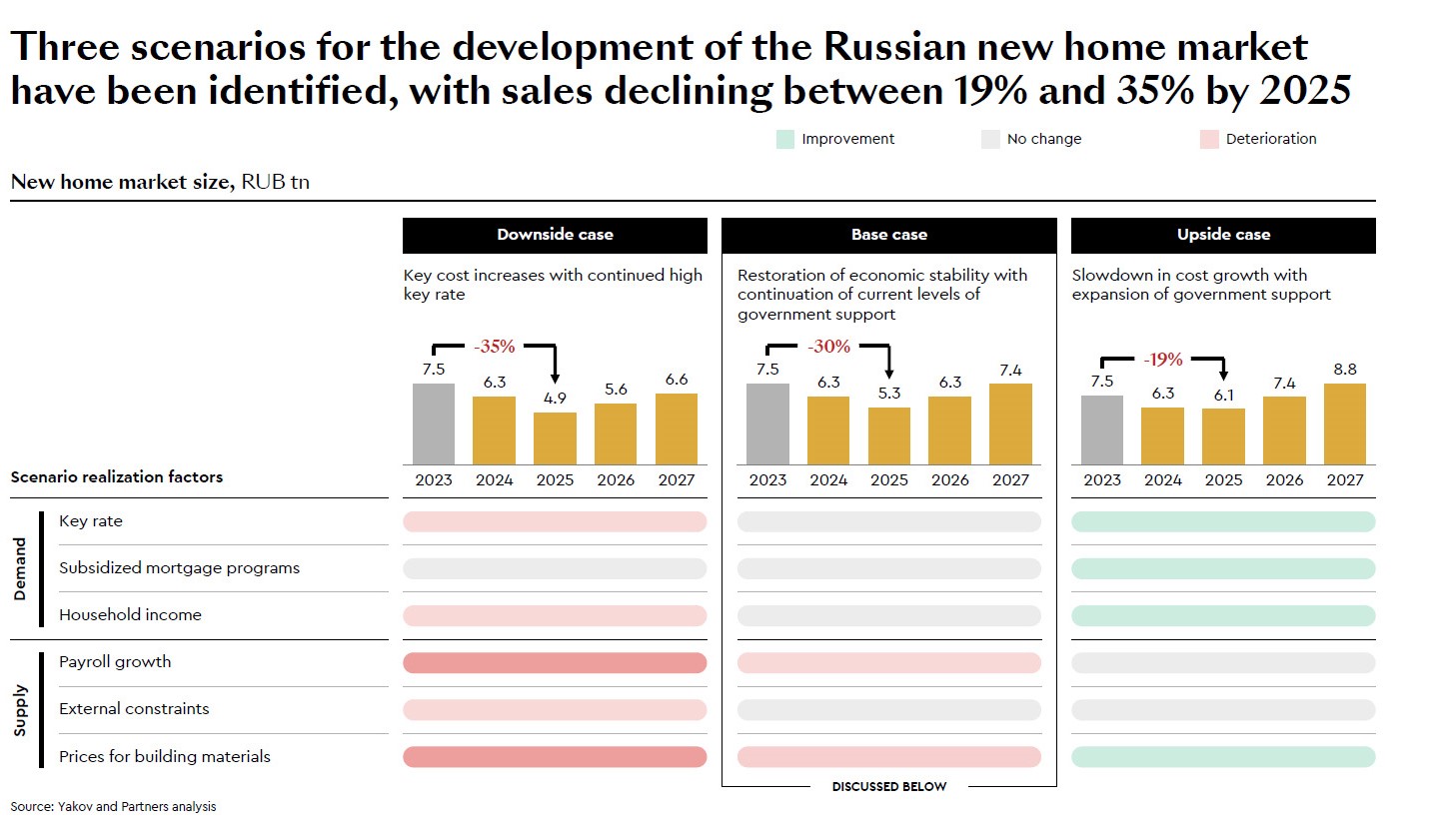

Next year new home sales across Russia may decline by 19% to 35%. In many respects, the current trend in the new homes segment is associated with a decline in the demand for mortgage loans. The issuance of housing loans began to decline against the background of changes in the conditions of subsidized programs, the increase in the Central Bank rate, as well as the general loss of purchasing power. These are the conclusions of the study titled "Outlook for Russia's Real Estate Development Industry: Survival Guide" published by Yakov and Partners experts.

Between 2020 and 2023, new home completions in Russia increased by more than one-third. The positive momentum was driven by strong government support for the industry. However, from 2022 onwards, developers have faced a number of challenges that have significantly complicated their operations. Key issues include the rising cost of labor and construction materials, as well as more expensive financing as a result of the Central Bank's rate hikes. At the same time, demand for housing began to shrink amid the end of mass subsidized mortgage programs and the lowering of limits on targeted housing loan programs.

"Rising construction costs combined with a shrinking market pose a threat to the sustainability of real estate developers. In this environment, some projects may be cancelled or postponed, and developers will start to cut costs aggressively"

Anna Danchenok, Director of the Construction & Real Estate Practice at Yakov and Partners

In Russia, based on current trends, new home sales could decline by 19% to 35% in 2025. In the base case, this means a decline in sales from RUB 7.5 trillion in 2023 to RUB 5.3 trillion in 2025.

Our analysts have worked out three scenarios for the development of the industry depending on six factors affecting supply and demand. New home sales may continue to decline – to RUB 4.9 trillion in 2025 in the downside case, should the Central Bank's rate and the cost of labor and construction materials continue to rise, disposable incomes continue to decline, and external constraints persist.

In the base case, the analysts do not rule out a price correction in the real estate market of up to 12% in 2024–2025, driven by several factors. For example, developers may start offering 5–30% discounts to support sales and repay project financing. In turn, the banking industry may introduce financial products such as adjustable-rate mortgage or deferred first payment to stimulate housing demand to some extent. At the same time, the high inflation rate projected for this period will support the relative nominal stability of property prices.

"In terms of the cost structure of residential construction, the cost per square meter in the base case will increase by about 15% in the next three years, while the real estate development margin may be down to 10% or even turn negative in 2025, compared to 15–60% in 2023. All of these factors will push 30% of developers into the red as early as 2025"

Anna Danchenok, Director of the Construction & Real Estate Practice at Yakov and Partners

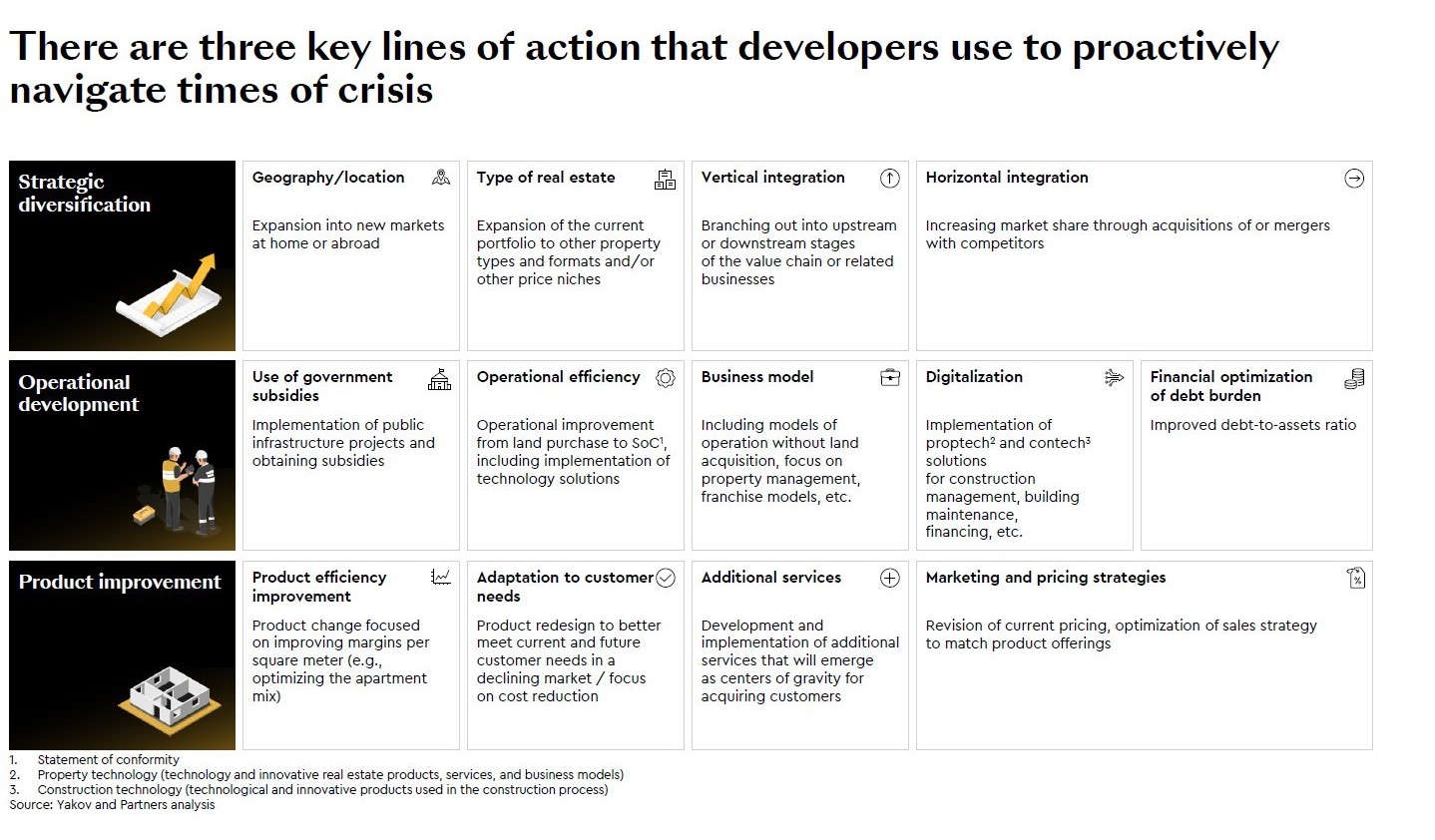

To sustainably adapt to the new reality, experts suggest that developers adopt a five-step plan that includes creating a dedicated change management office, formulating an adaptation strategy, analyzing growth potential, and selecting several tools in three key areas with an implementation roadmap.

According to the report's authors, the total potential benefit of implementing the initiatives, if properly combined, can reach up to 290% of long-term EBITDA growth. In particular, horizontal integration can lead to revenue growth of more than 25%, business model transformation and operational efficiency improvements can increase EBITDA margins by 10–25%, and adapting to rapidly changing customer preferences can have an incremental positive impact on revenue of 10–15%.

"Some Russian companies have already started transformation processes, but they are not systematic enough in implementing them, so they still face risks to their business. And given the huge social role that the sector plays in the life of the country, it is extremely important that the real estate development industry successfully adapts to the changes, maintains business stability in the long term, and minimizes risks for itself and ultimately for all of us. That is why we believe that companies need to take the coming period seriously and start preparing now for possible changes"

Anna Danchenok, Director of the Construction & Real Estate Practice at Yakov and Partners