Yakov and Partners experts have looked into the present and future of the Russian pesticide market. According to the study “The agrochemistry of life: growth opportunities for active ingredients production,” Russian farmers use more than 250 active ingredients that play a key role in crop protection. However, almost all active ingredients needed to produce crop protection final forms are imported, primarily from China, and only a few are made in Russia, for example, those based on sulfur and copper. All the active ingredients that were produced back in the Soviet era are no longer used or manufactured, the study noted.

At the same time, the value of fixed assets owned by Russian pesticides producers suggests that their investments are not enough to launch commercial-scale production of a sufficient range of active ingredients with an acceptable quality, the experts noted. They believe that if Russian crop protection manufacturers become interested in expanding their active ingredients production, the amount of financial support they would need is greater than the value of their existing assets by an order of magnitude.

“This makes the Russian agricultural sector critically dependent on imports and can result in yield losses of up to 100%, depending on the crop. In these circumstances, the country’s food secutiry is at risk, and the lack of local production of active ingredients makes the industry vulnerable to changes in the global market”

Yakov and Partners Director Alexey Kletsko

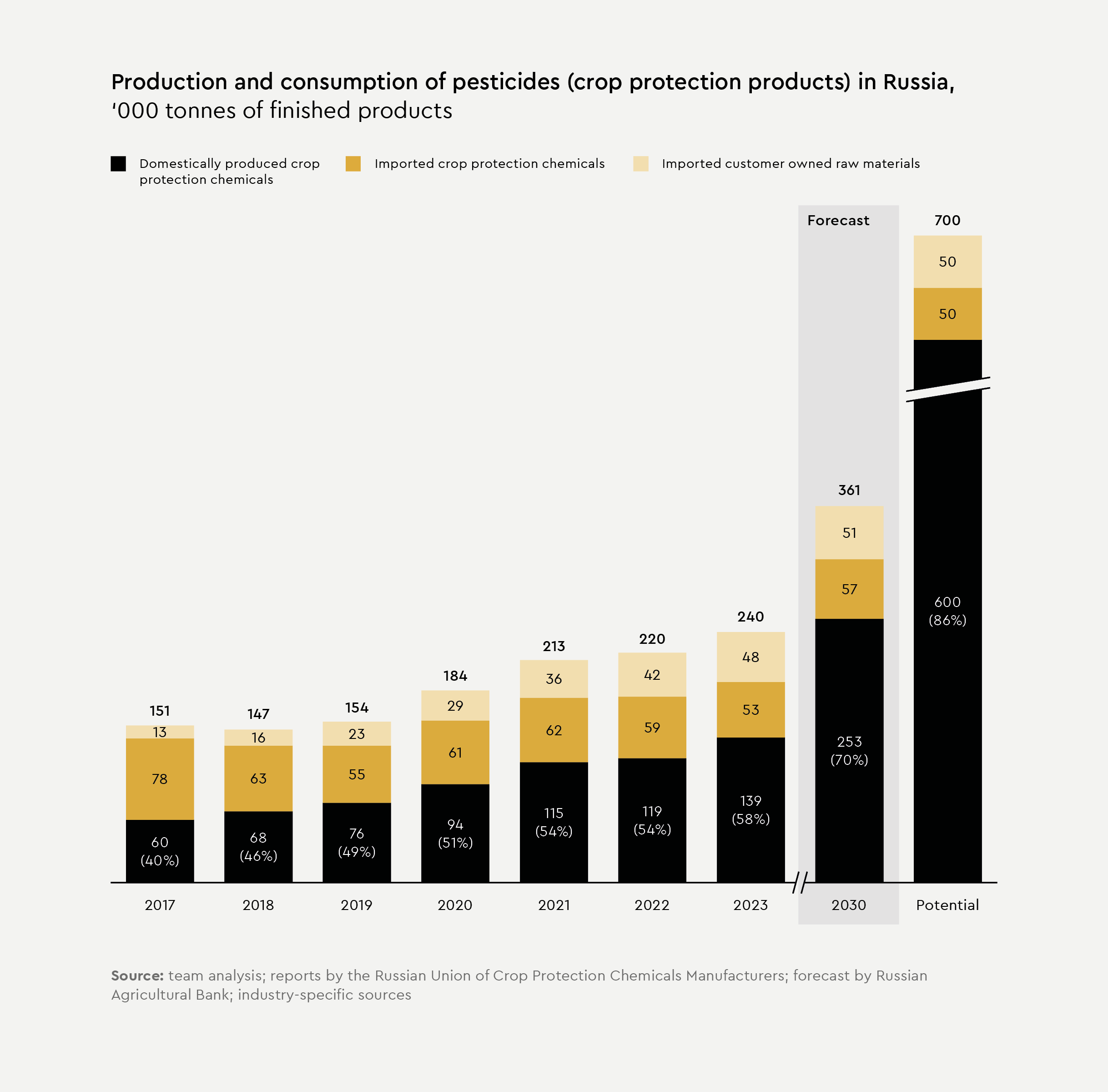

According to expert estimates, Russia’s consumption of crop protection agents went up 60% in the past six years, and the industry shows considerable potential for future growth. Taking into account the country’s total cultivated land, global benchmarks, and local specifics, annual pesticide consumption may reach 360,000 tonnes by as early as 2030. Moreover, the figure may rise to 700,000 tonnes in the longer term, according to the findings of the study by Yakov and Partners. To put that into perspective, in 2023, Russia’s pesticide consumption totaled 240,000 tonnes.

Also, the Russian agricultural sector faced additional challenges after major international companies such as FMC and Corteva had withdrawn from the country and BASF, Bayer, and Syngenta had scaled back their investments into business development. According to the analysts, this has limited Russian farmers’ access to advanced agrochemical patented products and high-quality generics, and impeded the adoption of global best practices in agronomy.

Yakov and Partners experts believe that in this context, it is crucial for the Russian agricultural sector to develop domestic production capabilities for active ingredients. To drive future growth and reduce the reliance on imports, the experts suggest creating a cluster of companies that will produce about 40 critically important active ingredients to ensure that the harvest of wheat, potato, and sugar beet do not decrease by more than 25%. The potential cost of creating such a cluster is USD 5–10 billion, and the project is expected to pay back in 10–20 years, according to Yakov and Partners estimates.

The experts believe that prior to that, Russia should adopt a diversification policy, importing active ingredients from countries with different geopolitical agendas. They are confident that government support to Russian companies setting up logistics chains and production facilities abroad will drive the industry’s development, as stronger partnerships with foreign companies will help enhance domestic technological capabilities. The experts also noted that the country should refrain from restrictions on the import of active ingredients in case no exact analogs are produced in Russia, as this may lead to an adverse impact on the agricultural sector’s financial and economic performance.

“The Russian crop protection market has reached a tipping point. On the one hand, there is every reason to expect that pesticide consumption will grow and domestic production will expand. On the other hand, creating domestic production capabilities and reducing the reliance on imports will require significant investment. With financial support from the government and a sound development strategy, Russia will be able to achieve technological sovereignty in the agrochemical industry in the medium term”

Yakov and Partners expert Stanislav Vetoshkin