage of this crop".

Producers warn that if they are forced to stop using imported seeds with high germination rates and rely on alternative domestic seeds instead, the yields will be definitely lower. In such case, it would be difficult to compete with western companies.

Taking into account the fact that a large share of sunflower seeds is imported, producers should reconsider their crop rotation strategy.

It is unlikely that the dependence on imported seeds could be eliminated within one or two seasons. Although the government has approved a program aimed at bolstering seed self-sufficiency, it is not expected to be completed before 2030, so it would be reasonable to secure alternative seed supplies. However, a number of producers do not anticipate any difficulties, as they still have sufficient seed stocks for the next season.

Harvesters that are "only good for the scrapyard"

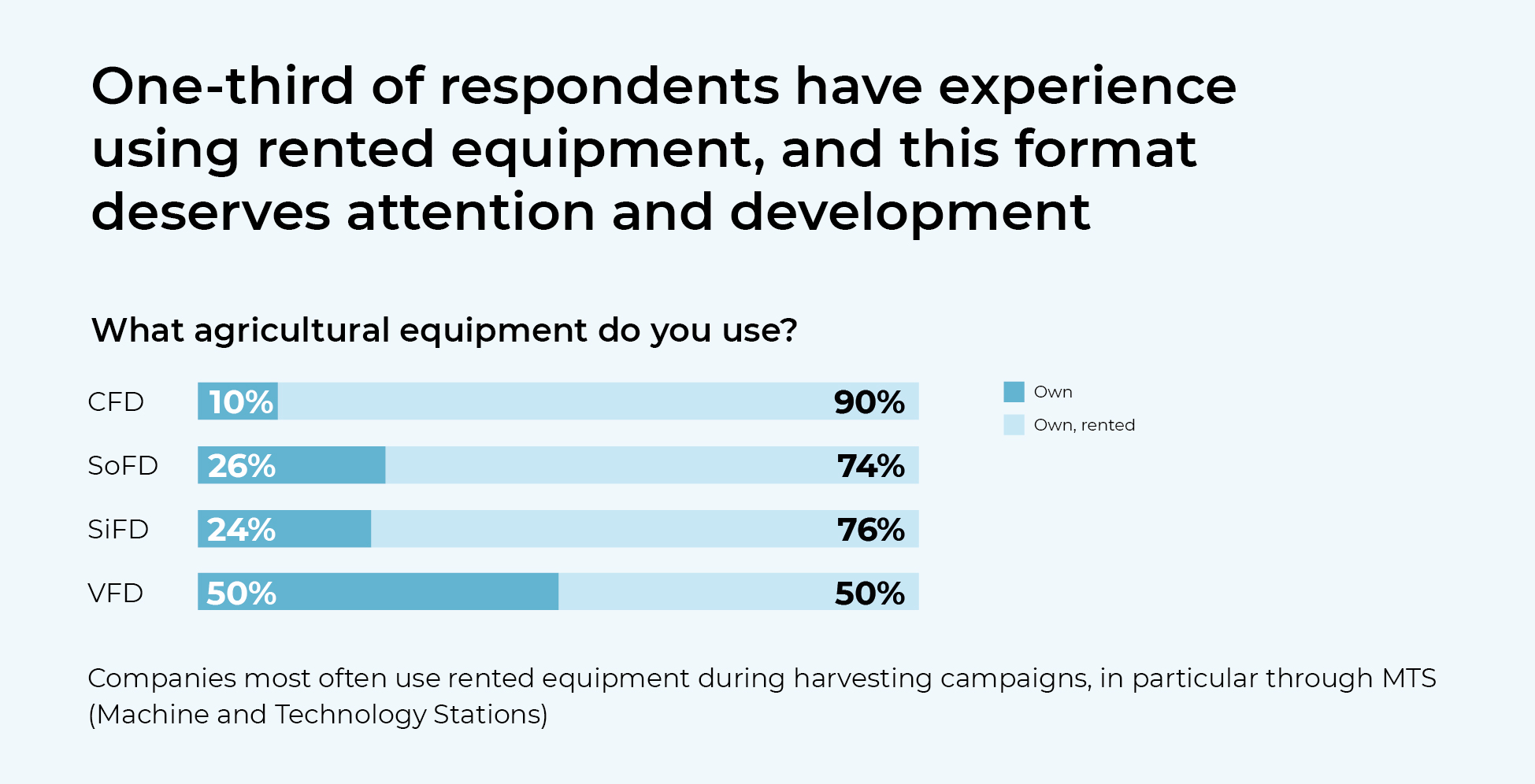

Yet another risk is associated with the availability and quality of tractors, combine harvesters, other self-propelled equipment, and spare parts. Industry professionals expect the existing problems in this area to persist or even get worse. Apparently, farmers will see the availability of agricultural equipment decline, as 70% of the respondents point to the lack of serviceable equipment as the main threat to their plans for the coming agricultural year.

Of those surveyed, most anticipated shortages of tractors (34%), followed by harvesters (25%), then towed equipment (11%). There will definitely be a shortage of heavy-duty tractors, which have traditionally been procured from foreign manufacturers and are now under sanctions. The fleet of light tractors could still be renewed with purchases from "friendly" countries.

Insufficient availability of harvesters and towed equipment is further exacerbated by suboptimal levels of local content in production of this type of equipment.

Nearly the entire range of agricultural machinery requires accelerated localization, from assembled units to components and spare parts. Finally, the situation with import substitution and localization is further complicated by the strong dependence of Russian manufacturers on suppliers of some key imported components. The shortage of spare parts, mainly imported ones, was reported by 19% of the respondents.

"We had to harvest with machines that are only good for the scrapyard," noted some of the survey participants.

In search of talent

A fourth and final risk is the shortage of people. Lack of qualified machine operators was mentioned by 7% of the respondents. "Nowadays equipment is sophisticated, training is required," they explained. Industry professionals are confident that the problem cannot be solved without government involvement. State support in getting "promising" young people into agricultural professions, e. g. an agronomist or a zootechnician, would be helpful. This includes both professional training programs and cultivating an interest among young people in working on the land, including material incentives and improvement of rural infrastructure in priority agro-industrial areas.

Business as usual is no longer an option

The agricultural industry is often viewed as archaic. The general public still believes that little, if any, progress has been made there. This is not entirely true. In recent years, Russian agricultural producers have performed quite well – not least due to the very cyclical nature of the agricultural sector, which allows to swiftly test best practices and approaches. For instance, it takes automakers three to five years to develop a new platform. Setting up production of modern microprocessors takes even more time. The fashion industry follows one-year cycles.

Agricultural companies have successfully pivoted after the events of 2014 and are widely practicing intensive farming, introducing new types of products and varieties to the market. In under five years they increased fertilizer application by 50%, while the area covered with protection agents increased by 11%. All this inspires belief that our agricultural companies will be able to rise to the new challenges as well.

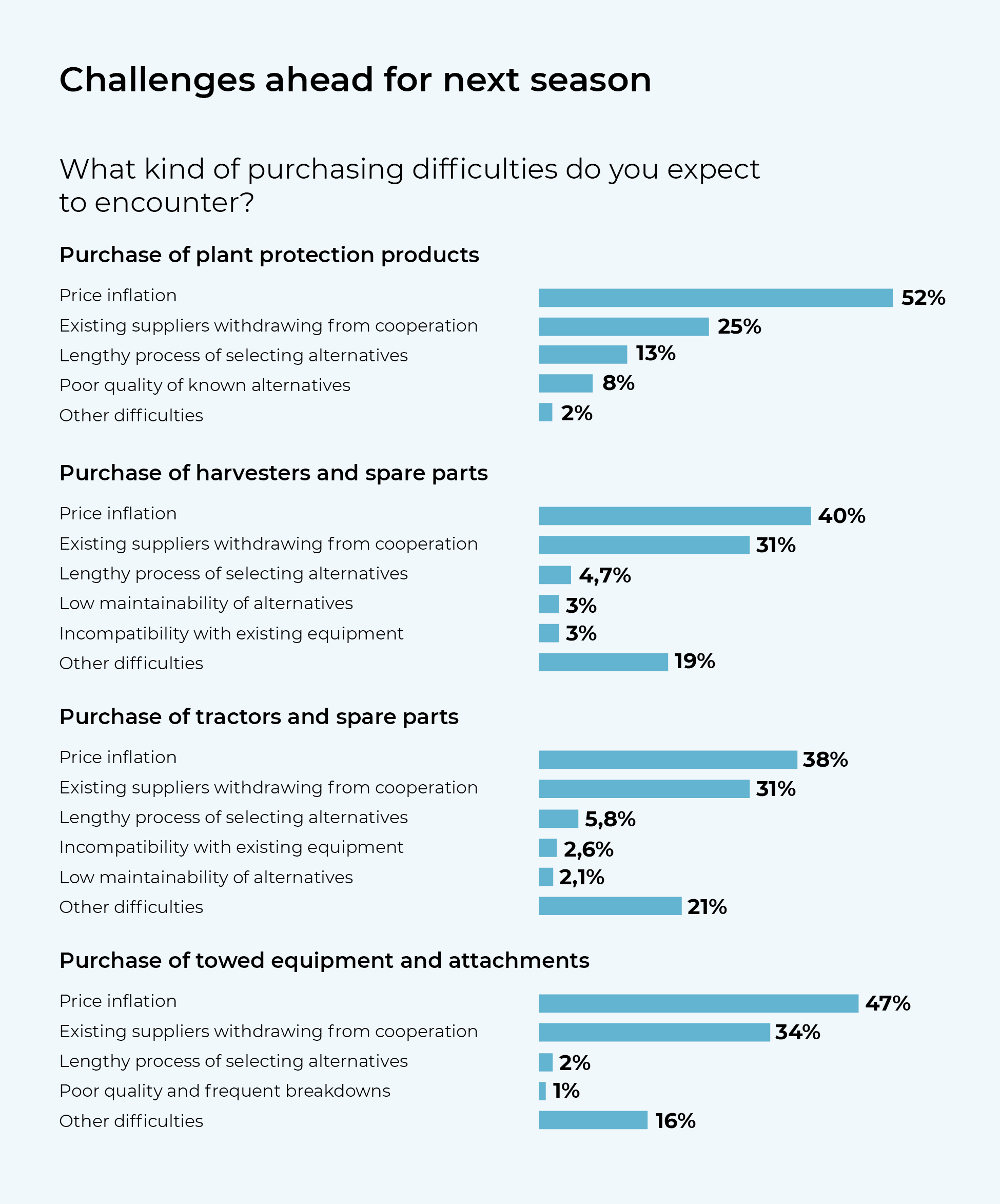

However, as the survey showed, in the 2022/23 season procurement of consumables is going to be a sore subject even for successful industry players. Even though the prices for spare parts, crop protection products, and fertilizers soared back in the 2021/22 season, 38 to 52% (depending on the segment) of our respondents anticipate further price hikes.

Industry players could save up on consumables by stepping up the implementation of "smart" farming technologies. Russia has quite a few companies, such as AgroSignal, Cropio, and others, offering digital solutions that could help transform each hectare of land. They will generate soil maps, advise on sowing rates and application of plant protection chemicals, and organize plant health monitoring.

It goes without saying that implementing "smart" farming systems requires considerable investments at the initial stage, but will pay off in the long run as it will help both reduce the costs and increase the yields.

To overcome the shortages of agricultural equipment, the industry will need to rely more on domestic manufacturers, as major companies, such as John Deere, have suspended shipments to Russia and Belarus, while Asian companies are still vetting the Russian market.

Export fees, state procurement, and new logistics

Agricultural leaders in Russia are ready to move away from conventional approaches which, although reliable, do not provide enough flexibility for doing business. But the industry needs a more flexible government policy and systematic support from the authorities.

It would be helpful, for example, to create a nationwide analytical platform to monitor the situation with the stocks, agricultural equipment, and seeds, and align the efforts of individual companies on a national scale.

The government could also stimulate the development of new export corridors, for instance, help establish new transport and logistics centers to increase grain exports through "friendly" countries, such as China and Iran, or actively develop exports from the Far Eastern and Northern ports, for instance the port of Vysotsk.

The agribusiness sector needs to know if the government considers stepping up state purchases of produce as an anti-crisis measure. The efforts of businesses alone, no matter how large or stable those businesses are, will not be enough to step up processing of agricultural products on the domestic market. The government could also consider lifting the export duties and increasing subsidies into rail and road shipments.

These are not the only issues the agriculture industry has raised with the state. Amidst the new economic turbulence, the government's assistance to the domestic agricultural sector is high on the agenda. After all, the issue of food security is ever more important in an increasingly fragmented world. If the government and businesses join their forces, they could transform this complicated situation into a "window of opportunity" and turn the country into a grain superpower and one of the Top 10 global exporters of agricultural products in general by increasing its exports by as little as 7%.