Russian consumers report their perception of well-being declined across all major aspects, especially long-term stability, opportunities for savings, and bodily health. At the same time, the vast majority believe that getting back to normal might take a year or more, finds the study titled "Russian Consumer Pulse Wave 1: The New Normal – 2022", carried out by the experts of Yakov & Partners and Romir Holding.

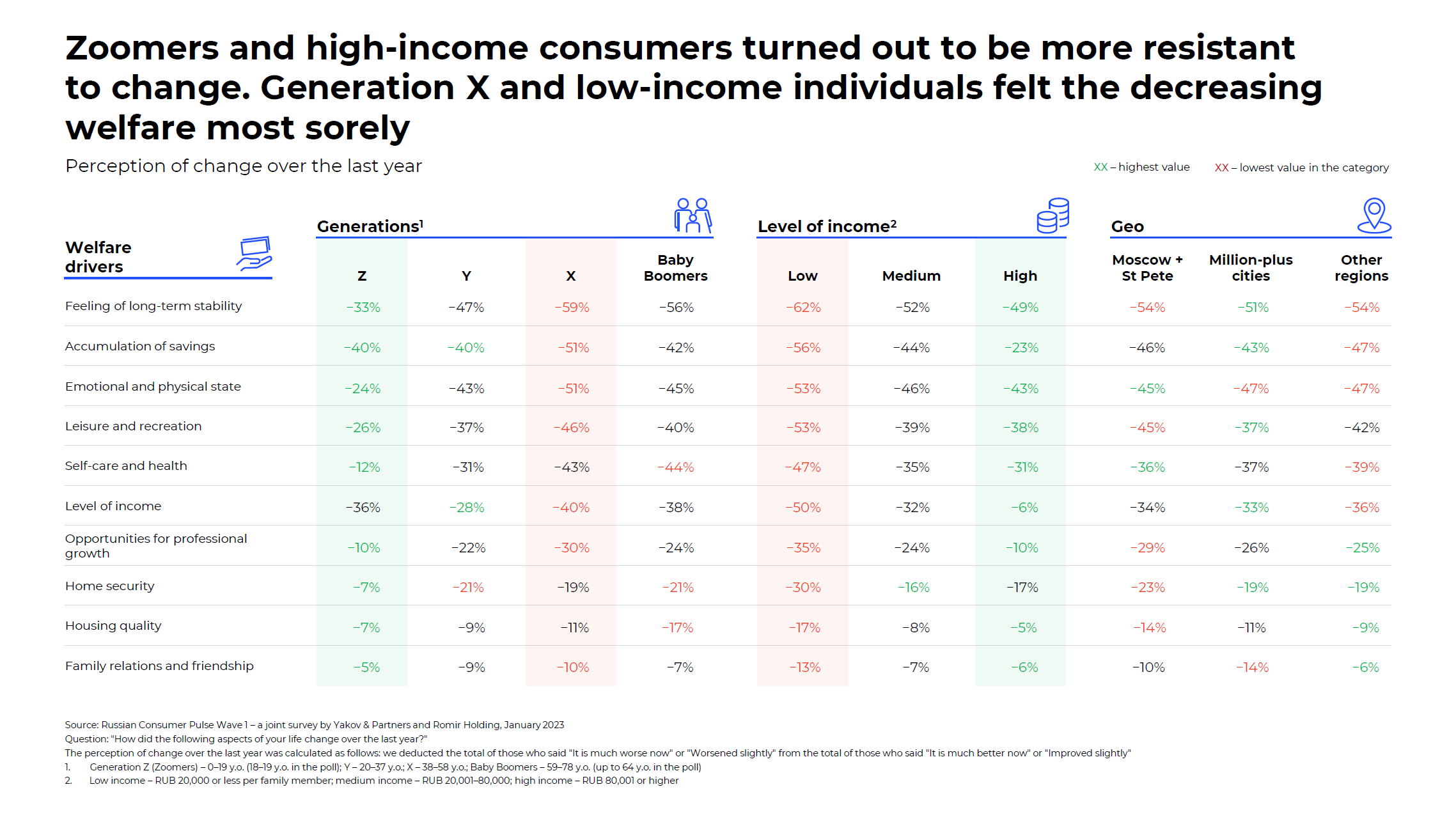

Changes were felt the least in such categories as family relations and friendship (-9%), quality of housing (-11%) and its safety (-20%). According to the study, the situation is similar across all regions of the country.

While Generation X and the low-income audience were the most likely to voice a negative assessment, the younger generation responded to changes with the greatest resilience. For a number of categories, such as a sense of long-term stability or emotional and physical well-being, family relations and friendship, there is a twofold (and sometimes even greater) gap in perception between representatives of Generation Z (18 to 19-year-olds) and Generation X (38 to 58-year-olds).

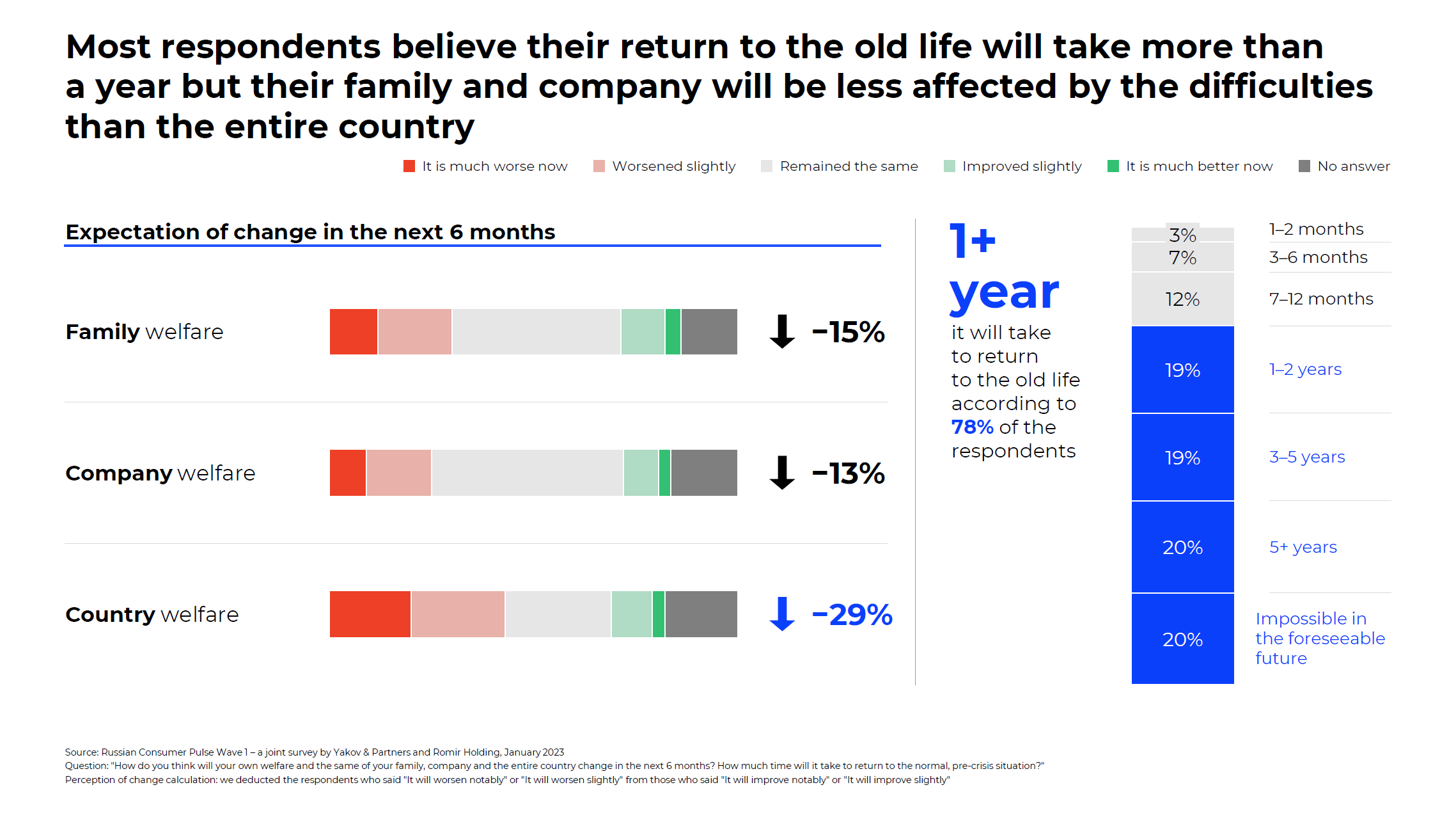

As to expectations for the foreseeable future (the next six months), the key consumer concerns are related to the level of income (59% of those surveyed), emotional well-being (39%), and bodily health (38%). At the same time, 78% of the respondents said that getting back to their old life might take more than a year, or even several years.

"Russian consumers indicated that their main strategy to overcome the expected difficulties is cutting back on major expenditures and helping their loved ones. It is also worth mentioning that the vast majority do not consider moving to another country or region in an attempt to cope with the difficulties," notes Denis Dovganich, Associate Partner at Yakov & Partners and one of the co-authors of the report.

Young people and high-income buyers expect the living standards of their families to somewhat improve in the next six months. At the same time, respondents in all categories have a more positive outlook on their family’s situation compared to their place of work or the country in general, which may speak to a growing importance of family values and associated adjustments in consumer preferences.

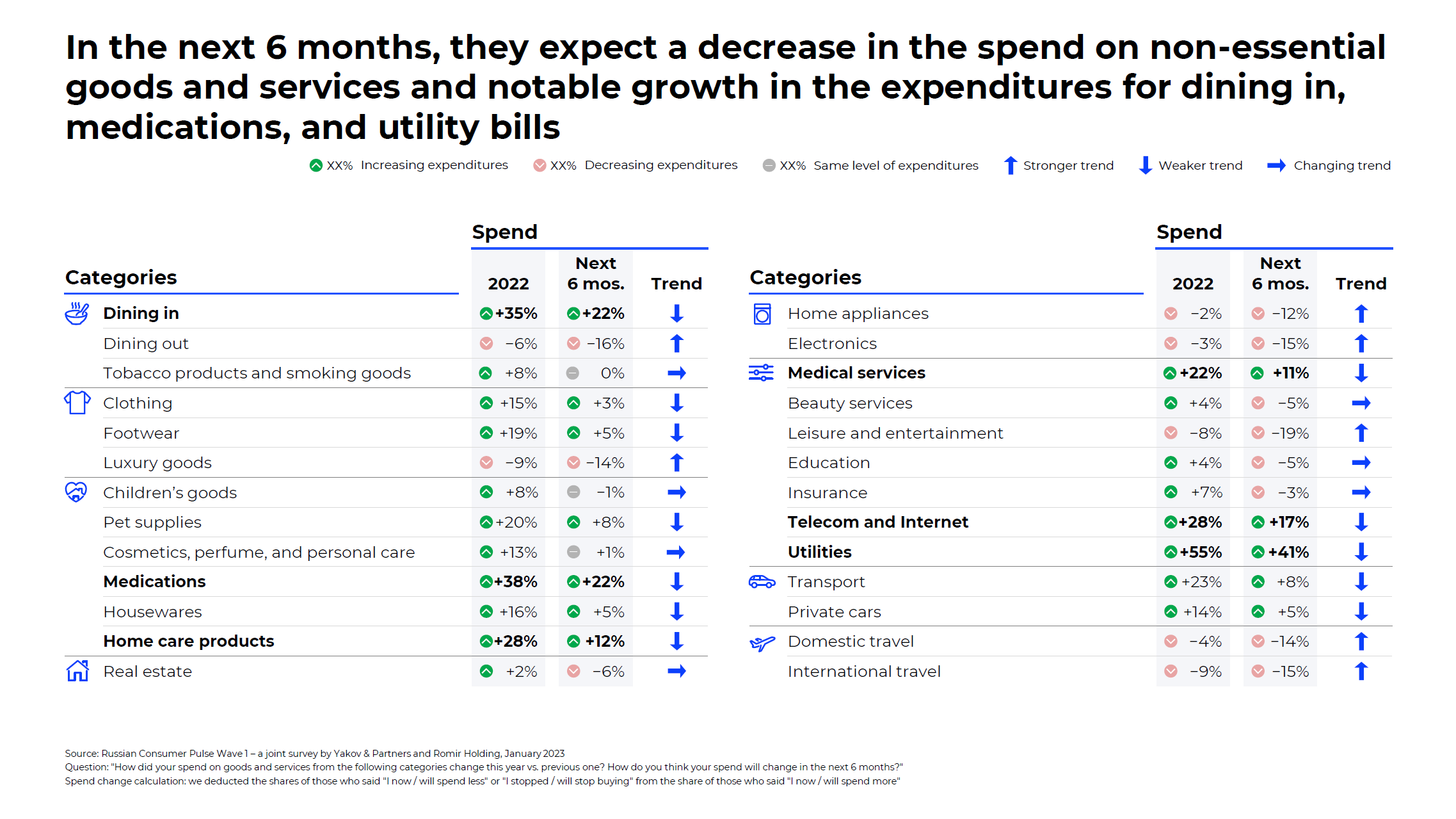

In terms of spending dynamics, the respondents reported that while they had cut back on luxury items, travel, dining out, and electronics, their outlays on housing and utilities, pharmaceuticals and medical services, groceries, telecom and Internet services, as well as home care products increased.

At the same time, the study says, it is not so much the increase in expected spending as such that is of interest, but rather its dynamics: "Consumers tend to be less likely to expect a further rise in spending in those categories where it has already increased over the past six months. For example, there is a two-fold gap for home care products and medical services; for housing and utilities, communications, and dining in it exceeds 11%. This might suggest that Russian citizens believe that they have already reached the "ceiling" in terms of consumption growth in these categories and do not plan to spend any more than they already do," explains Evgeny Yakushkin, an Associate Partner at Yakov & Partners and one of the co-authors.

"As we can see, consumers today have found themselves in an unstable economic environment, which triggered saving strategies, as 41% of the respondents across all generations spoke of the importance of taking a thriftier approach to shopping. However, they are not ready to sacrifice the quality of food products: health still comes first. All in all, 28% of the people polled find it important to consume healthy foods," says Executive Director of Romir Holding and one of the co-authors of the report, Inna Karaeva.

Survey participants explained that they identify a healthy product based on the information on the content of "natural" ingredients.

"Natural, as per GOST, no GMOs, no "E"s, farmer's, and balanced are the key standards inspiring confidence among Russian consumers. Curiously, statements that a product has low sugar or fat, is low in calories, or is gluten-free or lactose-free have a decisive impact on less than 10% of our respondents. This means our citizens put a lot of trust in certain standards and labels, which make the choice of products easier".

Overall, our respondents increased spending on dairy products (39% of those surveyed), fresh fruits and vegetables (36%), groceries (34%), poultry (34%), eggs (33%), and meat products (33%) and cut back on delicacies and ready-to-eats (7%).

"It is remarkable that while they showed an extremely high degree of loyalty to certain retailers, Russian consumers have for the most part changed the mix of brands in their grocery basket: 39% of them did so due to price hikes, 33% because their habitual brands withdrew from the market, and 21% wanted to give domestic products a try. So far, however, less than half of those who have switched brands are satisfied with the move. These two factors, along with consumers’ wish to rationalize spending, could contribute to further growth and development of store brands and exclusive brands – that is on top of the fact that 52% of the respondents already consciously choose such products," believes Anastasia Sidorina, a co-author of the report and Director for Client Relations at Romir.

Overall, convenience was one of the key factors for choosing a retailer: neighborhood stores lead in the frequency of purchases (62% of the respondents visit them two to three times a week or more frequently).

In terms of sales channels, 68% of the respondents still prefer to shop offline, while 25% shop offline and online in equal shares. "Physical experience is important for shoppers, as was confirmed by more than 56% of our respondents. However, more attractive prices as well as lower delivery costs and minimum order value could prompt them to go online," notes Evgeny Yakushkin.

Half of those surveyed (51%) mentioned a growing role of promos. In addition to the size of discounts and the product range covered with promos, the consumers find it important to have quality advertising and extension of promos. For 40% of the respondents, loyalty systems have become more important, and "direct benefits" in the form of discounts, bonuses and cashback are valued most.

The survey was nation-wide and included more than 1,500 respondents with widely different socio-demographic characteristics, including age, region of residence, income level, etc.