The energy landscape is changing: what’s going on?

The ongoing global energy transition is driven by long-term fundamental, irreversible factors. The turbulent recent years have given it a new impetus toward energy security and accessibility in the emerging multipolar world.

The current efforts and investments in energy transition technologies are basically sufficient to sustain the process, but manifestly powerless to limit global warming to below 2 degrees.

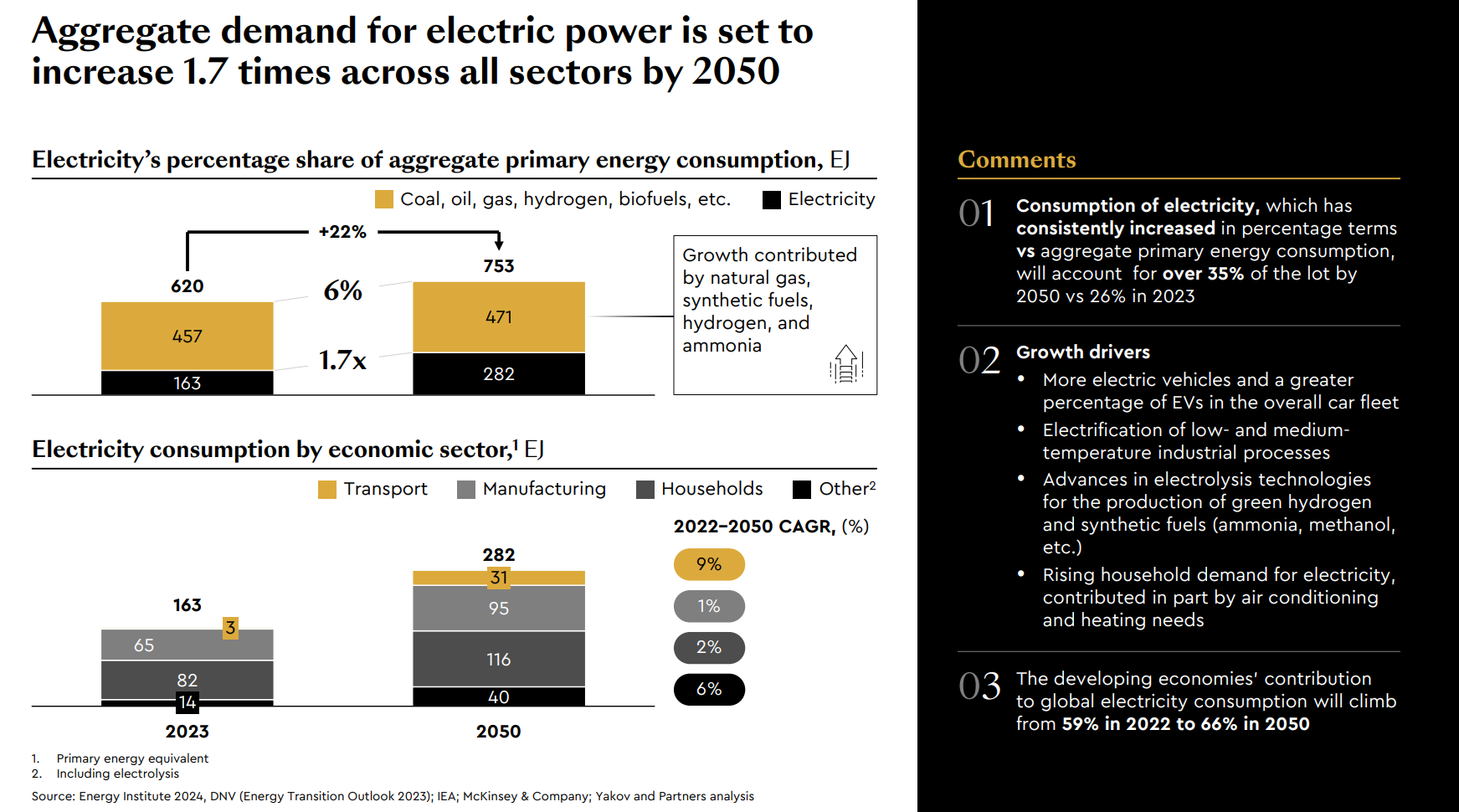

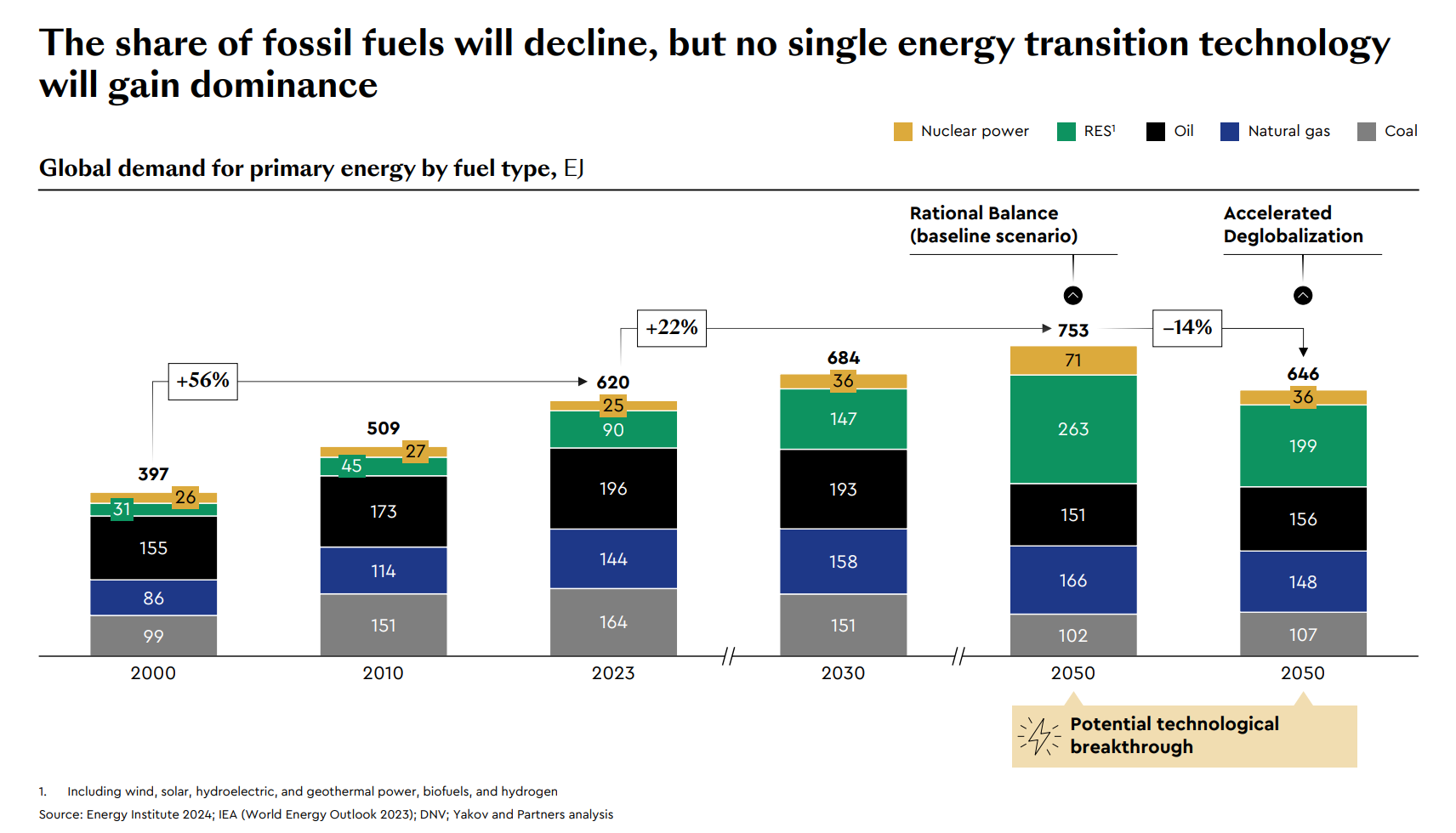

Global demand for primary energy is expected to climb 22% by the year 2050, with electricity consumption set to nearly double.

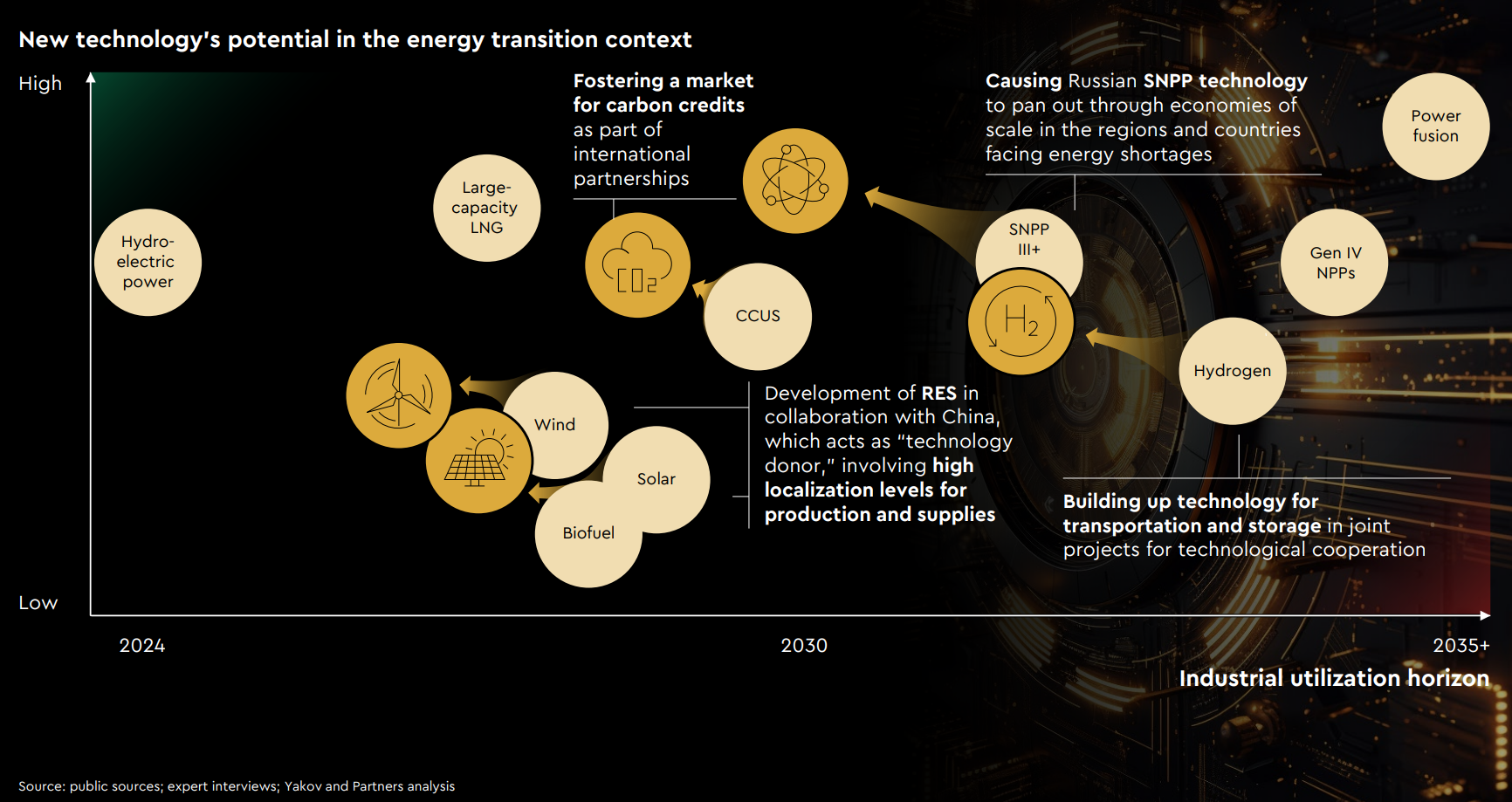

Meanwhile, the likelihood of local shortages of critical materials (such as lithium, copper, nickel, and rare earth metals), the need for substantial investment, and, most importantly, unreadiness of most new technologies for commercial utilization combine to lend a non-linear quality to the energy transition. Proactive technological advancement coupled with new business models lay the groundwork for a first mover advantage and open a window of opportunity.

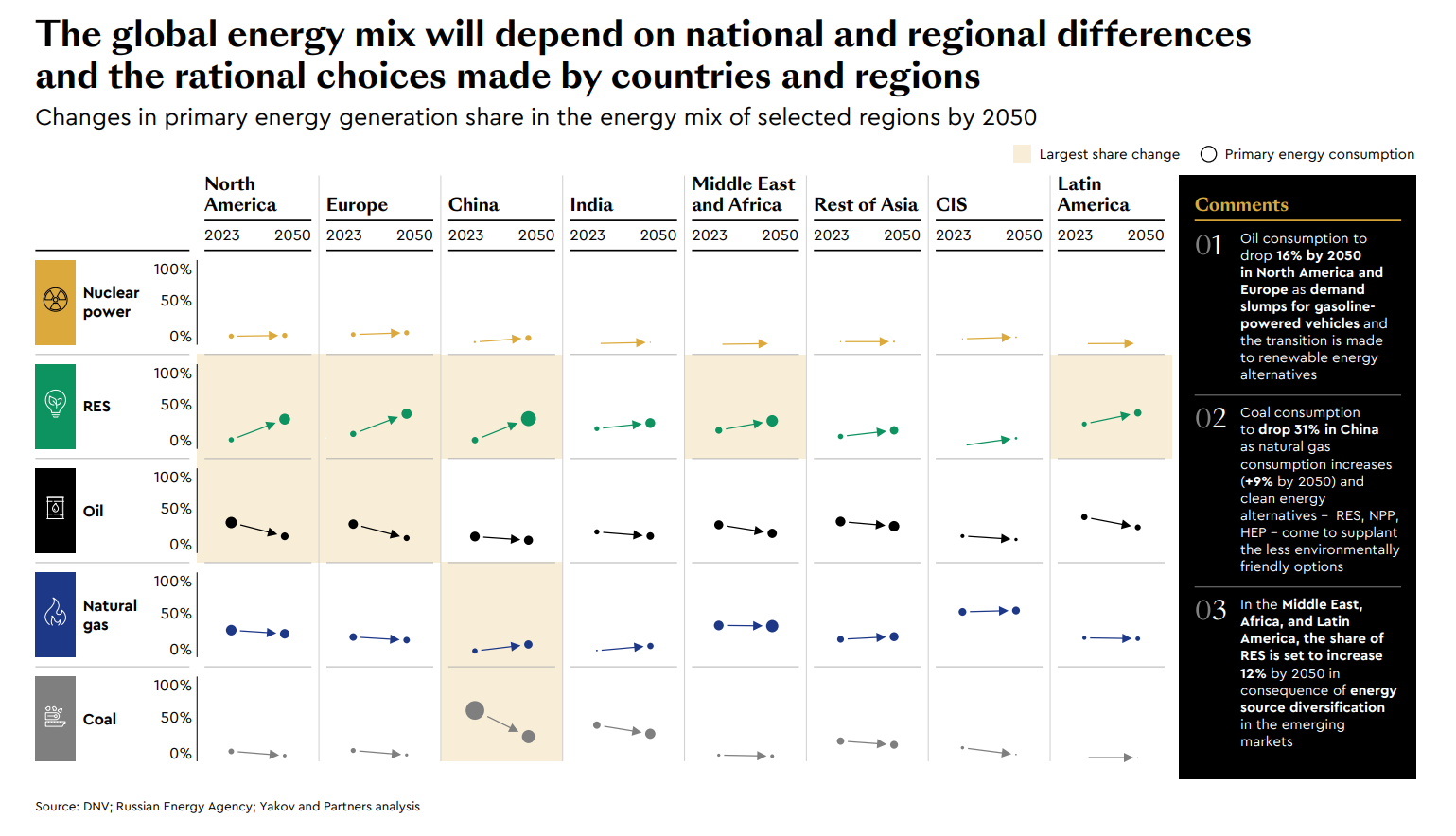

In view of the necessary changes and the current uncertainties, two key development scenarios may be identified for the global energy mix:

- Rational Balance (baseline scenario): the energy portfolio evolves in alignment with the environmental and economic interests concerned.

- Accelerated Deglobalization: polarization of the world and disintegration of energy supply chains cause the energy transition to slow down considerably.

Even if the optimal scenario (Rational Balance) takes hold, primary energy derived from fossil fuels will account for about 55% of the world’s energy by 2050.

“Greening” of fossil fuels and advancement of low-carbon energy technologies that are currently beyond the commercial utilization horizon form the basis of success for the energy transition in the long term.

Challenges and opportunities for Russia: what does this mean?

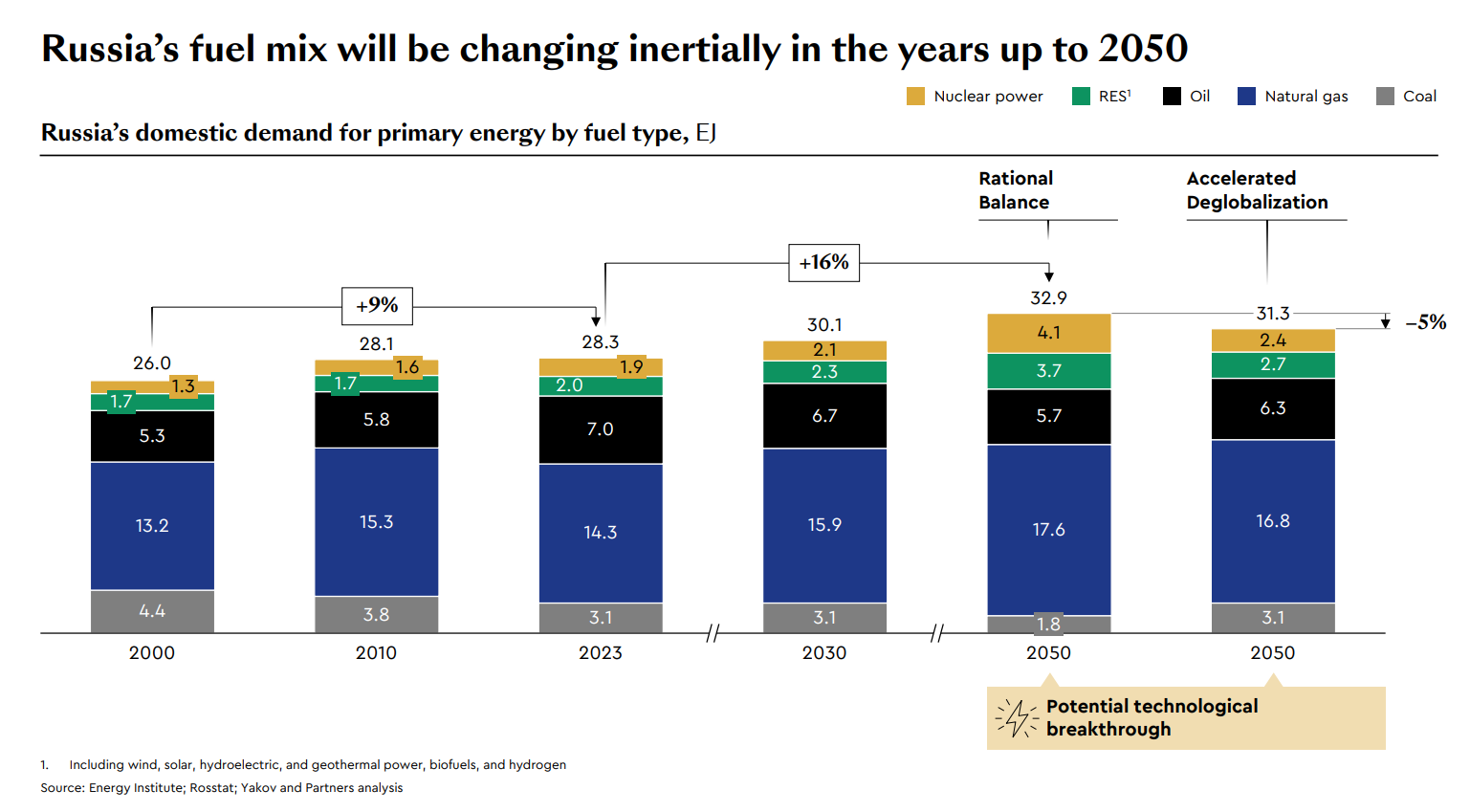

Russia will be replacing its fossil fuels at a markedly slower pace than the rest of the world. In the baseline scenario, their share is expected to drop from the current 86% to 75% by 2050 versus a global average of 55%. Russia’s electricity consumption will be increasing at an annual rate of 2%, compared to 2.2% in the rest of the world.

The key risks to the energy transition in Russia arise from impeded access to advanced technology and equipment. To mitigate those risks, imports of critical equipment have to be substituted by domestic production, particularly in LNG and thermal power generation.

Less-than-reliable supply chains and volatility in the external markets pose a serious risk to Russia’s fossil fuel exports, advancement of clean energy technologies (RES, NPP, and hydrogen), and potential surges in demand for them.

Russia will need to develop new technologies for both clean energy generation and “greening” of fossil fuels.

To use the window of opportunity, Russia will have to advance in these three key areas:

- Energy sovereignty: closing the strategic gaps in raw materials, technology, supply- and demand-side supply chains, and availability of workforce and financing.

- Infrastructure for accelerated growth of domestic demand (including the priority development hubs in the Arctic and the Far East) and electric vehicles, to be developed by private sector players in partnership with the state.

- The advancement of new low-carbon energy generation technologies will pave the way for a breakthrough by dint of economies of scale, made possible in part by international partnerships and by integrating technologies into turn-key energy solutions for the domestic and international markets.

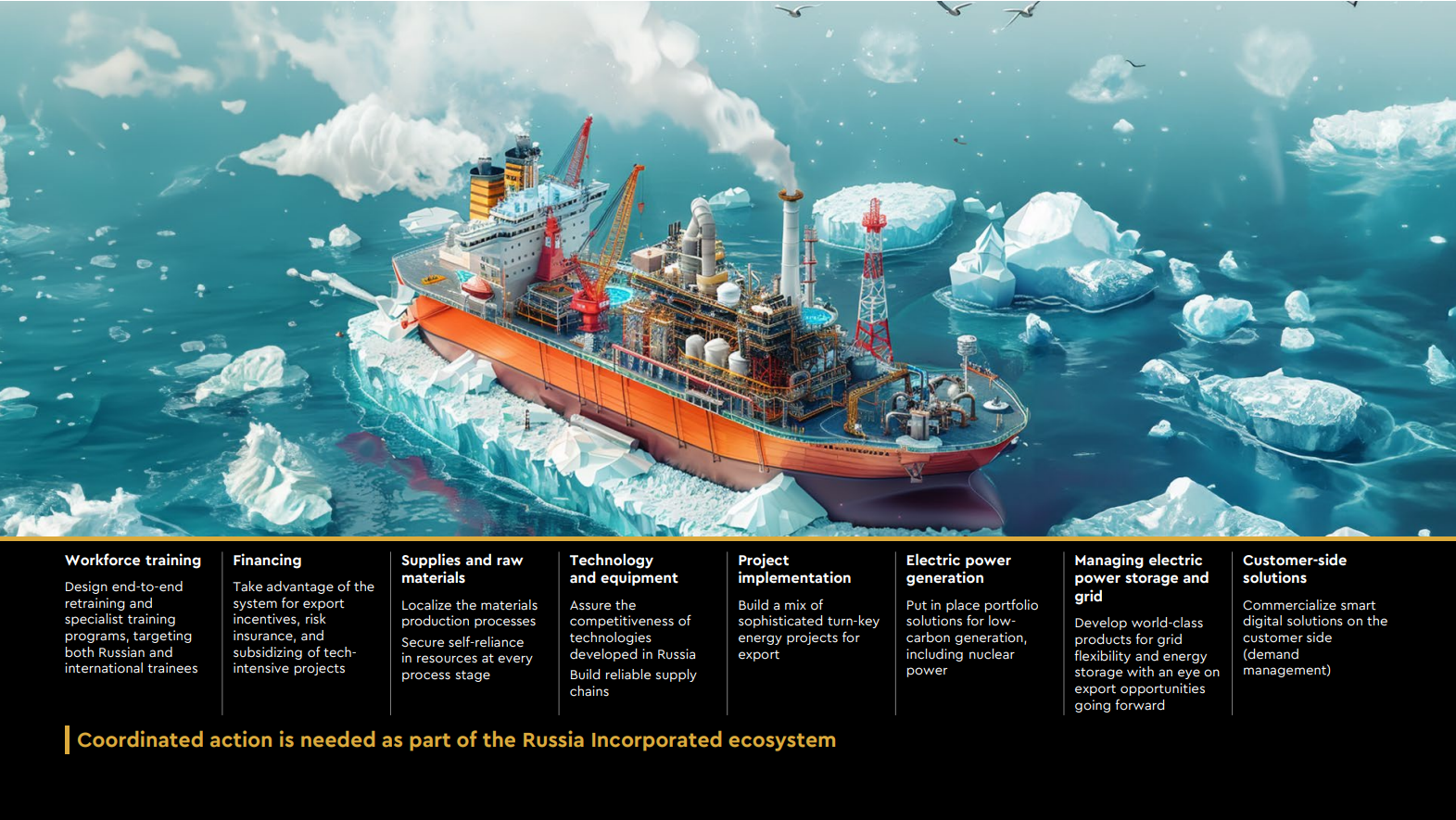

By making progress in these three critical areas, Russia will not only give a positive impetus to the manufacturing industries – it will increase the export potential of its energy sector with new technologies and solutions, which will require coordinated action as part of the Russia Incorporated ecosystem.

New strategy planning imperatives: what is to be done?

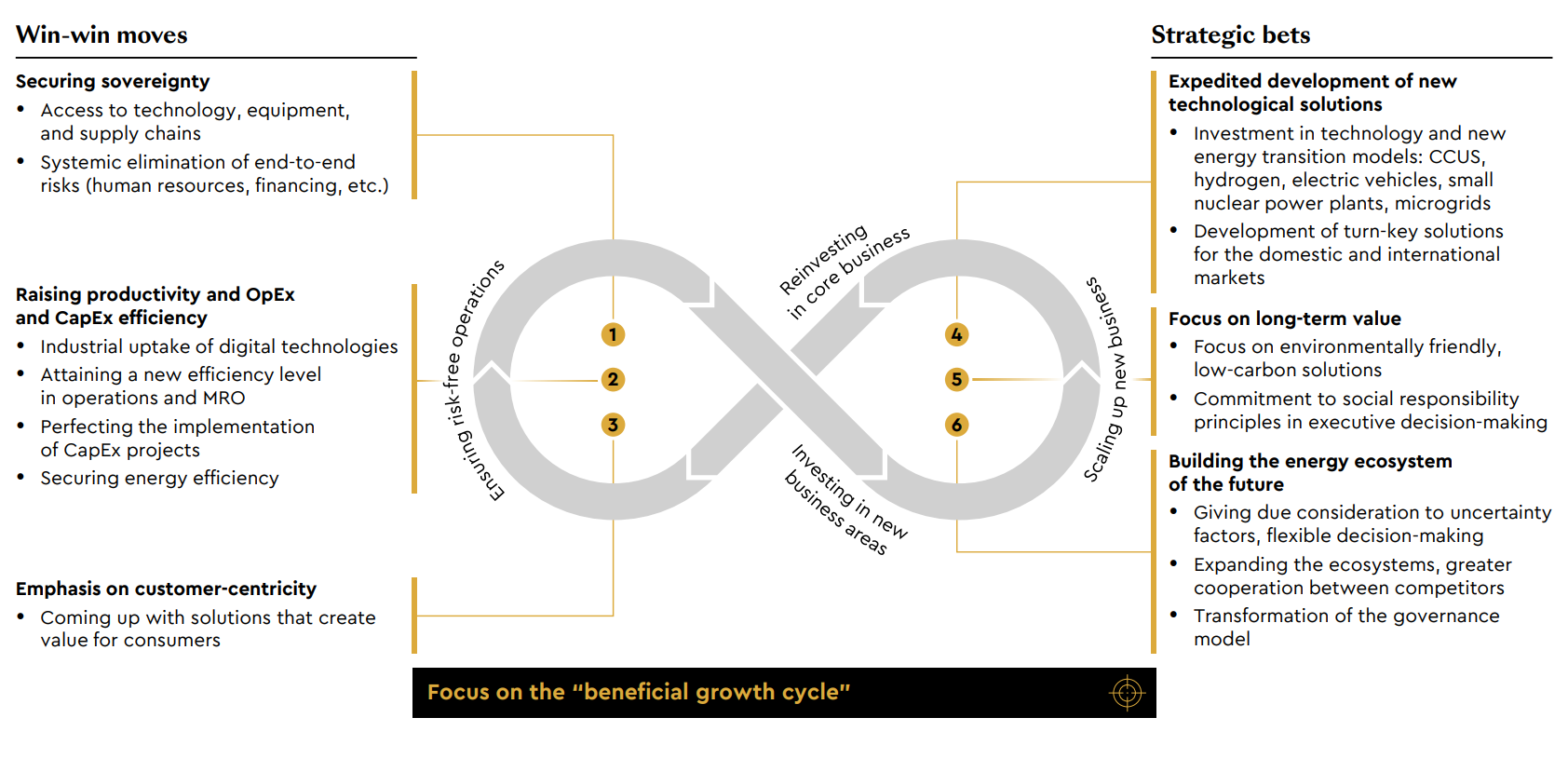

Successful advancement of Russia’s energy sector will hinge on accelerated commercialization of new technologies. We have identified three win-win moves and three strategic bets to make for Russia’s energy sector, which are able to jump-start a beneficial growth cycle.

To make it work in a highly uncertain environment, market players will have to learn some new methods and principles of strategy planning, which are five in number:

- Scenario planning: simulating extreme but possible scenarios for the external environment over a long-term planning horizon, and “pulling” them close to the present day.

- Dynamic decision-making: maximizing the strategic value of an asset or equity portfolio over a certain time horizon, taking into account the emergence of new technologies and potential management impact.

- Focus on long-term value: giving priority to investment decisions geared toward creating long-term value for the company, the state, and society, and converting that value to shareholder value.

- Business modeling innovation: actively working toward building up a portfolio of new business opportunities, a shift toward competition at the level of ecosystems, partnerships, and alliances, which may include direct rivals as members.

- Transformation of the governance model: differentiated approach to the governance model, which includes resource concentration to give impetus to cutting-edge competencies for the future, development of customer-centric verticals, flexible risk management, and merciless cost-cutting by means of digitalization or otherwise.

If all this action is steered properly and sufficient investment is made in new technology, Russia will see considerable benefits in terms of both domestic consumption and export.

By localizing the manufacturing of critical energy equipment, building robust supply chains, supplying energy demand with electricity produced by natural gas-fired and nuclear generating assets, and deploying new renewable energy projects, Russia will be able to achieve an increase of 16% in its domestic primary energy production.

On the other hand, by keeping its export volumes high through diversification of the fuel mix, designing turn-key energy solutions, boosting gas exports (including LNG) 2.4 times by 2050, prioritizing high-tech, low-carbon energy carriers, and tapping into the export potential of new generation technologies that were beyond the commercial utilization horizon in 2023, Russia will see a 8% rise in its energy sector’s exports by the year 2050, and will be able to retain a share of at least 8% of the global energy mix – all with the aid of domestically developed solutions