Benchmarking of banks with a total customer base of 110+ million people, which was part of a retail banking productivity survey made by FINIX YnP , showed the banks had kept their global leadership from the digitalization perspective. The situation is setting the stage for them to unleash a full-fledged price war, however, which also means degrading profitability for the organizations that will fail to retain and develop their own customers.

"Mobile" customer time

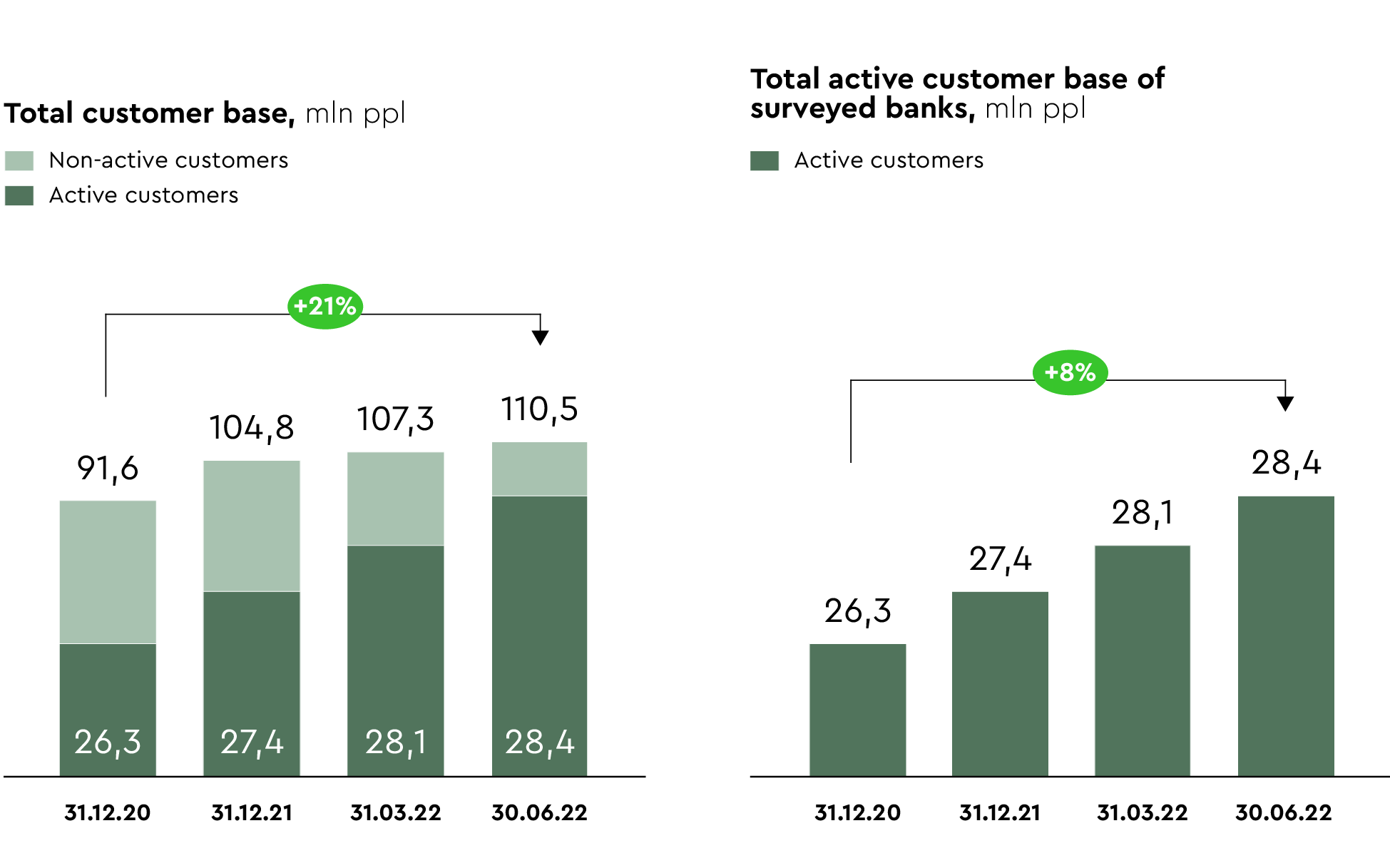

Nine out of ten banks reviewed in the survey have grown their customer bases over 18 months (2021 and H1 2022). The total active customer base (ACB) among the surveyed banks has grown by more than 7.5% over the 18-month period. Considering the fact that major banks also demonstrated growth in their active customers, it is to be stated that the banks’ customer bases are overlapping ever wider, so many Russians are being served or have recently been served by several banks at the same time.

According to the Bank of Russia, there are already more than seven active bank accounts (including term deposits) per country resident now, and the number is growing by 5% per year. In our estimation, each customer has effective agreements on bank products with at least 2.5 banks

Every fifth customer in the ACB is new to the banks; every third customer leaves the bank and loses their active status as early as in one year. Such selectivity, combined with the ease of moving, customer “mobility”, aggravates competition among the banks. The customers are ever more demanding, and the banks, in their turn, are ever more sophisticated and advanced in the battle for the customer.

Digital “hygiene”

The key product that draws a retail customer to a bank is the debit card that provides, as estimated by FINIX YnP, 60–70% of new customer acquisition. While customer attraction largely depends on the price terms, recommendations, and effective advertising, however, it is critical for customer retention and loyalty improvement to have quality daily banking and convenient digital channels.

Most of the reviewed banks have been aggressively investing in the projects designed to attract new customers over the last 5–10 years: they implemented large-scale projects for arrangement and significant development of customer journeys (CJ), primarily for daily banking products, set up first-rate product teams to manage product and service development, and rebuilt their digital channels. They actually had a great success in those endeavors. The Russian banking sector outperforms global players in multiple aspects of both daily banking and digital channel maturity.

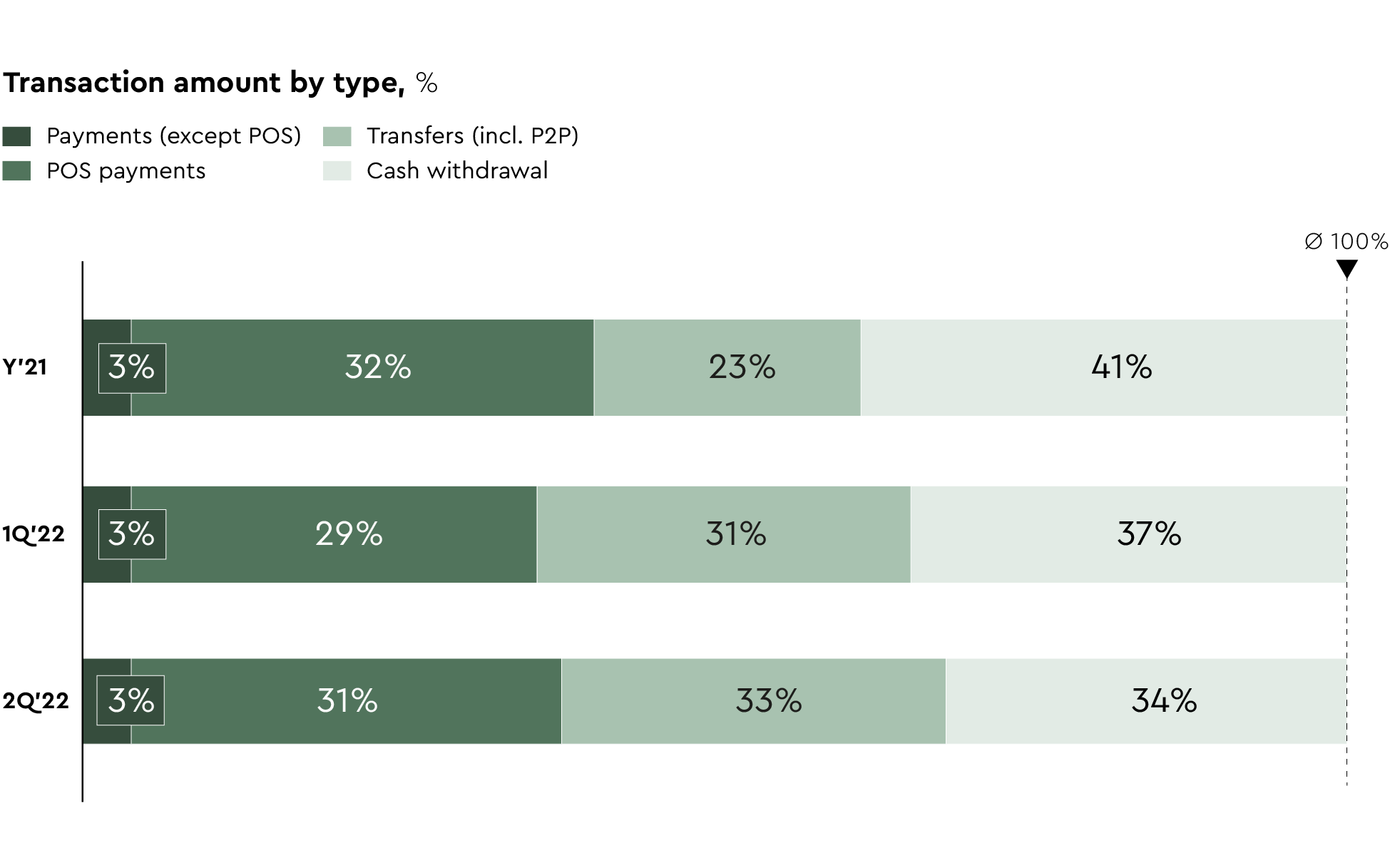

For many years, Russia has been among the global top performers in the share of non-cash transactions. In 2022, despite the withdrawal of international payment systems, the sanctions restricting a number of transactions, and the expectations of some experts about the customer outflow from the banking system in general, the transaction banking business actually continued to grow in Russia.

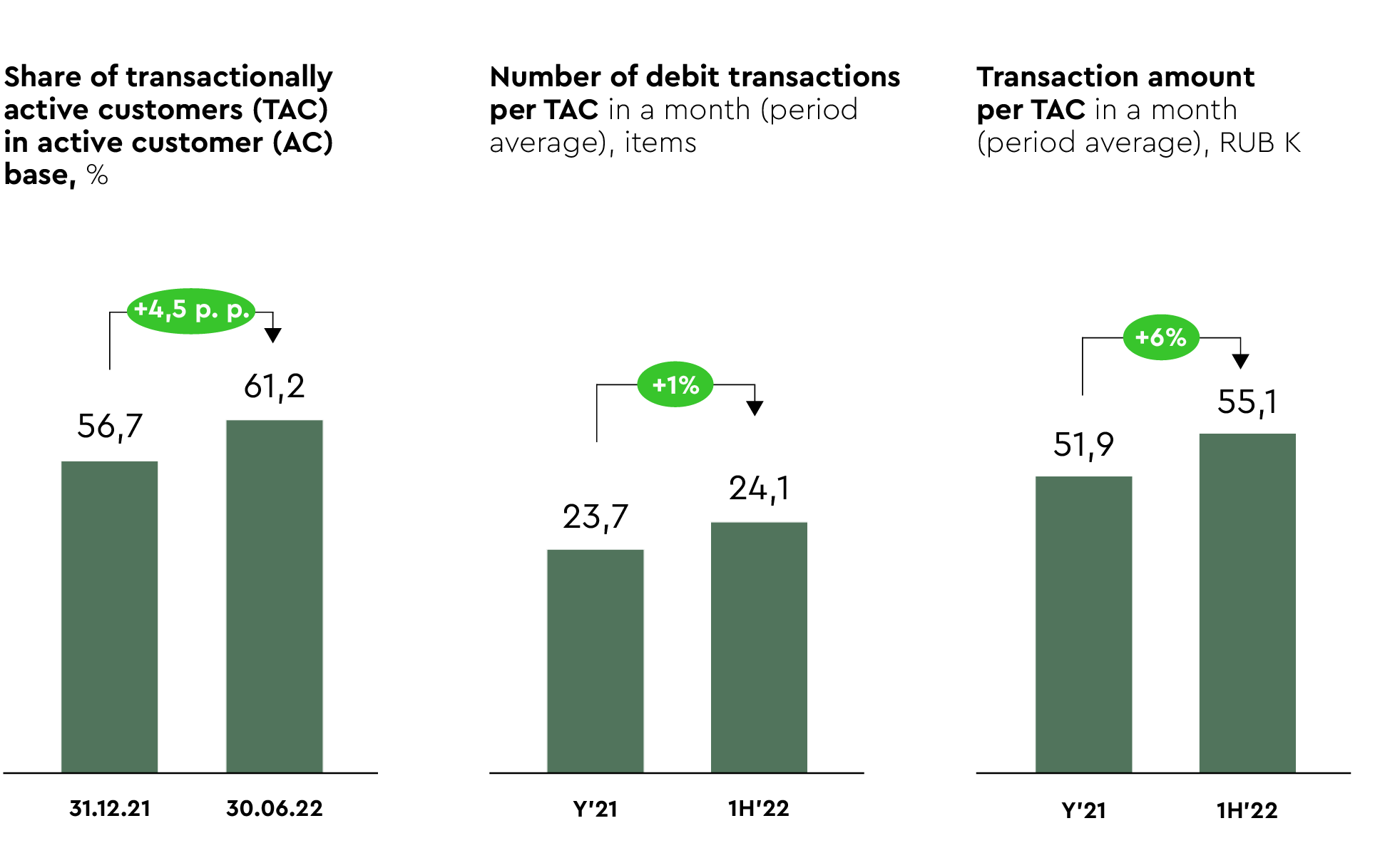

Thus, even in the first “crisis-ridden” 6 months of 2022, the share of transactionally active retail customers , i.e., the bank customers who use their bank accounts on a regular basis to pay for goods and services, grew by 4.5 pp. to 61.2% of ACB. The number and amount of the debit transactions attributable to such customers increased simultaneously.

In the breakdown of the debit transactions, cash transactions have actually been replaced by non-cash transfers to a substantial extent on the back of developing transfers using FPS. Therefore, the number of the customers who use their bank accounts, the number and amount of their transactions, and the share of non-cash transactions are growing simultaneously.

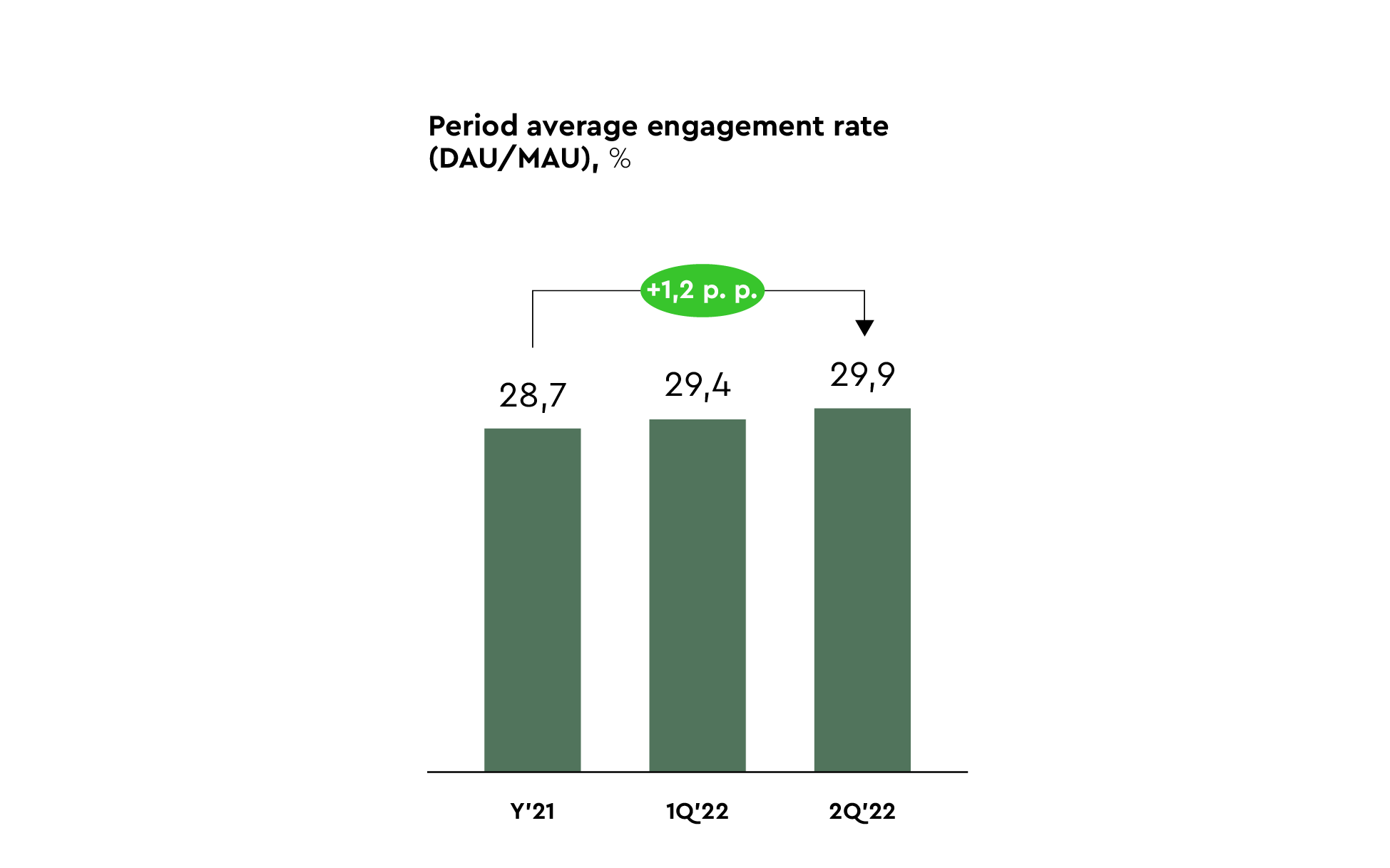

The level of digital channel maturity also outperforms the global market. According to McKinsey, some of the most successful digital neobanks globally attain a DAU/MAU engagement rate (i.e., the share of the daily digital channel audience in the total number of users) of 25–35% . The results of our survey indicate, however, that such a level of engagement in digital channels is demonstrated by most Russian banks in the Top 20. Moreover, the Russian market has examples of the engagement rate attained by systemically important players of up to 50%.

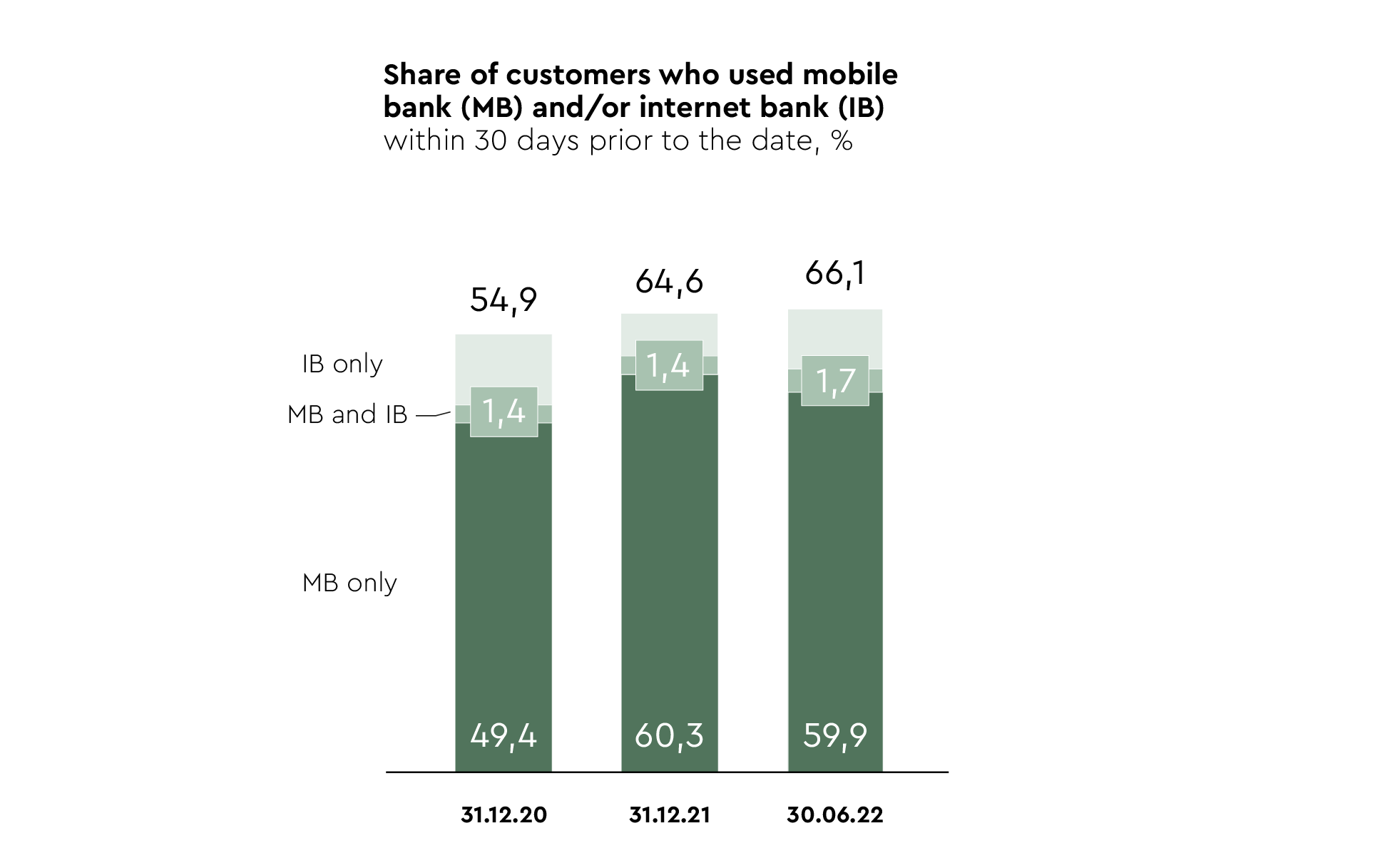

Notwithstanding the disappearance of some applications from such stores as App Store and Google Play, the share of the customers who use mobile banking has been growing steadily and consistently. Based on Q2 data, the share of mobile banking in the reviewed organizations has reached 61.6% of the active customer base. Therefore, the restrictions had virtually no impact on the channel, and the decrease was slightly more than 0.2% from the peak of 61.7% attained in early 2022.

The digital channels played an important part in banking product sales in the most turbulent period. Thus, the share of digital sales for deposits (one of the most solicited products in H1 2022) increased by 8 pp. to 48.5%.

It is a paradox but, in their battle for customers, Russian banks have created state-of-the-art daily products and digital channels but also, in a way, painted themselves into a tight corner by lowering the barriers for customers to move from one bank to another.

The Bank of Russia’s initiative for further reduction of the cost of such a move through much higher limits on free transfers of money between accounts in different banks, when it is put in place, will make the migration even easier. The race for the customer will go on, which means that mature transactional products and digital channels have become a “hygienic” minimum indispensable for retail bank development, rather than a differentiator.

Branches: A relic of the past or an opportunity to stay closer?

According to FlNIX YnP, the share of the customers who are active in branches has been declining for five quarters in a row – it amounts to 16.6% (-2.5 pp. over six months) of ACB on average now. The network of self-service machines (SSM) is also becoming less popular – it is used by 35.3% of the customers only. In addition to that, there is a decline in the number of transactions per ATM: over the six-month period, it declined by 20%.

Despite the decreasing share of the customers who are active in branches, the actual workload on branches and staff is growing due to the increasing total number of active customers and outstripping rates of network reduction. In total, over 18 months since the end of 2020, the number of active customers per branch increased from 7K to 8.8K people.

Brick-and-mortar branches still make the bank’s identity, so deteriorating quality of branch service may entail adverse effects for the image and, considering high customer mobility, induce customer churn. In this setting, it might be worthwhile for banks to adjust their strategy for aggressive reduction of regional presence to sustain the required level of service and availability of the bank network for the people who prefer physical interaction with the bank.

Knowledge is power

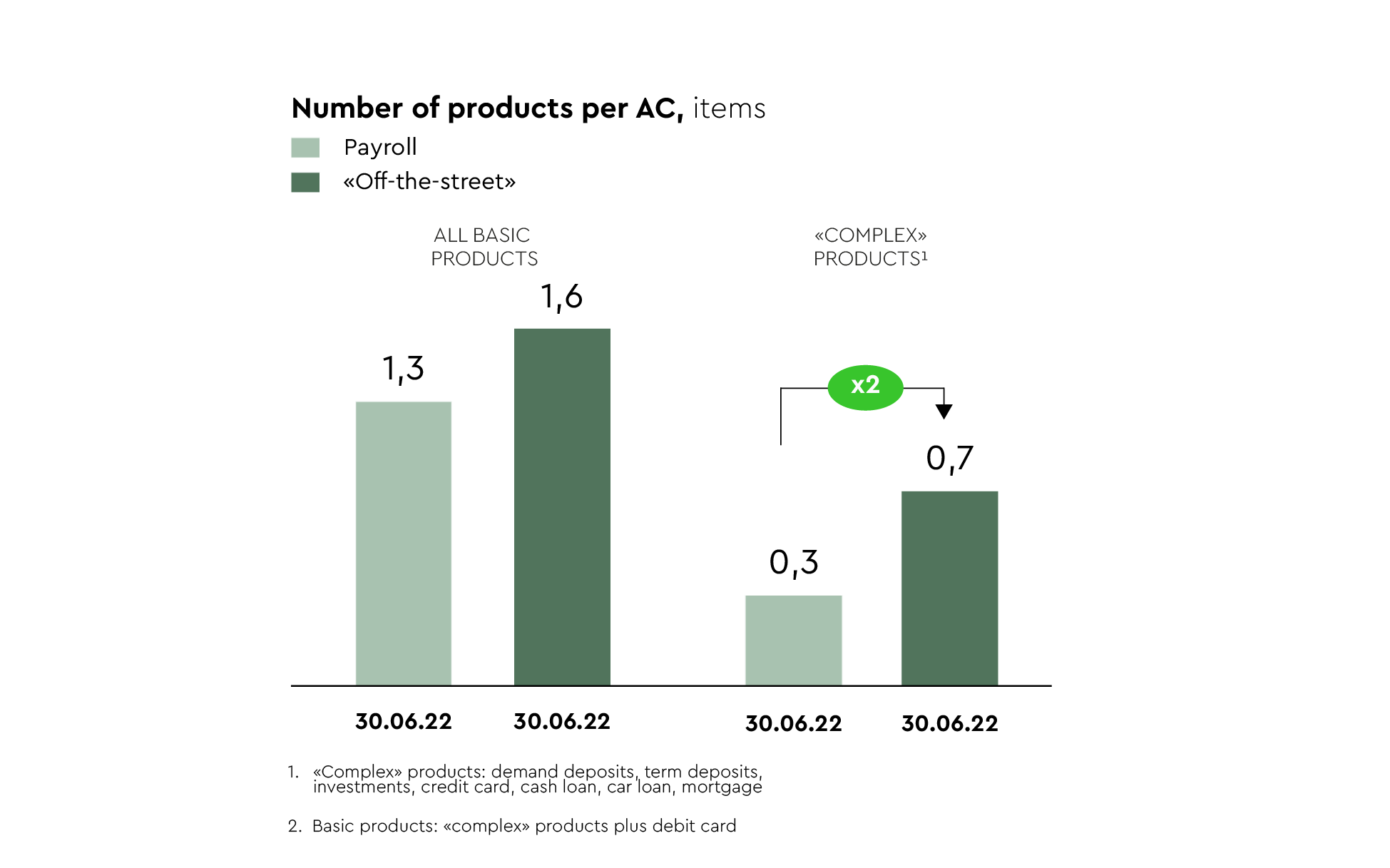

Having mastered the battle for the new customer, the banks still do a poor job developing customer relations. The average number of basic products per active bank customer never increased in 2021–2022. This means the effectiveness of cross-sell to the existing customers among the banks that took part in the survey remained at the same level.

It is revealing that payroll customers have fewer products on average than the people the banks have acquired “off the street”. This is most pronounced for the highest-margin “complex” products, such as loans or investments. The share of those who hold such products among payroll customers is 2–2.5 times lower than among “off-the-street” customers. The share of the payroll customers who have a payroll debit card only is above 50%. The payroll customers, however, are the most valuable and “transparent” bank customers, for whom the banks have reliable information on the level of income and a history of payroll card transactions that enables identification of a transaction profile and customer needs; as a rule, the banks also have access to information from credit bureaus.

Therefore, even when they have the required information on their customers, Russian banks do not leverage all of its potential to develop their customer relations, define better, including personalized, terms of service, and expand their cross-sell at the moment.

The still poor function of customer analysis is also indicated by the fact that even among the Top 10 banks in the survey we see the banks that are unable to precisely assess the number of sales in the channels, do not analyze the “economics” for various segments and, in some cases, even “see no value” in such analysis.

In our estimation, one of the most significant market drivers in the next 2–3 years will lie in the develop-ment of open banking, which is supposed to help financial market players to engage customers in their ecosystems more easily. The initiative will further simplify customer migration between banks and provide banks with even more data. Before the banks become capable of leveraging the potential of open data about their customers and customer transactions, however, they will have to learn to use the internal data in a more active manner.

To realize the benefits of both internal and external data, the banks need to invest resources along three lines:

■ build-in analytical insights to both internal processes and customer journeys inside and outside banks (e.g., BNPL (buy now, pay later) service or POS payment in equal instalments within a short time period);

■ develop analytical tools, such as transaction scoring and risk-based pricing, customer micro-segmentation, customer lifetime value assessment, and algorithms for identifying the value by customer, product, and channel;

■ build the infrastructure and provide analytics with quality inputs: single customer profile, convergence of estimates in the models made by different departments, etc.

Conclusion

The Russian market is apparently going through an era of “mobile” customers who “test” ever more banks and become more selective. A high level of daily banking and digital penetration on the back of the new initiatives pursued by the regulator, which might drive the cost of migration down to zero, will make the process even more active and unpredictable.

To remain competitive in the battle for the new customer, the banks need to keep developing their digital channels by improving the service offered to the customers. It is impossible to develop the existing customers, however, without further development of analytical functions for more accurate and timely coverage of the customers’ needs: it is the positive customer experience of interaction with the “home” bank that can “bind” the customer and protect the bank against price competition.