The refusal of some global companies developing and producing microchips, such as TSMC, Intel, and Nvidia to do business with Russia, and the intensifying competition among the largest industry manufacturers create new challenges for the Russian industry. This problem concerns both imports of modern chips and equipment and components required for their production in Russia and may eventually have a detrimental effect on the development of other national industries, including those of strategic importance.

Even though global cooperation in microelectronics is strong, in recent years the industry has seen a clear trend toward localization of microchip production. The world's largest economies are increasingly investing in the development of their own production facilities for national security reasons.

For example, the U.S. plans to move chip production out of Taiwan, where the largest chip manufacturers are located, and onto home soil. The American president has already signed an executive order prohibiting technology companies fr om using chips produced outside the country. Exports of ready chips and newest equipment for their production to China have been restricted, as has the use of American technologies: threatened with loss of citizenship, American engineers and highly skilled professionals who worked at Chinese chip production and research facilities were forced to leave the country. China, in turn, is stepping up its own production of advanced chips and equipment in an effort to reduce its reliance on Taiwan and the U.S. In total, between 2019 and 2022, the U.S. and China have invested about USD 80 billion into various efforts to localize microelectronics production.

Unfortunately, current economic realities prevent Russia fr om competing on such a large scale. Yet, technological sovereignty could be achieved even with a lower scale of government support.

Given the circumstances, in order to meet its production needs, Russia has to urgently eliminate technological gaps and modernize existing production facilities. The long-term goal is complete substitution of imports of ready chips that are in most demand in domestic industries and accessories required to produce them.

Basic-Level Chips Are Crucial for Domestic Production

Most chips are imported to Russia in the form of consumer goods, such as laptops, smartphones, memory cards, etc. The manufacturing industry mostly demands basic microchips (90+ nanometers), lack of which could lead to production stoppages. In 2019, the segment accounted for about 38% of global output (global production capacity expressed in equivalent 200-millimeter semiconductor wafers per month).

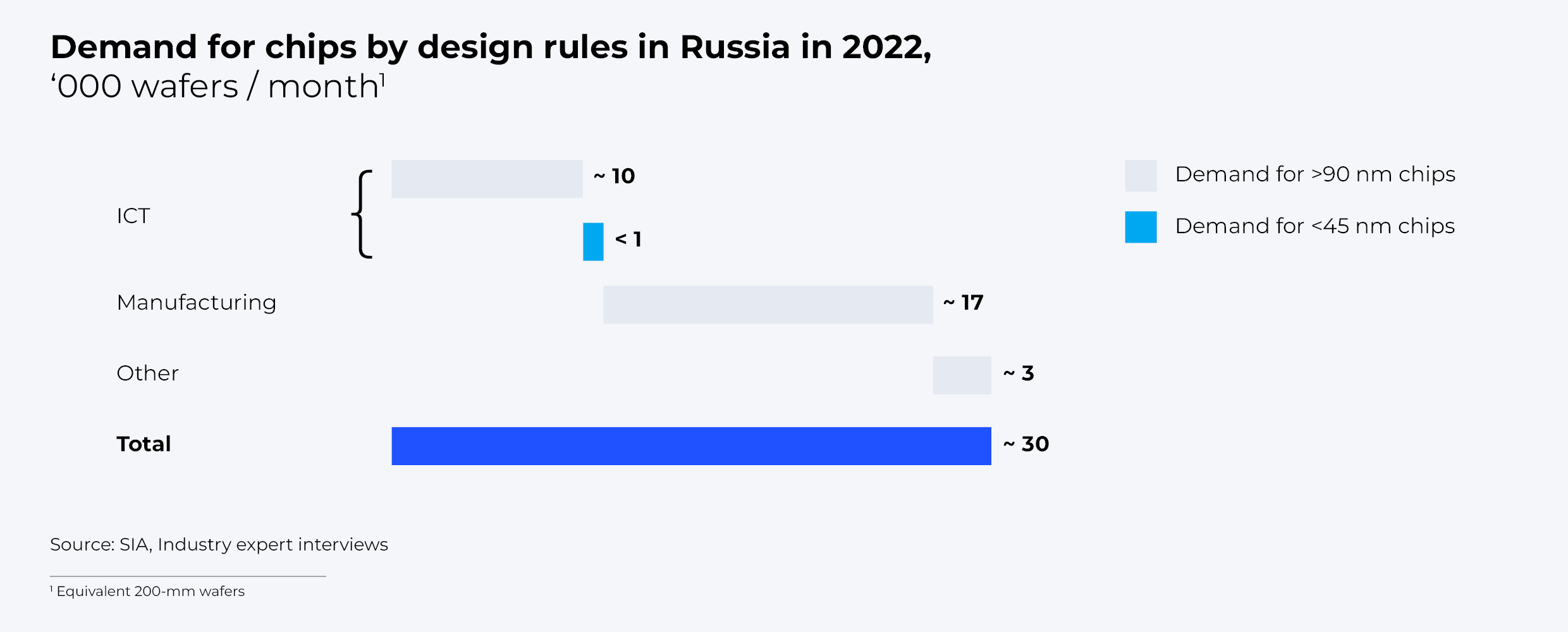

No modern production facility can function properly without microchips. Current domestic demand for 90 nm and larger microchips can be estimated at 30,000 wafers per month. Key areas of application are information and communication technologies, space and aviation industry, as well as automotive industry.

45 to 90 nm microchips have no wide application in the industry, and are considered outdated for use in modern processors and memory devices. All in all, they account for about 9% of global production.

Advanced-level microchips (below 45 nm) are used for personal and supercomputers, portable electronics, server equipment and memory cards, but today’s demand for this range of chips from Russian manufacturers is low (less than 1,000 wafers per month).

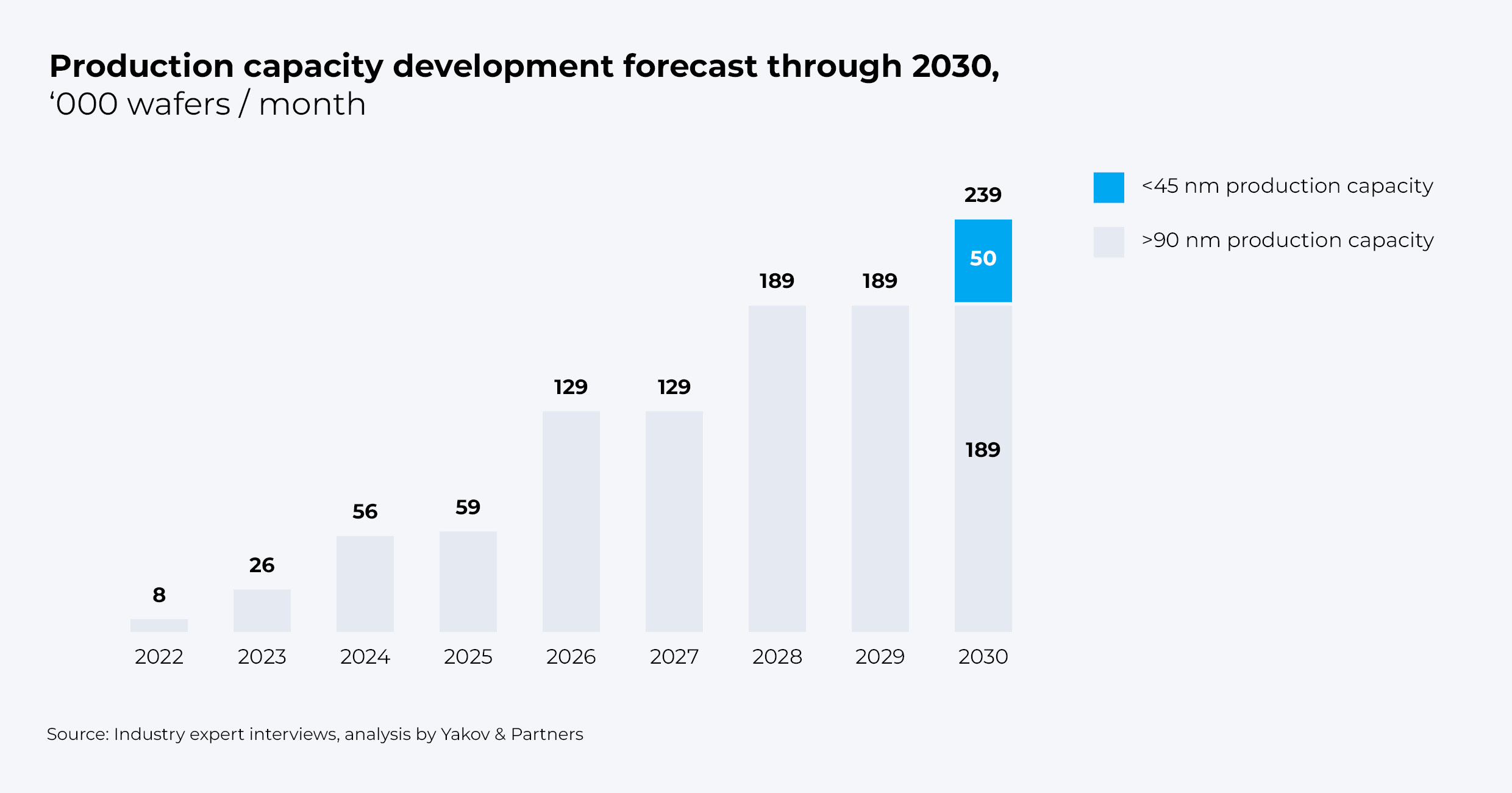

We estimate that in the next five years total demand for chips in Russia could double to 60,000 wafers per month, and in 2030–2035 it could exceed 100–150,000 wafers per month.

Rebooting Domestic Microelectronics Industry

Reducing the reliance of major Russian companies on external supplies requires resetting the entire domestic microelectronics industry. Efforts should be focused on both short- and long-term sets of tasks.

*In the short term*, it is vital to prevent the stoppage of high-tech production facilities and meet the critical demand for 90+ nm chips.

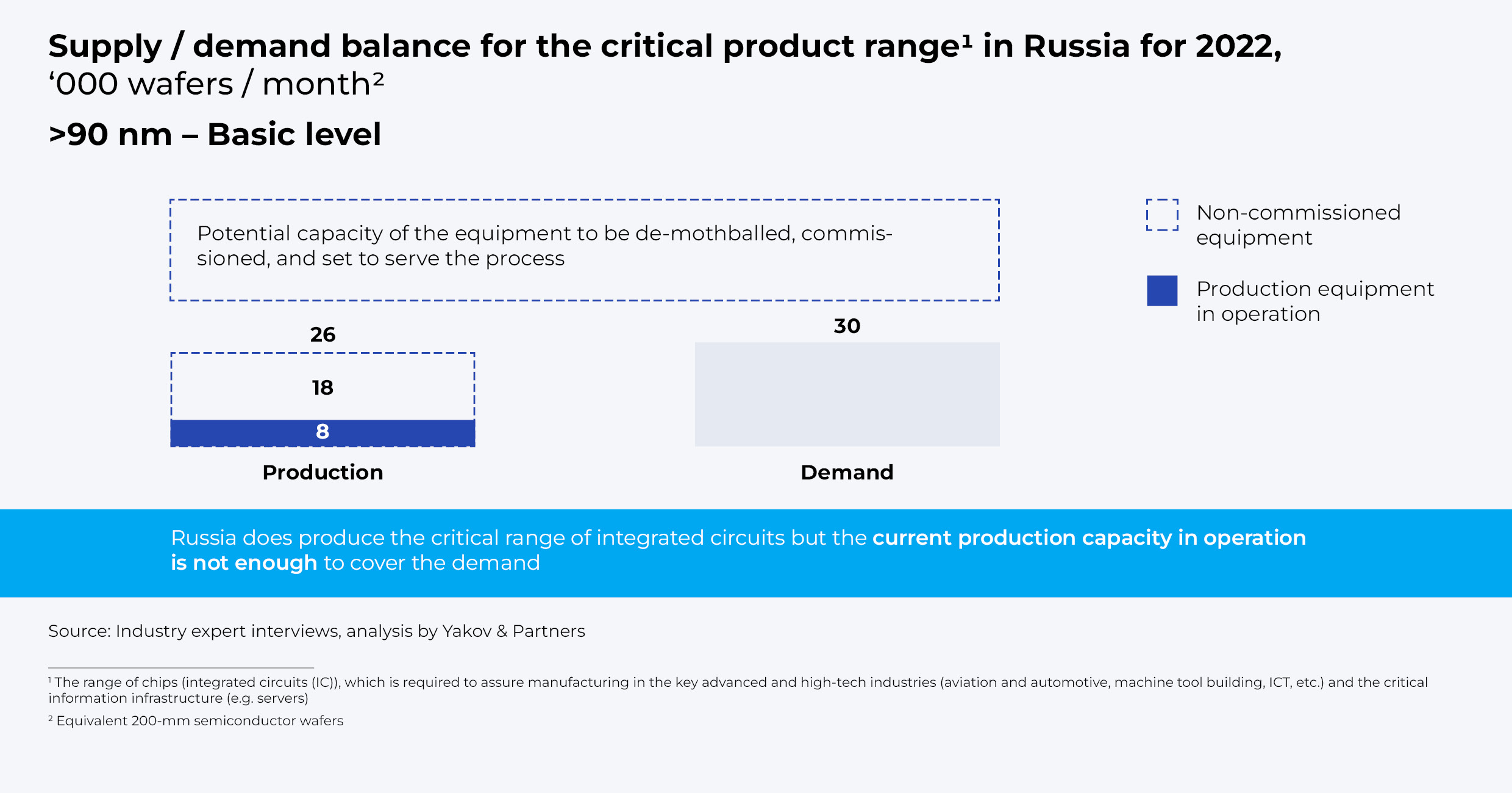

Like the absolute majority of other countries, Russia has few full-cycle manufacturers, with the most notable being Mikron and Angstrem. NM-Tech and Crocus Nano Electronics also have production facilities. Among design centers (fabless companies), Elbrus and Baikal Electronics stand out. At present, Russia produces the critical range of microchips, yet current production capacity is insufficient to satisfy even the demand for basic-level 90+ nm chips, and the industry demand is more than three times the actual production volume.

However, Russia has found itself in a situation, wh ere despite the obviously unsatisfied demand, more than 70% of production capacities (owned by NM-Tech (bought fr om the bankrupt Angstrem-T) and Crocus Nano Electronics) are out of operation. Even though potential capacity for production of basic-level 90+ nm chips in Russia amounts to 26,000 wafers per month, actual output stands at as low as 8,000. So, putting idle capacity into use and setting up basic technological processes could help almost fully meet the industry demand, which today amounts to 30,000 wafers per month, and lay the groundwork for further industry development. However, given the projected demand growth due to import substitution goals in multiple industries, chip production needs to be scaled out.

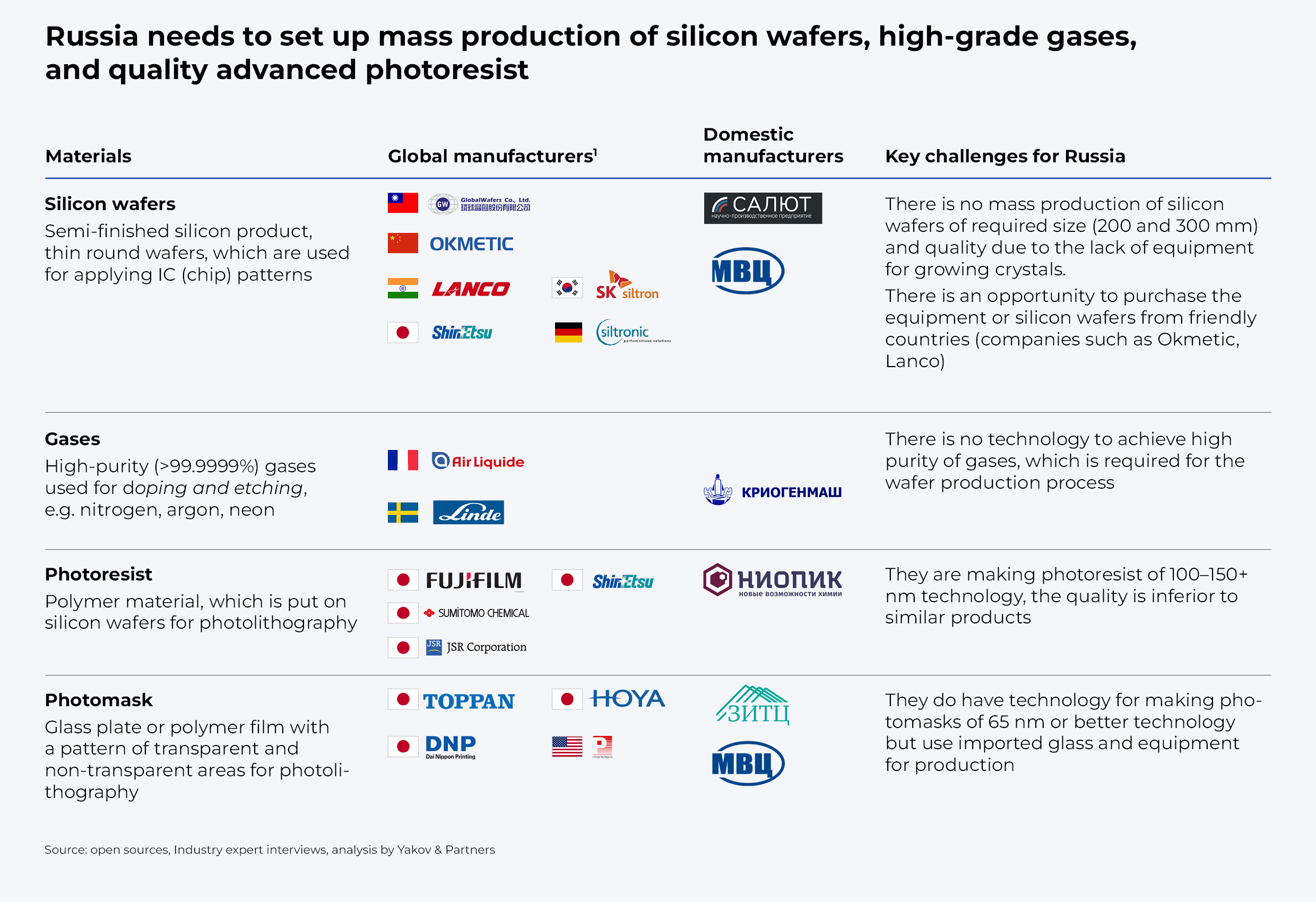

Among the biggest roadblocks holding back expansion of chip production is lack of equipment for making and patterning wafers (photolithography) in Russia. Even though the plans to develop such equipment are in place, they lag far behind the world's leading manufacturers. For instance, photolithography development program envisages creating the equipment to produce 90 nm chips, while the industry has already produced 5 nm (and smaller) designs. As previously mentioned, 45–90 nm microchips are not in such high demand today, so the next goal would be to deploy production of advanced-level chips (below 45 nm). Domestic design centers Elbrus and Baikal Electronics have the technology to design chips with required geometry rules (previously such chips were produced at the facilities of Taiwan’s TSMC), but localizing the production at this level of technology requires silicon wafers of larger diameter (300 mm) than those used for 90+ nm chips, and appropriate photolithographic equipment.

Another roadblock for localization of chip production is the lack of domestic production of consumables of required quality, such as gases, photoresist, and photomasks.

Since microchip production transitions to new design standards every 2-3 years, the easiest solution could be to purchase used equipment from manufacturers in Southeast Asia.

The Price Tag

We estimate that it is possible to set up local production of photolithographic equipment and equipment for growing crystals, as well as provide production facilities with domestic consumables and materials (for example, photoresist and photomasks) as soon as by 2030. In this case, the investments required to scale out local production and subsidize research may total RUB 400–500 billion, half of which will come from the budget. At the early stages of development, the industry will be operating at a loss, so strong government support will be needed, especially for R&D.

More than half of these investments should be channeled into capital expenditures, retrofitting production sites, and setting up new facilities for production of chips and 200 mm silicon wafers.

These investments will help secure a basic level of industry development, create a foundation to transition to more modern technological processes and eventually do away with imports.

*In the long term* (by 2040), however, this country needs to build up its own competencies in the development and production of both basic and modern chips.

Achieving this goal and moving further will require up to RUB 300 billion in additional investment. These funds will go to further stimulate R&D work along the entire value chain, as well as continuously finance research related to software development and creation of design centers (fabless companies) to expand the range of domestic microelectronics.

Ramping up production capacities will allow Russia to create an additional impetus for the development of other industries and cooperation with friendly countries. If the above-mentioned investments are implemented by 2030, it will be possible to fully satisfy the growing domestic demand for the critical range of chips, as well as create a significant impetus for the development of domestic high-tech products, such as a certain range of consumer electronics.

It is important to keep in mind that these production goals cannot be achieved if the industry lacks highly qualified technologists. In terms of indicators, a well-functioning technological process (which involves setting up and fine-tuning both individual pieces of equipment and programming the "recipe" for the entire production line) allows to bring the yield of good chips per wafer to the level of global best practices, i. e. 85–95%, which factors into both commissioning new production lines and expanding the existing ones. And here is wh ere the competencies of personnel are crucial. In the short term, experts fr om friendly countries could be brought in to set up the processes using imported equipment, as well as train local employees to create an internal talent pool.

By 2040 and Beyond: Qubits and Graphene

Microelectronics tends to evolve gradually, yet every 15–20 years new technologies emerge that revolutionize the industry. This is particularly evident in the evolution of storage devices, which have gone from a 20-cm floppy disk holding only 80 KB of data to a 15-mm microSD-card storing 1 TB over the period of 50 years. A new computing architecture that mimics the workings of the human brain is emerging before our eyes. Using neuromorphic chips in products will greatly enhance hardware learning capabilities, which is important for the development of artificial intelligence.

Global market leaders are now busy creating quantum computers that use qubits instead of bits and can perform complex calculations in an instant (as opposed to traditional computers, which rely on sequential computing). Machines using such technology will be able to quickly process highly complex models that will enable fundamental breakthroughs in such industries as finance, pharmaceutics, transportation, and information security. Russia is also developing quantum computing and quantum communications technologies, which are sponsored and overseen by major domestic players.

In terms of chip production technology, investing in revolutionary developments in new semiconductor materials, among other things, could help improve Russia's positions in microelectronics. The country has the resources to create new materials, such as synthetic diamonds, germanene and graphene, which have the potential to either completely replace silicon or fill the niches wh ere silicon application is restricted due to its physical properties and characteristics.

Defying the Restrictions

The microchip market size was estimated to be worth USD 555 billion in 2021. It is expected to exceed USD 600 billion in 2022, and grow another 1.5 times to reach USD 940 billion by 2030. Microchips have already been dubbed the "new oil", and major economies are ramping up investment into the industry.

Today, Russia's share of the market is less than 1%. However, if the required investments in personnel, technology and equipment are made available, Russia will be able, despite the pressure, to establish production of required quantities of basic microchips at the turn of 2027–2028, and fully meet domestic demand for the critical range of microchips by 2030. However, to achieve these figures it is necessary to start acting right away, as more and more countries are joining the global race for technological sovereignty, wh ere the main prize is the sustainability of the manufacturing industry and production in general.