Exports of Russian gas contracted in 2022, falling by 32.3% year-on-year, to 167 billion cubic meters (bcm), pressured by the sanctions and other geopolitical factors. At the same time, according to Gazprom, which has monopoly rights for pipeline gas exports, supplies to farflung countries (Europe, Turkey, and China) decreased by a factor of 1.8, to 100.9 bcm. Apart from transit through Ukraine, Russian gas is now delivered to Europe through one of the two strings of the TurkStream pipeline. Gas flows through the Nord Stream-1 and Yamal- Europe pipelines have been stopped, while the long-awaited export pipeline Nord Stream-2 has never been launched. Russia also pumps gas to Turkey via the second string of TurkStream and the Blue Stream pipeline, and to China via the Power of Siberia pipeline.

Russian gas exports declined by 32.3% vs. 2021, to 167 bcm

Yet the supplies through these routes cannot compensate for the «lost» volumes previously intended for European consumers. The loss of a significant part of the European market has curtailed the opportunities for commercialization of Russia’s enormous gas reserves. Now Russia faces the task of revising its gas export strategy for the next 5 to 7 years, finding new buyers in Asia, tapping into the unexploited potential of its domestic market, and offering competitive gas-based chemicals.

What’s in store for gas production and exports in 2023?

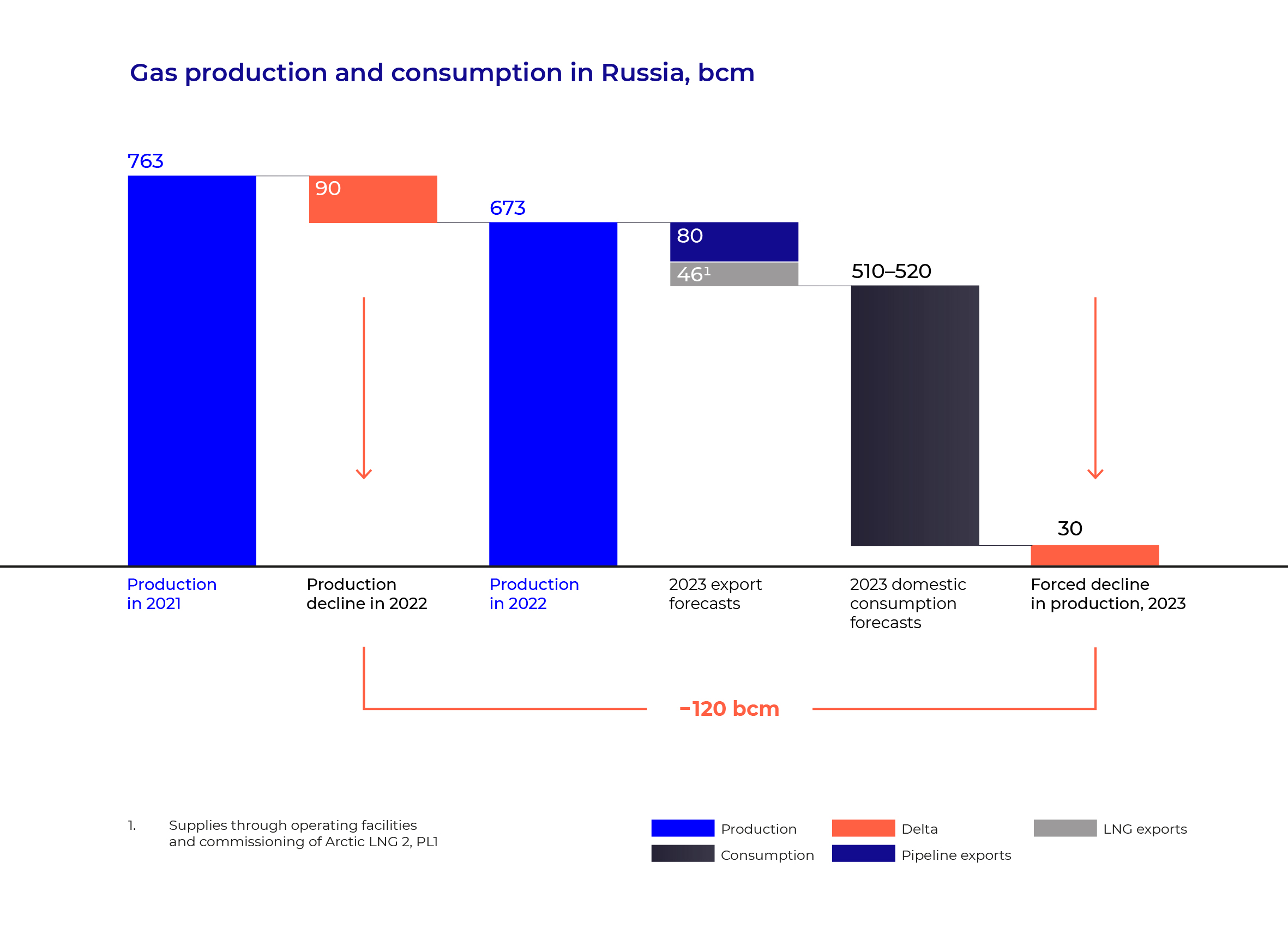

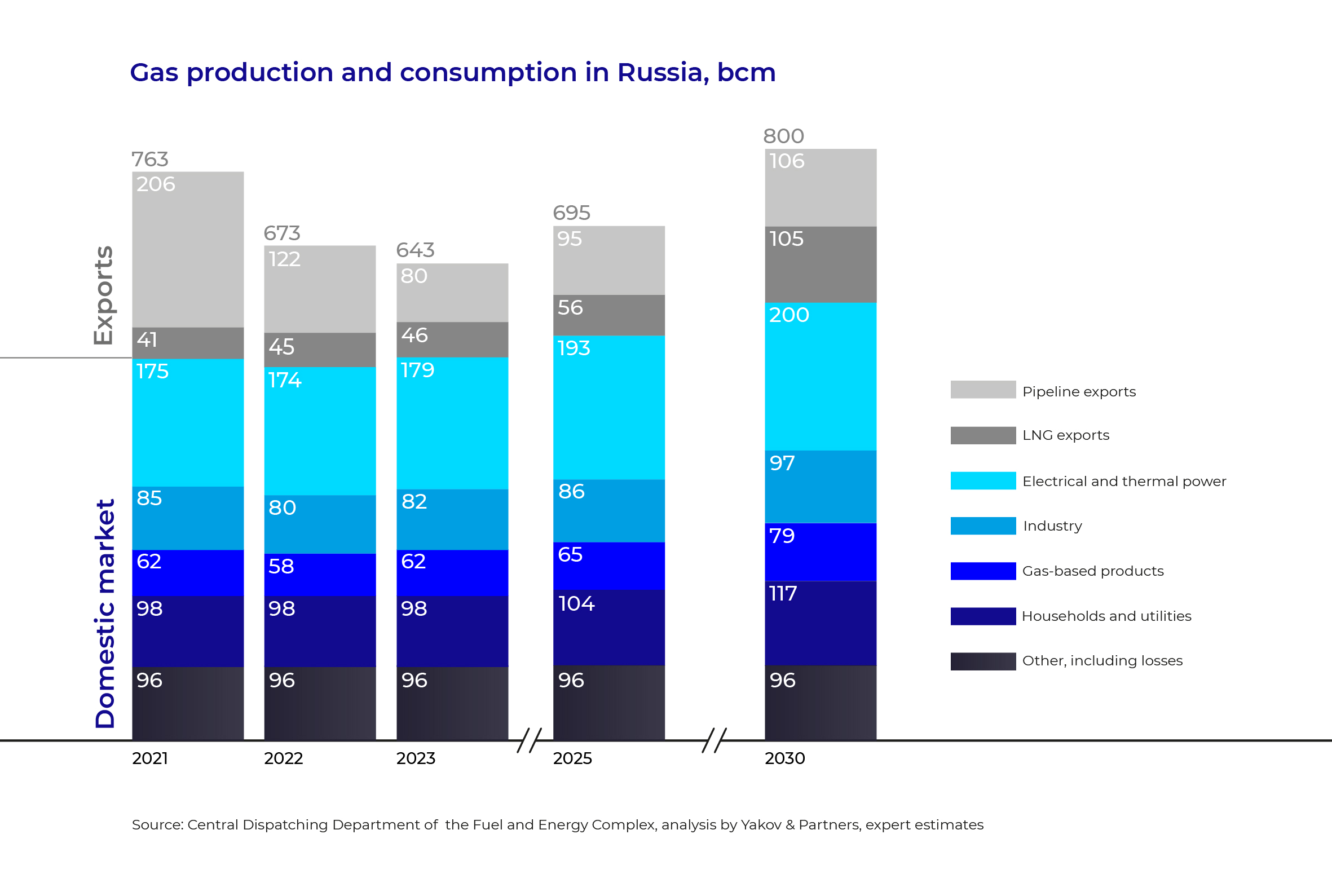

The decline in exports was followed by a 11.8% drop in gas production (down to 673 bcm). Both gas exports and production are expected to decline further this year. According to our estimates, 80 bcm of gas will be exported via pipelines, and another 46 bcm will be exported as liquefied natural gas (LNG). The volume of domestic consumption in Russia in 2023 is estimated at 510–520 bcm.

Thus, forced production reduction in 2023 triggered by the loss of the key EU export market may amount to about 30 bcm, while the total decline in production volumes compared to the 2021 levels may amount to 120 bcm.

European countries have already slashed their imports of Russian gas to a minimum, and we estimate that it is unlikely that exports to the region will be restored. In 2022, Europe ramped up its LNG imports by more than 45 mln tonnes. At the same time, there is a risk of sanctions on LNG supplies from Russia to the EU.

Even the implementation of all planned export pipeline projects will not make it possible to compensate for the lost export volumes to Europe. For example, 50 bcm of gas could be pumped to China annually through the Power of Siberia-2 pipeline, up to 20 bcm of gas could be transited through Kazakhstan and Uzbekistan, and another 10 bcm could be supplied via Turkey if the projected gas hub in that country is set up. In total, that will allow for exports of about 80 bcm per year through 2030.

Thus, gas production in this country could be stimulated either through new projects to expand domestic consumption, or through the development of new export routes.

Prospects of LNG projects

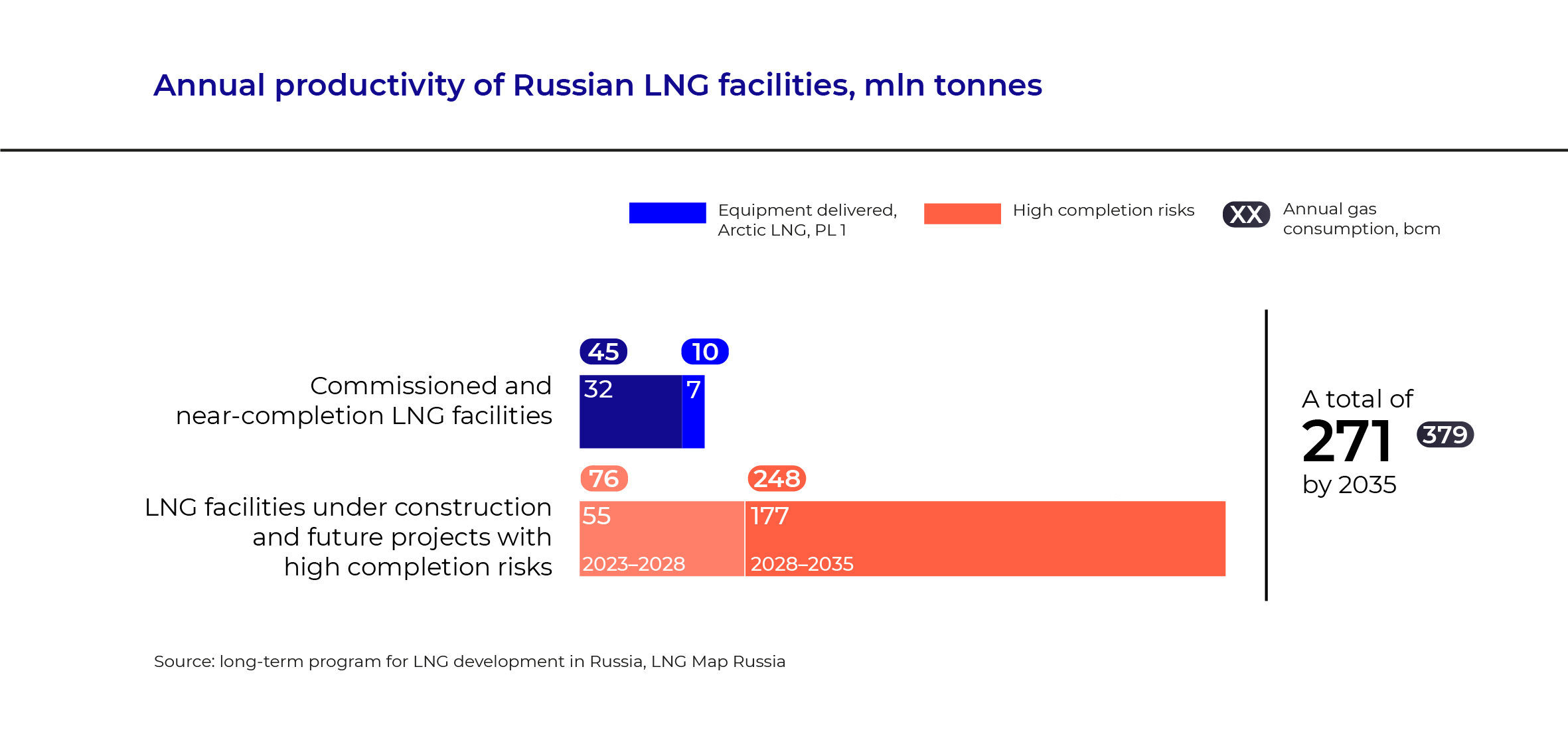

Converting enough gas into LNG to make up for the lost pipeline exports poses a challenge. The projects scheduled to be completed by 2028 will increase annual LNG production by 62 mln tonnes. But most of these projects are fraught with risks due to limited access to technology.

All of the announced projects rely on foreign technology, yet equipment has only been supplied to a limited number of facilities that could produce a total of 7 mln tonnes per year. Nevertheless, if all the scheduled projects are implemented by 2030–2035, given the current global LNG demand, the annual volume of LNG exports from Russia could reach 271 mln tonnes per year.

The majority of planned projects are fraught with risks due to limited access to technology

The implementation of gas liquefaction projects will depend on the development of domestic technology. The government-approved LNG Market Breakthrough initiative outlines a set of priority measures for localization of production of critical equipment and construction of LNG carriers. Key components for large-scale LNG production remain in short supply. Further scaling of technologies related to critical equipment requires massive R&D efforts. This may take up to five years.

Domestic gas consumption

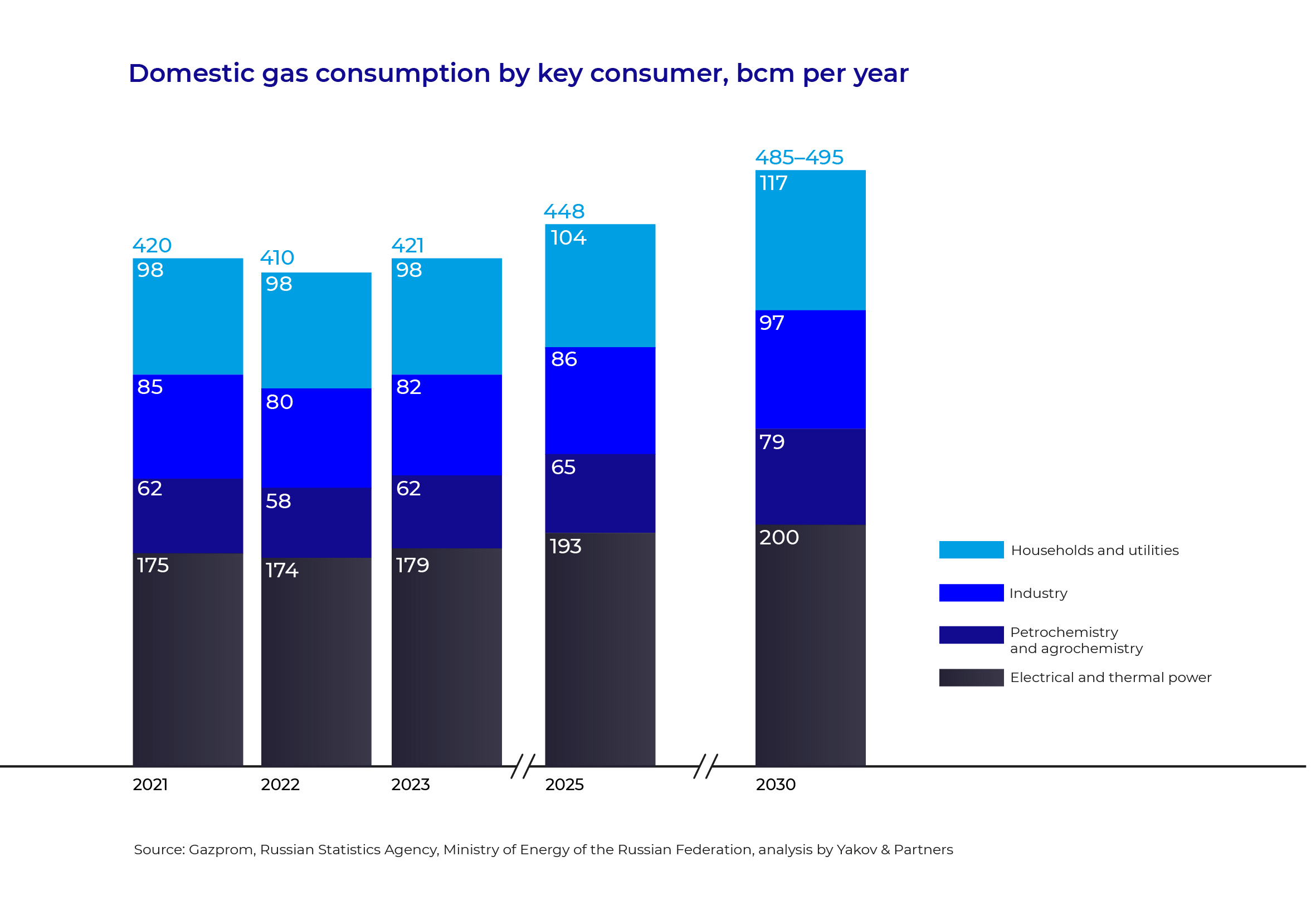

Domestic gas consumption in Russia is expected to grow through 2030. According to our estimates, domestic gas demand will increase by more than 17%, to 485–495 bcm per year, spurred by the development of certain sectors of the Russian economy. Annual gas consumption in the power sector between 2022 and 2030 will increase by 25 bcm, from 175 to 200 bcm. In the chemical and agrochemical sector, it will grow to 79 bcm (+17 bcm), and industrial consumption will increase to 97 bcm (+12 bcm).

Annual household and utility consumption will increase by about 20 bcm, to 117 bcm, on the back of increasing gasification levels (up to 83%). Specifically, the population is expected to consume 68 bcm of gas per year, while the housing and utilities sector will consume 49 bcm. After the Power of Siberia-2 pipeline is commissioned, additional regions may be gasified.

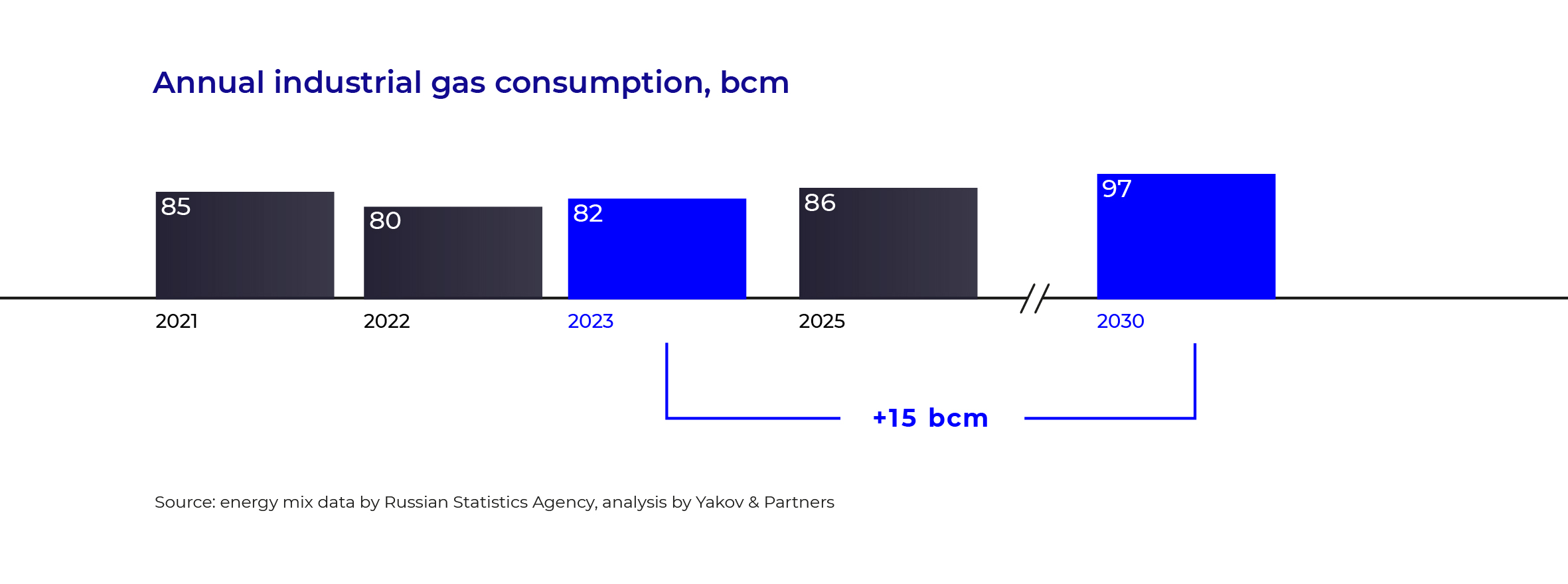

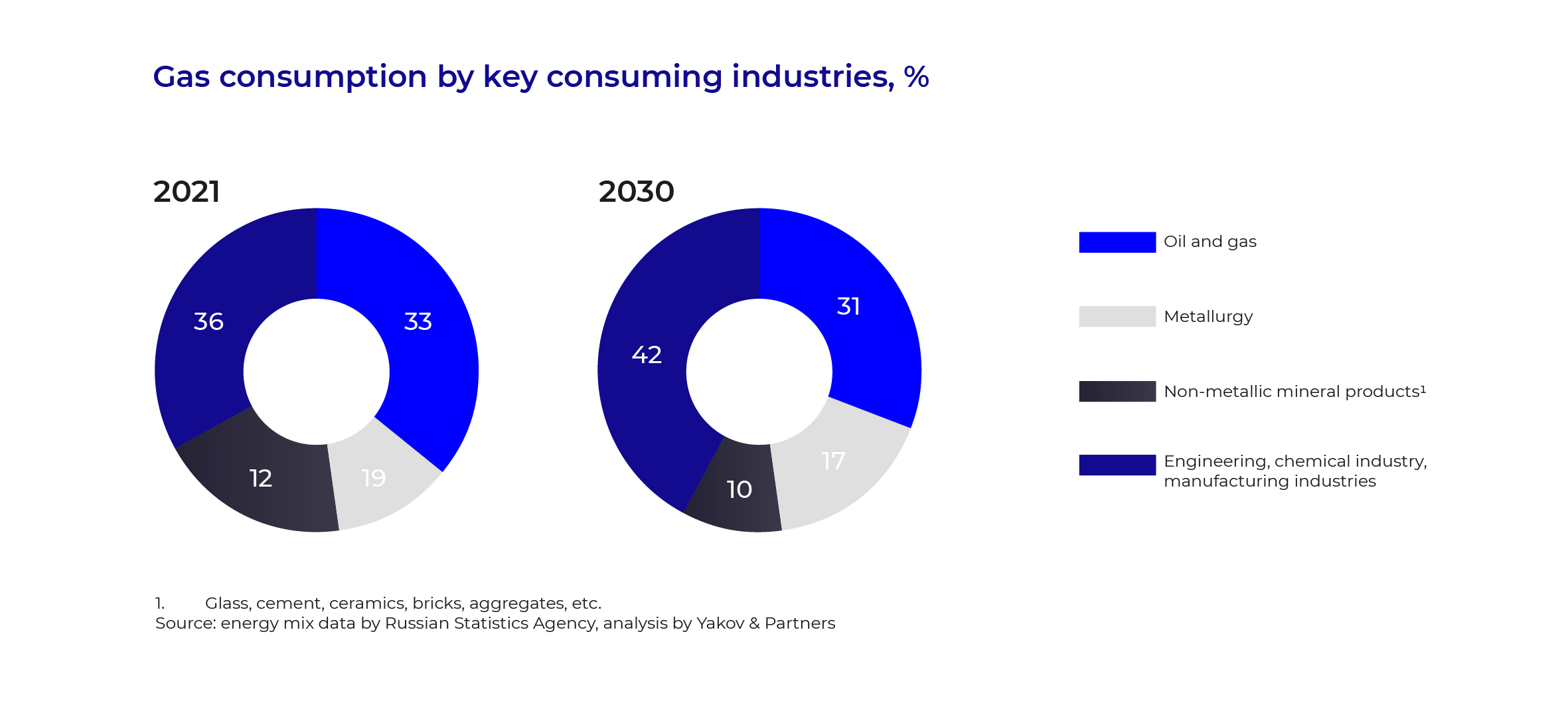

Gas consumption growth in the industrial sector will be spurred by the growing production volumes as much as the slow development of renewable generation. Between 2024 and 2030, gas consumption growth will be mainly driven by the machine-building, chemical, and manufacturing industries. The share of these sectors in the total industrial gas consumption will increase from 36% in 2021 to 42%.

Gas-based chemicals

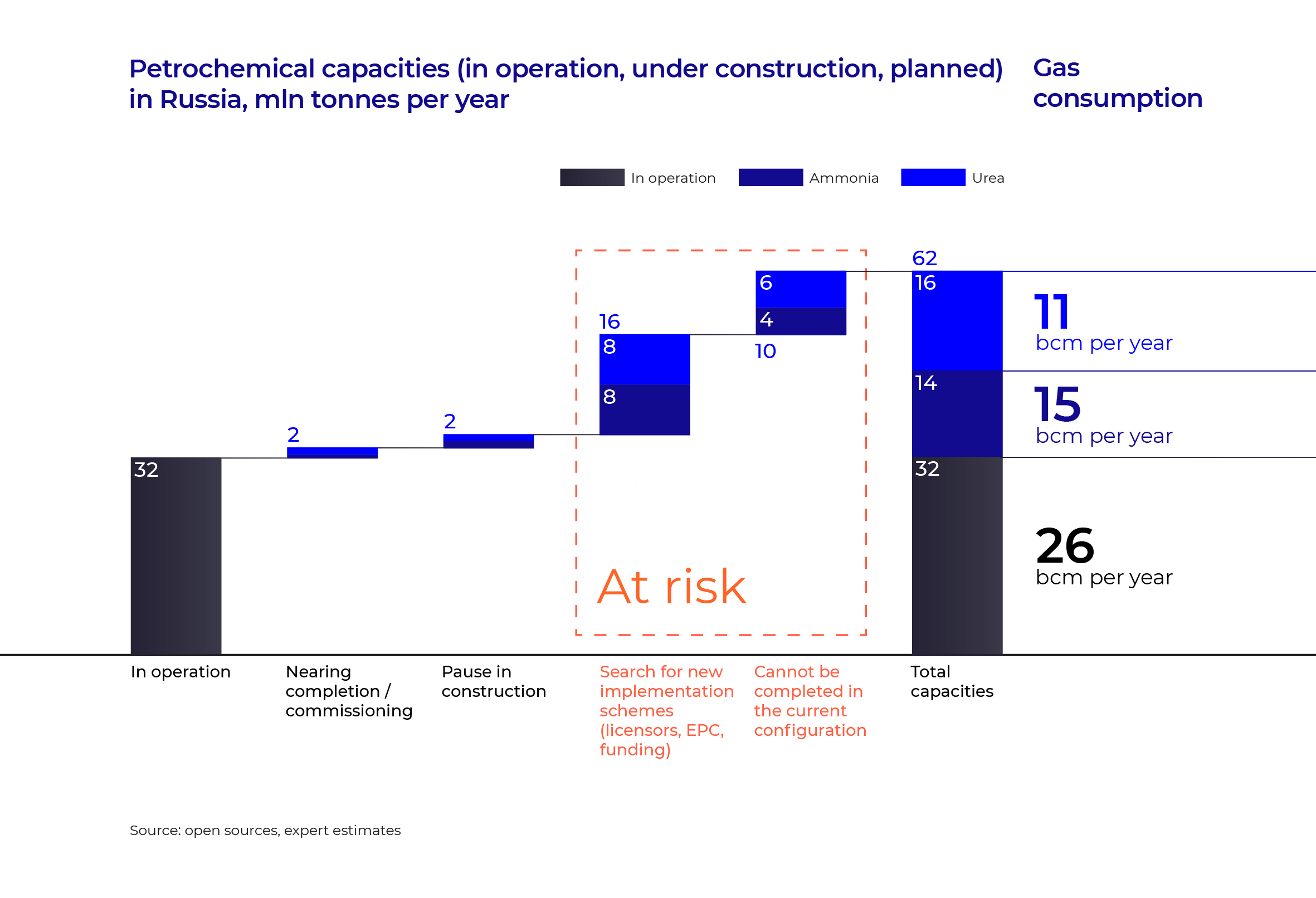

Commissioning of the planned capacities for production of gasbased chemicals may spur an increase in annual gas consumption of about 26 bcm. However, this will only be possible in case of domestic production technology advancement. The most critical types of equipment that require improvement are rotating equipment (unique turbocompressors for ammonia-producing facilities) and measurement and control products manufactured by Honeywell, Siemens, and Yokogawa.

Ammonia and urea-producing facilities in Russia may be constructed using domestic technology

The exit of foreign licensors and contractors from the Russian market led to a halt in construction or design operations at a number of petrochemical facilities. The chances of procuring equipment from friendly countries, such as China, are limited due to the risk of secondary sanctions.

All things considered, construction of the planned ammonia and urea production facilities in Russia could be completed even despite the exit of foreign licensors, using domestic technology. However, that would require extensive R&D on critical elements of the process chain and development of Russian EPC and EPCM contractors.

Given the growing global demand for fertilizers, ramping up ammonia production would be an attractive way of commercializing gas reserves. The demand for ammonia in the global market is set to rise steadily on the back of population growth and agricultural intensification. We estimate that global demand for ammonia will grow by 17% between 2022 and 2030, to 220–230 mln tonnes per year.

High demand for ammonia and nitrogen fertilizers is primarily driven by friendly countries in Asia, Latin America, and Africa. As a net exporter of gas, Russia will always enjoy a competitive advantage in the ammonia market due to the low cost of raw materials. By 2030, Russia’s share in the global market may grow to 14% (vs. 9% in 2022), while annual ammonia exports in absolute terms may almost double, from 17 to 31 mln tonnes.

There is also potential for increasing domestic consumption, as nutrient inputs in Russia are currently lower than the global average. For instance, fertilizer application rate stands at 61 kg per hectare in Russia, 140 kg per hectare in the US, and 130 kg per hectare in the EU.

Key approaches to commercialization of gas reserves

Key approaches to natural gas monetization

- Development of export pipelines (commissioning of the Power of Siberia – 2, full utilization of the Power of Siberia)

- Development of export-oriented LNG and petrochemical facilities

- Increased domestic gas consumption, including industrial consumption (e. g. conversion of some coal-fired power plants to gas following the commissioning of the Power of Siberia – 2 pipeline)

If these approaches are successfully implemented, gas production in Russia will start growing from 2025 on, and by 2030 the loss of export volumes will be fully offset. According to our estimates, gas production will amount to 695 bcm in 2025, and about 800 bcm in 2030.

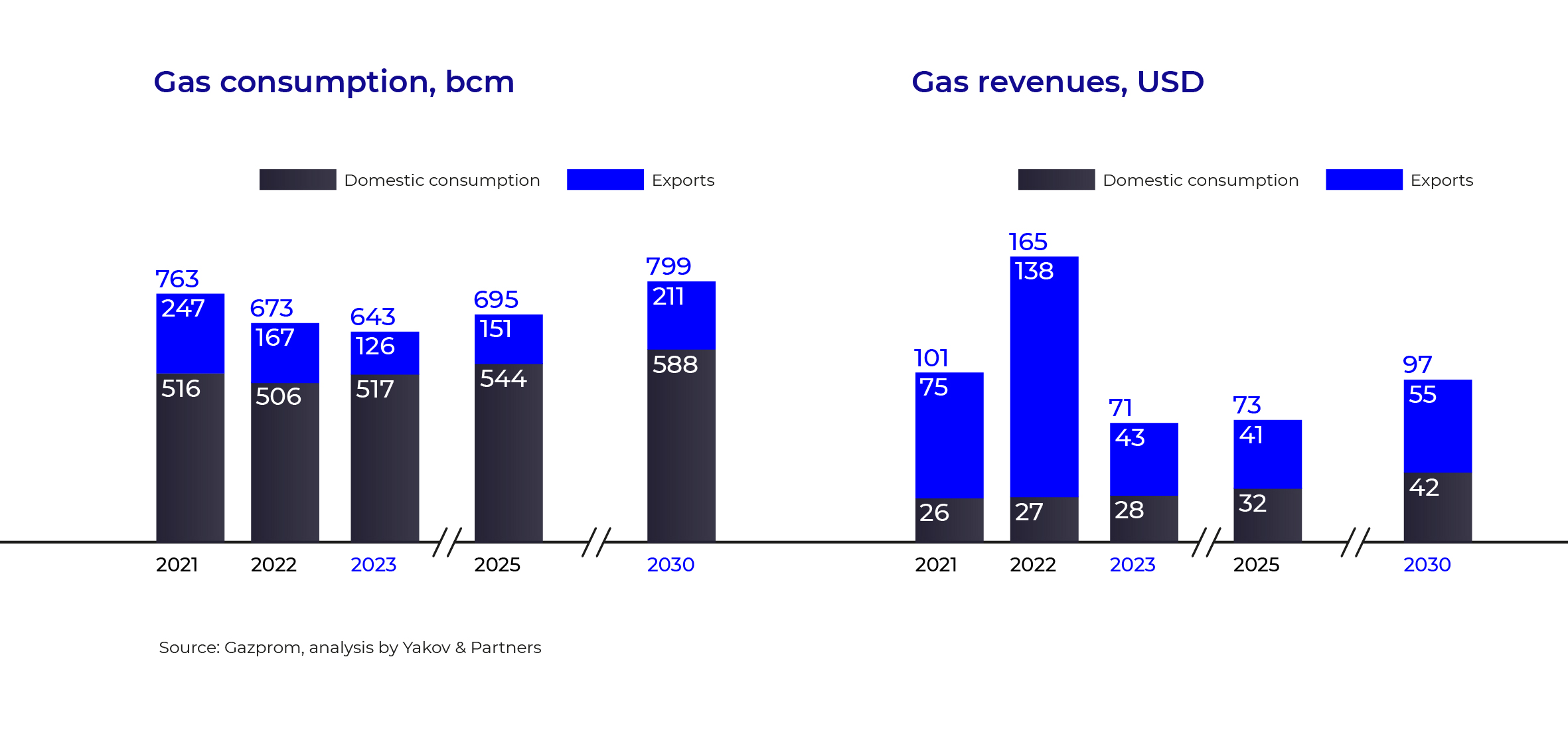

Russia’s gas industry revenues are forecast to decline by more than 50% in 2023 – down to USD 71 bn. If gas prices stabilize and scheduled export projects are successfully launched by 2030, this figure may reach USD 97 billion, which is almost in line with the 2021 levels. At the same time, the share of gas exports in the revenue will drop to 50–60% vs. 74% in 2021 and 84% in 2022.

Conclusion

Significant budget deficits in the gas industry may persist through 2030. The pipeline projects set to be commissioned before 2030 will not be able to fully offset the lost export volumes. Therefore, the most viable instruments of gas commercialization are projects in the petrochemical industry (ammonia and urea production), as well as LNG production.

We outlined two key factors that will determine the success of the measures aimed at compensating for the lost revenues in the gas industry:

- Technological partnerships between major gas companies, equipment manufacturers, design institutes, and relevant agencies to accelerate the development of domestic LNG, ammonia, and urea production technologies.

- Conclusion of an agreement between the Government, production companies, and producers of LNG and gas-based products that would stipulate sustainable feedstock pricing mechanisms to ensure investment attractiveness of gas monetization projects.

The following measures will help maintain gas production, increase the revenues and improve the sustainability of the entire industry:

- Updating the long-term industry development program and shoring it up with specific tools to support domestic LNG and petrochemical technology advancement.

- Maintaining the investment attractiveness of planned domestic LNG and petrochemical projects.

Successful implementation of petrochemical projects, further gasification of Russian regions and a growing industrial consumption will make it possible to compensate for the lost exports (120 bcm) by 2030 and ensure domestic market stability without adding to the financial burden felt by consumers, thus supporting sustainable national socio-economic development.