23-40 billion U.S. dollars worth of additional growth the sector may gain fr om the establishment of three to five “national champions”

Open sources; analysis by Yakov and Partners.

The Russian agribusiness sector is facing stagnation after several years of strong growth amid global macroeconomic changes and snowballing problems with the supply of plant protection agents (PPA), equipment, seeds, and other genetic materials. A study of the Russian and global agribusiness market conducted by Yakov and Partners finds that one of the possible solutions to protect and further develop the domestic agro-industrial complex may be establishing three to five "national champions" (companies of international standing) on the basis of the most promising players in the domestic market. Experts believe this step could propel additional sector growth worth an estimated USD 23 to 40 billion.

The bittersweet results and uncertain future

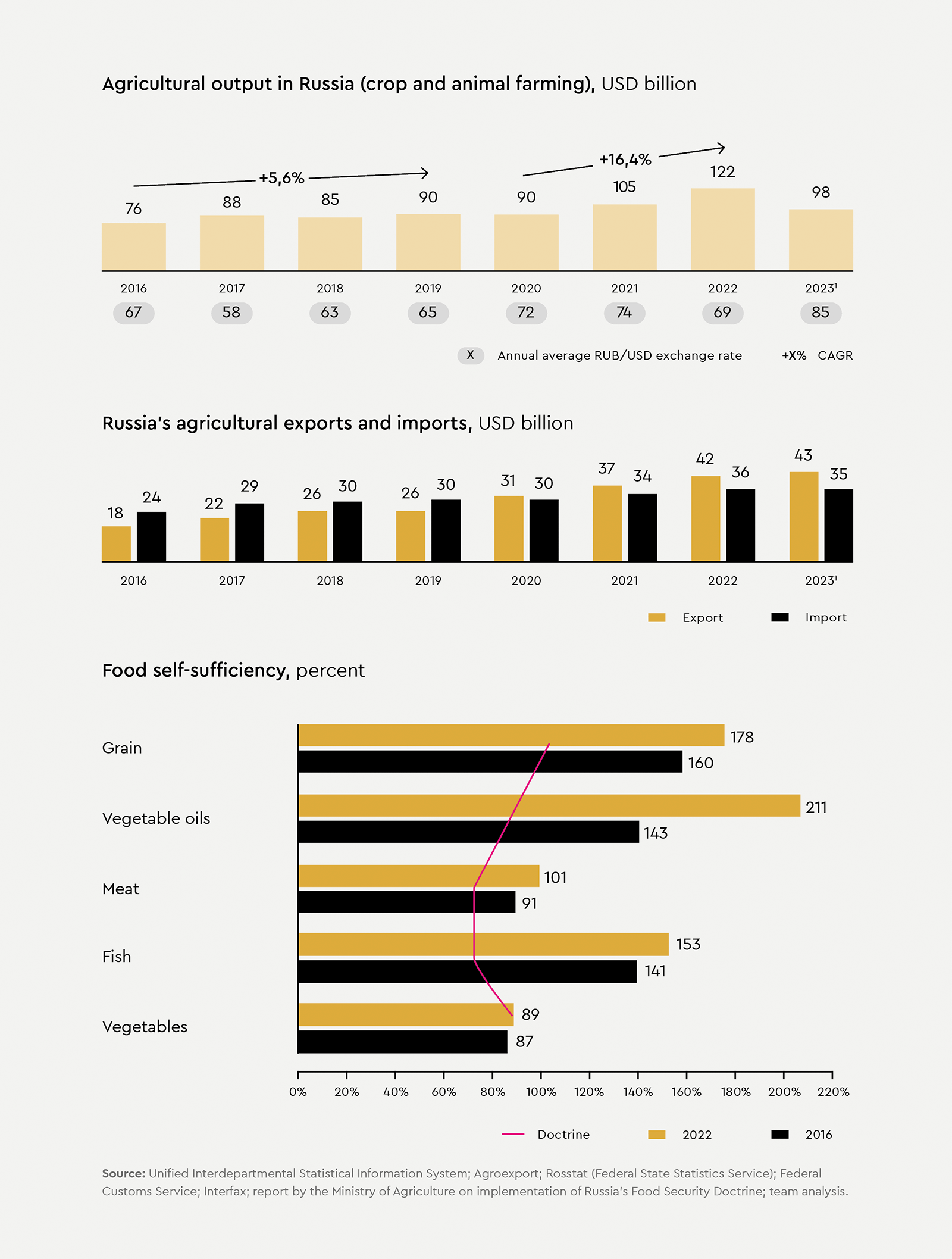

The results demonstrated by Russian agribusinesses so far testify to the obvious industry progress. Production growth attained between 2016 and 2022 amounted to 61% in value terms, while exports more than doubled over the same period. Russia has already outstripped its self-sufficiency targets in most categories, including grain, vegetable oils, fish, etc., while exports have been steadily growing and exceeding imports since 2020. The year before last, production growth in physical terms put Russia in the top five largest agriculture exporters by volume. Grain and oilseed production growth between 2019 and 2022 amounted to a solid 9% and 8.5%, respectively.

And yet there is no way around the fact that in financial terms, the results are less impressive. The Russian agro-industrial complex ranks only 17th in the world in export value terms, while its share of the global market barely exceeds 2%.

The Russian agro-industrial complex ranks 17th in the world in export value terms, while its share of the global market barely exceeds 2%

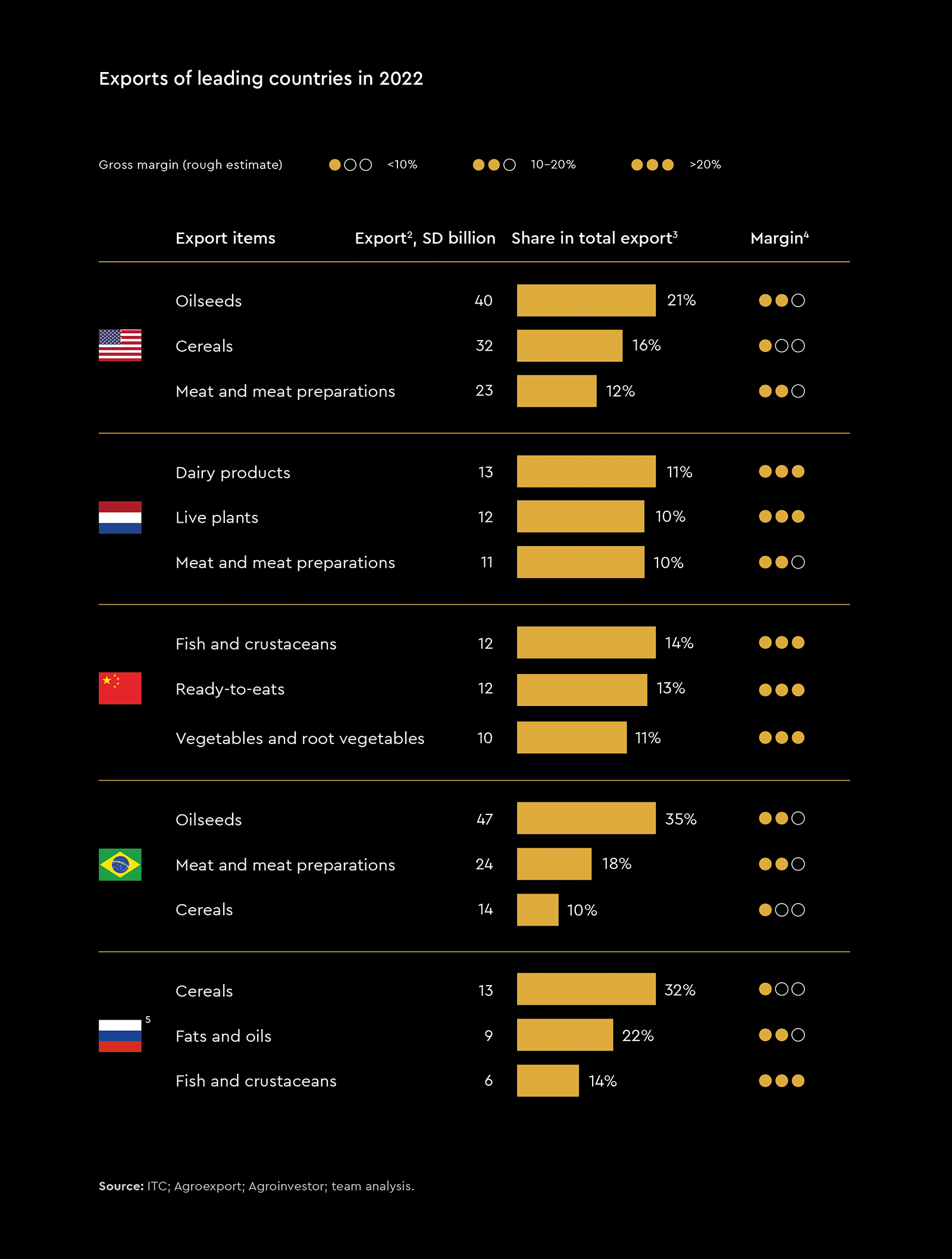

In order to join the ranks of leaders Russia will have to drastically improve its performance across a number of indicators, for example, radically increase the margins of exported products as well as the total output. As of today, Russia’s total agribusiness output makes up only a quarter of that of the US and half of that of Brazil.

Unless the situation is reversed, in the optimistic scenario the export growth momentum will plateau in the next 2 to 3 years if the current development trajectory holds. However, if the risks are realized, the country will start losing its share of the world market, and this will primarily affect high-margin products with high added value, with the exception of fish and crustaceans from the Far East, wh ere exports are guaranteed through territorial monopoly.

Structural industry challenges

To attain global leadership as well as to implement the Agriculture Development Strategy and reach the targets outlined in the Presidential Address to the Federal Assembly delivered on February 29, 2024 the industry will have to overcome a number of tough structural challenges.

First, it needs to ensure growth in both value and volume terms in the domestic and foreign markets, including an increased share of downstream products and higher margins for agribusiness exports.Second, it is necessary to increase the sustainability of agribusiness development taking into account the risks; in particular, it is vital to ensure national sovereignty in terms of agricultural technologies and means of production. Currently, the dependence of Russian agriculture on imported genetics solutions reaches up to 90% for certain types of products, while the gap between the yields of domestically selected and best selected seeds around the world reaches dozens of percent for most crops. Other challenges include developing financial and transportation infrastructure, solving the problem of staff shortages, and nurturing talent for the less-thanpopular industry, especially among IT professionals and middle to senior managers.

Last but not least, production efficiency needs a boost. To join the “major leagues”, domestic industry players need to bring down unit costs along the entire value chain, fr om genetics and cultivation to processing and distribution, increase end-to-end production efficiency, develop infrastructure for storage, logistics, and distribution, and implement best practices for integrated production planning. In recent years, digitalization has been one of the most important factors driving agricultural productivity around the world. For example, in the US, digital technologies helped increase yields by 5% to 10%. Yet according to our estimates, Russia lags far behind global leaders in terms of agriculture digitalization. For instance, the level of digital solutions implementation among domestic agricultural producers is 9 times as low as for their Israeli counterparts, while the average volume of private investment in the sector is 7 times as low as the global average.

Making a breakthrough and enhancing exports at a time when the domestic market is close to saturation would require ramping up industry financing. To make matters worse, none of the Russian industry players have made it to the world's top 20 in terms of revenue or profit, while debt financing is limited. Thus, attaining the targets set out in the Agriculture Development Strategy 2030 and the Presidential Address to the Federal Assembly clearly requires a brand-new approach to development.

Making a breakthrough and enhancing exports at a time when the domestic market is close to saturation requires ramping up industry financing

Ways to increase revenues by 3500%

Analysis of the current situation in the agro-industrial complex suggests that the most realistic response to the challenges may be market consolidation and establishment of several global integrated players in Russia that would be on a par with the world leaders in the agro-industrial complex. We call them "national champions".

The most realistic response to the challenges may be market consolidation and establishment of several domestic companies that would be on a par with global agribusiness leaders

Those are companies with a global presence (more than 25% of all products are exported), generating more than USD 10 billion in annual revenues and capable of controlling a major part of the value chain, especially higher-margin product segments; global R&D leaders, anchor tenants / major customers of infrastructure projects, employers with an international standing.

As of today, no Russian company meets these criteria, as their revenues are at least three times as low as the intended benchmark. Nevertheless, the prospects of setting up "national champions" in Russia are quite viable. This is in no way a "road to nowhere", which industry players would have to pave at their own peril, but a tried-and-tested mechanism that has already proved its worth in several countries around the world, wh ere behemoth agribusiness conglomerates became the driving force behind the rapid development of the industry, propelling their home countries to the major agribusiness league. Creating "national champions" is a reliable strategy of industry development recognized all over the world.

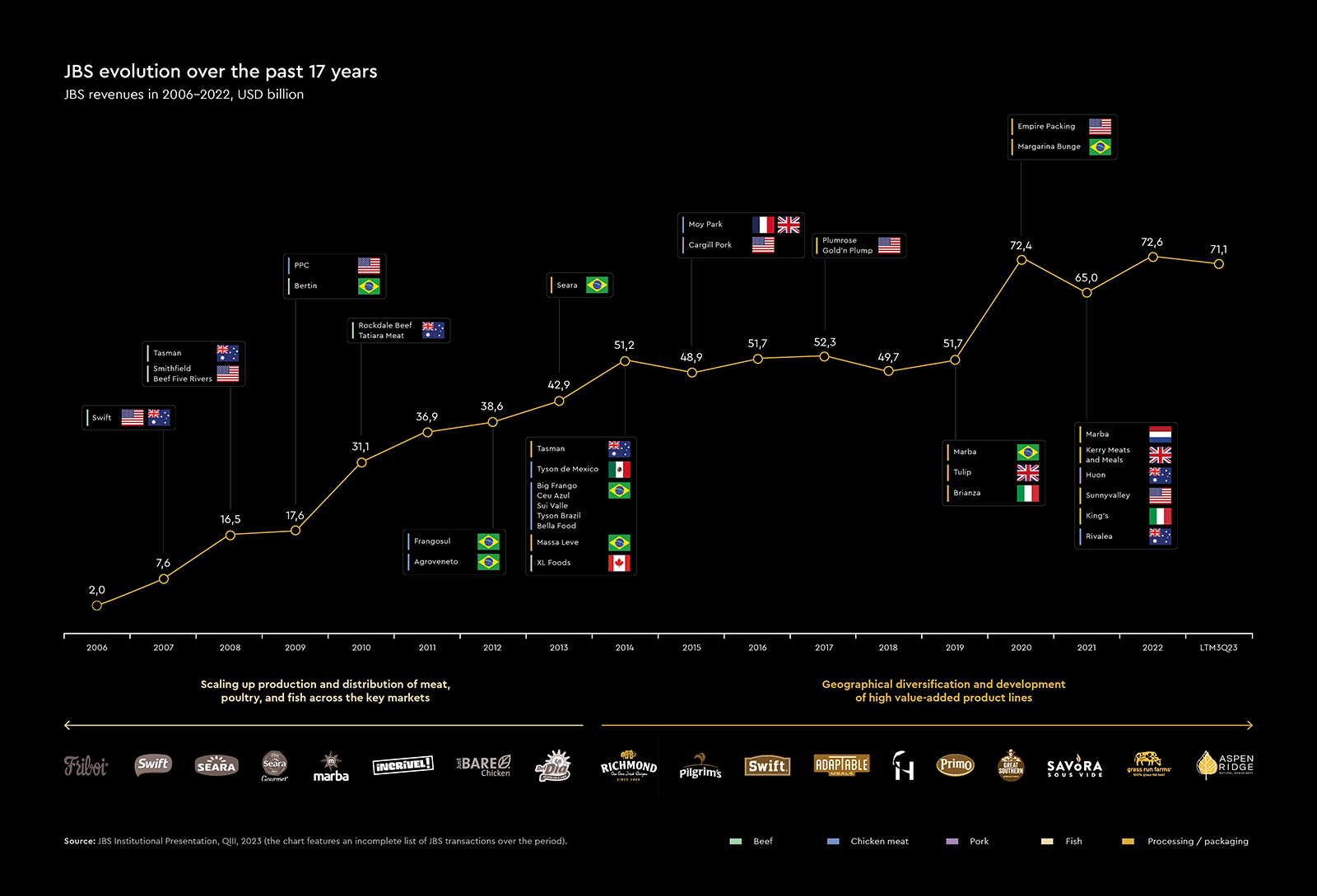

For example, Brazil, which has established itself as the absolute world leader in agricultural exports and the second largest exporter in value terms after the US, began its journey to the global pinnacle through the evolution of JBS, a major producer of meat, meat products, fish, and fishery products. Over the period of 17 years, the company increased its annual revenue by more than 3500%, from USD 2 billion in 2006 to USD 73 billion in 2023.

The main focus of JBS development was scaling up production in major global markets, as well as geographic diversification and development of a line of products with high added value. As for the main development tool, JBS opted for a continuous string of M&A transactions. Between 2007 and 2022, 38 such deals were wrapped up, including the acquisition of Cargill’s pork business in the US, the takeover of meat producers Moy Park (the UK), Primo Smallgoods (Australia), and Rigamonti (Italy).

The government actively supported the company's major transactions through equity investment and cheap loans on favorable terms extended by BNDES, the Brazilian development bank. The IPO of JBS was also an important milestone in its expansion into international markets. As a result, JBS is now present in 180 countries and has an extensive network of production facilities and distribution centers in two dozen countries despite starting its climb to the top of the global industry elite as a purely regional player.

Another example is CPF, a global company from Thailand with an annual revenue of USD 17 billion. CPF is a full-cycle producer of animal proteins and food products, from breeding to production and distribution to retailers and food service outlets. Starting with local operations in its home country, the company went on to global expansion, eventually building a business that generates 64% of its revenue overseas.

To ensure rapid growth, CPF focused on establishing its presence throughout the entire value chain, including feed production (24% of the revenue), livestock rearing (55%), processing, manufacturing, and distribution of finished products to end consumers (21%). Throughout more than 30 years of operation, this publicly traded company has been actively pursuing acquisitions and investments across all geographies to develop its research, production, and marketing capabilities. Today, Thailand's largest agribusiness company has key assets in 40 countries on all continents.

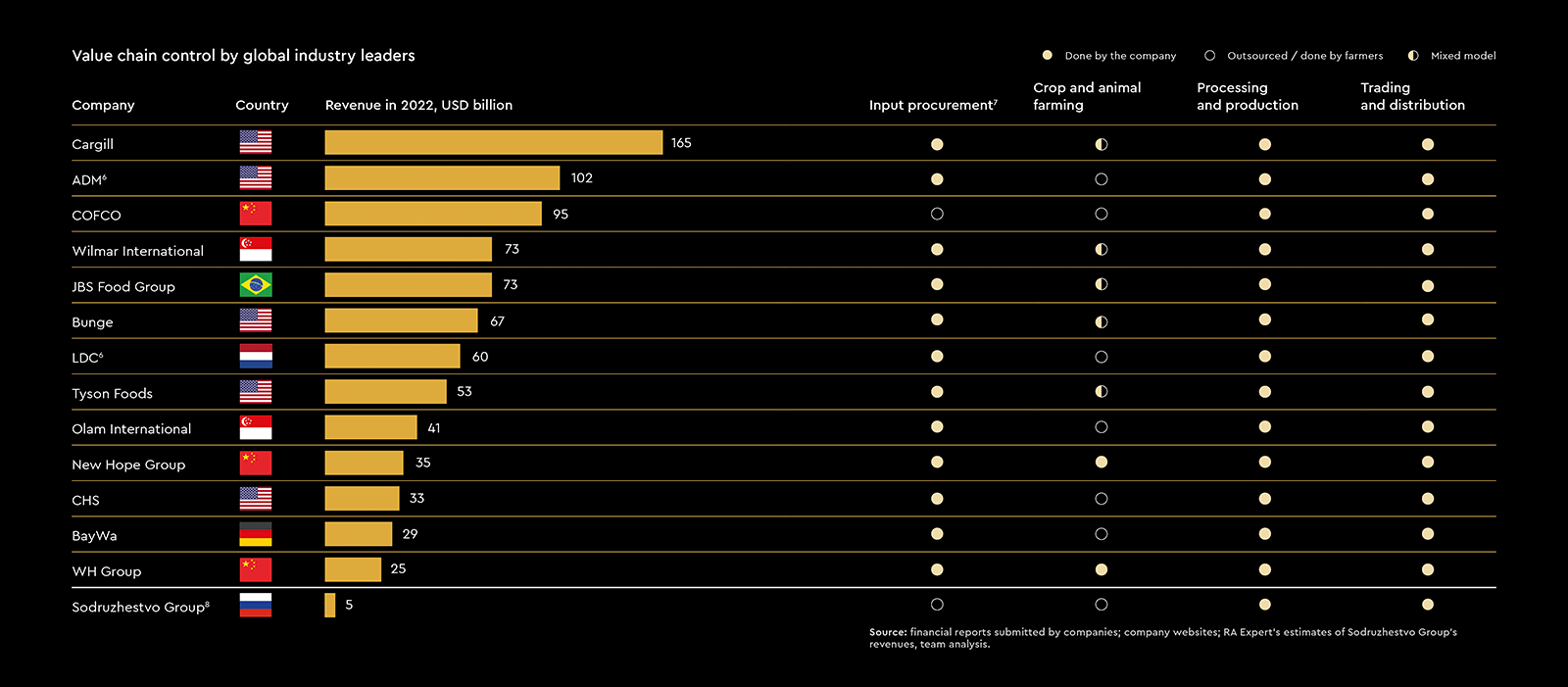

In general, a major proportion of production and exports in the leading countries is generated by largest producers. In addition to the above mentioned JBS and SPF, other examples include COFCO, China’s largest national food producer; Tyson, a US-based producer of meat and meat products; and LDC, a diversified trader and agricultural producer based in the Netherlands, which ranks sixth among the world’s largest exporters. Incidentally, in the US agribusiness sector, up to 50% of all production is concentrated within 3% of agribusiness companies.

A substantial proportion of production and exports in leading countries is generated by major producers

50% of all production is consolidated within 3% of agribusinesses

Open sources, analysis by Yakov and Partners.

The champion power

Our research of global practices shows that "national champions" in agribusiness have six key characteristics in common regardless of the country.

- Presence along the entire value chain, including trading and distribution.

- Global expansion into international markets.

- Effective inorganic growth.

- Focus on R&D.

- Production of high-value-added products.

- Operational excellence.

It is noteworthy that when global agribusiness leaders take over the value chain, they often tend to leave out certain stages, delegating primary produce to farmers and providing them with inputs and quality standards. Of the 13 global corporate leaders with annual revenues ranging from USD 20 to 200 billion presented in the table below, only two companies are engaged in primary produce. World leaders primarily focus on the higher-margin high-tech stages, i.e. processing and production of finished products, trading and distribution control. Genetics solutions for crop and livestock farming are usually outsourced to specialized R&D companies, although there are other approaches as well. For example, Cobb-Vantress, one of the world's largest suppliers of broiler genetics solutions, is owned by Tyson.

The resources required to jumpstart the industry

Organic investments and loans, which a few years ago sufficed to support the growth of major Russian players relying on local M&A deals, will not be enough to sustain the rapid pace of growth required amid the current global competition. Under the circumstances, an initial public offering may prove to be the only way to ensure revolutionary growth required to propel a company to the ranks of "national champions". Domestic public listings of three to five of the most promising Russian companies will make those companies more stable and transparent, while their shares will serve as an efficient tool for solving the most pressing corporate problems and financing vital M&A deals.

We estimate the total investment required to make future "national champions" competitive on a global scale at approximately USD 22 billion. These funds will go towards developing export infrastructure, acquisition of foreign R&D companies specializing on genetics solutions, and other investments. A subsequent IPO on a reputable Southeast Asian platform will help establish those companies as BRICS+ players and facilitate access to the region's markets.

The case of acquisition of Switzerland’s Syngenta by ChemChina for USD 43 billion in 2017 and the subsequent 2.6-fold growth of Syngenta's revenues over 5 years prove that such investments may be very profitable. In general, 11 out of the world's 15 largest agribusiness players are public companies. The issue of government participation in such investments, as demonstrated by the case of ChemChina and Syngenta, boils down to the desired level of control over a certain part of the value chain in the industry.

11 out of the world's 15 largest agribusiness players are public companies

Experts believe the current environment in Russia is favorable for IPOs, and the number of such transactions may reach 20 by the end of the year, compared to eight deals in 2023 and just one in 2022.⁹ At the same time, agribusinesses may play a major role in this process, given the continued annual growth of the Russian agro-industrial complex of 15% to 20%, as well as the absence of negative media coverage of industry leaders.

USD 40 billion worth of impact

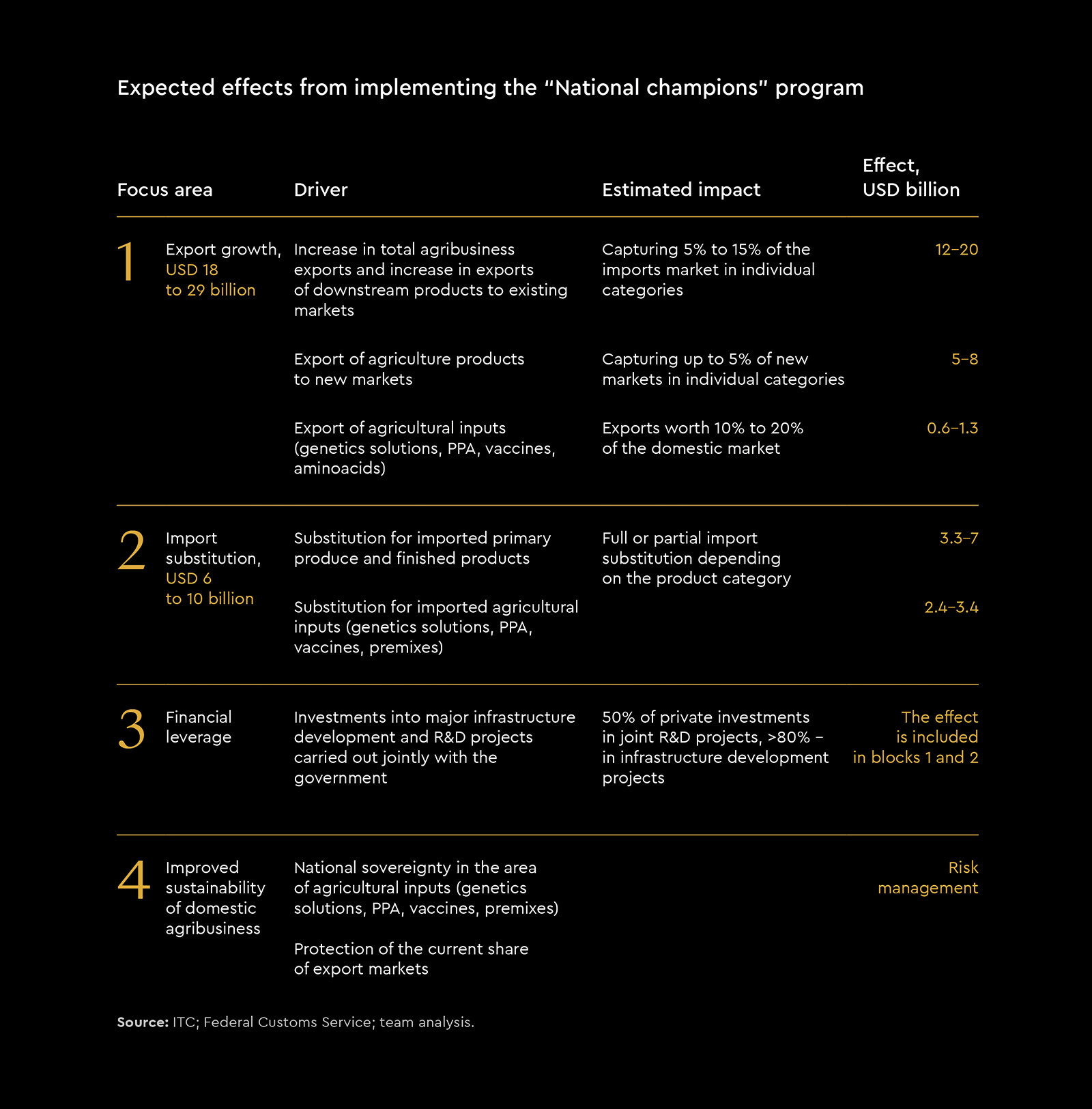

According to our estimates, if done right, the total annual impact from creating "national champions" in the domestic agriculture industry may reach USD 23 to 40 billion by 2035 provided the process is supported by the Russian Ministry of Agriculture, the Ministry of Industry and Trade, and the Federal Antimonopoly Service.

Given that the national market is close to saturation, focusing on exports may prove to be the most logical next step. Stimulating export growth in the existing and prospective global markets could help increase the annual contribution of the industry to Russia's GDP by USD 18 to 29 billion, including 12 to 20 billion captured through larger volumes of currently exported agribusiness products as well as an increase in exports of downstream products to existing markets, and another USD 5 to 8 billion through exports to new markets. For instance, breaking into the most promising ASEAN markets may bring USD 2.5 to 3.8 billion. Export of agricultural inputs (genetics solutions, PPA, vaccines, amino acids) will hardly exceed USD 1.3 billion per year, yet its contribution to import substitution effort is estimated at USD 2.4 to 3.4 billion.

Given that the national market is close to saturation, focusing on exports may prove to be the most useful next step

The total increase in import substitution in the agriculture products and technologies segment over the same time period will amount to USD 6 to 10 billion, including USD 3.3 to 7 billion worth of import substitution in the primary produce and finished products segment. The most significant aspect may be the substitution of imports in the ready foods and beverages category by "national champions" with an estimated annual potential of USD 1.5 to 2.5 billion.

22 billion U.S. dollars is required to make future "national champions" competitive in the global market

Open sources, analysis by Yakov and Partners.

Conclusion

Consistent effort aimed at establishing "national champions" will create an impetus that will allow the domestic agro-industrial complex to boost exports by two thirds and drastically increase the share of products with high added value. By 2035, this impetus will enable the industry to increase production by 20% to 40% in value terms, securing the achievement of Strategy 2030 targets and the benchmarks outlined in the Presidential Address, firmly putting Russia in the top 5 list of global suppliers in both volume and value terms.

IPOs of several Russian agribusinesses will galvanize the development of the domestic agriculture industry and help attain the Strategy 2030 targets

Domestic IPOs of three to five of the most promising Russian companies could prove to be the single most powerful option for attaining the set goals. Supported by regulators, such initial public offerings will equip the national leaders with the means necessary to solve the four most urgent problems in this vital industry:

- Preparation and implementation of transactions for acquisition of world-class genetics solutions which have the potential to take up more than half of the domestic market across the total range of categories, ensuring Russia's technological sovereignty and propelling it to the leading positions in agribusiness across BRICS+.

- Developing export infrastructure in line with production expansion.

- A radical increase in operational efficiency to reach at least the top quartile level of the global market.

- Finally, an IPO will help ensure an uninterrupted development of the sector in the context of generational changes in ownership. Currently, the average age of shareholders of the top-30 Russian agribusinesses is 57 years, and in 75% of cases the controlling shareholder and CEO are the same person. That is why an IPO and the accompanying efforts aimed at developing a high-quality corporate strategy that will make sense to external investors, separating ownership and operational management, etc. may be a good choice for shareholders wishing to poise their companies for long-term development across generations.

An IPO is a good option for shareholders wishing to poise their companies for long-term development across generations

Those goals cannot be achieved without the concerted effort of all the stakeholders aimed at developing and successfully implementing the "National champions" program in the medium term and bringing in adequate technological and managerial expertise.

Today, an incongruous situation has emerged in the Russian agro-industrial complex. Despite the undeniable achievements of the recent years, the domestic industry lags behind the global market across multiple criteria. While banking, IT, retail, and many other sectors of the domestic economy managed to catch up with (and often surpass) best global standards, the agro-industrial complex still has much to do to draw level with world leaders. Attracting massive resources will enable Russian agribusinesses to acquire advanced skills, technologies, and competencies and revolutionize the entire industry, bringing it to a whole new level of quality and efficiency.

Footnotes

1 The team’s estimate is based on Rosstat and Federal Customs Service data published in the media. The 2023 decrease in production in dollar value terms was largely due to the weakening of the national currency. As Interfax reports, according to preliminary data from Rosstat, in 2023 agricultural production in Russia showed a reduction in comparable prices of 0.3% vs 2022.

2 Export volumes by key major categories of agribusiness products in 2022.

3 Share of product exports in the total volume of national agribusiness exports in value terms.

4 Expert assessment of the average gross margin by product category.

5 Russian export data according to the estimates of the Agroexport center and Agroinvestor magazine.

6 Full company names are Archer-Daniels-Midland (ADM ) and Louis Dreyfus Company (LDC).

7 Supplying partner farms with machinery, seeds, PPA, vaccines, animal feed, fertilizers, and agricultural technology.

8 Sodruzhestvo Group is included for comparison purposes as the largest Russian agribusiness in terms of revenue, which, according to Expert RA, amounted to USD 4.6 billion in 2022.

9 https://www.banki.ru/news/daytheme/?id=11000220; The IPO Boom in Russia review by Expert RA.