Key insights

Global trends

- Global energy consumption will continue to grow through 2040 on the back of population growth and rising per capita energy consumption in developing regions.

- From 2030 onwards, a strong drive for lean technologies and organizational energy efficiency measures will result in a gradual reduction of fossil fuel consumption through 2050.

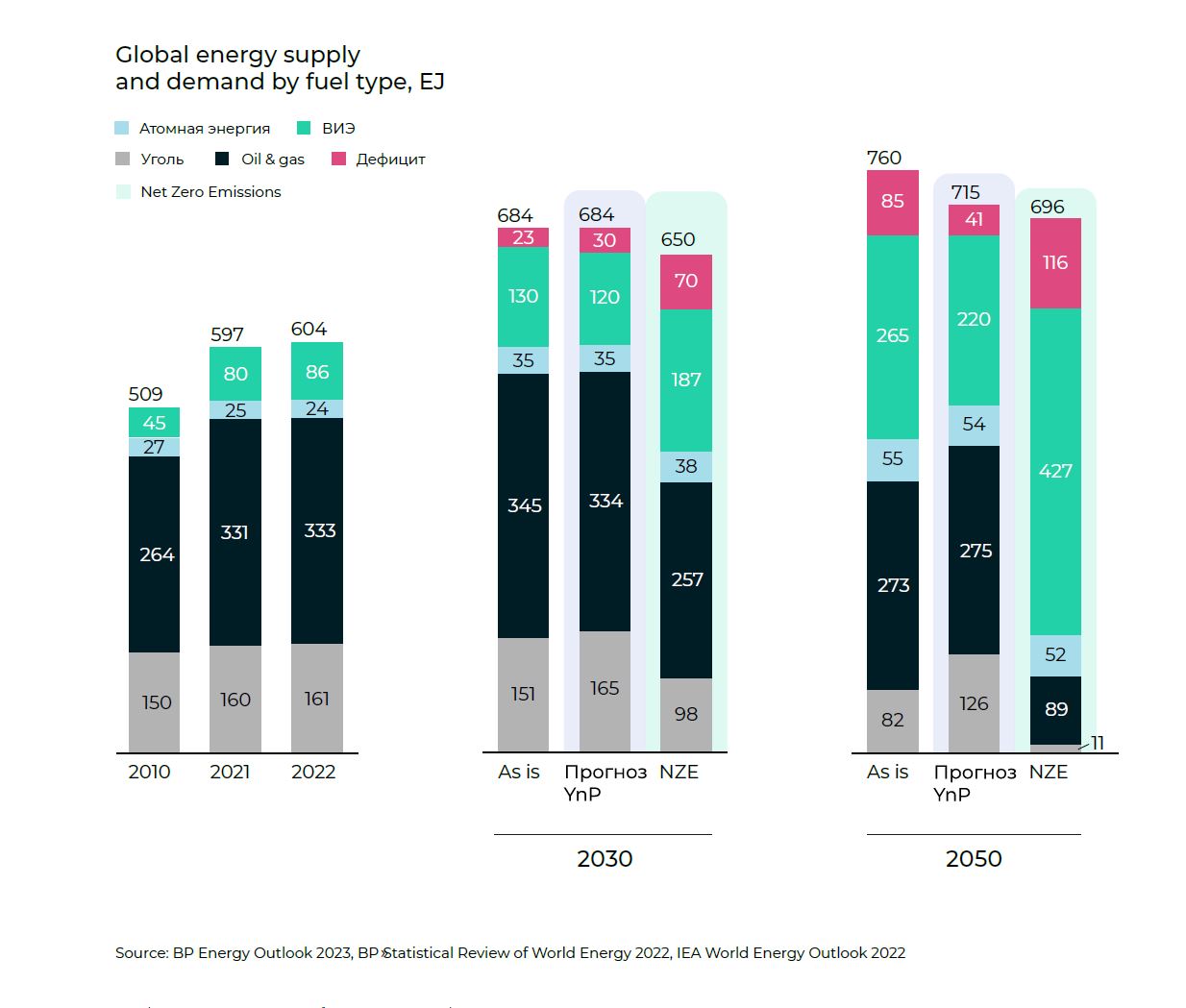

- Despite the projected growth of renewable energy production (from 86 EJ in 2022 to 220 EJ in 2050), fossil fuels will remain highly important in the global energy mix. They will account for 76% of energy in 2030 and 59% in 2050.

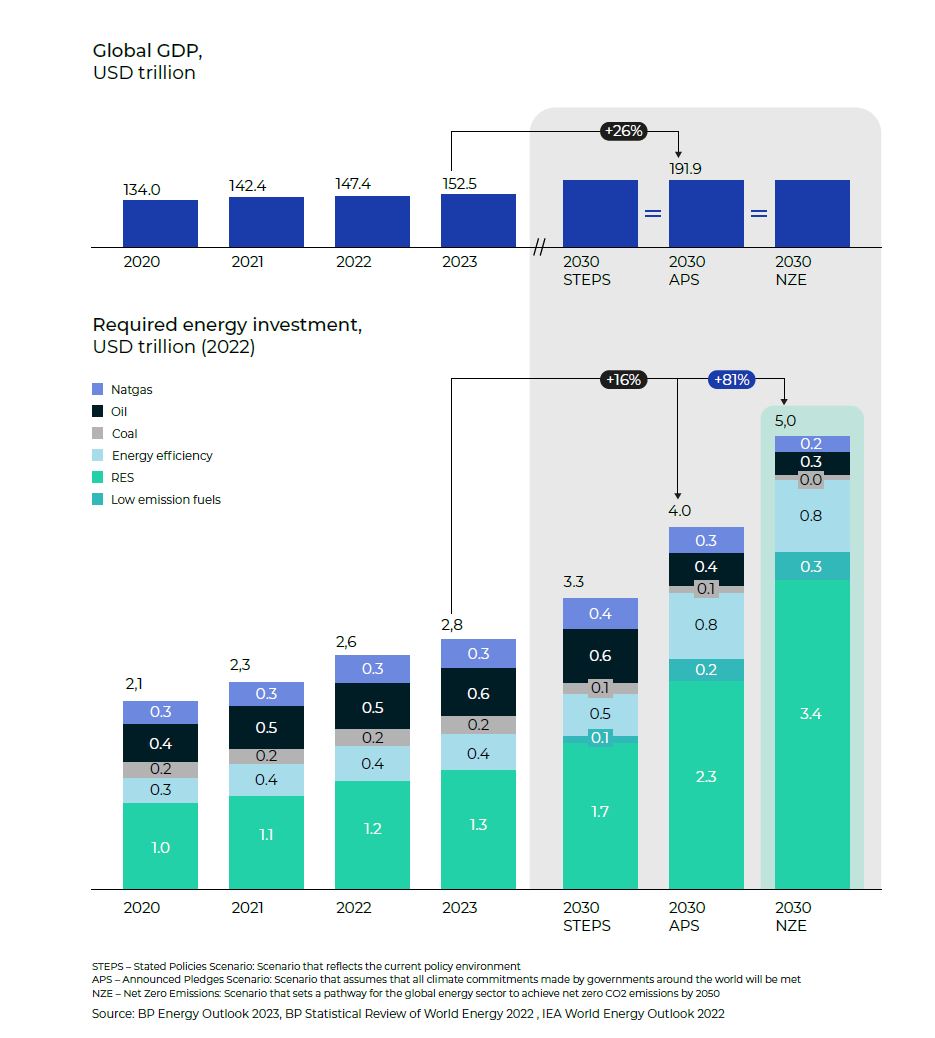

- NZE scenario with 78% renewables share by 2050 is unlikely to be achieved, as the required investment growth rate is 3 times higher than the projected GDP growth rate. Achievement of NZE goals is possible only with additional financing at the expense of other sectors of the economy.

Energy mix changes in 2022

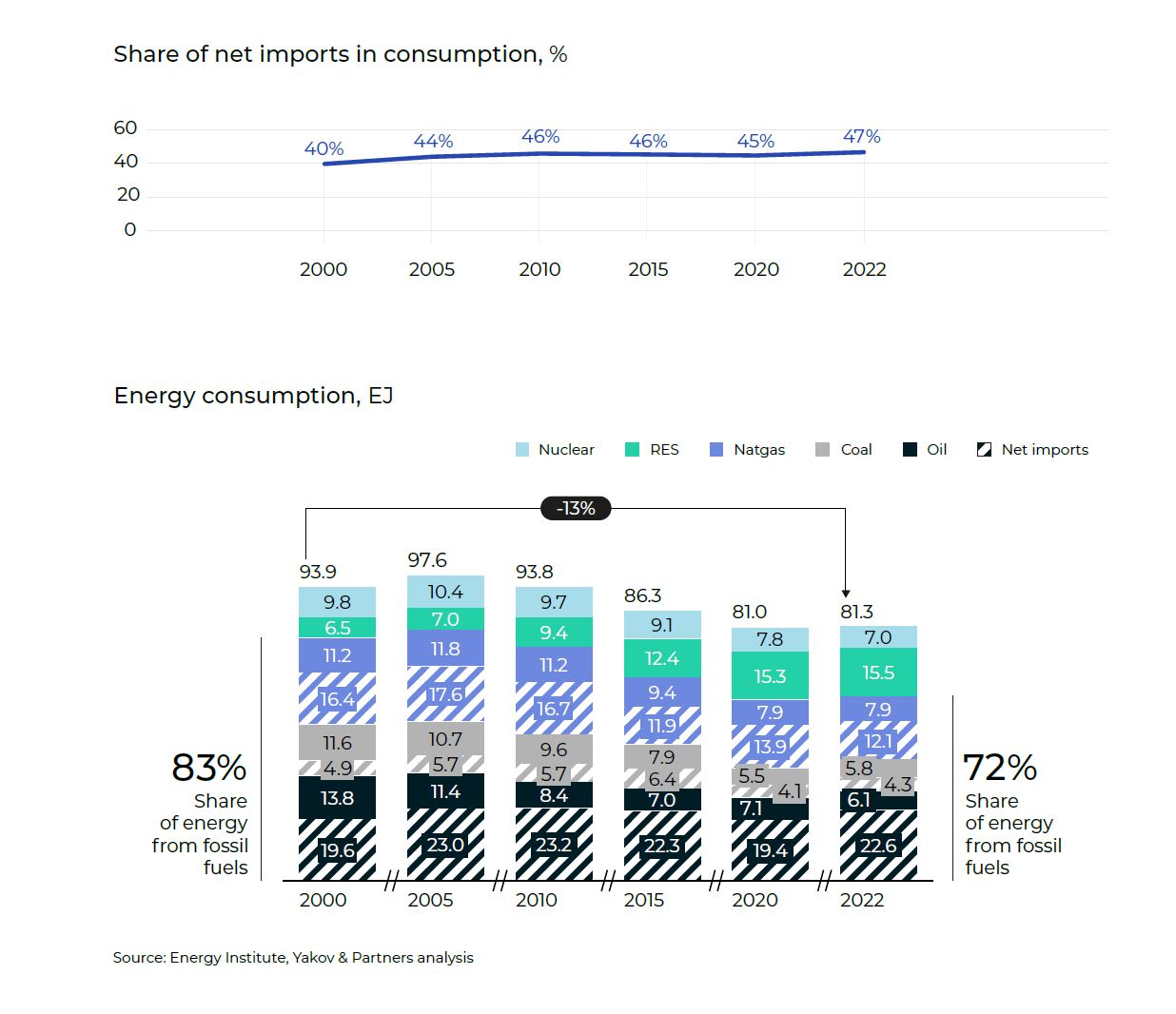

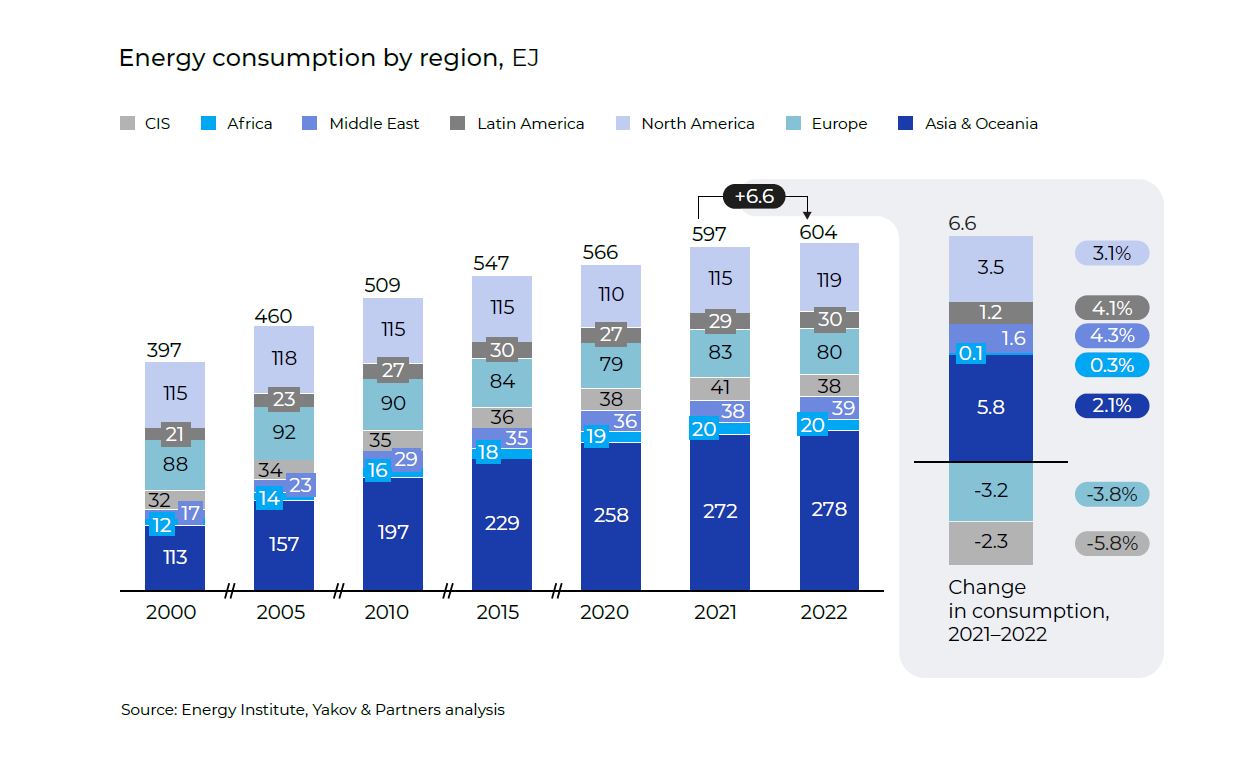

- Against the backdrop of a 1.1% (6.6 EJ) increase in global energy consumption, consumption in Europe and CIS countries declined by 3.8% and 5.8%, respectively.

- Europe stepped up its consumption of thermal coal, suspended nuclear power plant phase-out programs, and ramped up oil and LNG supplies from other countries to offset the slump in Russian pipeline gas imports. However, all these measures failed to keep consumption at the 2021 level.

- Gas exports from Russia fell by 32.3% in 2022 year-on-year. Oil exports, in turn, rose by 1.1%.

- Despite rising oil and gas exports by other sanctioned countries (Iran, Venezuela) and the United States, Europe faced a shortage of fossil fuels. This caused a dramatic rise in prices and, as a consequence, a 25% drop in industrial production throughout the region.

Key global energy trends

Global trends

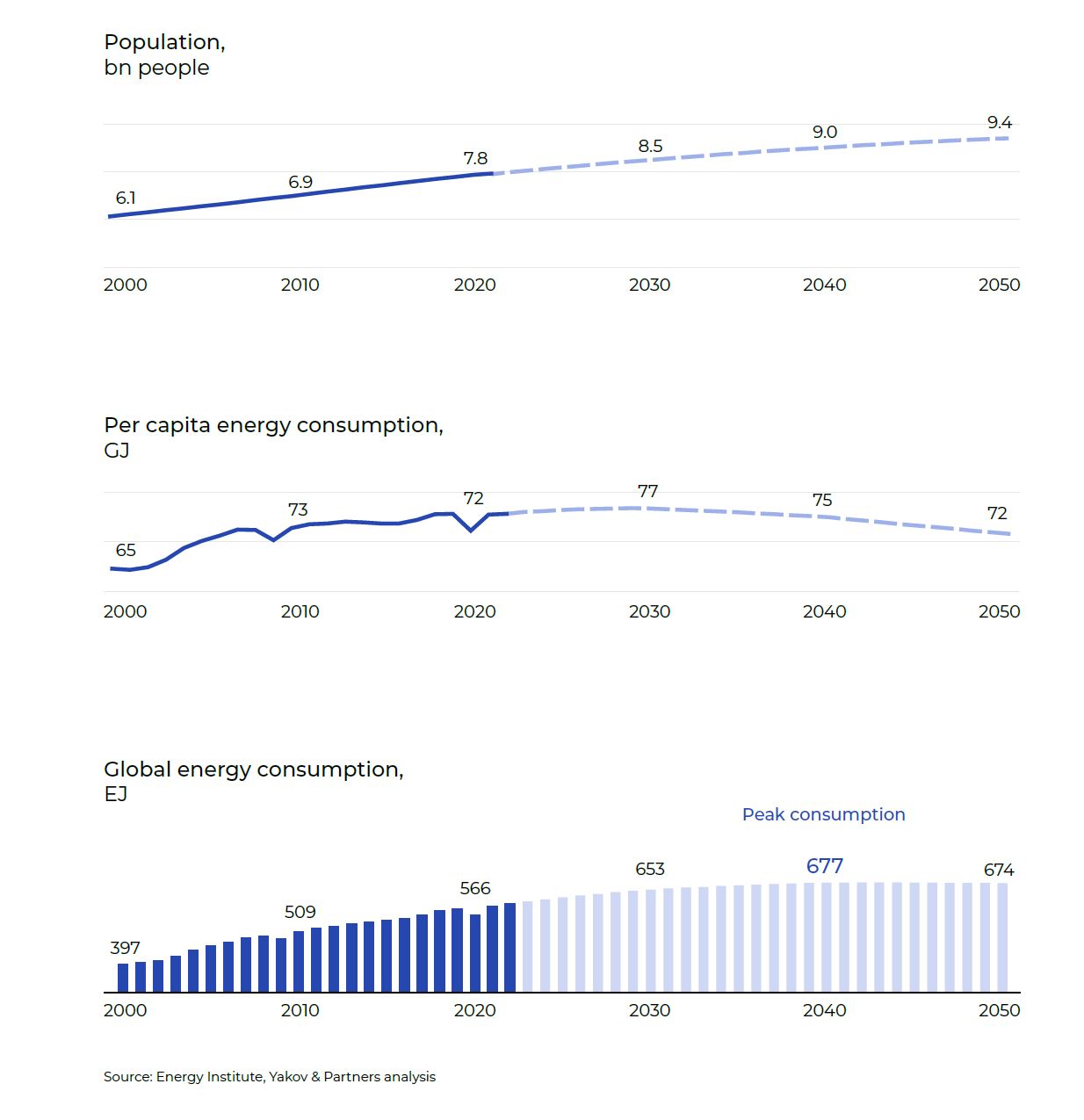

With population growth, global energy consumption is projected to keep rising, peaking at 677 exajoules (EJ) in 2040. It will remain at this level, declining slightly between 2040 and 2050. This decline will be driven by greater adoption of lean technologies (including energy reuse, reduced overproduction, and integrated organizational measures) from the 2030’s onwards, as well as slower population growth.

Per capita energy consumption between 2040 and 2050 will also decrease slightly (-4%) to 72 gigajoules (GJ) per year. However, global energy consumption will be 1.7 times higher by the peak year of 2040 vs. 2000.

Global trends characterized by divergent energy market trends in developed and developing countries will persist. As in 2000–2022, energy consumption growth will be mainly driven by developing regions, accounting for more than 85% of the world’s population in 2022. These regions have seen a stable trend of per capita consumption growth by an average of 1.4% p.a. over the last 20 years. By contrast, developed countries have been experiencing a decline in per capita energy consumption since 2000, due to energy efficiency improvements and deindustrialization.

Energy consumption growth will be largely driven by developing countries

However, in absolute terms, per capita consumption in developed countries is still significantly higher than in developing countries. In 2022, for example, each person in North America consumed an average of 283 GJ of energy vs. 64 GJ in Asia and Oceania and less than 14 GJ in Africa.

We have looked at several scenarios: from sustaining the current pace of development (As Is) to a radical pivot towards maximum energy efficiency and green energy. Based on these scenarios, we have formulated our energy market forecast.

According to this forecast, the oil and gas sector will continue to play a significant role in the energy mix through 2050. We assume that the share of renewable energy sources (RES) will continue to grow during this period. But it is unlikely that the pace set out in the green agenda will be sustained. Achieving Net Zero Emissions (NZE) targets will require an annual growth rate of 8.7% in renewable energy production, which is 3.1 p.p. above the 2010–2022 level. Meanwhile, the shortfall, i.e., energy that was not generated due to capacity constraints or lack of demand at that price, will continue to grow. This shortfall will be highest in the NZE scenario due to restrictions on fossil fuel production and the inability of green energy to offset it.

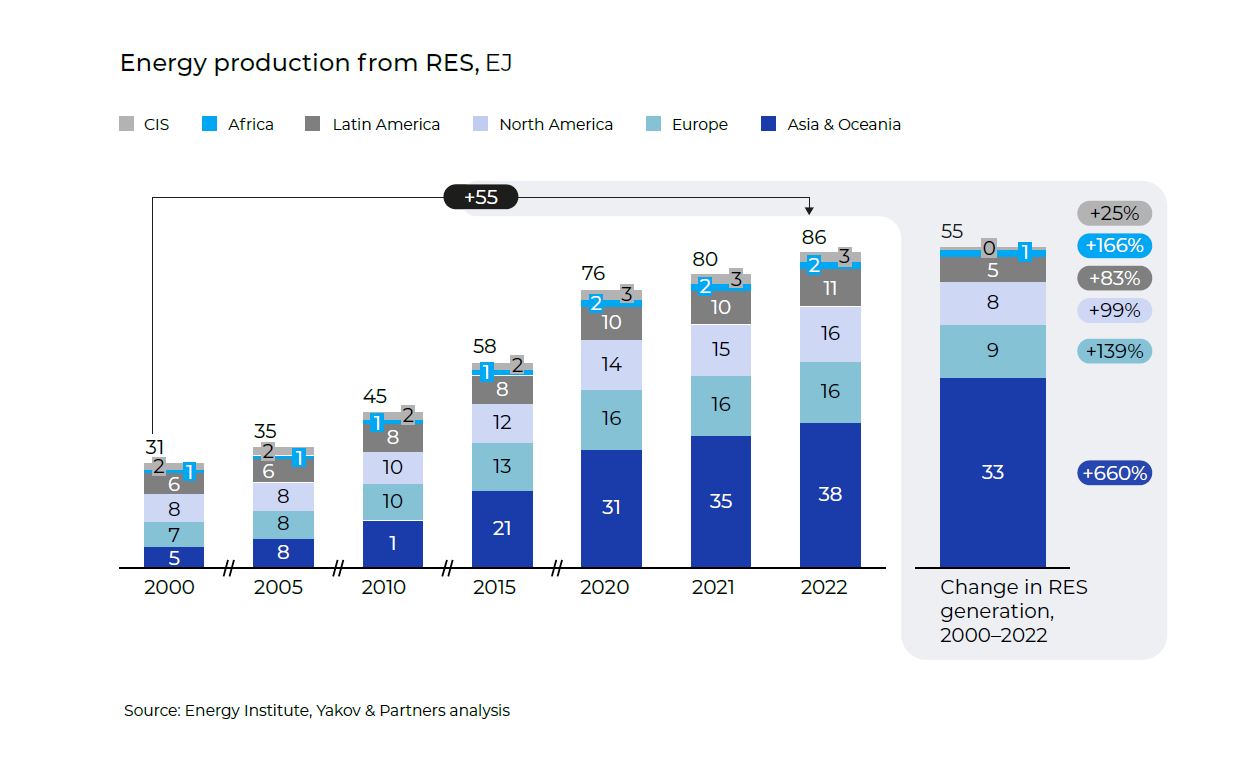

It is important to note that renewable energy production has more than tripled globally since 2000, reaching 86 EJ in 2022. However, the dependence on fossil fuels has decreased by only 5 p.p. over the same period to 82%. The share of RES is still less than 15% of all energy sources.

There are two key incentives to develop RES: the green agenda (longterm industrial development with a global balance between technology development and minimization of man-made environmental impact) and ensuring energy sovereignty in regions that lack resources for fossil energy production, which include coal and hydrocarbons.

Asia, Europe and North America, which had no energy sovereignty in 2000, have been major regions of renewable energy development over the last 20 years. Asia, however, has expanded green generation at a much faster pace, reaching 38 EJ p.a. in 2022, versus 16 EJ and 16 EJ in Europe and North America. Asia has thus outpaced other regions by a factor of two, despite the fact that generation from renewable energy sources was roughly the same in 2000.

Asia has outpaced Europe and North America in green generation by a factor of two

Asia Pacific

Despite the tremendous push towards adding renewable energy capacity, fossil fuels, predominantly coal, accounted for 85% of energy consumption growth in Asia. Coal consumption grew by 191% from 2000 to 2022, reaching 136.2 EJ. And while the contribution of renewables to the energy mix has expanded significantly, reaching 13.5% in 2022, full fossil fuel phase-out will require a six-fold increase in green energy generation. This will take more than 20 years, even at the current growth rates of renewable energy generation and energy consumption.

Historically, China, India, Japan and South Korea have been Asia Pacific’s key energy markets. However, against the backdrop of overall consumption growth in Asia Pacific, China’s share is growing at the fastest rate: between 2000 and 2022, it increased from 38% to 57% due to population growth and rapid industrial development. In 2022, China accounted for 68% of thermal coal consumption in Asia Pacific and 55% of global coal consumption. China’s share in renewable energy generation in 2022 exceeded 30% of global production. And against the backdrop of a slowdown in the global renewable energy capacity development in 2022, China is on pace to continue its momentum: it will account for more than 50% of global renewable energy capacity addition in both 2023 and 2024.

In 2022, China’s share in renewable energy generation was more than 30% of global production

For China, renewable energy is not only an energy resource, but also a source of long-term economic growth. The transition to RES enables China to develop technologies, create new jobs, and secure its place as a technology leader in the solar energy market. As of 2022, China’s share in the global supply of solar energy generation equipment (solar cells, polysilicon, silicon ingots and wafers) is 80+%.

India’s energy production structure is similar to China’s, with a historically high share of thermal coal. This fuel accounts for about 50% of the total energy consumption in the country, and in 2022 its share amounted to 55%. In physical terms, India’s coal consumption almost tripled between 2000 and 2022, from 6.9 EJ to 20.1 EJ. But unlike China, India has not yet sought to get as involved in the renewable energy capacity building race. As recently as 2005, RES generation in both China and India was very modest at less than 0.12 EJ p.a., but in 2022, China’s green energy output exceeded India’s full capacity by a factor of more than 6.

The energy markets of South Korea and Japan differ significantly from those of China and India. Their consumption structure is similar to the developed markets of Europe and North America, with oil and gas as the main source of energy and steadily decreasing share of coal. Energy generated by burning hydrocarbons accounts for 18% of total consumption in South Korea and 20% in Japan. 100% of oil consumed by these countries is imported: more than 50% of the total comes from Saudi Arabia and the UAE.

China’s green energy production exceeded India’s full potential by more than 6 times

Europe

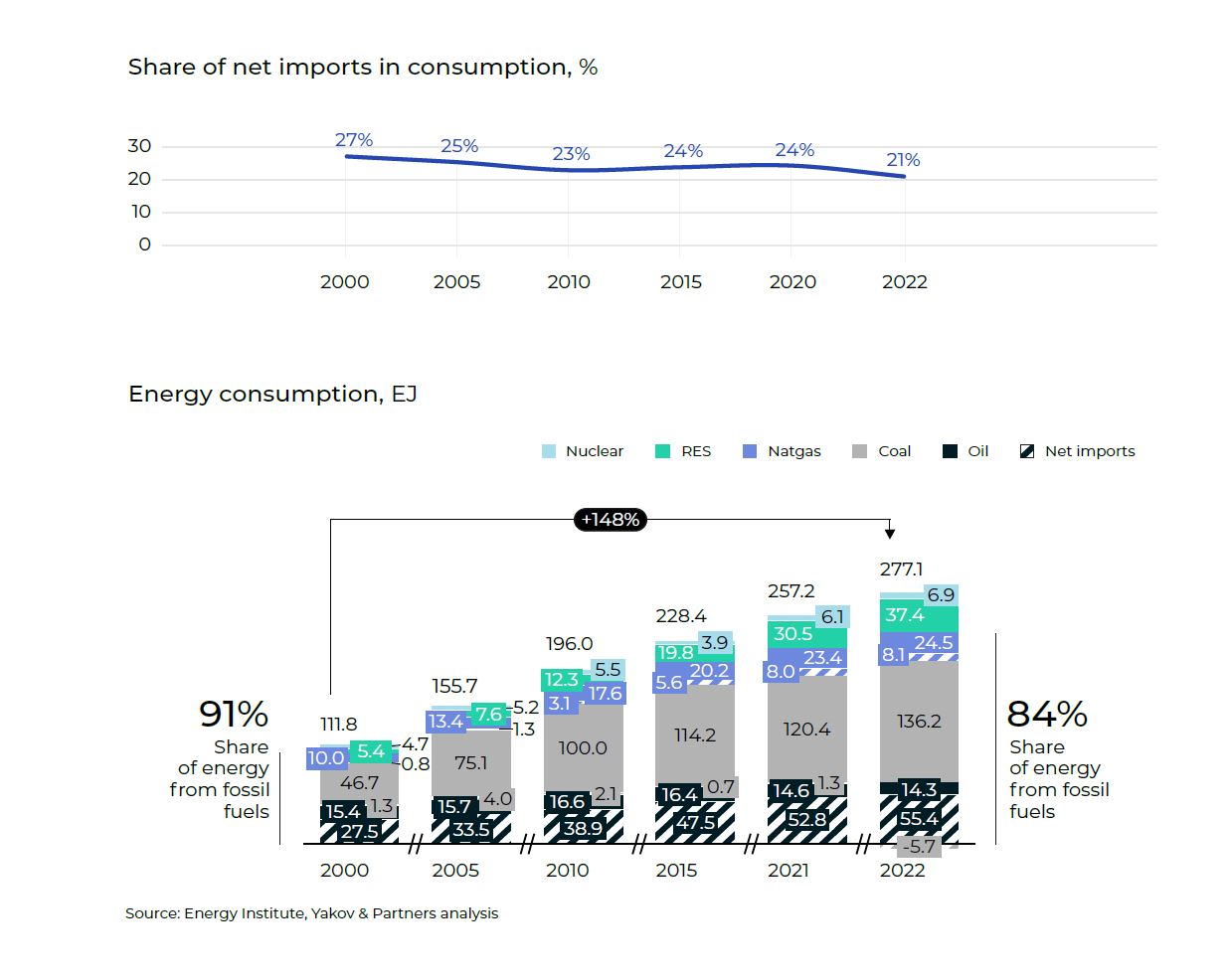

Europe has the highest share of energy imports. Moreover, dependence on imports of raw materials for energy generation has increased since 2000. Germany, Poland, the UK, Portugal, Germany, the Netherlands and the UK have made the largest contribution to reducing fossil fuel energy consumption. Germany, being the industrial powerhouse of Europe, reduced oil consumption by 25%, gas and coal consumption – by 7% and 35%, respectively (1.4 EJ, 0.2 EJ and 1.2 EJ). Cumulatively for all countries in the region, the share of fossil fuel fell by 9 p.p. (6.5 EJ). However, the share of fossil fuels in total energy production is still high: 72% in 2022 (-11 p.p. vs. 2000).

European countries have reduced fossil fuel production from 36.6 EJ in 2000 to 19.8 EJ in 2022 (-46%). But energy consumption from oil, gas and coal has not declined as much due to substitution of domestic production by imports. The key reason for the decline in energy production in Europe is the depletion of oil reserves. As of 2022, UK and Norway were the only European countries with relatively large proven reserves. But they accounted for less than 1% of global reserves, or 7% of Russia’s proven reserves. The situation is similar in the natural gas market: Europe’s share of global reserves is just 1.6%.

However, gas-fired power generation is on par with regions richer in fossil fuels. In the medium term, oil and gas production in Europe will continue to decline not only driven by the green agenda, but also due to continued depletion of resources.

North America

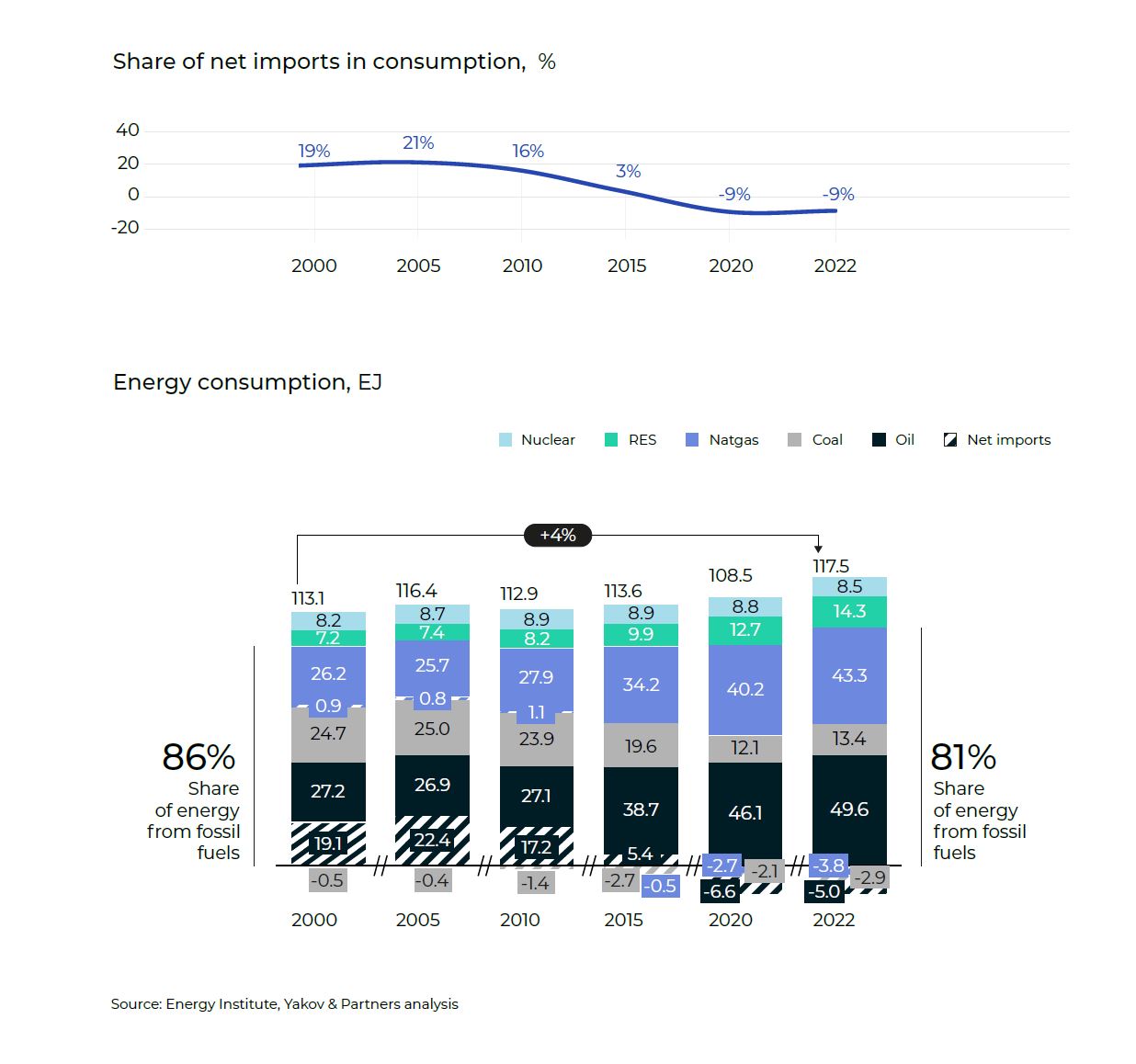

Over the last 20 years, energy production from renewables has doubled in North America. However, energy sovereignty (independence from energy imports) was not achieved through green energy, but on the back of a 51% increase in fossil fuel production. From 2000 to 2022, oil production in the US and Canada more than doubled, while the US also ramped up gas production by 89%.

The growth in oil and gas production has not only enabled North American countries to meet their own needs, but also to become net exporters by 2020. In 2022, almost 9% of gas and 7% of oil produced was exported to foreign markets.

The oil production growth was mainly driven by shale reserves, which accounted for more than 60% of the region’s total production in 2022. A similar pattern is found in the natural gas market: the share of tight reserves in production was about 74% as of 2022. It would not be possible to produce so much oil and gas without significant investment in indigenous technology for developing tight reserves and liquefied natural gas (LNG) capacity. As of 2022, the U.S. accounted for 46% of the world’s total LNG production.

Energy balance changes in 2022

The 2022 energy crisis was a major shock for the entire world, with a huge impact on almost all industries, particularly the most energy-intensive ones (e.g., fertilizer production and chemical plants). The crisis triggered an explosive rise in energy prices and also adversely affected households’ energy consumption in some regions.

While the global upward trend in energy consumption continued (consumption increased by 6.6 EJ vs. 2021), consumption in Europe and CIS countries decreased by 3.8% and 5.8%, respectively. In the CIS countries, the decline was primarily due to a drop in oil and gas refining into highermargin products as a result of export restrictions by unfriendly countries.

In turn, Europe’s energy market turmoil has resulted in lower per capita energy consumption and reduced output in energy-intensive sectors of the economy.

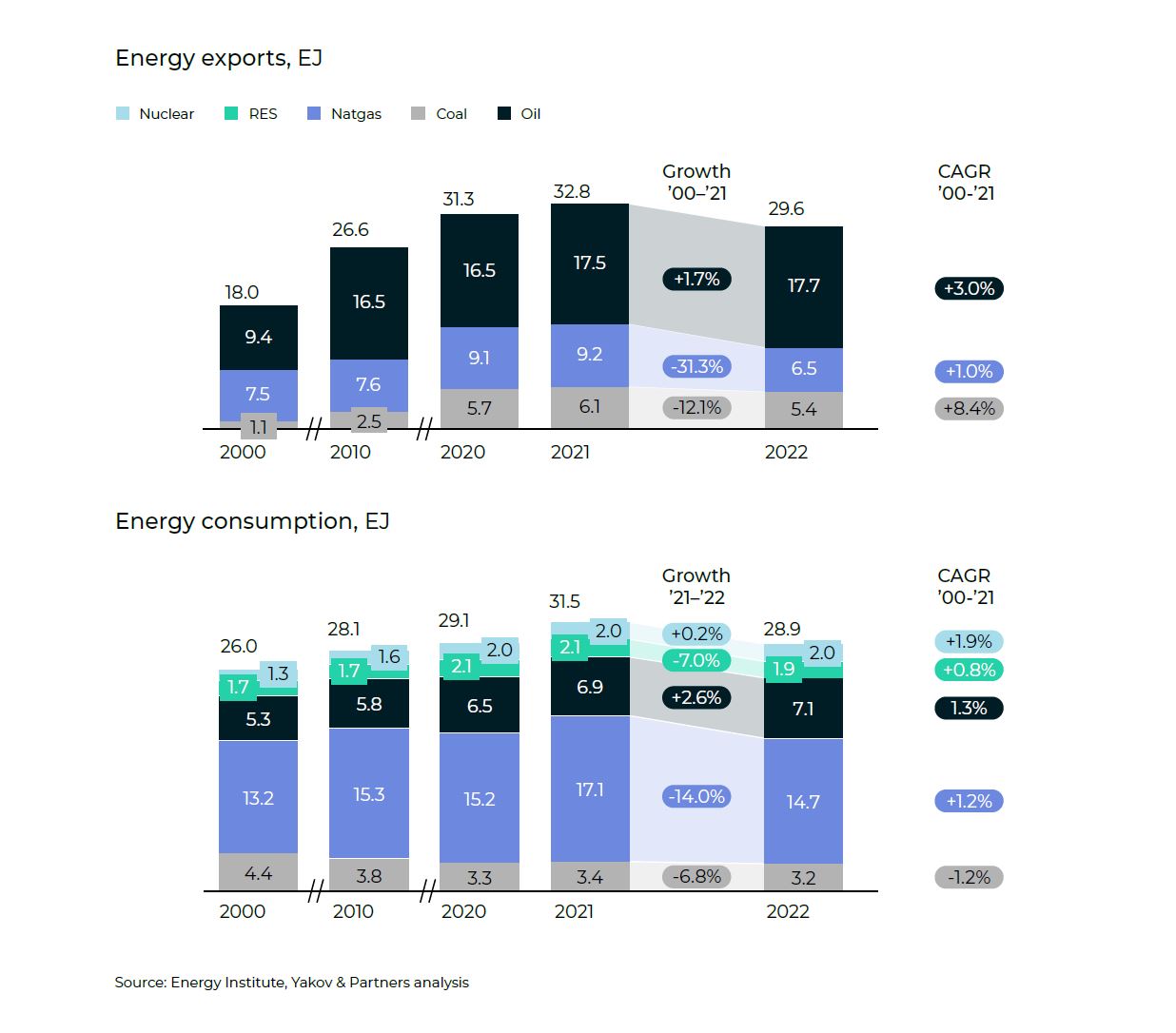

Russia

Energy consumption in Russia has been steadily growing at an average annual rate of 2% over the last 20 years. But in 2022, an 8% year-on-year decline in energy consumption was recorded (to 28.9 EJ). The decline in domestic demand was mainly caused by a slump in gas (-14%) and coal (-7%) consumption in the country. This was the effect of lower consumption in industries that traditionally use fossil fuels. For example, the country’s output of nitrogen fertilizers fell by 11%, steel and ferroalloys by 10%, and chemical products by 9%.

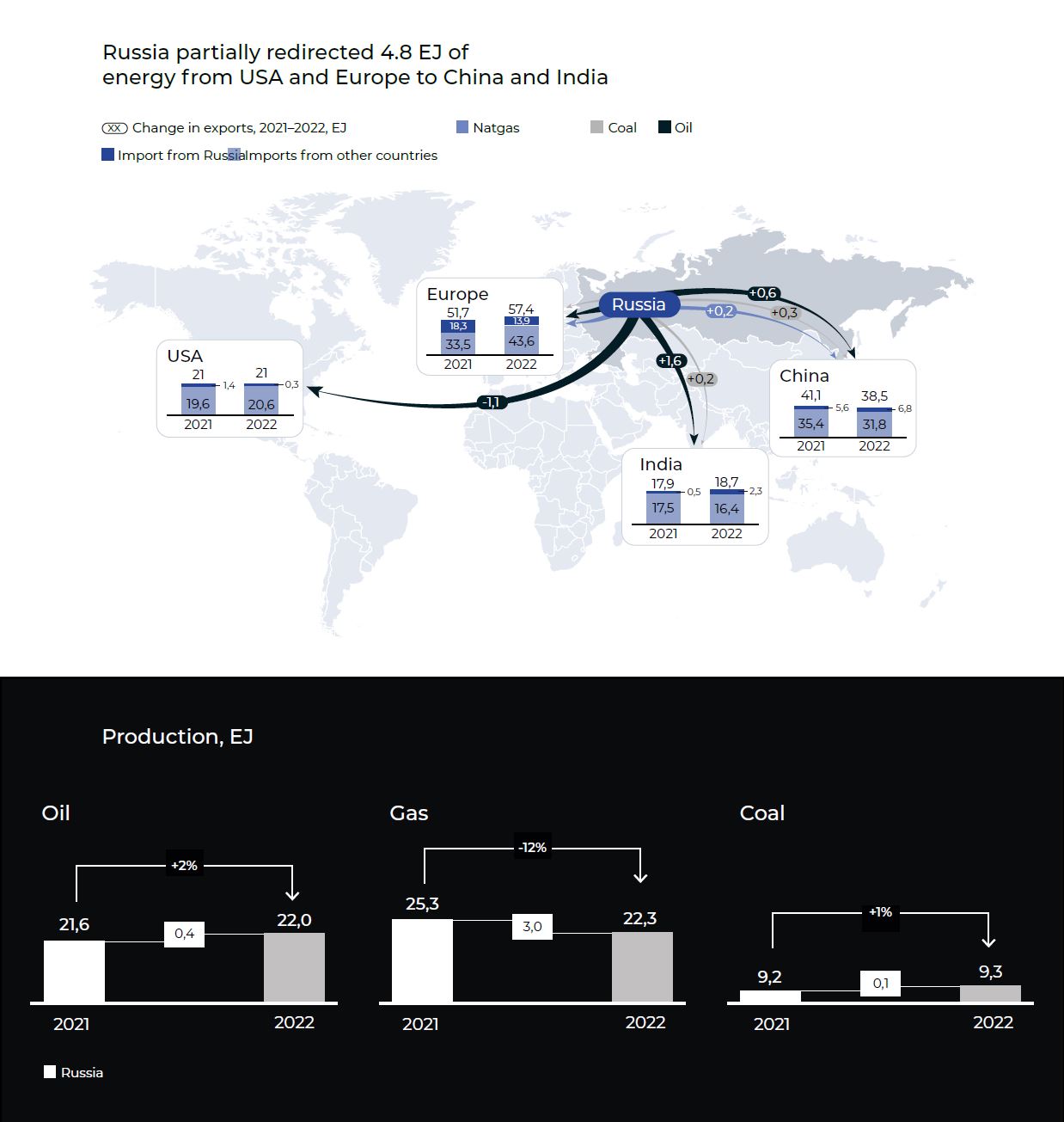

Energy exports have been booming since 2000. Coal exports grew annually by an average of 8.4, oil by 3.0, and natural gas by 1.0. However, just as in the case with consumption, the 2022 restrictions reduced fuel export volumes. The 31.3% year-on-year decline in gas supplies to the global market was a serious blow not only because of the unprecedented magnitude of the drop, but also because of the vague prospects of nearterm recovery to previous levels.

The shutdown of the Nord Stream and Yamal-Europe export pipelines reduced gas exports to the EU from 6.9 EJ to 4.0 EJ (-42%) in 2022. The restrictions imposed by the EU against Russia applied only to pipeline gas supplies. This made it possible to increase, albeit slightly (+0.1 EJ), LNG exports to the European market. Gas flows to China also increased by 0.2 EJ, but this was clearly insufficient to make up for the volumes previously supplied to Europe.

Restrictions on pipeline gas exports to Europe and the inability to convert that volume to LNG in 2022 resulted in a 12%, or 3.0 EJ, year-over-year decrease in natural gas production.

Restrictions have also dealt a serious blow to the coal industry. The 12% decline in coal exports was largely due to the EU ban on imports of this fuel from Russia. The volumes that Europe refused to import (0.6 EJ) were partially redirected to the markets of India (+0.2 EJ) and China (+0.3 EJ).

Oil exports, unlike natural gas, were not affected in 2022 – Russia managed to find new consumers and increase production and exports of crude oil and petroleum products by 2% (0.2 EJ) by redirecting supplies to Asia. India and China became top consumers, with exports increasing year-on-year by 1.6 EJ and 0.6 EJ, respectively. Exports of crude oil and petroleum products to Europe and the USA tailed off by 2 EJ.

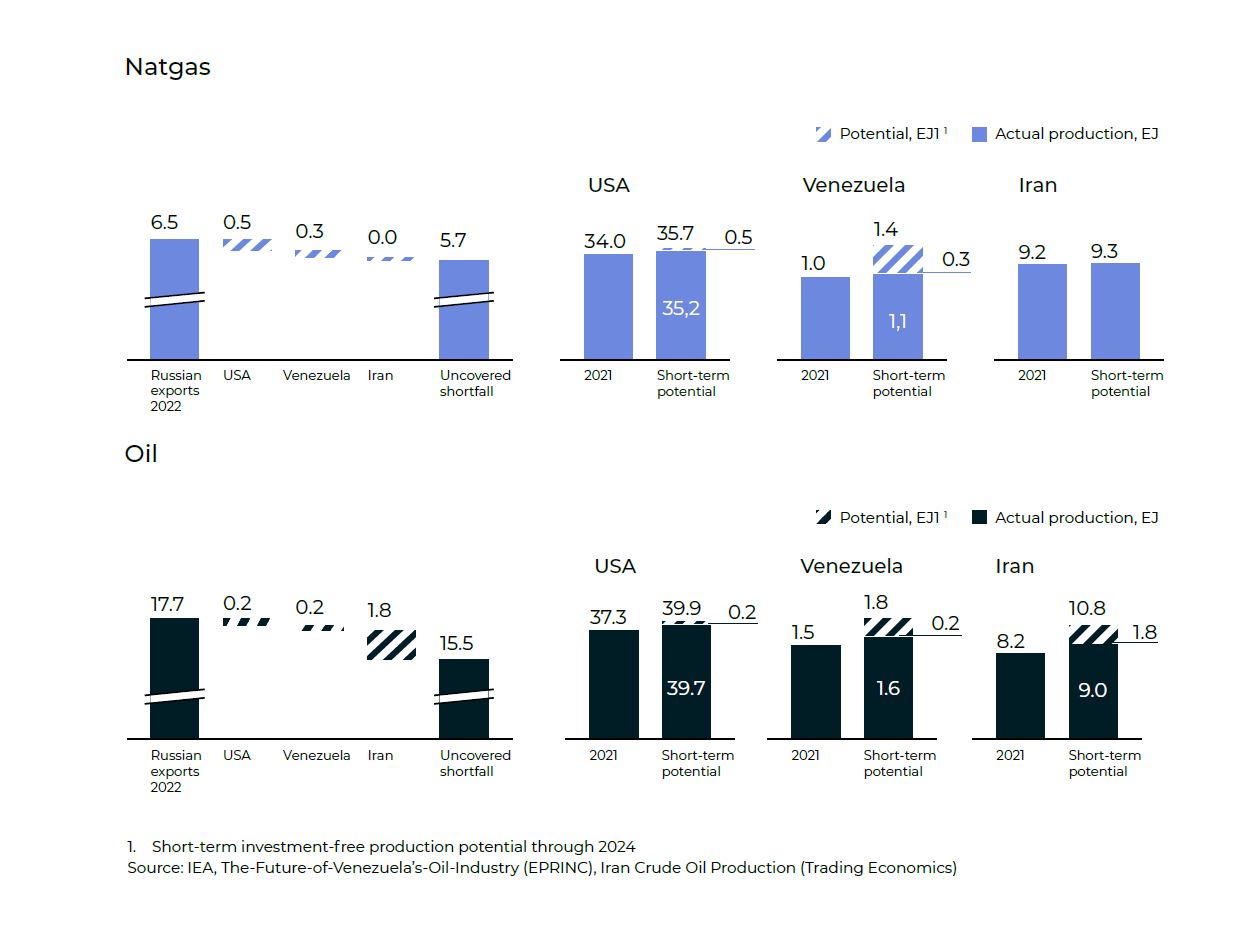

The imposition of anti-Russian sanctions forced importing countries to look for alternatives to Russian oil and gas. As a result, supplies from Venezuela and Iran have greatly increased, which necessitated a production ramp-up in these countries. Supplies from the US were also increased and the U.S. released oil from the Strategic Petroleum Reserve to the market. But without serious investments in field development, there will not be enough capacity to further expand supply, which in the short term will not make it possible to replace oil and gas supplies from Russia. Attempts to further restrict Russian oil and gas exports will inevitably compound the existing global market shortfall.

Europe

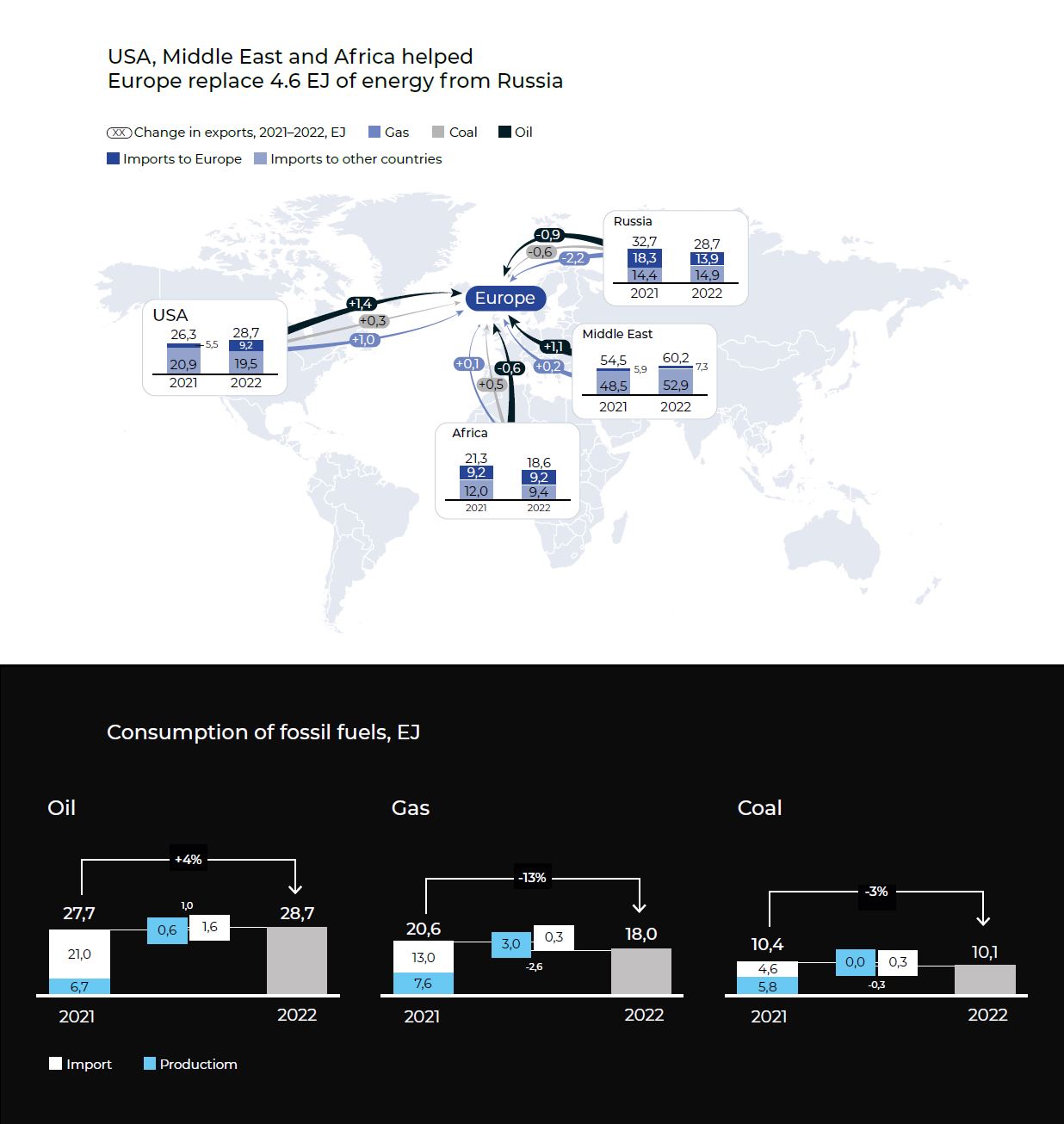

In 2022, energy consumption in Europe decreased by 4% year-on-year. The decline was mainly caused by a drop in energy imports from Russia. The lost volumes of pipeline gas were partially offset by an increase in oil imports from the U.S. and the Middle East (by 2.3 EJ) and an increase in the share of renewables. Europe also suspended nuclear power plant phase-out programs. But even this strong set of measures was not enough to keep Europe’s energy consumption at 2021 levels. The International Energy Agency (IEA) forecasted that energy consumption in Europe will continue to fall in 2023 to 75.7 EJ (3% below the 2022 level).

The EU is experiencing the consequences of deindustrialization, which may prove irreversible

Natural gas supplies from Russia to Europe fell the most in 2022 (-2.9 EJ). LNG was not able to replace the lost volumes. The U.S. (+2.0 EJ) and Middle Eastern countries (+0.3 EJ) significantly ramped up LNG exports to the European market.

Restrictions on affordable gas from Russia, coupled with the long-term European strategy to shift away from fossil fuels and towards green energy, have caused electricity prices to rise. Even before the energy crisis, electricity prices in Europe were 1.2–1.5 times higher than in the CIS countries. In December 2022, Europeans were already paying more than 0.5 euros per kWh of electricity. That is, it was more than 5 times more expensive than in Russia and 3 times more expensive than in North America.

The resulting energy market gap led to an increase in energy prices, which could not but affect the energy-intensive sectors of the economy. The industrial production index in Europe fell by 25% in 2022, but by now the index has almost returned to the 2021 levels. However, the EU is already experiencing the consequences of deindustrialization, which may prove irreversible.

Owners of energy-intensive companies are thinking about moving capacity to regions with the lowest electricity prices in order to keep their companies competitive. Statements to this effect have been made by Volkswagen¹, BASF SE and Yara². Earlier, the EU Central Bank noted that the power supply problem was one of the key factors behind the decline in industrial production in 2022.

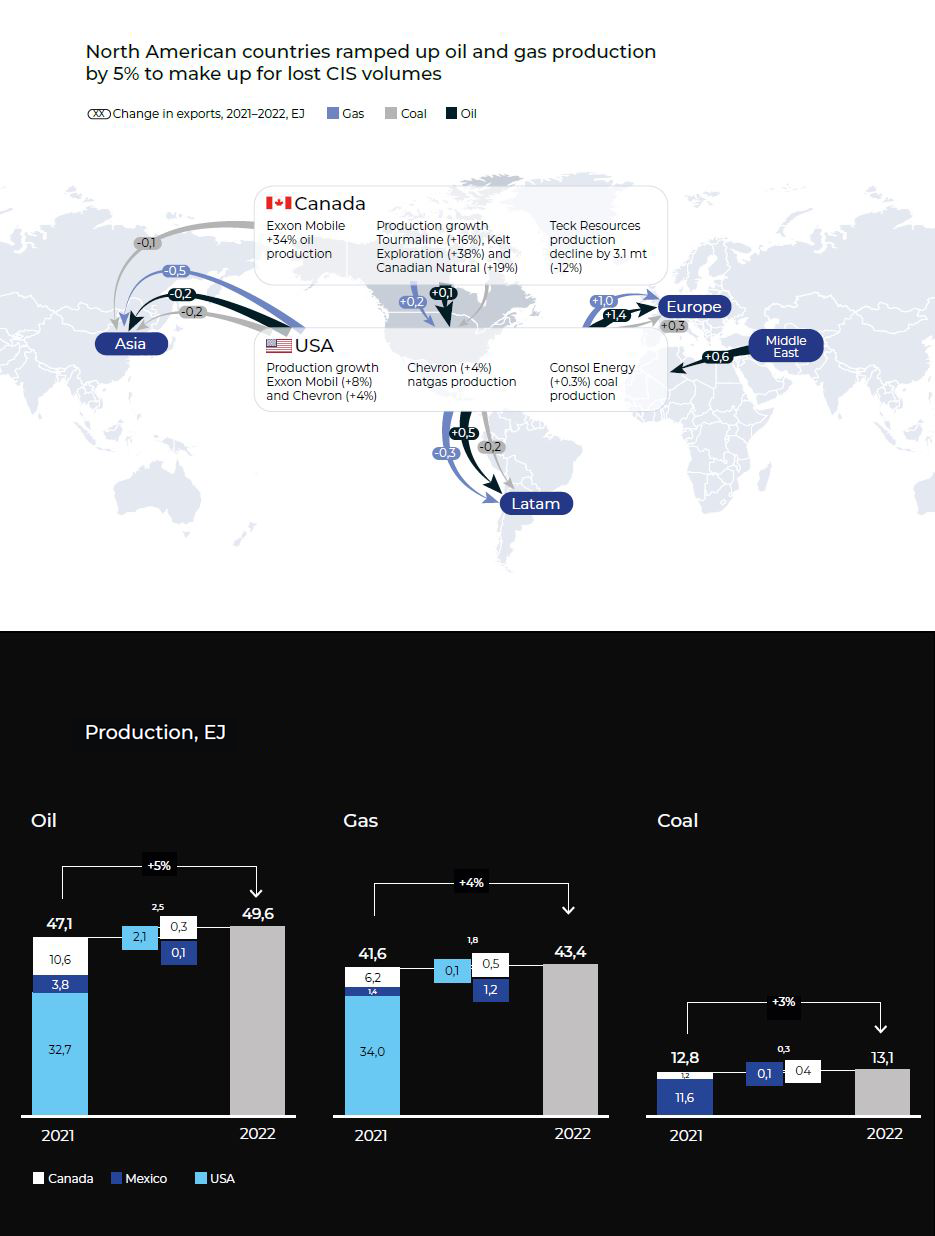

North America

For North American countries, the 2022 shocks were less dramatic than for the EU because of the energy sovereignty achieved in 2020. However, they continued to increase production of all fossil fuels due to energy shortages. Oil production in the region’s countries (USA, Canada, Mexico) increased by 5% year-on-year to 49.6 EJ, gas production by 4%, to 43.4 EJ. Even coal production, which had been steadily declining since 2005, rose 3% to 13.1 EJ in 2022. Notably, oil and gas giants such as Exxon Mobil and Chevron increased U.S. oil production by 8% and 4%, respectively. Chevron’s gas production in the U.S. market grew by 4% year-on-year and Consol Energy’s coal production by 0.3%. Meanwhile, in Canada, Exxon Mobil ramped up oil production by an impressive 34%. Gas production in the country also increased significantly in 2022: Tourmaline added 16% year-on-year, Kelt – 38%, Canadian Natural – 19%.

It is important to note that fossil fuels still account for more than 80% of all energy sources in the region.

Pivoting to fossil fuels

2022 saw an unprecedented growth in net income of oil and gas companies. Net income of oil and gas companies increased by 103% yearon- year, i.e. more than doubled to USD 4.05 trillion.

However, despite windfall gains, investments in RES failed to pick up, with some major vertically integrated energy companies even putting investment in RES on hold.

For example, Exxon Mobil, ConocoPhillips and Chevron did not invest in RES in 2022. BP pushed back its 2019 targets for oil and gas production cuts from 40% to 25% by 2030. The company also pared down its projected annual spending on renewable energy by 17% from its 2021 target. A similar dynamic of RES development slowdown can be clearly seen across Europe. Generation from RES between 2000 and 2020 increased from 2.9 EJ to 11.5 EJ, i.e., by almost 4 times. However, by the end of 2021 it amounted to only 11.7 EJ, showing only a token year-on-year increase, and 12.5 EJ (+6.8%) by the end of 2022.

By contrast, investments in the oil and gas industry, which showed a downward trend between 2015 and 2020, started to grow again in 2021 and 2022. In 2023, we also expect a 6% year-on-year growth.

Despite the assertions of European and U.S. leaders about the importance of the green agenda, business is taking the first steps towards a partial opt-out of the green agenda, raising doubts about sustaining the current pace of green energy development.

Such contentions have also been a regular feature in the media recently. In particular, John Herrlin, an oil industry analyst at Société Generale, asked, «Renewables sound good, but how do you actually make money?»

Feasibility of green transition

In our view, the events of 2022 put the energy transition on hold, highlighting the low likelihood of achieving the NZE targets. Despite the lower operating cost of renewables, achieving zero carbon emissions requires a significant increase in energy investments through 2030.

According to the IEA forecast, meeting NZE targets in 2030 will require investment to increase by 81% from the 2023 target. Annual investment will need to increase from USD 2.8 trillion in 2023 to USD 5 trillion in 2030, of which the lion’s share will need to be spent on renewables. The required investment growth is almost 3 times higher than the projected GDP growth rate, and therefore must be covered by taking funds from other sectors of the economy.

It should also be taken into account that maintaining the global energy balance under conditions of uncertainty is impossible without maintaining investments in the oil and gas industry and the development of associated technologies.

Russia’s role in the future energy mix

We forecast global demand for oil and petroleum products in 2030 to be only slightly below the 2022 levels, and to tail off by 19% in 2050, driven by growth in renewable generation capacity.

The share of tight oil in Russian production is projected to rise to 36% by 2030, and by 2050 tight reserves will account for almost half of production. This means an increasing important role for new technology and efficient production methods.

Globally, tight reserves production trends are different from those in Russia. In 2022, the share of tight reserves in production was 55%, but by 2050 the share will drop to 43% (from 54% in 2030) due to the shift of many countries, including the U.S., to alternative energy sources and the gradual phase-out of oil and gas from the countries’ energy mix.

Meanwhile, global demand for fossil fuels from friendly regions will remain high, with consumption only starting to decline after 2030. If the sanctions on fossil fuel supplies remain in place, there will be little opportunity for Russia’s exports to the European market. Demand for energy imports in Asia Pacific will remain high, which will make it possible for Russia to maintain and even increase its oil and gas exports.

Russia will need to increase hydrocarbon output from tight reserves to meet its energy needs in 2030. A higher share of tight reserves in the oil and gas production mix will result in lower margins and higher prices, which will boost the competitiveness of green energy and spur its development. However, if the downward trends in the global economy and RES investment observed in 2022–2023 persist, the energy transition could be pushed back beyond the 2050 horizon.

Pivoting to fossil fuels

A comprehensive analysis of the Russian fuel and energy complex and a survey of key oil and gas industry figures, including CEOs of industry leaders and Ministry of Energy representatives, identified some of the most acute challenges hindering the sustainable development of Russia’s oil and gas sector.

Among major challenges, we highlight limited investments in R&D, as well as skills gaps across the industry. According to our estimates, the industry needs about 25,000 employees, including engineers, IT specialists and workers. In addition, there are problems with employee adaptation to substituted equipment and software.

The high dependence on Western technologies should be separately highlighted.

High dependence on Western technologies should be separately highlighted

Most of the announced large-capacity LNG projects are at risk due to the departure of foreign licensees and contractors (key components for largecapacity LNG remain in short supply in Russia). For the same reason, gasto- chemicals projects under construction or planned may be put on hold. Before the sanctions were imposed in 2022, Western companies were the dominant players in the Russian oilfield services (OFS) market in high-tech segments such as exploration software, offshore drilling equipment, rotary steerable systems, telemetry and logging packages, hydraulic fracturing fleets, etc.

Three possible options for the development of Russia’s energy sector

1. Investment in technological sovereignty

Context: In the face of sanctions, the primary objective is to supply the market with domestic technologies and create sovereign OFS. This will make it possible to continue independent oil production, including addressing the problem of the growing share of tight reserves in total oil production. Securing technological sovereignty will necessitate a significant expansion of investment in domestic oil and gas technologies and R&D, and a new model of interaction between companies and the state for the most efficient process of technology development.

Risks: Development of indigenous technologies will result in lower production and refining margins as compared to the use of off-the-shelf technology solutions from Western companies due to significant short-term investment risks. Moreover, for some technologies, even sufficient investment may fail to develop domestic solutions within the required timeframe. The current state of affairs makes it obvious that the development of domestic oil and gas production technologies is of critical importance.

2. Waiting for technology to return

Context: We expect the already existing energy shortages to expand, which may force European countries to lift the restrictions on Russian energy imports, as well as the technology ban. The easing of sanctions will allow Russian oil and gas companies to maintain or ramp up fossil fuel production. The return of technology majors will enable Russian vertically integrated oil and gas companies to keep profit margins high and facilitate a smoother technological transition.

Risks: If sanctions remain in place, Russian oil and gas companies will need to seek a compromise with Western technology suppliers – discussing the unacceptability of sanctions that impede global economic growth and opportunities for mutually beneficial cooperation. The lack of high-performance technologies will depress the margins of tight reserves production and risk a potential production decline of up to 20%. However, this scenario does not address the problem of technological dependence, and the risks of production declines due to the lack of technological solutions will remain in the long term. A conflict with Western licensees will again put Russian oil and gas production at risk.

3. Green race

Context: Russia’s vast territories have great potential for renewables. Adding renewable capacity will reduce domestic consumption of fossil fuels and provide 25 EJ of energy per year, becoming a viable option for long-term energy development in the country. Reducing oil consumption in the domestic market will, in turn, make it possible to receive significant export revenues from oil sales to Asian countries for a longer period of time. Russia will need to develop domestic renewable energy technologies with the ambition to export them.

Risks: Transition to renewables will require enormous high-risk investments across the economy. Sanctions from Western countries and restricted access to advanced RES markets may become an additional barrier to the green transition. China is currently the clear leader in the solar energy market. China can potentially be a technology supplier for Russia, meeting some of the RES technology needs, however, it is essential not only to expand renewable power generation capacity, but also to invest in the development of green energy technologies.

In the long term, such a scenario will require not only commitment of global financial resources, but also confidence in the sustainability of the green transition trend, with its outlook becoming ever more uncertain in the light of the energy crisis.

In our view, opting for one of the scenarios does not rule out investments in other areas. Yakov & Partners analysts believe that the first scenario should be the primary focus for the development of Russia’s fuel and energy sector, but selective investments in high-potential technologies should also be pursued. Judging by recent public statements, oil and gas companies also prefer to think along the lines of the first scenario, recognizing the inevitable risks and the resources required to implement it.

The energy crisis and attempts to dislodge Russia from the global energy market is a time of decisions for the oil and gas industry. Companies and the government need to jointly identify priorities for the domestic fuel and energy sector, develop effective mechanisms to overcome the challenge and maintain Russia’s leadership in the global energy market.

1 European Industry Buckles Under Soaring Energy Prices - Bloomberg.

2 Europe’s energy crisis risks forcing factories across the continent to relocate or close down (lemonde.fr)