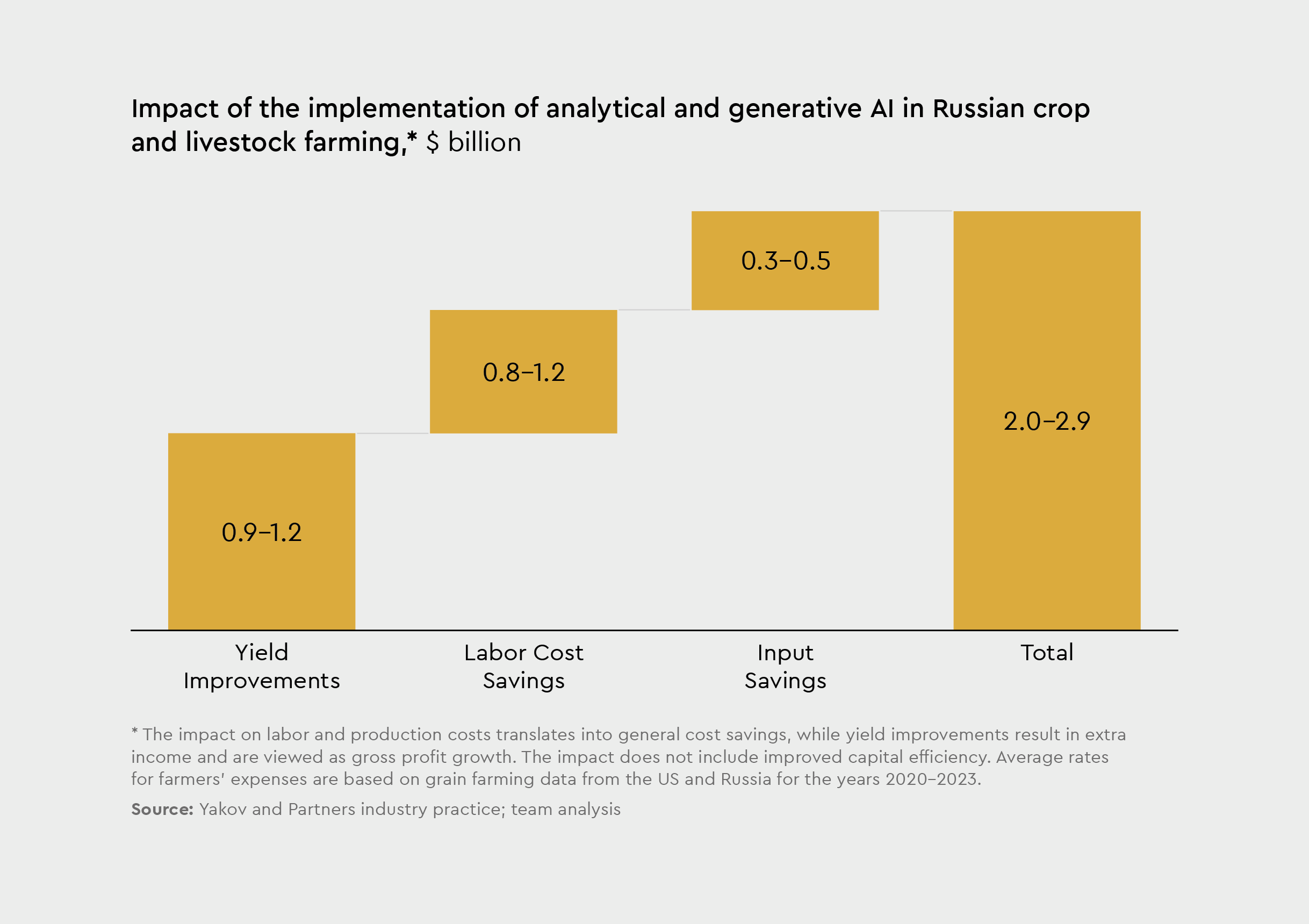

Yakov and Partners experts have looked into the present and future of artificial intelligence (AI) in Russia’s agriculture sector. According to the study “Artificial intelligence in Russia’s agricultural sector: hype or real money?” the anticipated economic impact of AI adoption may reach $2–2.9 billion in extra operating profit for crop and livestock farmers and $1.6–3.2 billion for agricultural input manufacturers and service providers. In Russia, some two-thirds of the economic impact in the second group inures to the benefit of fertilizer producers.

Artificial intelligence is no longer just hype, it’s one of the key factors of successful industrial transformation. By adopting AI, companies can dramatically improve process efficiency, especially when labor is scarce, costs are rising, and access to financing is limited

Alexey Kletsko, Director at Yakov and Partners

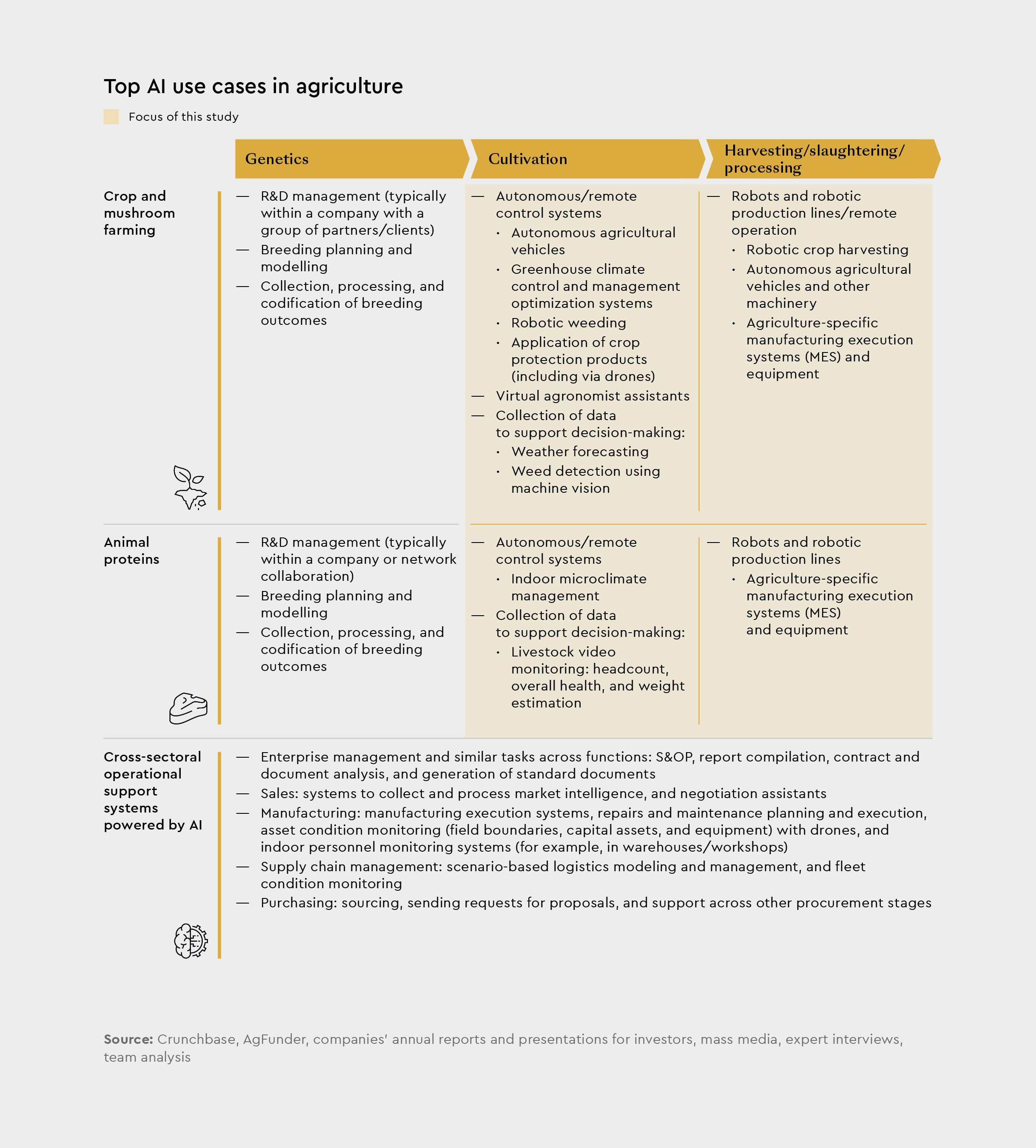

He noted that digital transformation in the agriculture sector is enabled by two categories of artificial intelligence: analytical AI and generative AI. The former helps forecast crop yields, optimize supply chains, and improve equipment maintenance, while the latter is able to create new scenarios, develop recommendations, and even teach farmers when used as a digital assistant.

Despite the widespread belief that agriculture is a tradition-bound sector, digitalization in Russia’s agriculture is advancing quickly. According to expert estimates, digital platforms are already used by farms covering over 20 million hectares of land. These solutions include modules for weed detection, satellite image analysis, crop yield forecasting, and operations management. Our Window of Opportunity 3.0 survey of over 100 top managers (chief agronomists and heads of agricultural enterprises from all Russian regions, with a pool of land exceeding 20,000 hectares) vindicates this observation: more than 85% of the poll respondents use AI in their farm machinery controls, over 65% use it in agronomist assistants, and most respondents plan to keep adopting new AI-based solutions going forward.

Agricultural input manufacturers are also actively adopting new digital technology, investing a significant share of their revenues in R&D and thus speeding up technological development in the sector. For instance, state-of-the-art self-driving and machine vision systems help improve the efficiency of agricultural machinery by 30%–50%, depending on the equipment type and conditions.

The agricultural processing industry is also implementing digitalization strategies: new factories often are being designed with Industry 4.0 principles at their core, that is, full process automation – from feeding materials to shipping finished products. All operations are controlled by smart systems integrated into MES.

In the international market, US manufacturers continue to be the industry benchmark: their digital ecosystems control hundreds of thousands of agricultural machines and hundreds of millions of hectares of land. Real-time data collection and processing is instrumental in optimizing the use of resources, reducing production costs, and increasing yields.

Developing nations are rapidly adopting digital technologies, too. For example, over 120,000 farmers in India use Dhenu Agri, an LLM-based agricultural platform. Available in 12 local languages and optimized for budget smartphones, the system provides personalized recommendations on the use of agricultural technologies and fertilizers, as well as crop rotation advice. Pilot programs showed yield improvements of 10%–25% on average.

However, despite their efficiency, widespread adoption of these solutions in Russia encounters multiple barriers, the experts say. One of the main hindering factors is the Bank of Russia’s high key interest rate (18% as of July 2025). Experts estimate that the agriculture sector loses RUB 500–650 billion because of the high cost of capital each year. Another barrier is the recycling fee on farm machinery, which costs the sector RUB 150–250 billion annually. Seed import quotas and the full transition to domestic genetic material may generate extra RUB 250–300 billion in losses.

The authors note that even with advanced technology in place, the impact of AI adoption will be minimal if companies fail to achieve higher levels of operational maturity and integrate the innovations into their manufacturing systems. One should also remember that for artificial intelligence to make a difference, there have to be carriers for AI to work through, either physical or digital ones – tractors, control systems, software, etc. Without such carriers, AI remains an abstract solution without any practical value.

According to the experts, the basic prerequisites for widespread AI adoption by Russian agriculture companies include growing demand from customers who are willing and able to pay, lower regulatory and financial barriers, and embracing of the operational best practices that have been successfully implemented in other industries, from metallurgy to retail.

Artificial intelligence is not a product, it’s a system. It does not replace people but helps them take more accurate decisions, make their business more sustainable, and open new markets. New economic growth opportunities are rapidly emerging at the intersection of the agricultural sector and digital technologies

Stanislav Vetoshkin, Expert at Yakov and Partners