The Yakov & Partners Banking Practice analyzed retail payment systems in 75 largest economies in the world to identify leading-edge payment technologies, as well as assess the current state and opportunities for the development of the Russian payment system.

The payment system is the heart of any country’s economy

It is impossible to imagine modern economy without payment systems. When people have reliable and convenient instruments to make payments quickly avoiding exorbitant fees, they use banking services more extensively and there is a growth in the number of transactions. At the same time, gray economy shrinks, consumer demand increases as banks expand lending opportunities thanks to more accurate risk assessment. Thus, an important indicator of the maturity of a payment system is the share of retail payments made in cash. Among the 75 largest world economies, it varies fr om 4% (Norway) to over 70% (Morocco).

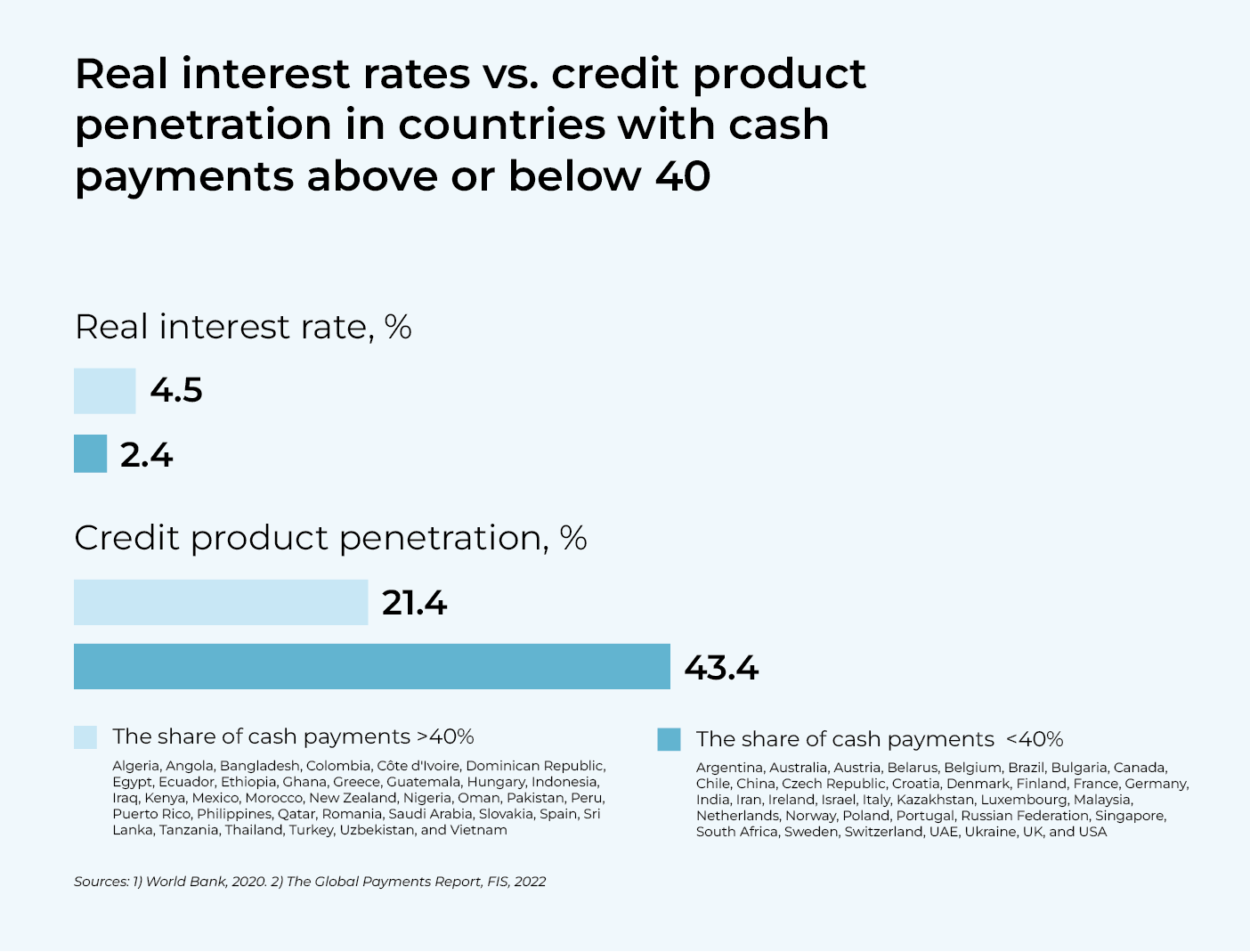

However, 26% of the global population over 15 years of age (and these are 1.5 billion people) still have no access to banking services, and 52% of them live in countries wh ere the share of cash in circulation is at least 40%. In 2021, the average real (inflation-adjusted) lending rate in those countries was 2.1 percentage points higher than in countries with more advanced payment systems, whereas the credit products penetration rate was 22 percentage points lower.

Payment systems are established and run by government institutions, banks, and other financial institutions, but the prevalence of payment mechanisms depends on the population and retailers, as well as on the direction of commodity and cash flows. P2P and P2B payment transactions account for 47% of international payment industry revenues5, the rest is generated by B2B and B2G settlements.

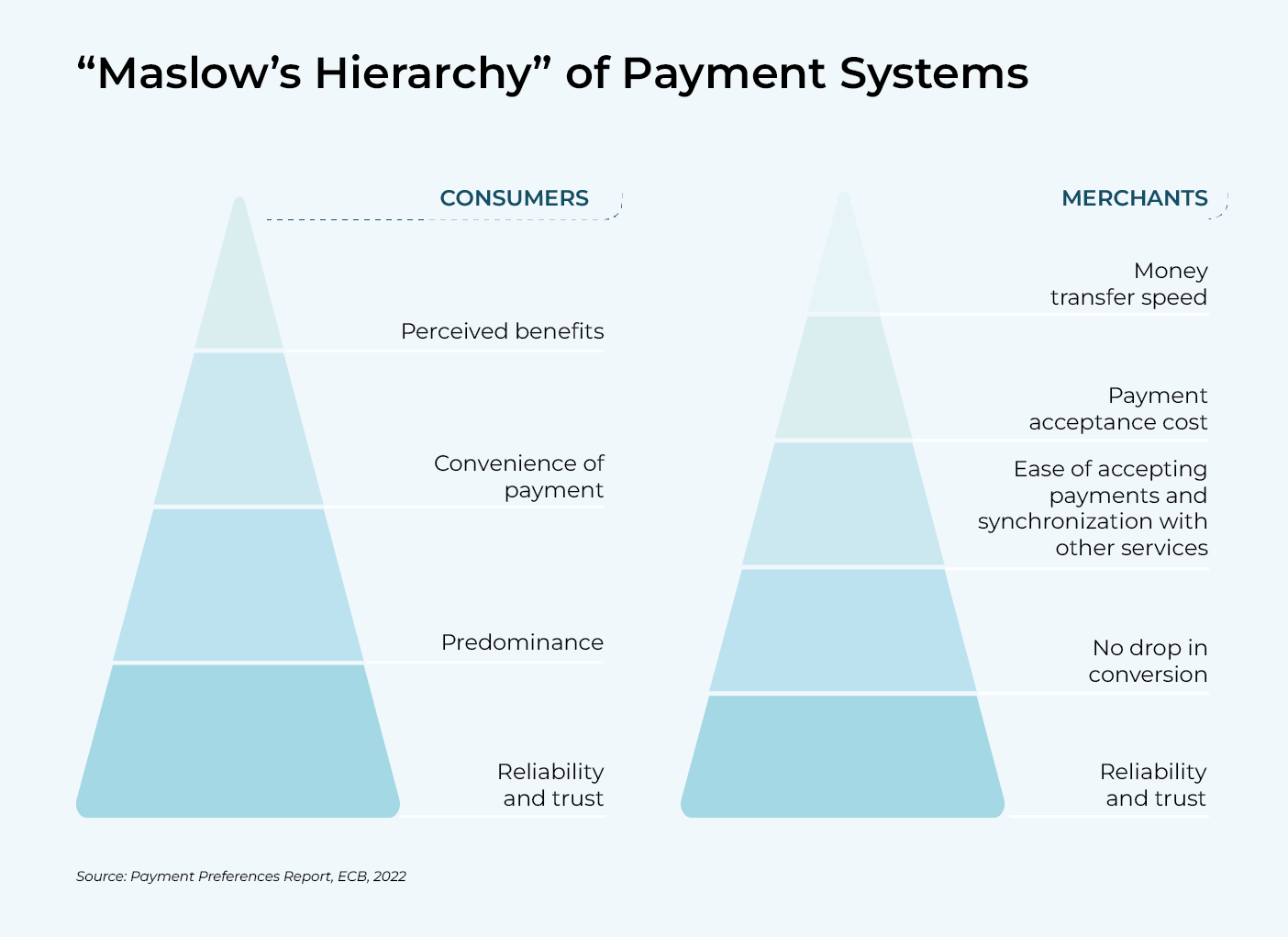

For consumers, the hierarchy of retail payments characteristics is similar to Maslow's pyramid, with the payment method predominance at the bottom, the convenience of making payments on top of it, and perceived benefits (cashbacks, installments, etc.) at the very top. For merchants, the hierarchy is as follows: no drops in conversion, convenience for the seller (simplicity of the process, synchronization with other services, and customer support), the payment method cost (infrastructure investments and transaction fees), and the transaction speed6. While commission fees are important for large businesses, SMEs are ready to pay more − the ease of use and early-stage saving opportunities are more important for them. The described "pyramids" look like that provided that the payment method is reliable and trustworthy. Almost all the above characteristics primarily depend on payment infrastructure but buyer’s convenience is determined by the preferred method of payment (cash, bank card, QR code, etc.).

Since the emergence of bank cards, the payment sphere development has been mainly driven by the competition of different payment methods. Market players offer convenient payment formats to buyers and businesses, and progress in this sphere often leads to major structural changes. However, new technologies are driving even more significant changes in payment infrastructure, such as the introduction of national payment systems and the widespread adoption of digital currencies and blockchain. In particular, Russia and China have carried out significant infrastructural transformations. In Russia, large-scale changes have taken place thanks to the active cooperation between the regulator, payment systems representatives, and leading commercial banks. China's success in this area is also largely due to joint efforts by the government and business.

Building a payment system is a challenging and highly capital-intensive task. The experience gained when building the Russian National Payment Card System (NPCS) shows that the cost of creating and launching payment infrastructure can be in the order of RUB 3 billion. Apart fr om that the lead time of a successful pilot project can be fr om two to four years, and the scaling-up period can vary significantly. However, building payment infrastructure is not enough − it must be ubiquitous. For example, more than a year passed following the signing of a law providing for the development of the NPCS processing system in Russia before international payment systems’ cards were processed by the new domestic transactions system; and the first million MIR cards were issued within two and a half years. However, such investments pay off after a few years − according to the World Bank, making banking services available to individuals can reduce gray economy and unemployment and increase per capita income of the population affected by the transformation by 7%. Building an efficient payment system boosts economic growth by 0.5–1%, therefore in a large economy, it pays off in less than a year, while in some situations (as was the case in Russia in 2022), the existence of an independent payment system enables normal functioning of the country’s economy.

Competition between payment methods: in the fight between cash and bank cards, smartphones took the prize

Consumers increasingly prefer non-cash payments to cash. Over the past five years, the share of cash in the global POS turnover has decreased by 12 percentage points down to 18%, and in some countries, it does not even reach 8%. In North America, the average share of cash in circulation is 11%, in Asia − 16%, and in Europe − 26%. In the Middle East and Africa, the share of cash in retail transactions decreased fr om 70% in 2019 to 44% in 2021. However, there are exceptions. For instance, in Germany, the share of cash in the turnover of retail outlets is 40%, and in the US, wh ere the share of cash is insignificant, bank checks still account for about 4% of the turnover.

Consumers began to actively use plastic cards in the 1990s. While the market was dominated by card operators such as Visa, MasterCard and UnionPay until the 2010s, a lot has changed with the advent of smartphones. Banks and payment systems have lost their monopoly on payments, and QR codes and mobile wallets have become firmly established, while bank cards have switched to tokenization. Moreover, tokenized card payments have quickly taken root in those countries wh ere, at the time of the emergence of the tokenization technology plastic cards were widespread. As for financial institutions, everything is as before, only the user experience has changed.

In countries where the share of cash was high, QR codes have become one of the main payment methods. Such countries already represent more than 10% of the largest economies in the world. QR code payments do not require big infrastructure investments and are, therefore, very attractive to retailers. Even payment terminals are not required and can be replaced by a mobile phone or simply by a code printed on paper. This technology is most widely used in such Asian countries as China, Indonesia, and Malaysia15.

Unlike tokenized cards, QR codes have not only created a new customer experience but have changed the balance of power in the payments industry. In countries where they became the predominant payment method, closed-loop ecosystems have emerged and are still actively developing. In such ecosystems, money comes fr om the paying client's account directly to the recipient company’s account bypassing such intermediaries as payment systems, and often traditional banks. Major ecosystems like WeChat, Alipay, and OVO operate not only in banking but also in other industries such as retail or logistics. Other companies are trying to imitate them but creating a closed-loop ecosystem is very expensive, costs may exceed USD 30 million. Notably, to promote such an ecosystem it will be necessary to develop a financial institution brand and subsidize payments at early stages.

The payment method prevailing in a particular country rarely changes. A curious exception to this rule is Kazakhstan. In 2019, bank cards were widely used there − in the country with a population of less than 20 million people, financial institutions issued more than 23 million cards. The availability of POS terminals was low, about 7 units per 1,000 people, i.e., more than three times lower than in the Russian Federation and four times lower than in the EU. Kaspi Bank began to actively invest in QR-based POS terminals infrastructure and subsidize retailers by reducing interchange fees, so by mid-2021 the bank took over 51% of the POS terminal market ensuring an explosive growth in the popularity of QR codes. At the same time, over that period the total share of non-cash payments in the country increased fr om 66% to 84%, which was in line with the best international practices. A similar situation is observed in Singapore wh ere in 2021, more than one third of the country citizens made QR code payments despite the high penetration of bank cards. Characteristically, in both countries, the changes are driven by a player who is ready to make significant investments to change people's behavior. While in Kazakhstan it was a private bank, in Singapore it is the government, which promotes QR code payments − the authorities subsidize POS terminals and have introduced a single QR code standard for all banks.

The next step in the development of payment services may be the technology of biometric payments. Many countries are experimenting with it but so far it has not been broadly adopted. It is related to the fact that it is not easy to collect biometric data. For instance, in Russia, 32% of people are not ready to provide such data to banks, because they consider it unsafe while 20% of respondents do not believe that it would be more convenient to make biometric payments compared to other methods. Probably, people find it convenient to pay with a smartphone and they are not going to give up that method.

Large-scale transformations in payment infrastructure

While payment methods are gradually evolving, payment infrastructure is now undergoing radical changes. Firstly, many countries are launching national payment systems that allow for domestic (and in some cases cross-border) payments without traditional international payment systems. Secondly, instant payment systems (Real Time Gross Settlement, RTGS) are being created, which are also usually national. The Faster Payments System (FPS) in Russia or the SCT Inst system in the Eurozone may serve as examples. Thirdly, digital currencies are being introduced, often using the blockchain technology.

The implementation of each of the above components provides certain advantages. In particular, the financial system of a country that has its own payment system is more resilient to external shocks. For example, in 2022, it was the existence of the National Payment Card System (NPCS) that allowed Russia to ensure the stability of domestic payment settlements. Systems like Shetab in Iran, BancNet in the Philippines, and UnionPay in China have been enabling the functioning of autonomous payment infrastructure in their countries. Among the 75 largest economies reviewed, 22 countries have developed their own payment systems. In most cases, these are major regional countries both in terms of GDP and population: China, India, Russia, Iran, Brazil, USA, the Philippines, Indonesia, Nigeria, South Korea, France, Italy, Germany, etc. Among the countries with a population of less than 10 million people only three turned out to have their own payment systems − Singapore, Denmark, and Norway.

As of 2021, the average population of the countries with their own payment systems exceeded 150 million people while the total population of the above 22 countries is over 3.7 billion people.

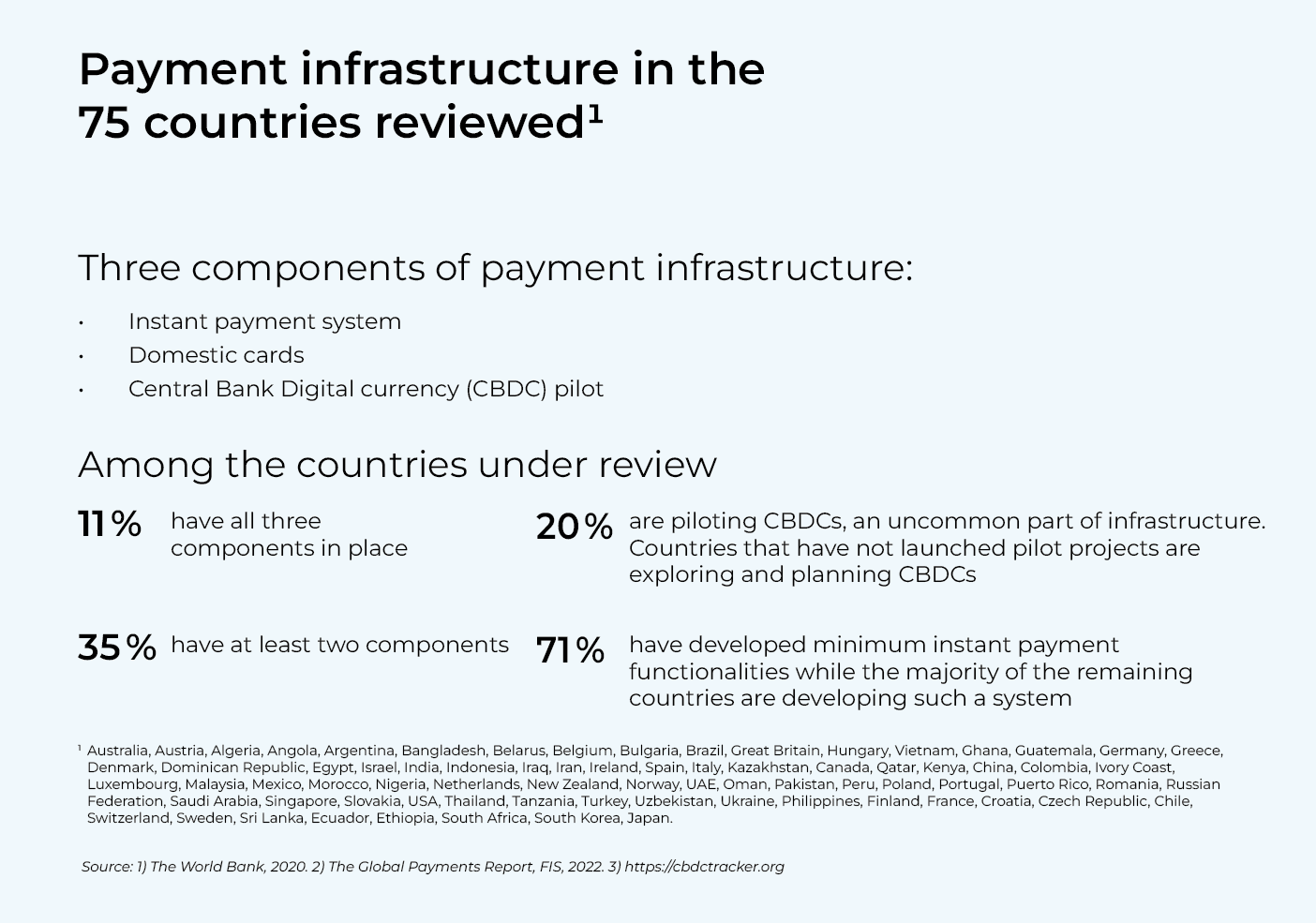

The creation of RTGS systems improves the convenience of making payments for users, for example, they can transfer money fr om one bank to another by using a phone number. In B2B settlements instant payments make it possible to reduce the amount of temporarily “frozen” funds when making payments. In addition, RTGS systems reduce settlement costs for businesses. Such systems have already gone live in the majority of developed economies: 70% of the countries reviewed have launched at least minimum RTGS functionalities. Among the remaining major economies, the system is most often in the final stages of development or pilot testing. The system is not developed only in large economies with a low per capita income (Tanzania, Côte d'Ivoire, Ghana, Iraq, etc.).

Finally, the introduction of digital currencies (most often based on blockchain), although fraught with considerable difficulties, unlocks additional opportunities in terms of the transparency, reliability, and security of payment infrastructure. Currently, there are three principal forms of digital currencies − cryptocurrencies, stablecoins, and Central Bank digital currencies (CBDCs). Notably, the impact of digital currencies on the payment sector varies significantly from country to country. The CBDC is the newest and, as a result, the rarest of the three elements of payment infrastructure. Only 15 countries out of the world's 75 largest economies have completed the exploratory, planning and development phases and have launched as much as the pilot phase. These are primarily regional leaders in terms of GDP and trade turnover − China, Russia, India, the UAE and Saudi Arabia, Nigeria, Iran, Singapore, South Korea, and Kazakhstan.

Russia is one of the most developed payment markets in the world

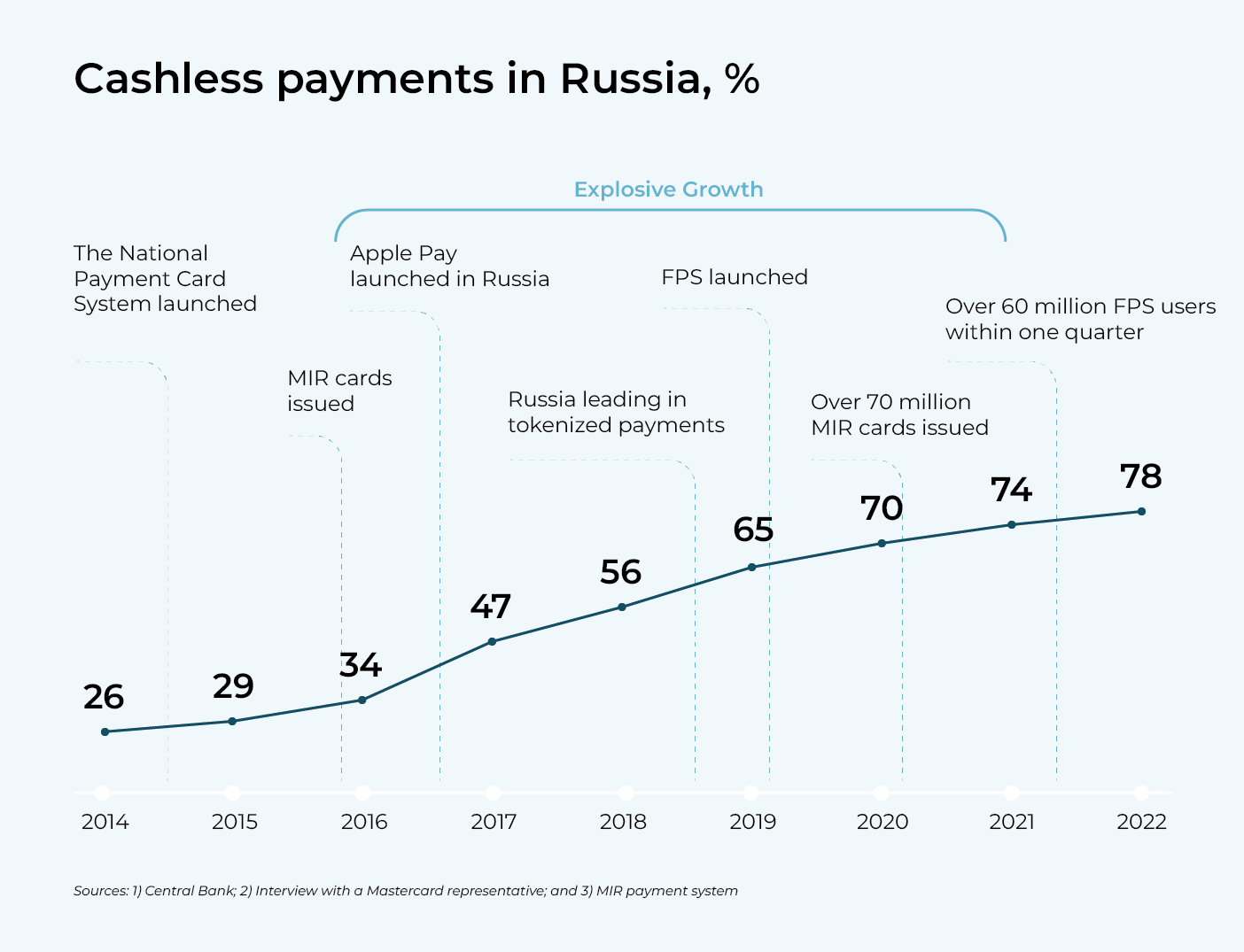

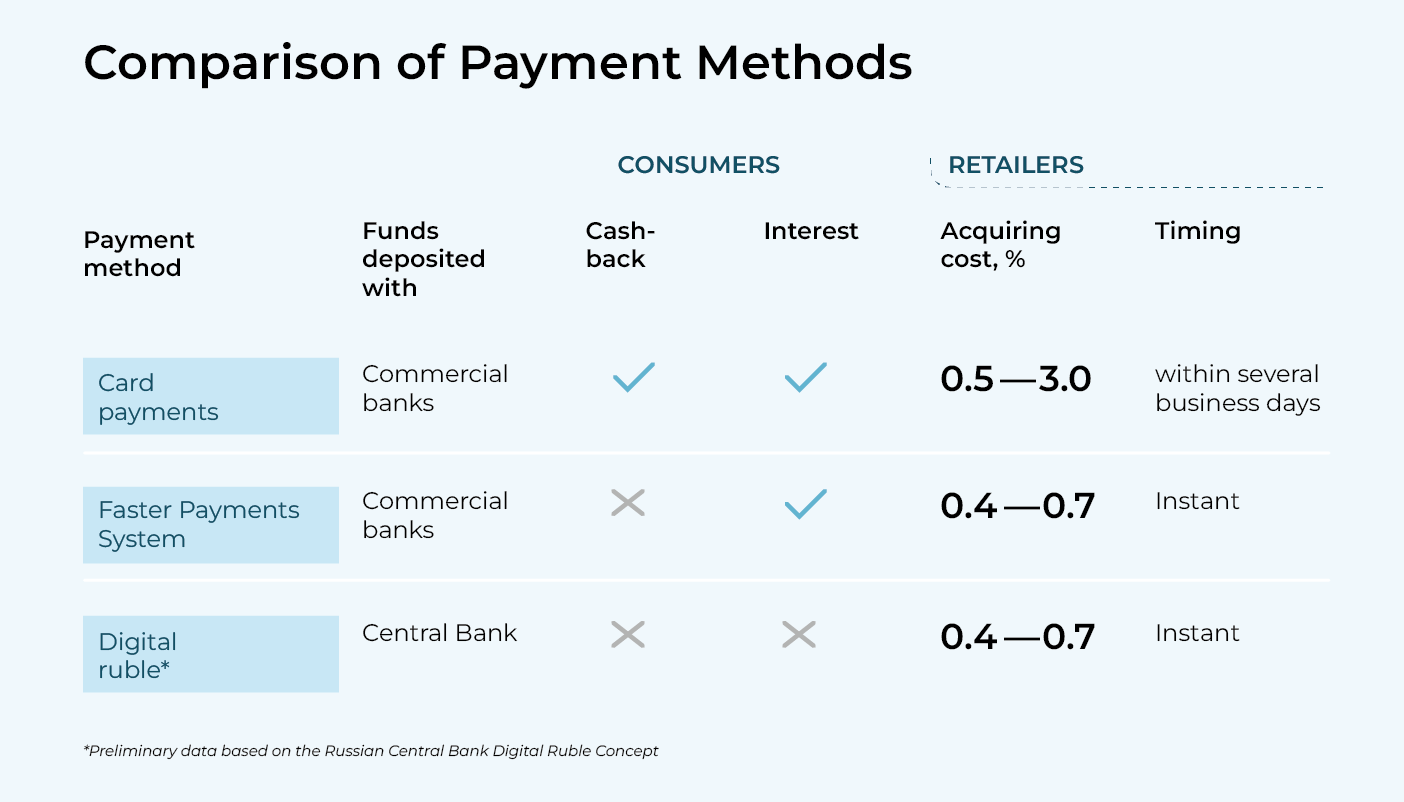

Russians massively switched from cash to bank card payments in the mid-2010s − early 2020s. In 2021, bank interchange fees carried over to acquirer fees averaged 1.5%. It was 5–7 times higher than in the EU countries and is comparable to the cost of processing cash for retailers. Such high rates made it possible to offer beneficial loyalty programs (cashbacks, miles, etc.).

The main impetus for the transition to cashless payments was the development of contactless payment methods, especially tokenized cards. It was facilitated by appropriate POS terminals becoming ubiquitous. The contactless payment technology was supported by 90% of such terminals as early as 2019, while the world average will reach this level by 2025 only. In 2018, Russia was the world leader in contactless payments.

As noted above, the prevailing payment method rarely changes. Therefore, FPS mechanisms and bank payment services launched at the same time could not compete with tokenized cards despite lower payment acceptance costs for retailers. It is explained by the fact that those services have not improved customer experience (shoppers are invited to scan QR codes) and are less beneficial for consumers (cashbacks are not provided or are too small). The more profitable payment infrastructure for retailers has been mainly developing in online commerce (which accounts for less than 10% of total payments). At the same time, there were significant (2% and higher) discounts/markups for the payment method, which exceeded seller’s benefits from the difference in acquiring costs.

The exit of international companies from Russia in 2022 created new challenges as well as new opportunities. On the one hand, the customer experience of using tokenized cards deteriorated, especially on Apple devices. Some banks are trying to rectify the situation, for example, by using stickers with card functions that are glued to phones. On the other hand, major acquiring banks introduced QR code payment mechanisms, in particular with the help of FPS. It creates user experience similar to what they are accustomed to but does not yet allow customers to receive the same benefits in the form of cashbacks, although sellers benefit from instant funds transfer and lower acquirer fees of 0.7% or less.

International experience shows that in countries wh ere QR code payments prevail there is closer interaction between banks and retailers. This is how closed-loop ecosystems wh ere customers can get additional benefits (discounts and loyalty points) for paying for goods through appropriate applications are built. Moreover, QR code payment mechanisms allow for convenient installment payments (BNPL). In Russia, however, this practice is not yet widespread: the share of online installment purchases is only 1%. For comparison, the EU average is as high as 8%.

Prospects of digital currencies in Russia

For almost 10 years, Russia has been discussing regulation of the circulation of digital currencies and the use of blockchain in payment infrastructure. The use of cryptocurrencies as a means of payment is currently prohibited. Among other things, such distrust is explained by their limited scalability and exchange rate instability. And events like the recent collapse of the FTX exchange cast doubt on the credibility of unregulated digital money.

Of the main forms of digital currencies mentioned above, Russia is most likely to introduce CBDC, namely a digital ruble. It could occupy a certain niche in the domestic retail payments market since it is an alternative means of payment rather than a speculative asset. CBDC can be implemented in various forms for retail payments. The ongoing pilot project in Russia has the following parameters:

• Individuals’ accounts will be on the Bank of Russia balance sheet;

• Access to accounts will be provided via the mobile application of any commercial bank and customers will also have access to an offline wallet with transaction volume limitations;

• Digital rubles will be issued by purchasing digital rubles for non-cash funds;

• No interest will be paid on the balance;

• Acquirer fees will not exceed the FPS rates.

The rollout of the digital ruble allows to strengthen payment control and reduce transaction costs. The issue of digital currency is faster and cheaper than the issue of cash, so the Central Bank decisions would be implemented more quickly.

At the same time, it will improve budget enforcement and raise the transparency of the economy. Considering the above factors, it can be expected that the digital ruble will be actively promoted by the Bank of Russia.

The Central Bank highlights several other important advantages of the introduction of digital currency. It will be convenient for customers to use a single digital wallet via the application of any commercial bank or other financial institution. The offline mode will enable secure digital transactions without Internet access. The costs of administering budget payments will be lower for the government. Commercial banks will have new opportunities to offer products based on the digital ruble. The new form of payment can become an important instrument in cross-border payments.

At present, the digital ruble is not expected to take over the bulk of retail payments. It has no obvious benefits in terms of everyday usability and is not so lucrative to end users as other means of payment because there is no interest accrued on the balance and, most likely, no cashbacks. But the digital ruble still has a number of unique advantages:

• The possibility of earmarking digital rubles for payments for intended purposes only;

• The possibility of implementing smart contracts;

• The possibility of making payments in an offline mode within certain limits.

The introduction of the digital ruble can significantly impact the profitability of key market players since they receive a considerable income fr om high interchange fees and interest rates. Banks may lose net commission income from processing card payments and the average cost of cash pooling may increase. The absolute drop in the banking sector revenues depends on the turnover of the digital ruble and CBDC wallets balances. According to preliminary estimates, within 3–5 years after successful piloting and full-scale implementation of the digital ruble banks may lose up to RUB 50 billion per annum in payment handling fees and due to higher costs of attracting liabilities whereas consumers may be left without cashbacks on purchases. Retailers will, on the contrary, benefit as they will be able to reduce acquiring costs and instantly credit funds to their accounts.

The introduction of the digital currency will also allow to lower the financial services entry threshold. The Central Bank plans to introduce an API for processing end user orders when using the digital ruble, so new digital players may appear on the market. They will attract users with a convenient digital ruble wallet interface.

Thus, the digital ruble basic scenario assumes that payment servicing costs will decrease, and retailers will become the main beneficiaries of this step. In contrast, it spells lower incomes for consumers and financial institutions. Along with QR code payment mechanisms, it can become another impetus for banks and retailers to build partnerships.

How different players can improve their financial results when the digital ruble is introduced in retail payments

To minimize losses issuing banks can use a "defense" or "attack" strategy. In the first case, they can highlight to their customers such advantages of card payments as cashbacks or interest on account balance while financial institutions can revise loyalty programs by reducing cashbacks in categories with a lower risk of switching to the digital ruble (supermarkets, fast food restaurants, etc.) and raising them in categories that are more at risk (clothes, electronics, home improvement goods, etc.) Considering that about 40% of card payment turnover traditionally falls into categories with higher payment processing fees, banks are able to lim it the transition of customers to the digital ruble when making large purchases in those categories. To implement this strategy, it is necessary to maintain high interchange fees but given the rapid popularization of FPS payments it seems unlikely. One would rather expect lower commission income so this strategy would be inefficient in the long run.

In turn, the "attack" strategy involves active promotion of products that unlock the unique advantages of the digital ruble in order to attract customers and receive commission income:

• Servicing special-purpose expenditures, such as pension payments, maternity capital, art, and humanities endowments (for example, the Pushkin card) and other target payments;

• Servicing retail transactions with residential real estate or private vehicles using the digital ruble;

• Labelling rubles for certain population groups, like "children's" rubles, which can be used at school, but not on gaming platforms, "Islamic" rubles with appropriate restrictions; "charity" rubles, which are automatically transferred to charity when a payment is made, etc.;

• Issuing retailers’ gift certificates, which can only be used to pay to the wallets of the respective outlets;

• Ensuring end-to-end integration with operations involving digital financial assets.

The above measures unlock wide opportunities for banks to earn commission income. Special-purpose social payments (maternity capital, one-off child allowances, and Pushkin card) amounted to about RUB 0.6 trillion in 2022 with the list of such payments still expanding and payments subject to annual indexation. As to special-purpose transactions, the secondary housing market alone is estimated to exceed RUB 10 trillion per annum and combined with the primary housing market the total annual transaction volume is over RUB 15 trillion. The private vehicles market even with the industry’s deep crisis in 2022 amounted to more than RUB 0.6 trillion. Insurance payments amounted to about RUB 0.8 trillion in 2021. The potential market for specialized currency is not limited to those categories and can be larger. It is not easy to estimate potential banking commission income, but it may be assumed that the aggregate banking sector commission income from such operations may be at least 0.35% or about RUB 60 billion per annum with a stable and predictable upside potential. Moreover, the new digital currency could play an important role in corporate settlements wh ere payment volumes are disproportionately higher.

Thus, the banking sector has the opportunity not only to make up for the loss of income from card payments processing and the outflow of cheap liabilities but also to increase the commission income base. Taking into account the redistribution of the income base from processing payments, banks that are able to be the first to implement an active strategy to adapt to CBDC payments will benefit from the introduction of the new payment method. In turn, a passive strategy will prevent them from offsetting potential income losses.

The choice of an appropriate strategy reminds us of the prisoner's dilemma: if none of the banks launches an attack, then the introduction of the digital ruble will be delayed, and banks will incur losses relatively slowly. If a leader appears, it will receive a disproportionately high income, while other banks will suffer losses. And if the "attack" strategy is chosen by many organizations, then the dynamics of financial performance will depend on the ability to replace lost income with a new one.

Unlike banks, retailers will benefit in any case if they launch an "attack" on interchange fees. Both the infrastructure of the digital ruble and existing infrastructure will be suitable for this. But since the most important task for retailers is boosting their revenues, it is better for them to develop value-added customer services, for example, a "seamless" installment plan, in particular, in an offline channel, free delivery, etc. The overall gain for retailers can be at least RUB 80 billion per annum although early-stage investments in the development of customer relations may be required.

International experience shows that a decrease in acquiring costs does not lead to a price drop but to higher retail margins. For example, the European Commission cites the following data: when interchange fees dropped from more than 1% down to 0.2–0.3%, the price increase did not slow down significantly. Customers just had to pay more for card servicing and retailers turned out to be principal beneficiaries. However, in some countries, like Australia such changes did not allow consumers to save money especially when banks were unable to convert lost revenues into a new income. When promoting a digital currency, it is important for any Central Bank to cooperate with other government agencies, including antitrust authorities. Some of the savings received by retailers must be shared with consumers in the form of lower or slower price increases.

Conclusion

Russia enjoys one of the most developed payment systems in the world, both in terms of client experience and infrastructure, therefore banking executives seek to develop this system even further. Despite the immense challenges they created, the events of 2022 unlocked new growth opportunities as well. Forging new partnerships and fostering closer cooperation between banks and retailers could give a fresh impetus to competition that would in turn improve customer journeys.

Digital currencies could help improve payment infrastructure, or more specifically, boost its reliability and performance. They will allow to develop new types of services that could help improve customer experience. In the new normal, the success of each market player will hinge on how fast it can adjust to the changes and how flexible it can be in managing the terms of service.