According to the findings of a new study titled “The New Russian Society: Consumer Sentiment Pulse Check” carried out by the experts of Yakov and Partners and ROMIR Holding, 55% of the respondents have at least some savings, and every third respondent has enough to support their entire family for more than 6 months. Compared to 2022, the share of such citizens increased from 21% to 32%; the majority reside in Moscow, St. Petersburg, and other million-plus cities.

The study was conducted in May 2024 using ROMIR’s proprietary Longitudinal System which allows to analyze the evolution of public sentiments taking into account all the relevant criteria and segmentation by socio-demographics, lifestyle, values, and other criteria.

The share of Russian citizens who have at least some savings increased by 3 percentage points compared to December 2022. It is worth taking into account that back in 2010 this figure stood at just 30%, meaning it had increased by a factor of 1.8 in recent years. Nevertheless, Russia still lags behind many developed and emerging countries, including Japan (83%), Australia (76%), Germany (70%), India (69%), and the US (68%). According to the authors of the study, such underperformance indicates significant potential for stimulating savings and channeling household savings into the national economy.

According to the study, the majority of the respondents who reported having at least some savings live in the Far Eastern (71%), Urals (54%), and Siberian (52%) federal districts, while the Volga (49%), Northwestern (48%), and North Caucasian (45%) federal districts bring up the rear.

Representatives of the senior generation (59 to 78 years old) turn out to be the thriftiest, with 64% of the respondents having at least some savings. To put this in perspective, 54% of the respondents among Generation X (38 to 58 years old) and 49% among generation Y (20 to 37 years old) have no savings of any kind.

Marriage seems to stimulate the tendency to save up, as 57% of married respondents have at least some savings, compared to 49% among those who are single. At the same time, the volume of savings gradually declines as the number of children in the family increases. More than half of the respondents (63%) with three or more children have no savings at all.

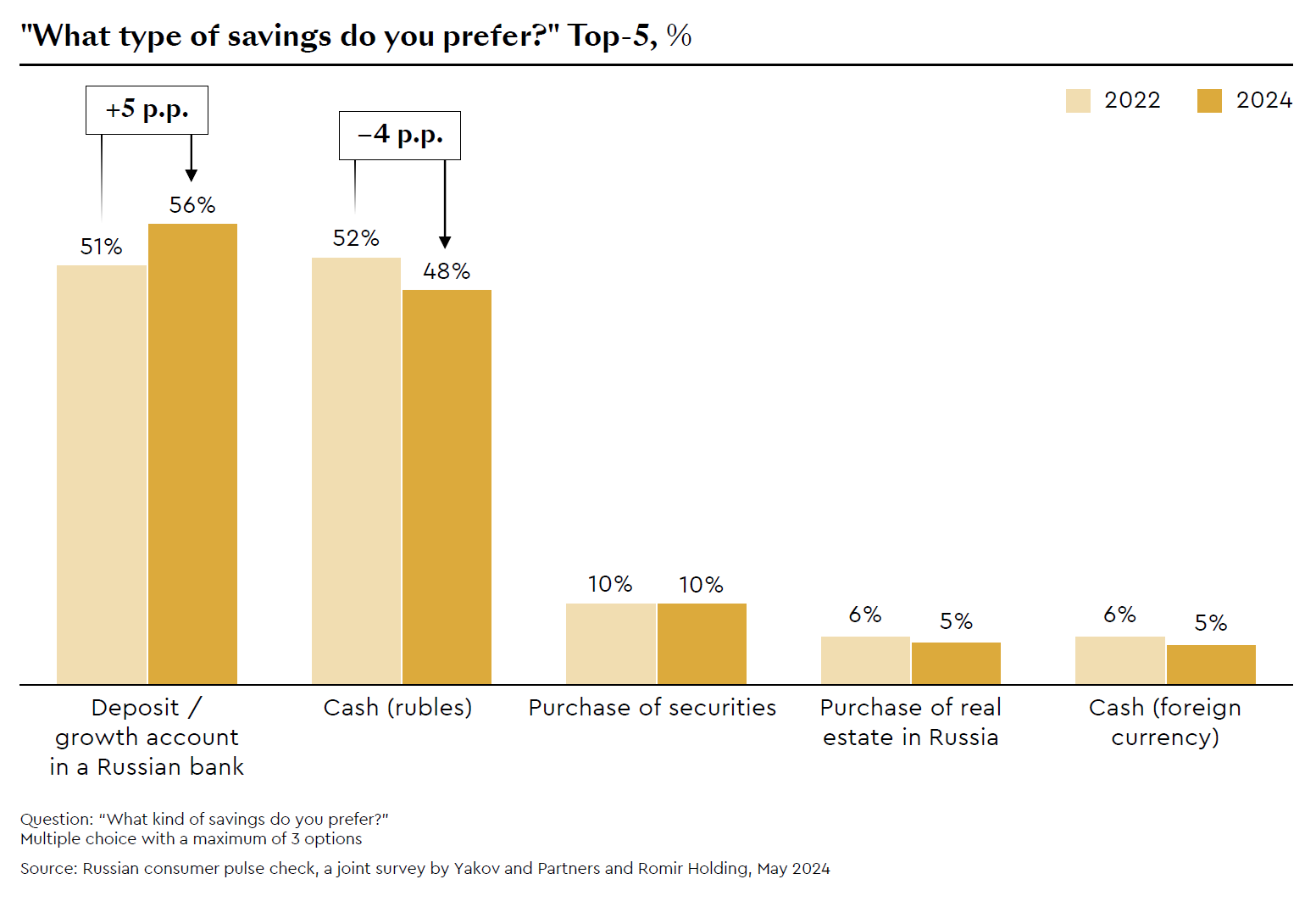

According to Elena Kuznetsova, Director of the Yakov and Partners Research Institute and a co-author of the study, unlike the previous year, most Russian citizens prefer to keep their savings on deposits and growth accounts in domestic banks (56%), and a little fewer than half of the respondents (48%) rely on cash rubles.

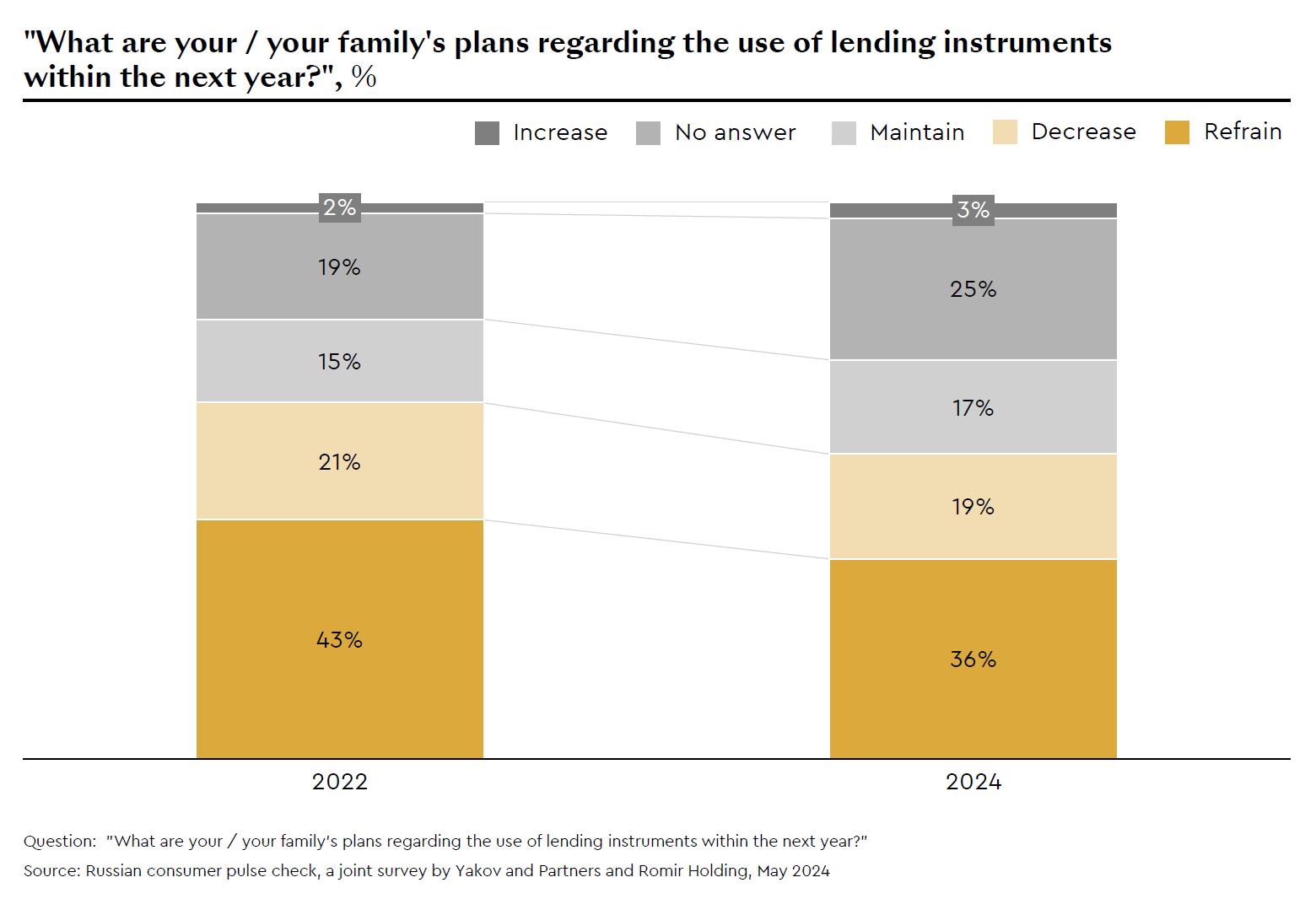

According to Inna Karaeva, Executive Director of ROMIR, given the rising interest rates in Russia, the proportion of the respondents who have not yet decided whether they will use any credit instruments in the coming year has increased significantly."More than half of the respondents aged 18 to 37 prefer to keep their savings in cash. The tendency to keep savings on deposits in Russian banks increases along with respondents’ age. As to foreign currency cash, this does not seem to play any meaningful role as a savings tool for any generation"

Elena Kuznetsova, Director of the Yakov and Partners Research Institute and a co-author of the study

More than a third of the respondents (36%) are not going to use loans in the near future in any case."Zoomers (respondents aged 18-19 years old) intend to use credit instruments more actively than other generations. Answering the question "What are your or your family's plans regarding the use of lending instruments in the next 12 months?", 25% of the Zoomers indicated that they intended to maintain the same level of usage, while 6% had plans to increase it. The highest propensity to use credit instruments was predictably demonstrated by high-income respondents. However, it is noteworthy that one third (29%) of Moscow and St. Petersburg residents are yet to make up their minds whether to use credit instruments or not"

Inna Karaeva, Executive Director of ROMIR