Global energy flows shaped before 2022 are rapidly changing, driven by geopolitical shifts, volatile combustible fuel prices, and risks related to unpredictable price swings in the future. While suppliers are seeking additional long-term contracts, amidst high prices, buyers are trying to reduce consumption, diversify and optimize supplies, and develop local energy sources.

Global energy flows shaped before 2022 are undergoing significant changes

The green agenda and alternative energy sources continue to influence the energy industry worldwide. BP’s most conservative scenario predicts¹ an increase in the share of renewable energy up to 20% and a reduction in the share of fossil fuels fr om 80% to 65% by 2030. Despite possible adjustments to specific targets for renewable energy, combating climate change remains a priority for many countries.

Several new technologies that enhance energy efficiency and have a lower carbon footprint are now being deployed in industry. One notable example is solid oxide fuel cells (SOFCs, SOF cells) and batteries, which will significantly transform the existing power generation process in the coming years. For instance, SOF cells powered by natural gas are 10–15% more efficient than internal combustion engines (ICEs) and only produce carbon dioxide and water as by-products of power generation.

In 2022 alone, global venture capital investment in energy storage systems reached $18.4 billion², reflecting the ongoing trend towards electrification in industry and transportation.

These global trends have a direct impact on the energy sector in Russia, prompting us to consider its development prospects. Back in April 2022, the President of Russia signed an order to review Russia’s energy strategy and extend it until 2050. Given the limited investment potential, it is advisable to focus on the development of economically viable new technologies that either have significant export potential or can have a positive material impact on the energy landscape within the country.

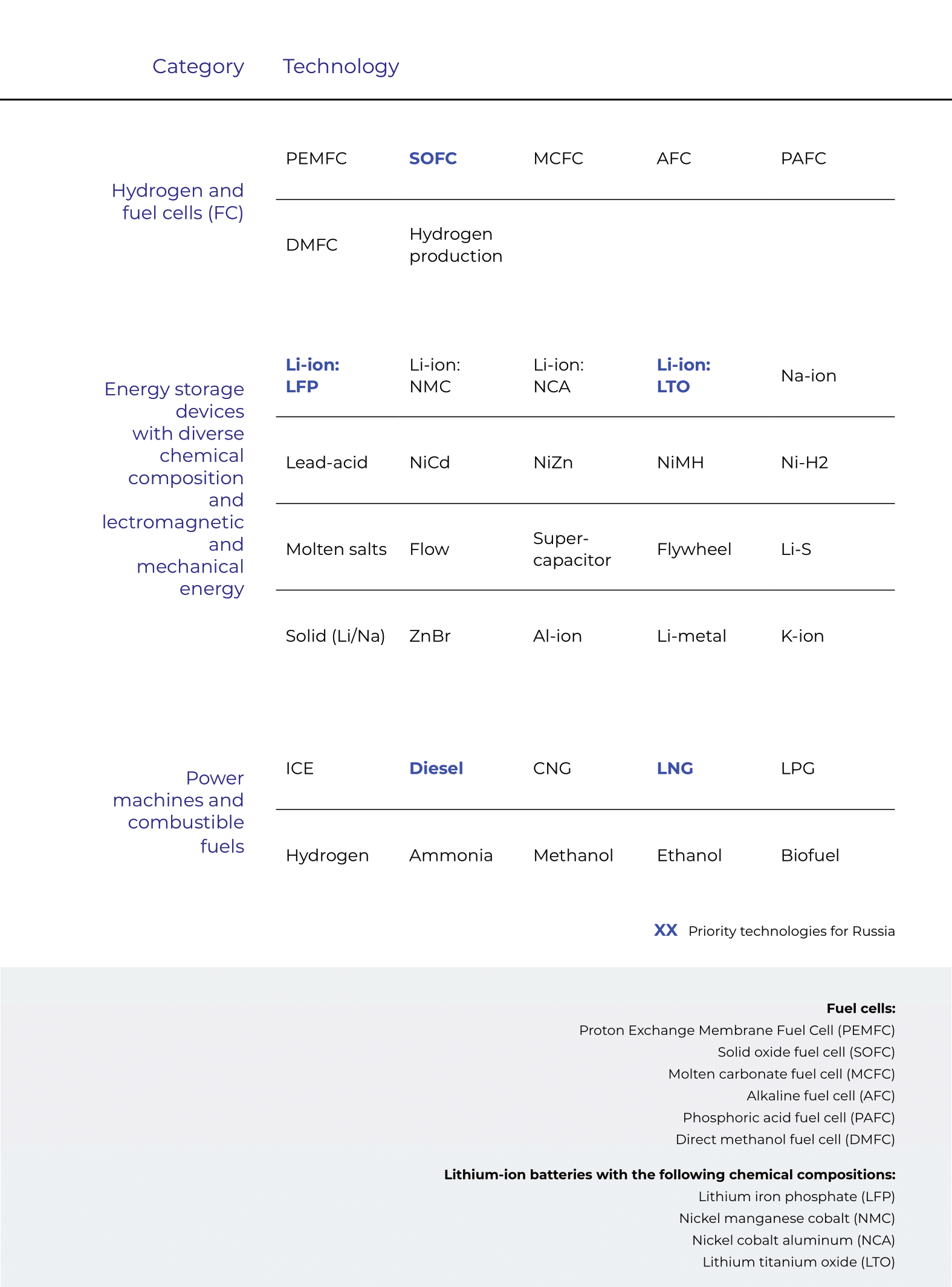

Our study covers more than 30 different power generation and storage technologies, including alternative fuel ICEs, energy storage devices, and fuel cells. We identified the solutions with the highest potential for Russia until 2030 by considering both economic efficiency for end users and the ability to develop under constraints. We primarily focused on power generation and various transportation segments, including rail, wheeled, and waterborne transport. Air transport was not included due to its relatively low energy consumption share of less than 10%.

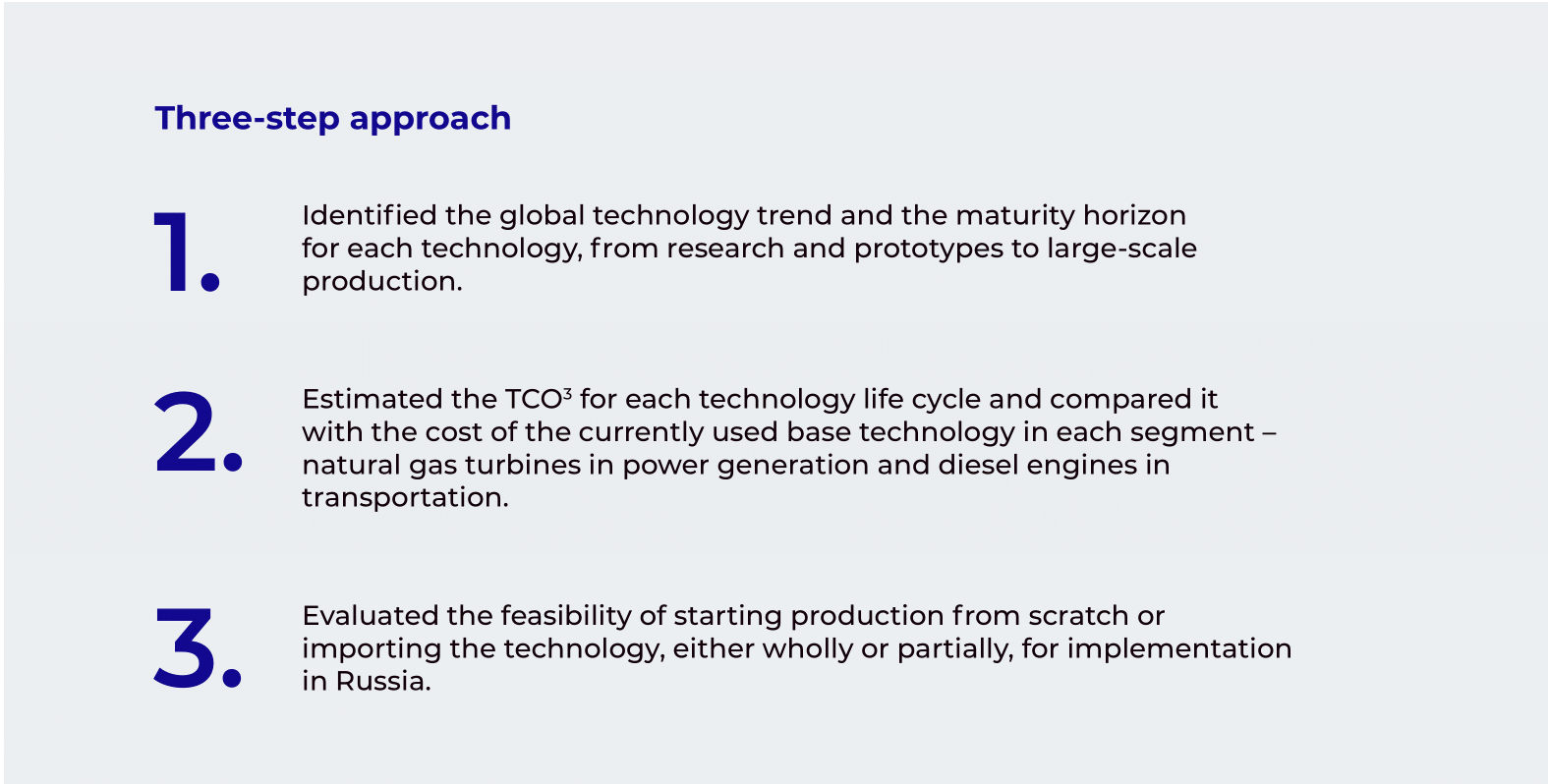

To assess the prospects, we followed a three-step approach.

Prospects for energy transition in Russia

Until 2030, the country will largely rely on fossil fuels in industrial equipment and transportation. The transition to new technologies will be relatively slow due to objective reasons, including the need for investment in development and infrastructure and unproven efficiency and high TCO of some new energy solutions. The progress of such technologies in other countries should be closely monitored by experts. In case of significant economic and technological improvements, an informed decision can be made about the feasibility of pursuing them in Russia.

However, thanks to their decreasing TCO, some technologies in Russia can be potentially implemented by 2030. In fact, Russia also could export certain technologies to friendly countries with developed economies that prioritize green initiatives as well as to developing countries that lack a strong scientific foundation. In order to achieve this, the focus should be made on rapid research and development in attractive segments that require limited capital investments and hold the potential for mass production. This would include engaging new experts, promoting in-house R&D, and purchasing licenses.

Our study has revealed three technologies that hold the most promise for commercial development in Russia within the next 2–3 years and can be potentially exported by 2030. These technologies include lithium-ion batteries for passenger cars, SOF cells powered by natural gas for power generation, and liquefied natural gas (LNG) as a more environmentally friendly alternative for long-range transportation solutions.

Russia will continue to rely on gasoline until 2030

Solid oxide fuel cells

The priority for investment in the short term lies in the use of SOF cells for power generation. Thanks to technological improvements, extended service life, and advancement of component production, potentially enabling their reuse (for example, for current collectors), by 2030 we can expect a fourfold reduction in the TCO, which will be comparable to the TCO of diesel engines and gas-fired power plants in cogeneration mode. Thanks to their economic performance, environmental friendliness, and absence of moving elements, SOFCs can become a breakthrough solution that can be potentially commercialized.

By 2030, we expect a fourfold reduction in the total cost of ownership of SOF cells, which will be comparable to the TCO of diesel engines and gas-fired power plants in cogeneration mode

First, developing this technology will not require capital expenditures or expenses on infrastructure. Russia has the necessary research and engineering expertise to launch large-scale production, first of all, experts from ISSP RAS⁴, MIPT, Rosatom, and BIC RAS⁵. Small-scale production of all critical components for SOF cells and electrolyzers is ongoing and can be scaled up.

Second, Russia has a potential price advantage over developed economies due to its own resource base, including non-ferrous and rare metals, and relatively low labor costs. The wide availability of hydrocarbon fuel will be an advantage for mass introduction of SOFCs.

And third, setting up assembly production does not require complex, high-precision equipment or a large number of experts. Besides, at the first stages, the issue can be partially solved by streamlining imports of certain elements. For example, high temperature fans and power conversion systems (standard electronics) can be purchased in China. The production of current collectors (high temperature steels) is now being mastered in Russia, and ceramic flue liners are already being produced in Novosibirsk.

Apart from creating a reliable industrial product, reducing its cost to compete with base technology, i.e., methane-powered ICEs, is also a crucial task. To achieve the target TCO, the price of both the cell and additional equipment must be reduced, and their service life increased. The first goal requires scaling production and supporting industrial deployment at the initial stages, while the second one calls for consistent research efforts. Potentially, a TCO that is 15% lower than that of an internal combustion engine can be achieved by 2030.

Solid oxide electrolyzer has an efficiency of 80%, which is notably higher than the standard 50–60%. Bloom Energy has already brought a product to the market that significantly reduces the cost of green hydrogen production and expands its applications.

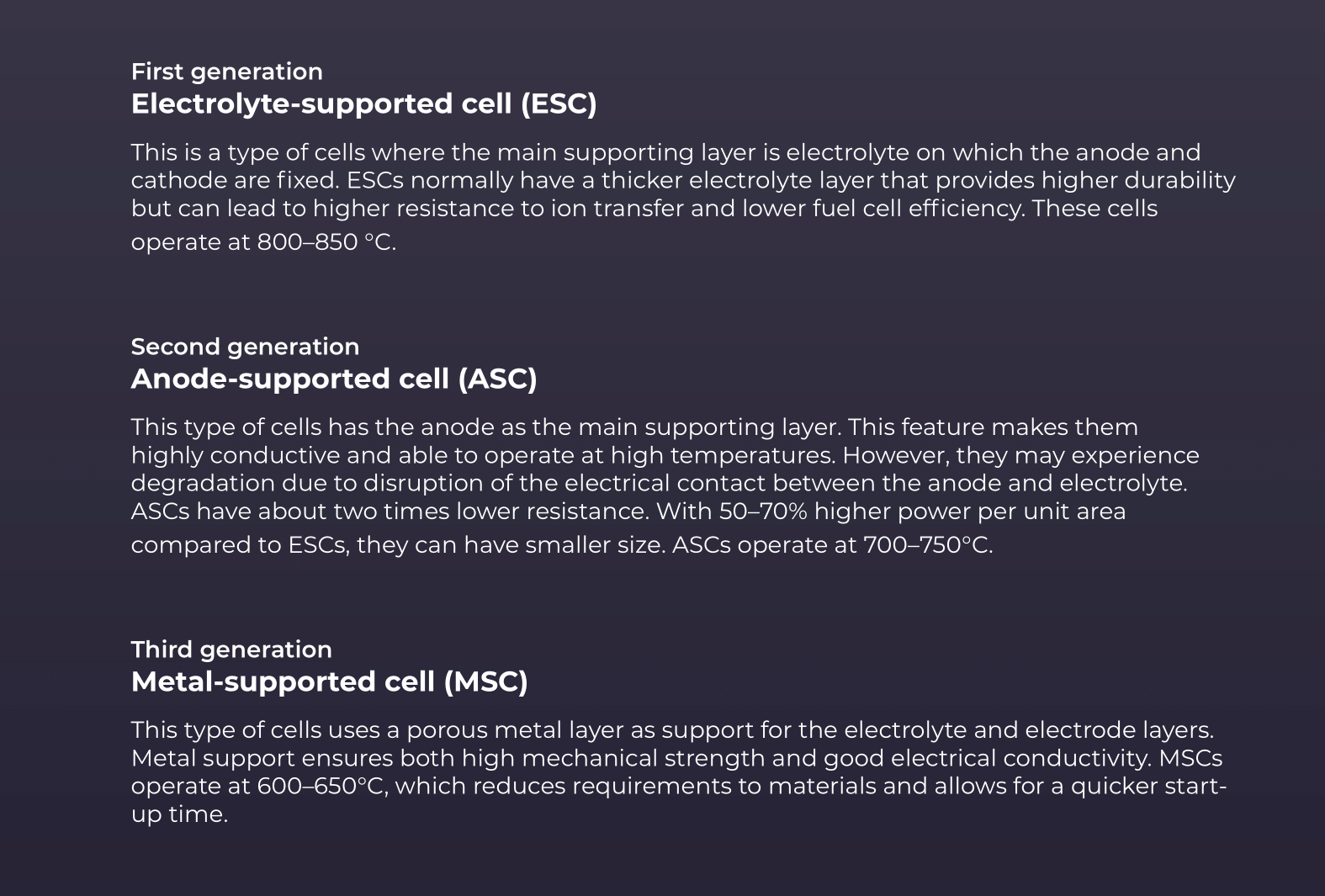

SOFC types

A 15% lower TCO for SOF cells compared to internal combustion engines can be potentially achieved by 2030

The introduction of MSC technology in 2019 opened up new opportunities for SOFC application in transportation, specifically in buses and trucks. As a result, the potential for utilizing methanepowered SOF cells in some sectors has significantly increased. They are expected to have 10–15% higher efficiency levels compared to ICEs in power generation, while dump trucks and waterborne transport can benefit from their TCO, which will be 15–40% lower compared to methane-powered ICEs. SOF cells are also easy to operate and maintain due to the lack of moving parts and have more eco-friendly exhaust than ICEs.

However, the main obstacle to implementing SOFC solutions in transport is the need to develop domestic MSC technology, which requires R&D financing and streamlining large-scale production. The Osipyan Institute of Solid State Physics of the Russian Academy of Sciences has announced its plans to present a prototype cell by the end of 2023.

In addition, several Russian companies, including EFKO (ASC; technology developed by ISSP RAS, NEVZ-CERAMICS JSC, and IHCE RAS6), ODK JSC, and Rosatom, have expressed interest in investing in industrial production. NEVZ-CERAMICS JSC has already launched large-scale production of ESC ceramic membrane, a critical SOFC component for power generation.

Batteries

Electricity prices for industrial use have increased by two to three times, and lithium prices are also on the rise. Despite this, lithium-ion (Li-ion) batteries are still the most promising option for energy storage primarily due to their technological maturity and efficient use and extraction of raw materials.

Since 2022, electric cars have had a 50% lower cost of ownership compared to ICE vehicles

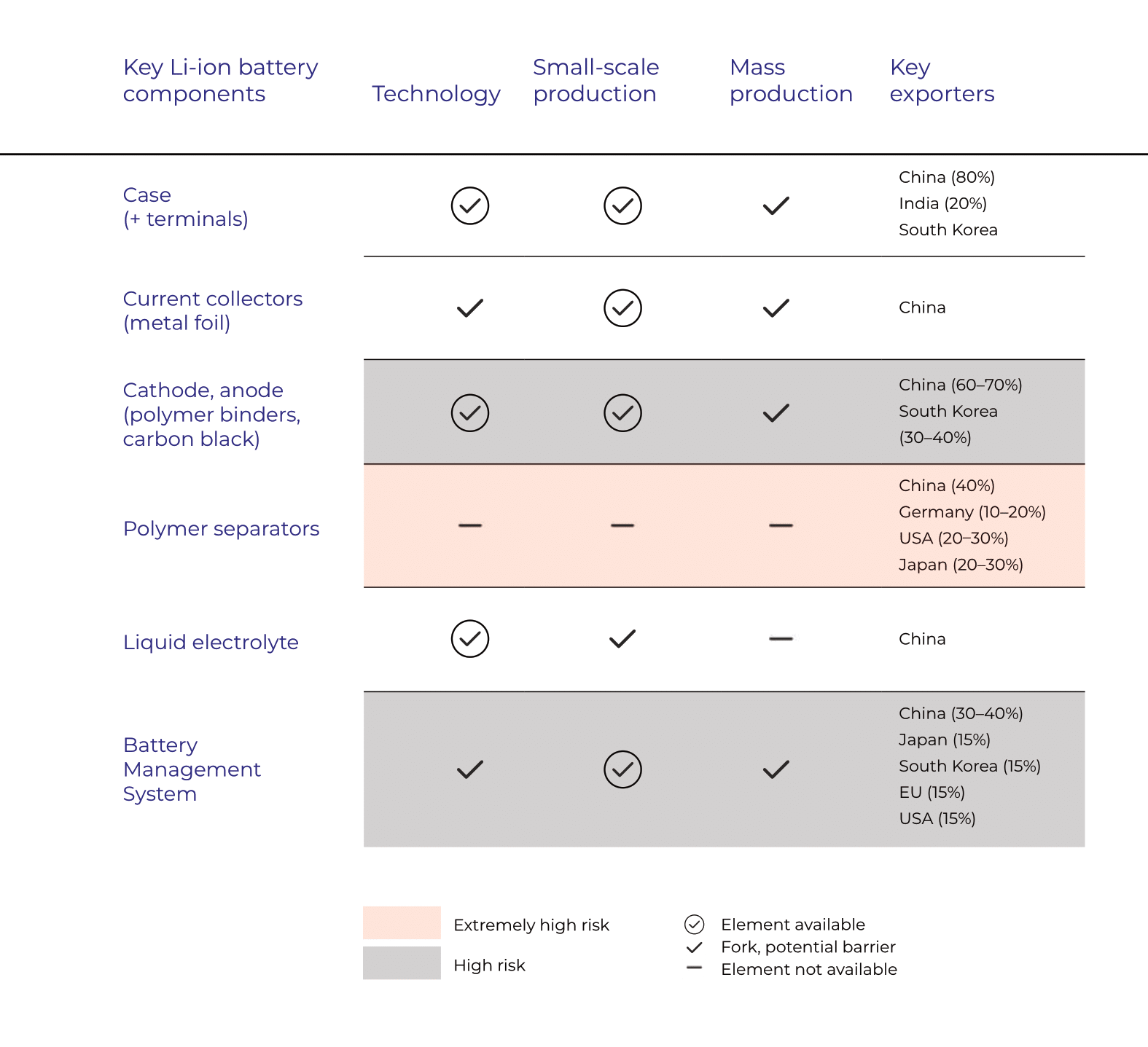

However, Russia does not currently have large-scale production of Li-ion batteries as it has not developed its own polymer separator technology and has not been able to streamline mass production of other components like cathodes and anodes. Additionally, each factory keeps the details of their technological process, including liquid electrolyte pouring and molding technology, strictly confidential as a know-how.

Russia’s primary prospect for self-sufficiency in Li-ion battery production lies with the RENERA gigafactory project, led by Rosatom. The factory aims to commence operations by the end of 2025. In 2021, Rosatom acquired a 49% stake in a South Korean lithium-ion battery manufacturer, intending to utilize its existing technology to establish a battery factory in Kaliningrad. In May 2023, it was revealed that Rosatom had become the sole owner by purchasing another 49%.

By 2030, improvements in the production process, economies of scale, established recycling and reuse chain, and optimization of chemical composition (including abandoning expensive nickel and cobalt) are expected to lower the TCO of Li-ion batteries, making them a 50% more cost-effective option compared to diesel. In fact, in the passenger car segment, the TCO of electric vehicles has been 50% lower that of ICE vehicles since as early as 2022.

Apart from being a power source for vehicles, batteries can also be integrated into propulsion systems together with key generators (e.g., ICEs or fuel cells) to enable regenerative braking. This approach is suitable for segments with shorter cycles and frequent braking and acceleration. LTO batteries are becoming economically viable not only for subway trains, but also for buses, dump trucks, switcher locomotives, and electric trains.

Producing its own lithium-ion batteries will help Russia reduce its reliance on battery imports and foreign car manufacturers in the long term. Like with other technologies, one of the crucial factors in achieving this goal is securing financing, and to do so, the government can encourage private investment in this sector. Local production will not only cater to the growing domestic demand, driven by the expansion of charging infrastructure in major cities and the declining cost of owning electric cars (which now stands at 50% of the TCO of ICE vehicles), but also create opportunities for exporting value-added secondary processed products.

Additionally, launching joint production ventures with international partners, particularly Chinese manufacturers, and importing primary and secondary batteries from abroad, again primarily from China, also remain feasible options. Establishing partnerships with Chinese manufacturers would ultimately pave the way for arranging the entire production chain on Russian ground. Alternatively, using imported components to locally assemble batteries offers benefits such as better integration into electric transportation and better adjustment to different regional climates wh ere the resulting batteries will be eventually used.

It is important to note that sodium-ion (Na-ion) batteries also have a high development potential. Currently, they are less cost-effective compared to lithium-based products, with $150/kW∙h against $135/kW∙h for Li-ion batteries. However, their cost is expected to decrease by 50–60% by 2030, allowing them to capture 30% of the market and replace lithium-ion batteries in short-distance transportation. For instance, CATL, China’s top battery manufacturer, is already actively developing sodium-ion batteries for use in passenger cars and other applications.

The lack of polymer separator production technology is the key barrier to creating an end-to-end lithium-ion battery production chain

Gas motor fuel

Natural gas has been used as a fuel for quite some time, but its usage in Russia is expected to increase. This is mainly due to its economic advantages, as the cost per cubic meter for private consumers is less than 10% of the average value in Europe. Another reason is its better environmental performance compared to other fossil fuels, with up to 80% fewer nitrogen oxide emissions (depending on the engine technology) vs oil and significantly lower particulate matter emissions during combustion.

The environmental benefits of natural gas are especially relevant for waterborne transportation as the International Convention for the Prevention of Pollution fr om Ships (MARPOL) imposes strict regulations on emissions. The switch to LNG in marine transportation meets both the existing and future requirements until 2050.

Stricter environmental regulations and the longer range of maritime vessels, which do not require a dense network of refueling stations, can facilitate the transition to LNG in this sector. For the same reasons and since LNG engine has a 20–30% lower TCO than a diesel engine, liquefied gas can be a promising option for mainline locomotives.

However, the transition of wheeled passenger transport from diesel to LNG would require the development of a refueling station network and ₽700 billion in investments. Currently, the government’s declared financing until 2025 stands at only ₽10 billion. For this reason, the use of natural gas in wheeled vehicles would primarily make sense for localized solutions, such as specialized vehicles used in quarries.

The transition of wheeled passenger transport from diesel to LNG would require ₽700 billion in investments

Another option that holds high potential is the use of more environmentally friendly compressed natural gas (CNG) together with liquefied petroleum gas (LPG) for passenger cars and buses. However, a significant transition (1% or more of the fleet) would require substantial government investments in the development of refueling infrastructure. CNG has a lower energy density compared to LNG, resulting in a shorter drive range, and for this reason, its viability depends on the availability of multiple refueling stations.

Hydrogen

Hydrogen fuel cell power plants are facing significant technological and economic obstacles, making their cost-effective implementation unlikely before 2030. Under the Clean Energy federal project, the Russian government plans to allocate ₽9.3 billion from the federal budget for the development of hydrogen technologies until 2024. However, this funding may not be sufficient to develop reliable and low-TCO solutions for hydrogen production, transportation, and storage.

Hydrogen can also be used in PEM⁷ fuel cells but Russia currently does not have its own domestic production technology. The polymer membrane is the key element in PEM manufacturing, and as of now, DuPont, an American company, is the sole possessor of the technology to produce these components. Without a domestic PEM technology, it is not feasible to widely implement this type of cells in Russia. Additionally, this technology relies on platinum as a catalyst, and its limited reserves pose a challenge for scalability. Therefore, without alternative catalysts, PEM technology will struggle to meet demand and remain uncompetitive compared to diesel, LNG, and lithium-ion batteries due to its high TCO.

To be used as a standalone fuel, hydrogen needs to be compressed or liquefied for transportation and storage, while delivery increases its cost to $8–20 per kilogram. The estimated cost of transporting hydrogen per 100 km ranges from $0.25 to $0.5 per kilogram. This makes it economically viable to produce hydrogen only at the same location wh ere it will be consumed8. For instance, the cost of hydrogen produced by electrolysis in Moscow would be around $20 per kilogram, which is 370 times higher than the cost of diesel equivalent in 2022 prices.

The feasibility of hydrogen technologies will depend on the possibility of bringing down the cost of fuel

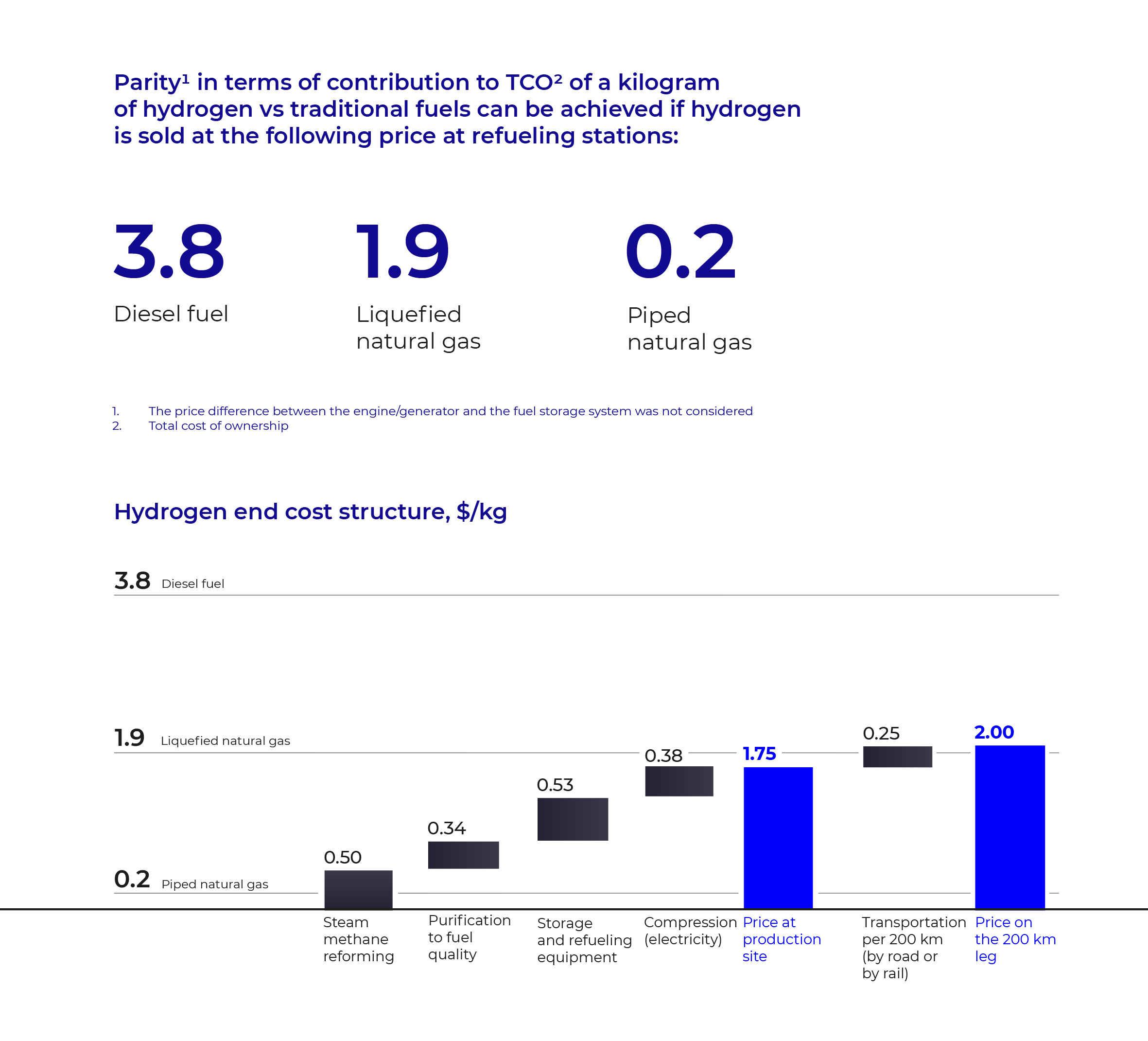

The feasibility of hydrogen technologies will depend on the possibility of bringing the fuel cost down to $1.5–2 per kilogram. However, by 2030, achieving such reductions will likely only be possible within a 200–300 km radius from the production site. That said, this cost can be attained for green hydrogen produced by water electrolysis using renewable energy sources and solid oxide electrolyzers at energy tariffs not exceeding ₽1/kW∙h. The production of gray hydrogen, which is generated through steam conversion of methane with carbon dioxide emissions released into the atmosphere, is not a primary focus for development since any exports of this type of hydrogen will be subject to carbon taxes.

Hydrogen price can only be comparable to LNG directly at the production site

It is noteworthy that hydrogen energy development can be commercially attractive in an export-oriented scenario. Some countries aiming for zero CO2 emissions in the next 30–40 years, such as Japan, South Korea, and China, are betting on hydrogen technologies. However, none of these countries is currently able to produce the planned volume of hydrogen.

Russia could also sell hydrogen abroad, but first, it needs to monitor the advancements in other countries to choose the most suitable method. Currently, there are several options for exporting hydrogen from Russia, including hybrid gas pipelines, maritime transportation, and metal hydride technology that can significantly reduce transportation costs.

The decision on which method to prioritize globally will determine the infrastructure required for exports and the overall profitability of this project. For example, Japan announced the development of port terminals capable of receiving large ships with liquid hydrogen, which is expected to reduce fuel costs through increased simultaneous transportation and storage capacity.

This project could become a long-term investment for energy suppliers. The estimated capital expenditures, excluding liquefaction and injection, for a production capacity of around 40,000 tonnes per year would amount to $50–60 million. For instance, in the Russian Far East, the estimated cost of hydrogen production using the methane conversion method with carbon dioxide capture and storage and delivery to the border could stand at $3–4 per kilogram if transportation technologies are provided by the buyers. This option can be attractive to importers from Asian countries.

Building a hydrogen production plant with a production capacity of approximately 40,000 tonnes per year would require $50–60 million in capital expenditures

Hybrid solutions

In addition to being used as stand-alone power generation products, some of the above technologies can also become a part of hybrid solutions. Hybrid solutions are becoming increasingly popular as they offer improved performance in end products, including regenerative braking, load peak shaving, extended service life, and reduced costs by optimizing the size and power of transmission. Smart control of energy flows in combined solutions can also enhance the effectiveness of fuel systems.

We anticipate that by 2030, a hybrid system consisting of a diesel engine and a lithium-iron-phosphate battery will become the most promising solution for all modes of transportation. In case of serial connection, this combination enables higher system integration, reduced power system weight, and a 25–35% lower TCO for rail transport (Siemens and Alstom are already actively implementing this solution) and a 20–25% lower TCO for wheeled and waterborne transport.

Alternatively, parallel connection offers faster implementation timeframes (typically from 10 days to two months) and does not require engine modifications. The downside of this solution is that it is 20–30% more expensive than serial connection. However, this option is preferred for waterborne transport, buses, and dump trucks, as it enables a 25–35% reduction in TCO.

The next step is incorporating a supercapacitor into the batteryengine hybrid system. This solution minimizes system complexity while providing significant power gains over short periods. These benefits make it suitable for mainline diesel locomotives, buses, and dump trucks. This technology is not yet in mass production, but a pilot large-scale production project is already underway.

In the long term, combining a battery with a fuel cell will become the top-priority solution. Since the fuel cell TCO is expected to go down, this hybrid solution will become especially relevant for passenger cars (Mitsubishi Motors is actively developing it), waterborne transport (Hitachi), and to a lesser extent, subway trains.

Another option that holds high potential is a combination of a battery and supercapacitor. This solution offers a 20–30% power increase during acceleration, starting from a standstill, and high torque, making it ideal for reducing TCO by 20–25% in buses and 25–35% in electric and metro trains. Siemens is already actively developing this technology for electric trains, mainline diesel locomotives, and switcher locomotives.

Based on our estimates, the most promising solution for Russia in the coming years is the hybrid of engine and lithium-ion battery, which can potentially have an approximately 25% lower TCO compared to diesel.

What needs to be done in the next two years

Diversification of energy products for vehicles will require joint efforts of transport solution manufacturers, infrastructure builders, and consumers, along with government support and subsidies. Strengthening the green agenda will also provide further momentum.

We have identified several measures Russia should focus on in the short term:

Despite global investments in renewable energy sources and technological advancements, certain technologies, including hydrogen solutions, have limited potential for development in Russia in the short term due to factors such as technological maturity, total cost of ownership, and infrastructure availability. Large-scale investments in a wide range of technologies are not currently feasible due to existing limitations. Russia should primarily focus on closely monitoring technological advancements worldwide and promoting rapid R&D development (which includes engaging experts, obtaining licenses, and developing in-house solutions) in promising sectors with limited capital expenses and relatively short commercialization periods. This strategy can help it develop expertise and a technological foundation in promising areas, introduce economically viable new technologies into the energy sector, promote the export of these innovations, and swiftly expand to new sectors when they become economically and technologically mature. As a result, Russia will strengthen its role as a global energy provider by offering promising and economically feasible solutions for energy transition.1 BP Energy Outlook 2022.

2 Bloomberg, How the World is Spending $1.1 Trillion on Climate Technology.

3 Total Cost of Ownership.

4 Osipyan Institute of Solid State Physics of the Russian Academy of Sciences.

5 Boreskov Institute of Catalysis of the Siberian Branch of the Russian Academy of Sciences.

6 Institute of High Current Electronics of the Russian Academy of Sciences.

7 Proton-exchange membrane.

8 Logistics to the point of consumption (compression at 300/700 bar; liquefaction; metal hydrides).