12% of the respondents did not encounter any problems, which is 2.3 times as low as the previous figures

Open sources; analysis by Yakov and Partners.

This became clear in the course of our survey of 98 key employees (CEOs, chief agronomists, chief engineers) of large domestic crop production companies (more than 20,000 hectares) conducted in December 2023 and January 2024. The respondents were asked to answer 40 questions to help identify the current problems of the agricultural industry and compare them with the results of the previous year.

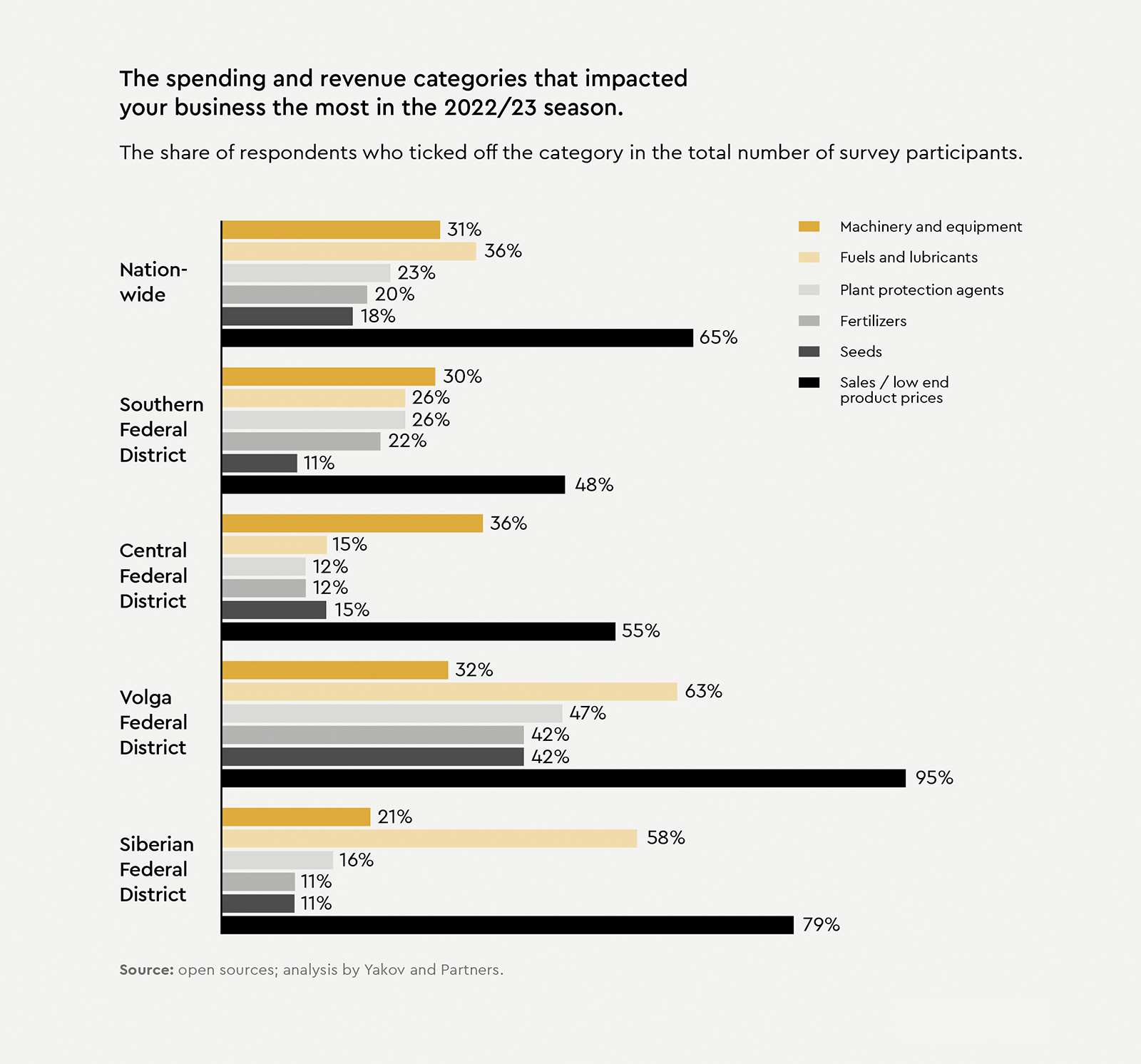

Almost two thirds of the respondents¹ ran into economic problems of some kind: 65% of those surveyed reported declining selling prices, and 53% were faced with rising costs of inputs which directly affected production costs (a 13-fold increase vs. the previous year (4%)).

Agribusinesses located at large distances fr om the export-oriented ports in the southern regions were among the worst hit by the decline in end product prices. Those holdings that focus on using crop products further down the value chain (livestock farming, sugar plants, etc.) were the least affected by the problem of lower sales prices.

Only 12% of the respondents did not encounter any problems, which is 2.3 times as low as the previous figures.

Declining financial performance

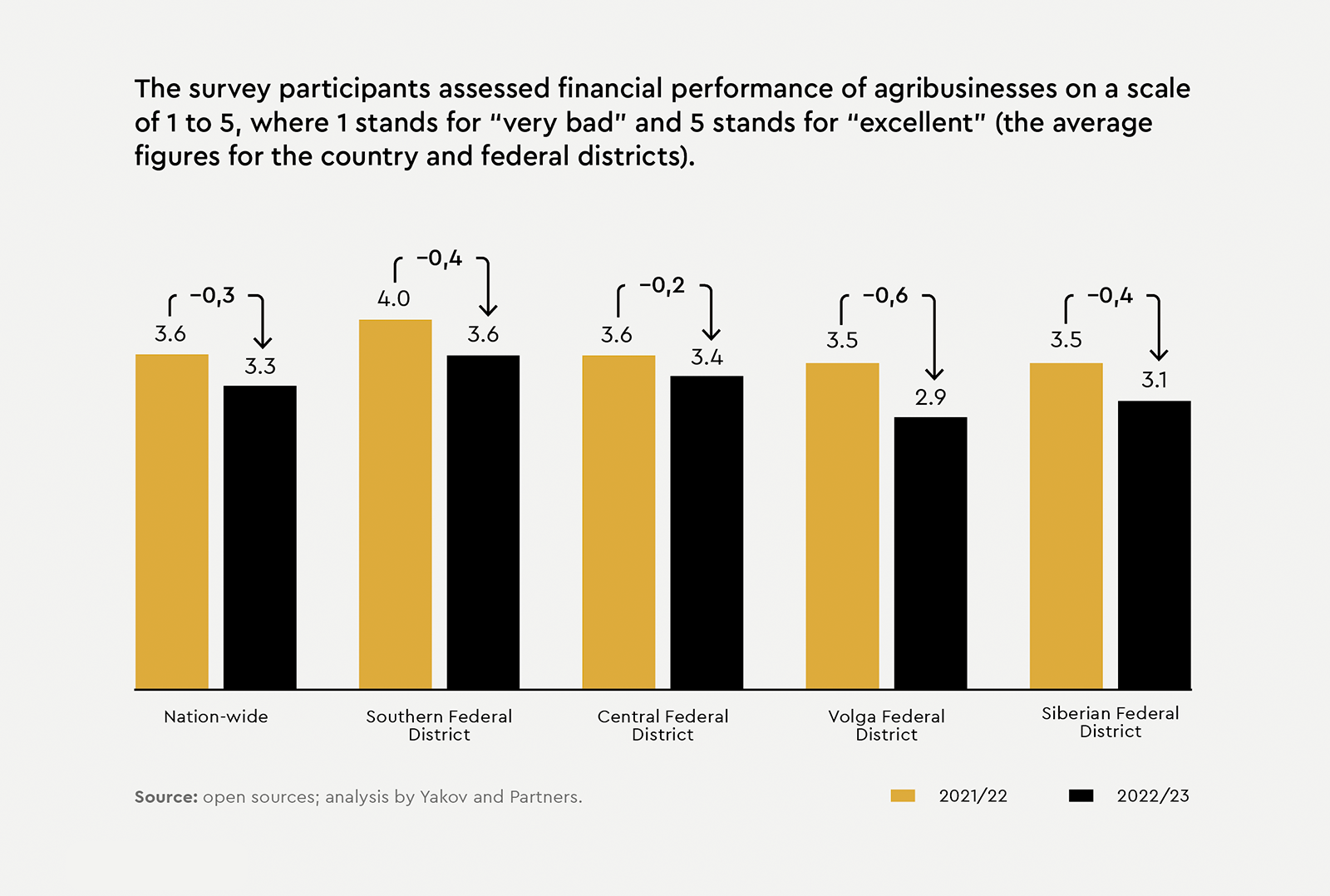

Unsurprisingly, lower selling prices coupled with higher costs and limited access to technology led to deterioration of financial performance.

Under the current market conditions, in the high-margin southern regions the profitability of crops ranges from 10% to 15%, while some farmers from the Central Federal District and the Volga Federal District reported near-zero profitability or even direct losses: "The results are negative, as the selling prices of products are below the cost of production. The quality of grain is low due to weather conditions", "The price of wheat is low, the selling price is below the cost of production", "We are focusing on selling oilseeds as the current prices are adequate. As for grains, the selling price is now equal to the cost price, so we are stalling".

As a result, the assessment of their financial results provided by agribusinesses across all regions was 10% below the previous levels and may be called "satisfactory" at 3.3 points out of the 5.0 possible.

Our previous survey² identified four key risks facing the industry:

- low quality and availability of seed stocks;

- low availability and quality of machinery and equipment and required spare parts;

- lack of qualified personnel;

- logistics and distribution challenges.

We have to admit that in one way or another, all the risks have realized. Besides, the list of problems now includes increased PPA (plant protection agents) and fertilizer prices.

Quality and availability of seeds

The survey results show that farmers were absolutely correct in predicting (or in some cases already observing) problems with seed procurement. While only 24% of the respondents polled a year earlier considered this category as one of the three most acute problems, in reality about half of them faced some procurement problems. Unsurprisingly, this time around the share of those who included seeds into the top-3 list of the most problematic procurement categories jumped to 36%. Difficulties in finding suitable domestic alternatives and inadequate quality of domestic seeds were two of the most common grievances.

As almost 50% of agribusinesses ran into problems procuring seeds, the share of those who included seeds into the top-3 list of the most problematic procurement categories jumped to 36% this season

Sugar beet producers agree that domestic seeds are inferior in quality to foreign seeds: "We produce sugar beets. There are no good domestic seeds". As to sunflower seeds, opinions were divided: "There is no difference between domestic and imported sunflower seeds. Imported corn seeds, on the other hand, are better, so we prefer them", "There are no high-quality domestically selected sunflower seeds. Those seeds that are available on the market are yet to be tested", "I would never sow domestic sunflower and corn seeds. As to the rest of the crops, we already use domestic products".

However, the general sentiment of those surveyed indicates that the domestic selection industry is floundering. Setting up more domestic research centers and ramping up funding in this area were some of the most popular industry support measures suggested by our respondents.

Although the domestic industry can offer some world-class genetics solutions, those are limited to a small number of crops, including wheat and barley. Agribusinesses tend to take a very pragmatic approach to domestic seeds that need further improvement. While only 4% of the respondents said that they use domestic seeds "willingly", 84% of the respondents would not use them as long as more effective alternatives were available, and another 10% would switch to domestic seeds only if there were “no budget" for other options.

Since the deadline for the government program designed to achieve self-sufficiency in seed stocks is set as far ahead as 2030, industry experts believe that it will be impossible to alleviate the acute dependence on imported seeds without suffering reduced yields during a couple of seasons.

Availability of machinery and spare parts

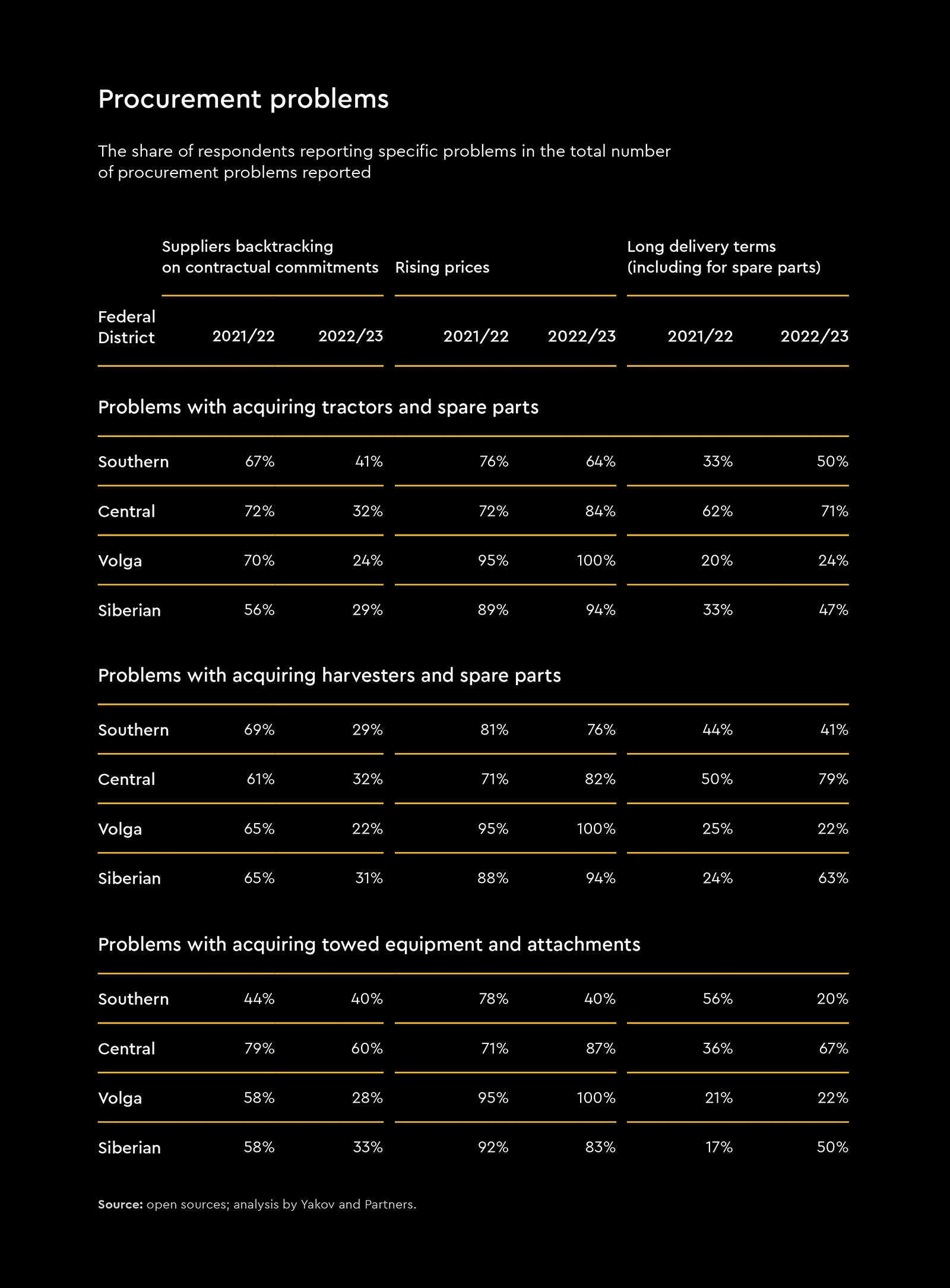

The share of respondents who reported problems with procurement of agricultural machinery and spare parts more than doubled compared to the previous survey, from 19% to 44%. The problem is at its worst in the tractors and combine harvesters segments (89% and 81% respectively).

It is important to mention that many agribusinesses are already reviewing their supplier arrangements and looking to strike new partnerships. This time around, only every third respondent reported dealing with refusals to fulfill contractual obligations or sign new contracts, compared to 64% a year earlier. At the same time, 84% of industry players faced increasing prices, while 46% of the respondents faced longer delivery terms.

Only every third respondent reported dealing with refusals to fulfill contractual obligations or sign new contracts, compared to 64% a year earlier

Machinery availability deteriorated the most in the Central Federal District, as 84% of the respondents complained about rising tractor prices and 82% reported the same problem for combine harvesters. In our previous survey, those figures stood respectively at 72% and 71%.

The industry seems to take a dim view of the situation with spare parts availability: "We have to order non-original spare parts", "Spare parts for harvesters, either imported or domestic ones, take a long time to arrive. We waste a lot of time", "The economy was hit by spare parts shortages and high prices. Foreign-made tractors idled because the delivery of spare parts was delayed. The supply chain is long, and the prices for spare parts are exorbitant".

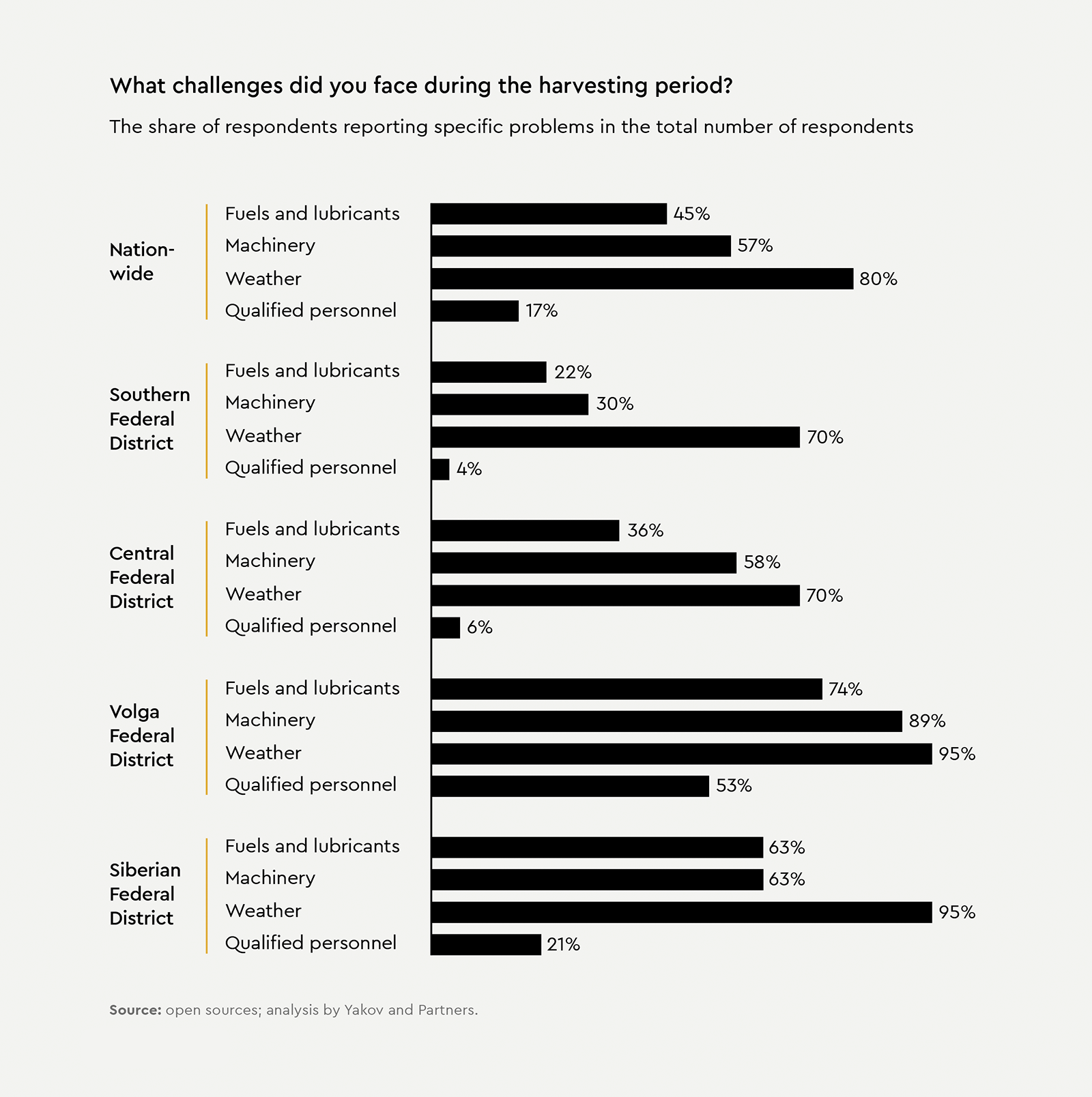

In our previous survey, 70% of the respondents identified the lack of serviceable machinery as one of the main risks for realizing their plans for the coming agricultural year. Unfortunately, we have to admit that the insufficient availability of agricultural machinery indeed affected harvesting for 57% of the respondents, coming in as the second most significant negative factor after the weather. The Volga Federal District and Siberian Federal District were most affected by this problem, with 89% and 63% of the respondents, respectively, choosing the lack of serviceable equipment as one of the relevant problems.

We have to admit that the insufficient availability of agricultural machinery indeed affected harvesting for 57% of the respondents, coming in as the second most significant negative factor after the weather

The structure of the Russian market is changing as domestic manufacturers and suppliers from friendly countries are gearing up to occupy the target niches vacated after the withdrawal of Western competitors.

Due to quick product adaptation and flexible pricing policy, Chinese suppliers took the lead in the tractor segment. For instance, in the 150 to 250 hp segment, Chinese manufacturers have already captured more than 40% of the market, while the total volume of imports of Chinese agricultural machinery in 2023 exceeded the 2017 levels by 4.4 times in value terms.

Agricultural machinery supplied by Latin American companies is also a valid alternative. Local manufacturers keep actively adopting and implementing best global practices and technologies.

The points of growth for all suppliers from friendly countries are warranty service and spare parts supply.

Yet there is still a lot to be done to cover the entire agribusiness value chain. This presents great opportunities and equally great challenges for Russian producers:

- Accelerating implementation of modern technological solutions (both digital and mechanical) to improve the economics of domestic machinery. Large farms can still rely on western sprayers, seeders, and harvesters which reduce seeds and chemicals waste as well as combine losses. All this efficiency translates into serious cost savings.

- Localizing production of components. A lot of pieces of domestic machinery rely on Chinese or western electronics and hydraulics, which results in maintenance delays.

- Machinery design and manufacturing. It is vital to establish manufacturing of special-purpose agriculture machinery, for example, telehandlers, as well as machines for harvesting potatoes, green peas (for canning), sweet corn, and beets.

Labor shortages

Unfortunately, the problem of staff shortages seems here to stay. There is still a strong need for both professional training and stimulating the interest in working on the land, including material incentives and improvement of rural infrastructure in top-priority agro-industrial areas. So far, our respondents failed to notice any meaningful progress in addressing this problem. For instance, this season 17% of the respondents across Russia reported the lack of qualified mechanics, while last year this figure stood at just 7%. Meanwhile 53% of the respondents in the Volga Federal District pointed to the shortage of personnel as one of the three main challenges during the harvesting season.

The 50% gap between the average monthly income in the agricultural industry and incomes in other sectors of the domestic economy (RUB 52,600 in 2023 vs. RUB 73,700) does nothing to overcome the personnel deficit. Given that the entire country is expected to face acute labor shortages in the range of 2 to 4 million people by 2030, we can expect an exodus of workforce from the agricultural sector to other sectors, which will bring the number of agricultural workers down to the level of international benchmarks (2-3% vs. the current 6%).

The 50% gap between the average monthly income in the agricultural industry and average incomes in other sectors does nothing to overcome the personnel deficit

It goes without saying that such shifts will be very painful for the industry unless productivity is dramatically improved.

Challenges related to logistics and storage

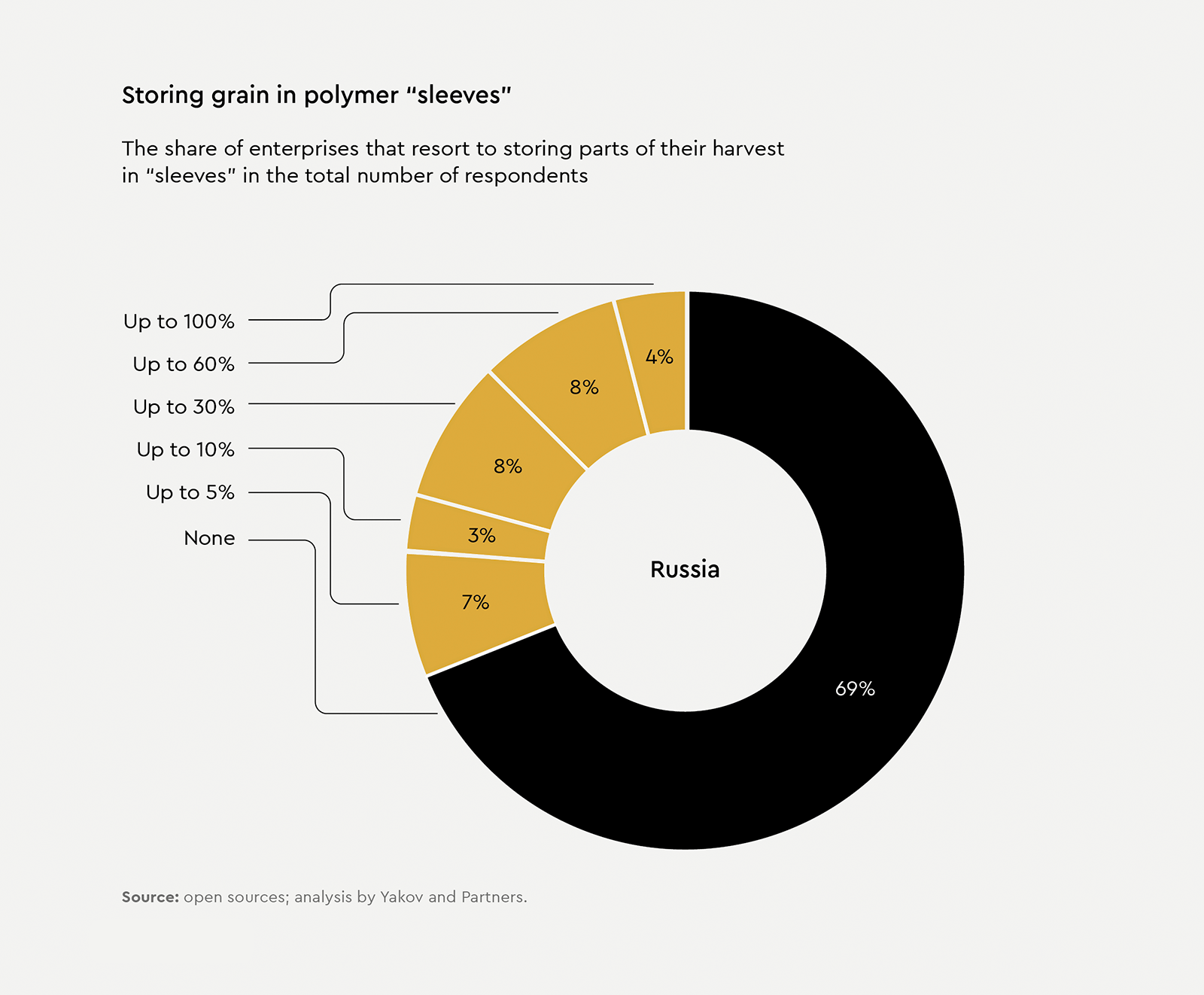

One of the challenges identified last year was the problem of storage, when as a result of record-breaking harvests and logistical problems, dozens of millions of tonnes of grain had to be categorized as "carry-over balances" and 37% to 80% of the survey participants reported surpluses of products. However, the problem of vertical storage development was very seldom mentioned this year. In a number of regions, agribusinesses experiencing storage shortages resort to storing grain in polymer “sleeves”. This technology is the most popular among farmers in the Central Federal District, wh ere 64% of the respondents reported having used such “sleeves”. Nation-wide, this technology is used by slightly less than a third of enterprises.

30% of domestic agribusinesses resort to storing grain in polymer “sleeves”

Open sources; analysis by Yakov and Partners

Role of the state

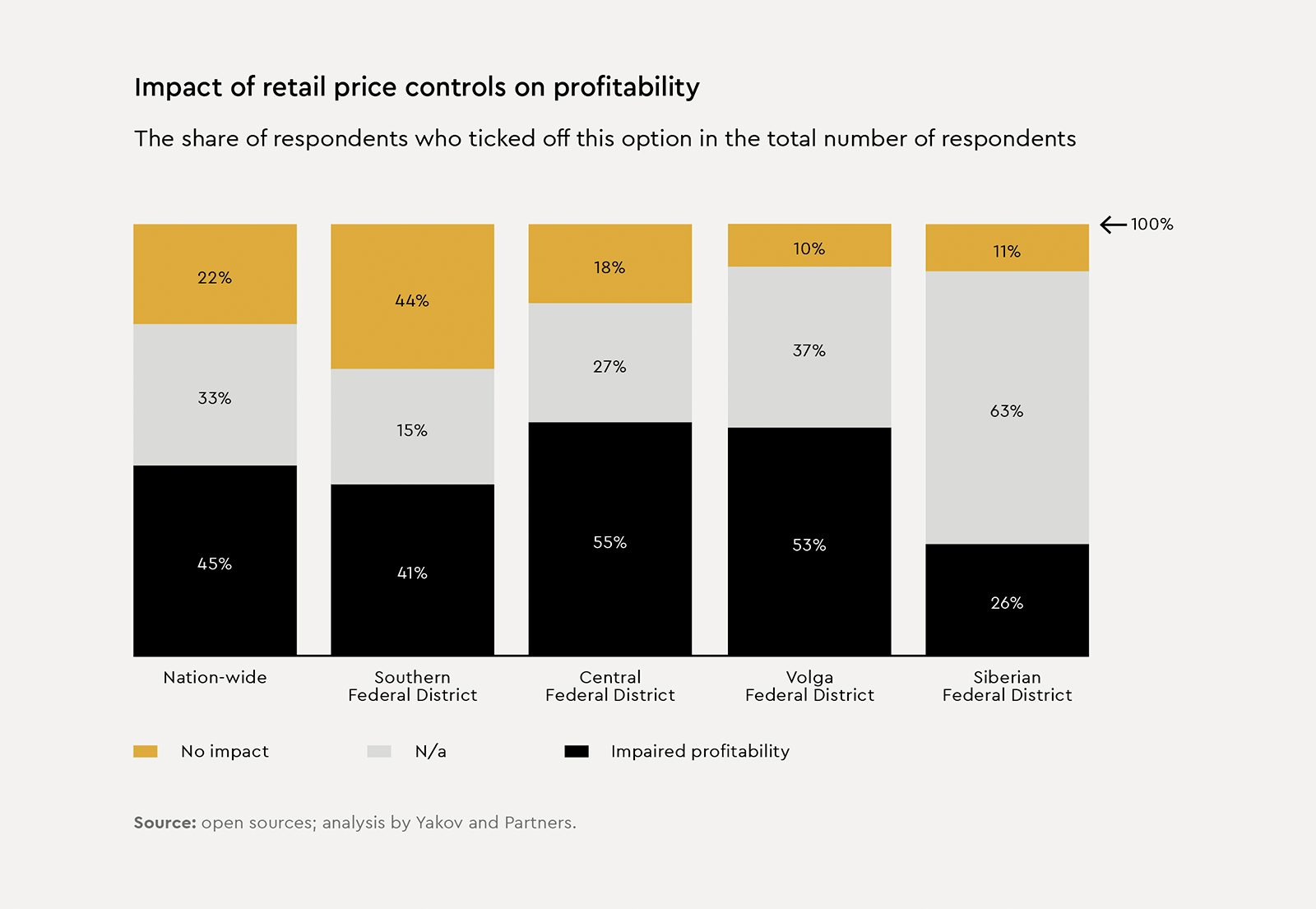

In addition to the realization of last year's risks, new issues have emerged on the agendas of domestic agribusiness. Two thirds of the respondents pointed out the need to adjust the regulatory landscape to fit the current situation in the sector. Export duties and retail price controls, as well as rising input prices, are causing losses among agricultural producers. 65% of the respondents named decreasing selling prices as one of the factors determining the levels of efficiency this season, while 53% of the respondents pointed to the rising input prices.

Farmers voiced suggestions ranging from canceling duties and price regulation to switching to regulating the entire supply chain: "State regulation of prices across all cost categories would help keep the price ratio intact. Revive economic planning, like back in the Soviet times, when things could be somehow anticipated and people had the time to get ready".

All in all, 36% of the respondents believe that duties hurt business, and not a single respondent in the Siberian and Volga Federal Districts believes that state duties benefit their businesses in any way. About half of the respondents had no opinion on this issue.

36% of the respondents believe that duties hurt business, and not a single respondent in the Siberian and Volga Federal Districts believes that state duties benefit their businesses in any way

Another popular sentiment is the need for subsidies. At the same time, agribusinesses were generally positive in their assessment of the financial support provided by the state. More than half of those surveyed had applied for a soft loan, and all the applications were approved. As to requests for reimbursement of costs related to production and modernization and maintenance of fixed assets, less than 10% were denied.

In general, it is worth mentioning that in our previous survey suggestions related to regulation were raised less frequently.

The issue of sufficiency of government investments in land improvement deserves a separate study. The need for amelioration varies from region to region: for example, 68% of the respondents in the Volga Federal District were dissatisfied with the allocated state investments, while the national average was 47%.

New horizons

Measures taken to support the domestic agribusiness over the past few years have ensured Russia's self-sufficiency in key categories of primary produce. Exports totaled USD 43.5 billion in 2023, and the country has been maintaining its status as a net exporter of agricultural products for the fourth consecutive year.

Domestic producers have developed a taste for new technologies and have become bolder in their experiments, while keeping within the bounds of reason. For example, despite the existing restrictions, some agribusinesses have already benefited from the use of agrodrones. In total, 6% of the respondents reported using drones in their operations, mainly in the Siberian and Southern Federal Districts.

More than RUB 3 billion has been allocated for digitalization of the agro-industrial complex this year. It is expected that farmers will be able to use modern technologies to increase yields, optimize costs, establish new marketing channels and gain a number of other competitive advantages.

All these measures lay the groundwork for further industry development. Yet as our survey shows, it is equally important for producers to urgently tackle such pressing issues as land amelioration, export and domestic infrastructure development, availability of high-quality equipment. At the same time, it is unlikely that market regulation in the best traditions of planned economies or restrictions on high-tech imports, such as quotas on seed imports, could promote sustainable growth.

As our current survey shows, domestic agribusinesses need to urgently tackle such pressing issues as land amelioration, export and domestic infrastructure development, and availability of high-quality equipment

Footnotes

1 The survey spanned 98 respondents representing agribusinesses with a land bank of 20,000 to 200,000 hectares. The survey perimeter includes 3.4 million hectares in 19 regions in four federal districts of the country, which is commensurate with the 2022–2023 survey.

2 https://yakov.partners/publications/prospects-for-domestic-grain.