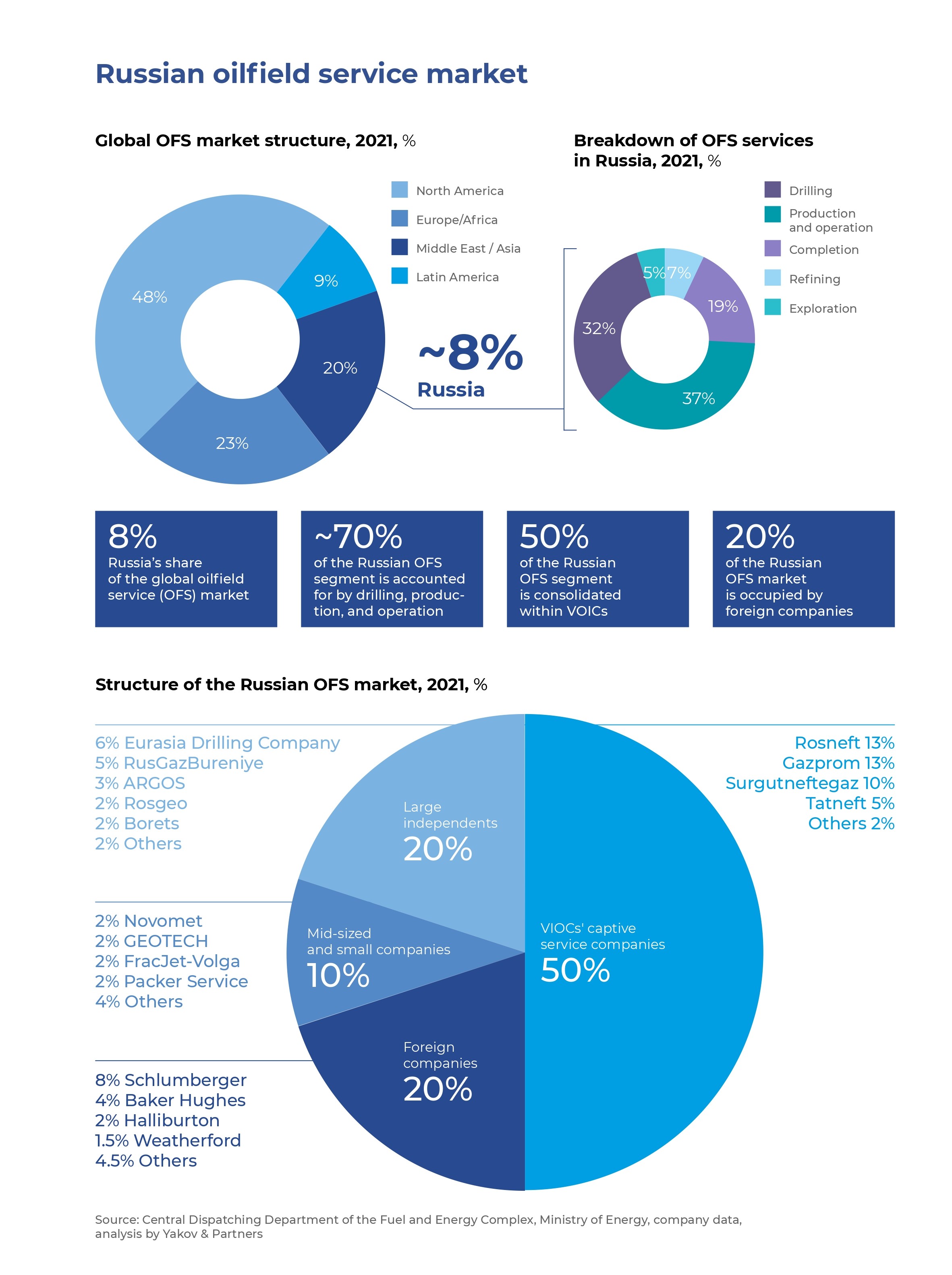

Despite the adverse circumstances, including the 2014 sanctions, market volatility, and backward technologies, the Russian oilfield service segment evolved into a mature market over the past two decades. In addition to the vertically integrated oil majors (VIOCs) and foreign market leaders, smaller players with strong competencies yet limited resources have established themselves in the market.

Last year, however, saw dramatic changes in the sector. After leading western players suspended operations in Russia, new challenges arose, including the need to find alternatives to critical technologies within a short period of time. Given the instability in global markets, the importance of oilfield technologies required to maintain current oil production levels in Russia will only increase in the coming years. Russia has every chance to increase the volume of its oilfield service (OFS) market fr om USD 20 to 24 billion by 2030 and keep up high oil production levels, provided it finally starts tackling the problems that have been piling up. Otherwise, it risks losing up to 20% of its oil production, primarily due to the shortages of high-tech services that have traditionally been provided by western companies.

Key trends dominating the global OFS market

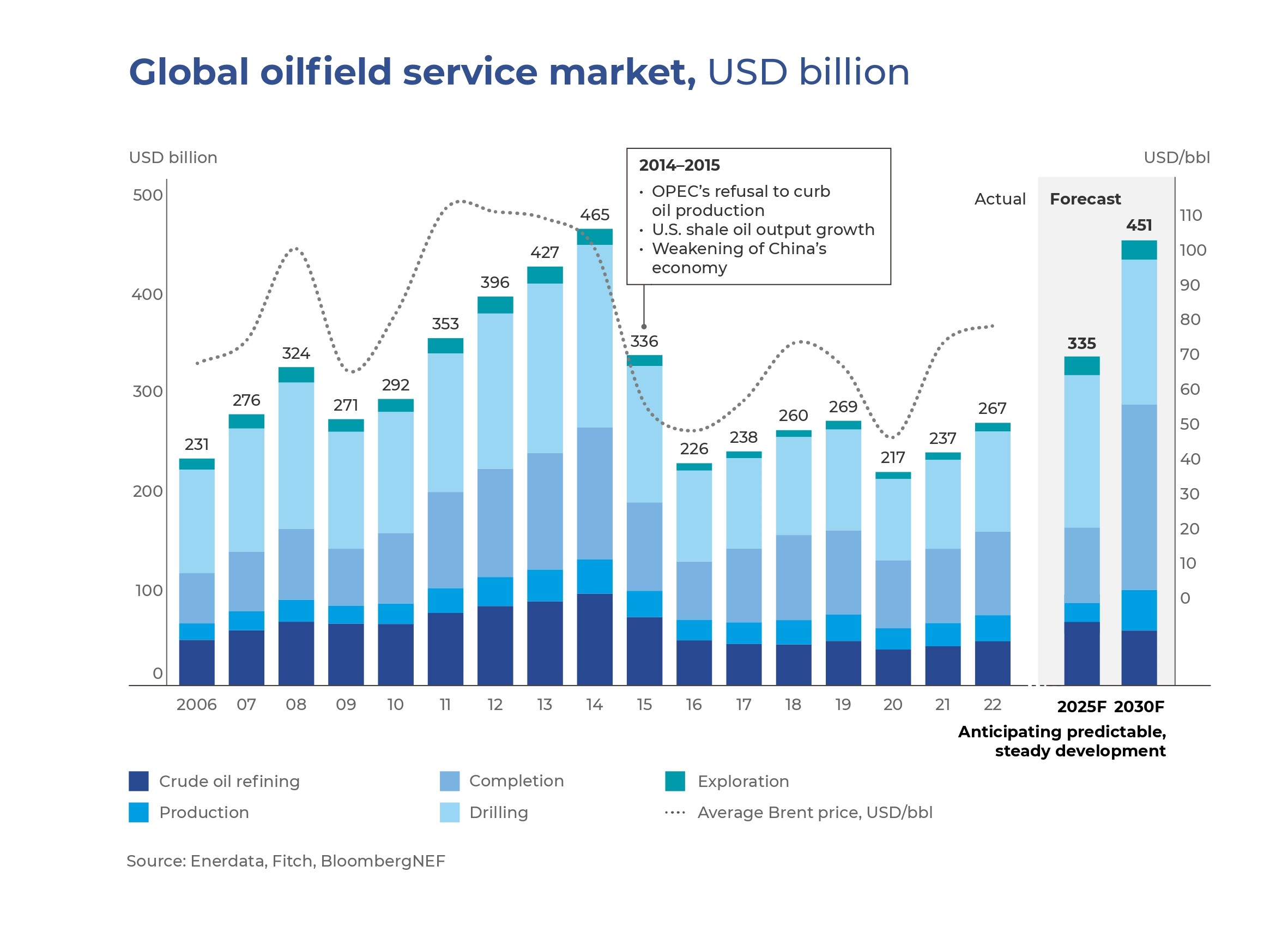

Following the 2008 financial crisis, the global OFS market underwent a period of rapid development, yet in 2015 it sagged from USD 465 to 336 billion. Several factors contributed to the decline, including OPEC’s refusal to curb production, growth of the U.S. shale output, and the weakening of China’s economy. All those factors upset the demand and supply balance in the market and led to an oversupply of oil, which, in turn, affected the prices and caused a drop in production. Since 2017 the demand for oilfield services has been slowly picking up, although the recovery slowed down in 2020–2021 due to the pandemic.

According to our estimates, the size of the global OFS market will increase by 69% compared to the 2022 level – to USD 451 billion, nearly matching the 2014 figures. We believe this scenario will materialize in case the current production volumes are maintained and the prices remain consistently high.

Further development of the OFS market during this period will as before be driven by the level of oil production, increasingly complicated geological settings, and the price of oil. The retrospective data show that the strongest market growth – and its peak values – were observed when the prices exceeded USD 100 per barrel. At the same time, the OFS segment is sensitive to both falling prices and production cuts under the OPEC+ deal.

At the moment, the energy crunch in Europe and other destabilizing factors cause oil prices to rise, thus stimulating the OFS market growth. Therefore, we expect that oil prices will remain consistently high and oil production will keep growing until 2030.

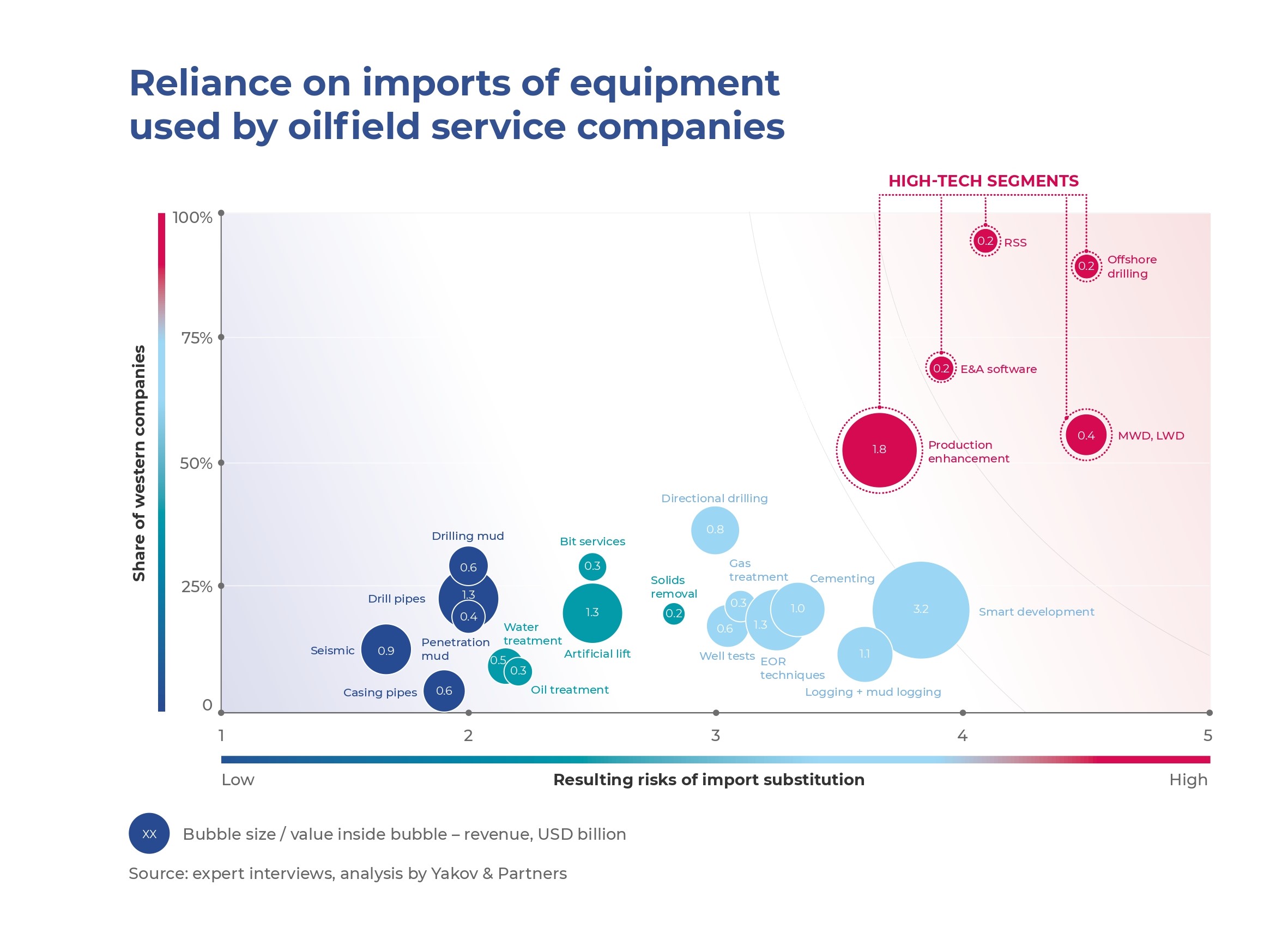

At the same time, a significant increase in the development of hard-to-recover (HTR) reserves (those with adverse geological conditions, low-permeability reservoirs, or high-viscosity oil) will stimulate the demand for advanced technologies, such as equipment for offshore drilling or drilling in challenging geological conditions (RSS, MWD, LWD), for production enhancement (frac, multi-frac), or completion of difficult wells, etc.

The current state of the Russian OFS market

The Russian OFS market remained stable until 2021 despite some major oil price fluctuations, as the development of new fields and stable demand for Russian oil in the global market stimulated OFS growth.

The Russian and global OFS markets have not always strongly correlated with each other. For instance, in 2015, when both Brent and Urals prices fell by half, instead of following suit, the Russian OFS segment grew by USD 1 billion, or 6%, reaching USD 17 billion. By comparison, the global OFS market sagged by 28% that same year. In 2016, it shrank by another third, while the Russian segment defied the global trends to gain another 6%.

Concentration of high-tech services within western companies, however, could prove to be its vulnerable spot, as it impedes healthy development of the industry in a market economy.

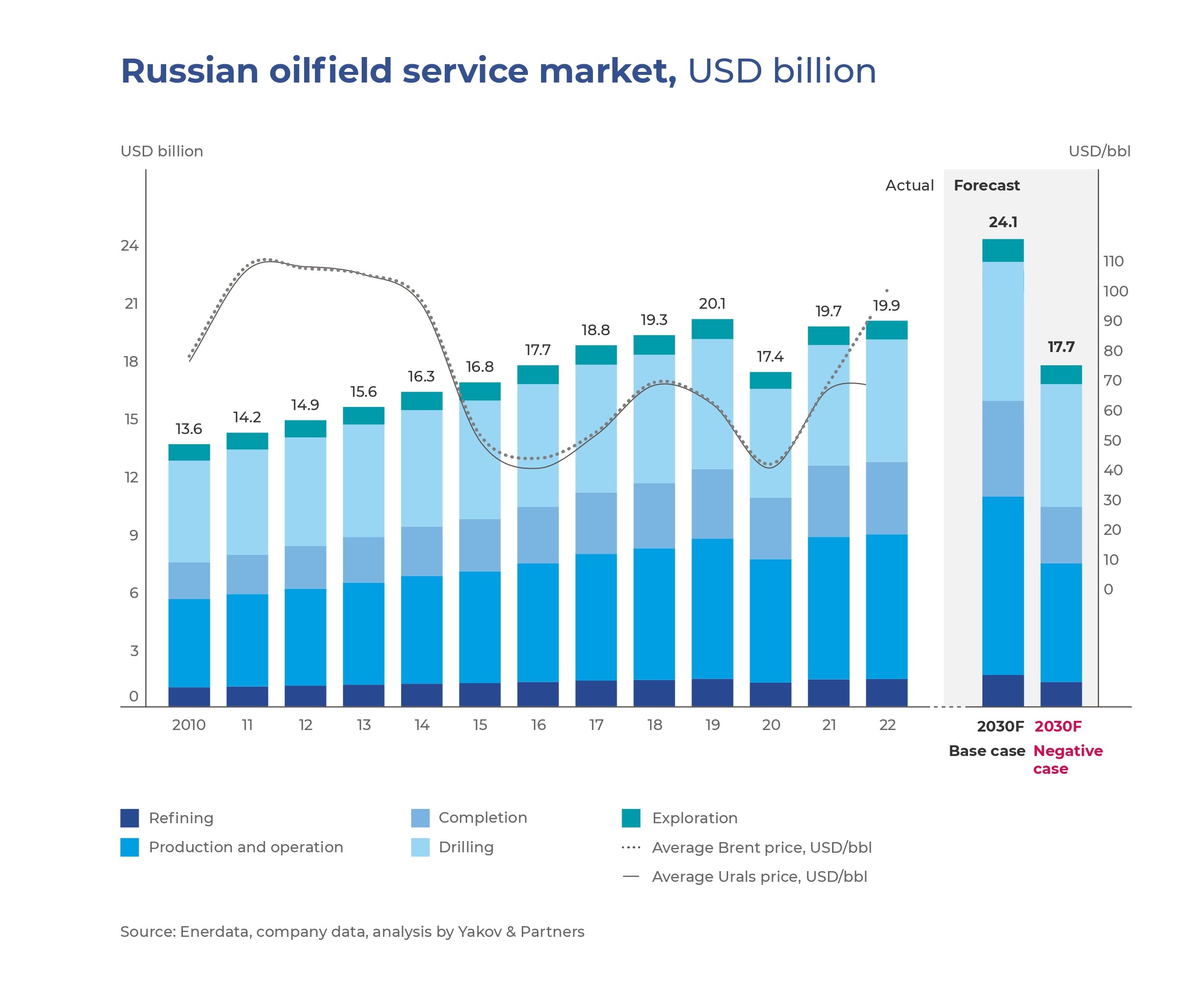

On the back of the growth observed since 2014, in 2022 the size of the Russian OFS market was estimated at approximately USD 20 billion. Our estimates suggest that in the base case, if Russian oil prices settle at above USD 60 a barrel, the Russian OFS market will sustain the positive trend to reach USD 24 billion by 2030. Among the key factors driving this growth will be the energy crisis in Europe and the global shortage of hydrocarbons and, as a consequence, rising oil prices and increasing volumes of OFS. In the long term, high demand for hydrocarbons will be maintained due to the uneven pace of transition to alternative energy sources.

Yet, it should be admitted that the current situation is marred by a short-term planning horizon and is in no way conducive to the development of local oilfield service companies. High-tech equipment is still purchased from western companies or those in “friendly” countries, while supplies of some of the most in-demand equipment, such as rotary steerable systems (RSS), have basically stopped. According to our estimates, the available stocks may last 2 to 3 years; then the gradual reduction in the availability of high-tech equipment might force companies to cut back on the wellwork.

So, to sum up, despite the observed difficulties, no crisis is anticipated in the Russian OFS market in the short term. In the medium term, however, building up competences in the high-tech OFS segment is a must, otherwise the oil industry will be running the risk of production slowdown due to inadequate technology.

Key risks and opportunities

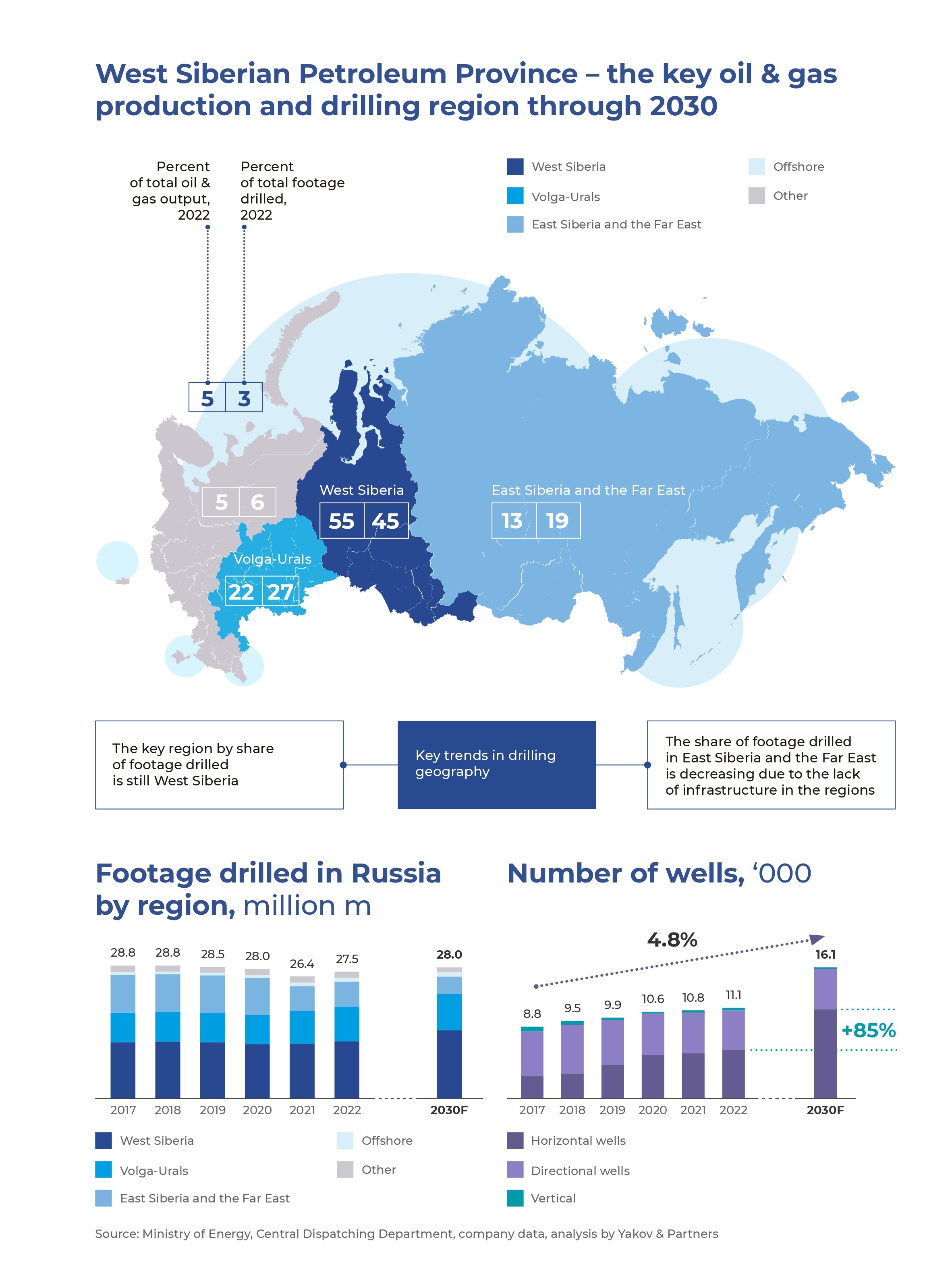

The key oil and gas production and drilling region in Russia through 2030 will still be the West Siberian Petroleum Province. As of today, it accounts for 55% of the oil and gas output and 45% of the total footage drilled. By 2030, the region’s share in drilling will go up to 52%. The share of the Volga-Urals region will increase from 27 to 28%, and the share of the Far East will decrease from 20 to 13.5% due to the lack of infrastructure.

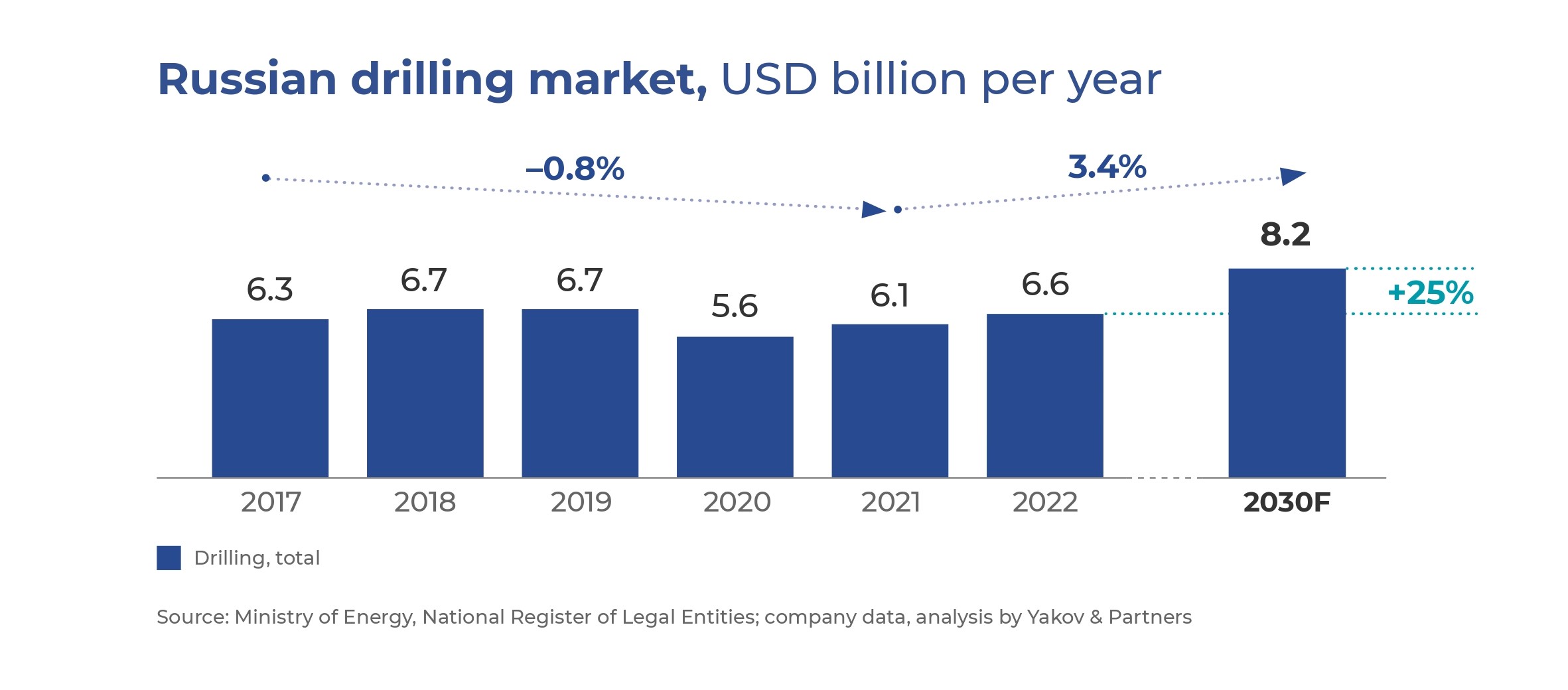

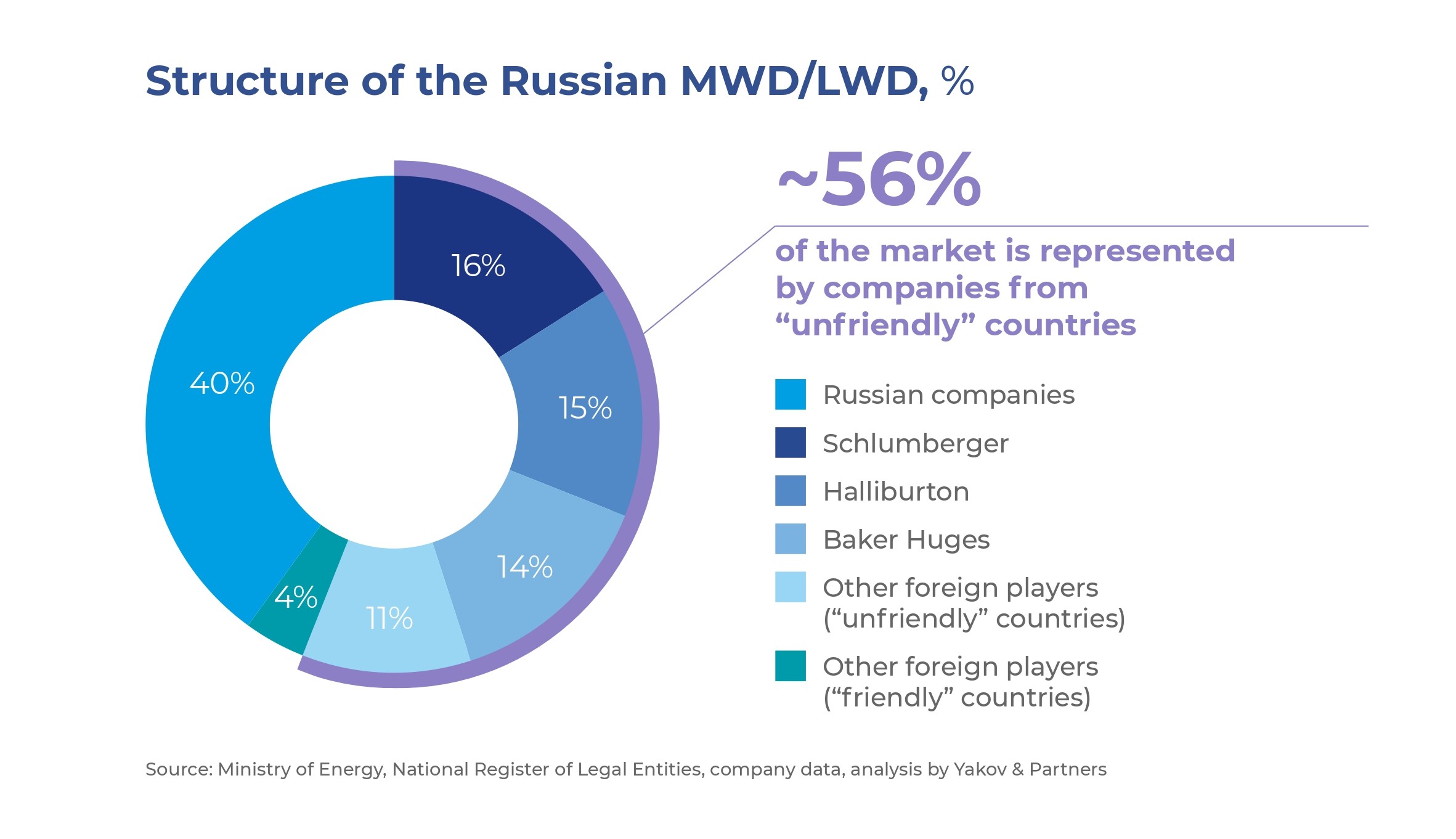

We forecast the total footage drilled to increase to 28 million meters by 2030 vs. 26.4 million in 2021 (+6%) and 27.5 million in 2022 (+1.8%). In our estimation, the number of wells drilled in 2030 will amount to 16.1K vs. 10.8K in 2021 and 11.1K in 2022. The number of horizontal wells will grow by 85%. The total drilling market in Russia in 2022–2030 will grow in terms of money by 25% to USD 8.2 billion. The companies from “unfriendly” western nations now cover just 15% of the Russian drilling market. Those are, however, the most complex services technology-wise, such as MWD/LWD, RSS, frac, and offshore drilling

Due to the depletion of conventional reserves and a growing share of HTR oil reserves in hydrocarbon production, the key trend in the Russian oilfield service market in the period under review will be an increasing share of drilling of high-tech horizontal wells. A persistent constraint that impedes active development of HTR reserves and offshore fields is the small number of high-tech equipment, lack of infrastructure, and price risks. The most dependent on import are such offshore technologies as floating drilling rigs (90% imported), offshore production equipment (80%), marine seismic (70%), and support vessels (80%).

The aforesaid scopes of drilling by 2030 will also require significant expansion of the drilling fleet. The Russian drilling fleet now roughly amounts to 1.5K rigs. According to expert estimation, however, about 40% of the rigs are essentially obsolete, so the equipment will have to be renewed substantially to keep and increase the rates of drilling.

With respect to reserves, a promising line of progress for the oil and gas industry is the Russian offshore. Offshore development is uneconomic now, however. In our estimation, despite huge oil and gas reserves, offshore fields will still be brought into development at an extremely slow pace in the next 10 years due to the lack of high-tech equipment and infrastructure. The most active offshore development is taking place in the Sea of Okhotsk now.

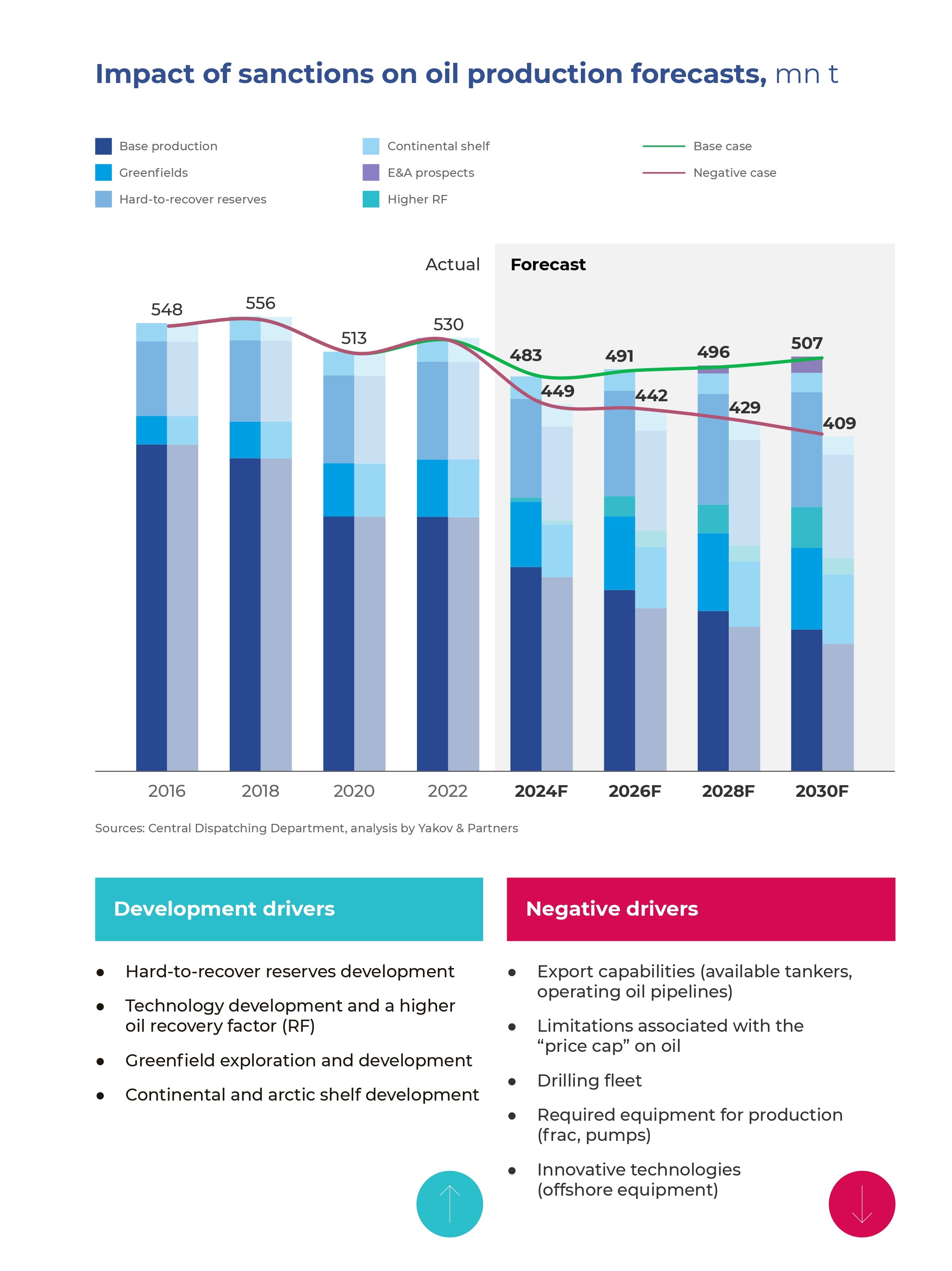

The negative case for the oilfield service market may realize if the shortage of domestic technologies persists and the sanctions are tightened further. The OFS market stagnation at USD 18 billion for the next 5–7 years will lead to a notable decline in hydrocarbon output by 2030.

The main problem is that western companies are playing the key part in the high-tech segments of oilfield services in Russia now. Therefore, it is the high-tech equipment that will require active import substitution in the next few years. In our estimation, the risk of missing alternatives for substituting such equipment is present in the segments that account for about 15% of the Russian OFS market in total.

Virtually all companies from “unfriendly” nations, including the OFS Big 4 (Halliburton, Schlumberger, Baker Hughes, and Weatherford), announced a suspension of business in Russia in 2022. Some of the companies decided to sell their Russian assets to the local management who keep working independently without support from the global companies or access to technological resources. On the back of increasing sanction pressure, the remaining western companies may stop the business, which poses risks of a cutback on well operations. In addition to that, the existing VIOC / OFS collaboration model prevents Russian oilfield service companies from investing in research and development (R&D), which leads to high dependency on western technology, while the investment capabilities of independent Russian OFS companies are very limited. In essence, the domestic OFS companies are largely represented by small and medium-sized businesses, which cannot equally compete with majors in technology.

The lack of domestic high-tech oilfield services poses risks to 20% of the output by 2030. Absent that, any plans to increase oil recovery, extensively bring HTR reserves into development, or expand development in new fields, including offshore ones, may fall by the wayside.

Technology priorities in oilfield service development

The most solicited technology for sustaining the output and enhancing greenfield production is hydraulic fracturing (frac). At the present time, 52% of the market is represented by companies from “unfriendly” nations; the domestic frac equipment accounts for less than 1%. From among active fleets, 3–5 fleets actually retire each year on average. Amid tightening sanctions, the only frac fleet supplier that remains is China. Therefore, within its sanctioned economy, Russia has to develop domestic technologies and arrange manufacturing of Russian frac equipment to satisfy growing demand. By 2030, the industry demand, considering planned drilling, will increase to 160 fleets (135 fleets in 2022).

The Russian MWD/LWD (measurement and logging while drilling technologies) market is represented by companies from “unfriendly” nations for 56%. According to expert judgments, the quality of Russian substitutes still lags way behind, yet multiple oil companies collaborate with Russian manufacturers and service companies to mitigate risks in the future and invest in fine-tuning of the technologies and local equipment.

The Russian RSS (equipment that enables well trajectory control) market is 100% dependent on import from “unfriendly” countries. This might become a barrier to HTR oil development and offshore projects. To develop the segment, Russian companies need to secure government support to work out a strategy for bringing quality domestic RSS equipment to the market and find opportunities for import substitution via partners from “friendly” nations. In our estimation, the Russian market will need about 150 new RSS by 2030.

An invariably important priority for progressing the domestic OFS segment is import substitution for offshore equipment, wh ere the dependency on imported technologies amounts to 80%. According to the new draft General Development Plan for the Russian Oil Industry, the government will postpone Russian offshore development until 2030–2035. Nevertheless, the industry will need 30+ new drilling platforms by 2030.

Conclusions

In our estimates, to level out the risks and ensure fast-track development of the Russian oilfield service market through 2030, i.e., to realize the base case, several steps should be taken.

Top priority measures include:

■ approving a list of priority (critical) technologies for developing the domestic segments of oilfield services;

■ agreeing with VIOCs on the target demand and required technology quality parameters plus a new model for collaboration with domestic contractors;

■ assigning actions under the technology roadmap to VIOCs, equipment manufacturers, and oilfield service companies and aligning on specific government support measures for each segment of oilfield services.

Creating incentives for sharing R&D risks and rewards requires a new VIOC / OFS collaboration model. Another important condition for developing the market is elaboration of a mechanism for building a guaranteed order for oilfield services, equipment, and specialized services.

Some VIOCs have already started building a market of contractors for complex oilfield services to satisfy their requirements whereby key competences are developed on the side of independent companies and VIOCs provide favorable conditions for technology development and fine-tuning, including long-term finance and a firm order for the scopes.

In addition to that, most of the polled independent OFS companies noted that they required special tax preferences and a different payment mechanism (medium-sized companies do not always have an opportunity to provide long payment deferrals until their technologies are tested and implemented successfully). Lastly, conditions conducive to expanding the domestic component base should be created, as in the long run it will help reduce the risks and cost of equipment.

Subject to implementation of the above measures, Russia will be able to grow its oilfield service market to USD 24 billion by 2030 and avoid a loss of 20% of its oil output. In this scenario, there is a high chance to realize the base case whereby the oil output in the country will amount to 500+ million tonnes in 2030, the oil recovery rate will significantly improve and the share of HTR reserves will increase from 22 to 28%.