The number of vacancies published by Russian employers has increased by 80% in the past five years, while the median pay offer has doubled, far outstripping GDP growth, inflation and the CPI during the same period. Between now and 2030 the staff shortage will only increase. These are the conclusions reached by experts from Yakov & Partners after analyzing data on 38 million vacancies posted between 2018 and June 2023 and on the basis of a forecast of how the labor market will evolve in view of official socio-economic development forecasts.

Data on vacancies, salary offers and unemployment for 2018–2023 indicate that the worker shortage has already begun. The number of vacancies published by Russian employers has increased by 80% over the past five years. Following a short-term fall in 2022, demand for labor recovered in the first half of 2023, and August was a record month for new vacancies (1.2 million). The number of vacancies has been growing rapidly in all regions, especially the Central, Ural and Far Eastern Federal Districts (by 108%, 96% and 94%, respectively, relative to base demand in 2018). In absolute terms, the number of vacancies has increased fastest in the Central and Volga Federal Districts, and also in Moscow.

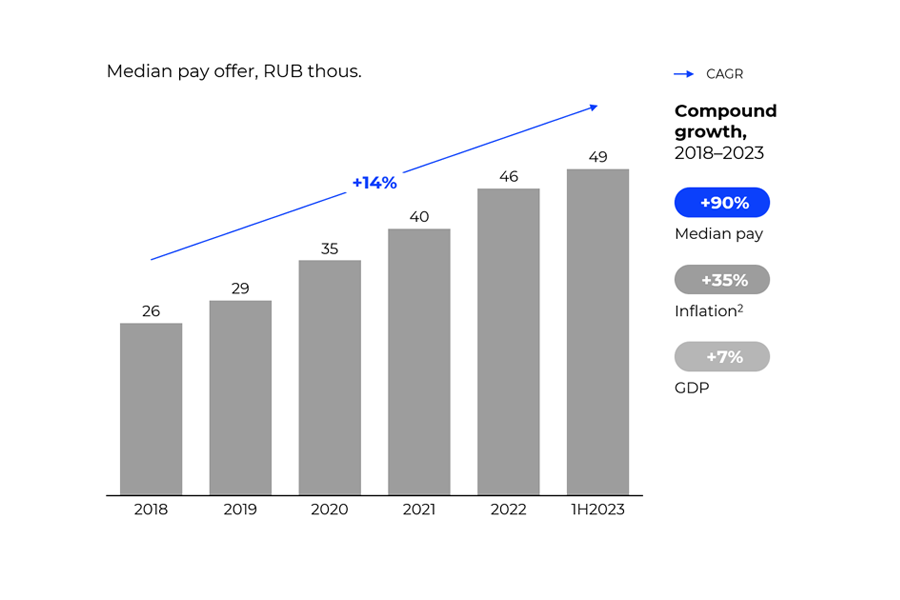

Against a backdrop of growing numbers of vacancies, the median salary offer has doubled, far outstripping GDP growth, inflation and the CPI during the same period. In the regions with the strongest growth in salary offers, the increase amounted to 85–114%, while Moscow has recorded a rise of just 51%. Consequently, the difference in salary offers between Moscow and the regions has shrunk from 58–188% to 25–105%. Notwithstanding, absolute salaries in the Russian capital remain higher than in all other federal districts.

Broken down by sector, salaries have grown fastest in construction and industry – up 160% and 114%, respectively. Judging by the number of jobs posted, the same sectors have seen the strongest growth in demand for workers – by 137% and 109%.

If one looks at vacancies from the perspective of experience required, salaries offered to specialists with at least 3 years' experience have grown 25% more than for specialists with no work experience. In addition, industry and construction are experiencing the strongest competition for experienced staff, resulting in record increases in salaries offered – by 2.5 and 3 times, respectively.

"The labor market is currently experiencing a long-term and fast-growing need for qualified specialists with work experience. Demand in the manufacturing sector is particularly high. The growing requirement for qualified staff is most noticeable in the regions, particularly if one looks at increased salary offers. It’s worth noting that salary offers for qualified staff in the regions are growing faster than in Moscow. This confirms the willingness of regional employers to invest in such a vital resource as qualified staff, as they understand the significance of their role in the success and development of the business"

"The labor market is currently experiencing a long-term and fast-growing need for qualified specialists with work experience. Demand in the manufacturing sector is particularly high. The growing requirement for qualified staff is most noticeable in the regions, particularly if one looks at increased salary offers. It’s worth noting that salary offers for qualified staff in the regions are growing faster than in Moscow. This confirms the willingness of regional employers to invest in such a vital resource as qualified staff, as they understand the significance of their role in the success and development of the business," commented Vladimir Dzhuma, Director of the Center for Digital Transformation and Data Analysis at the All-Russian Research Institute of Labor.

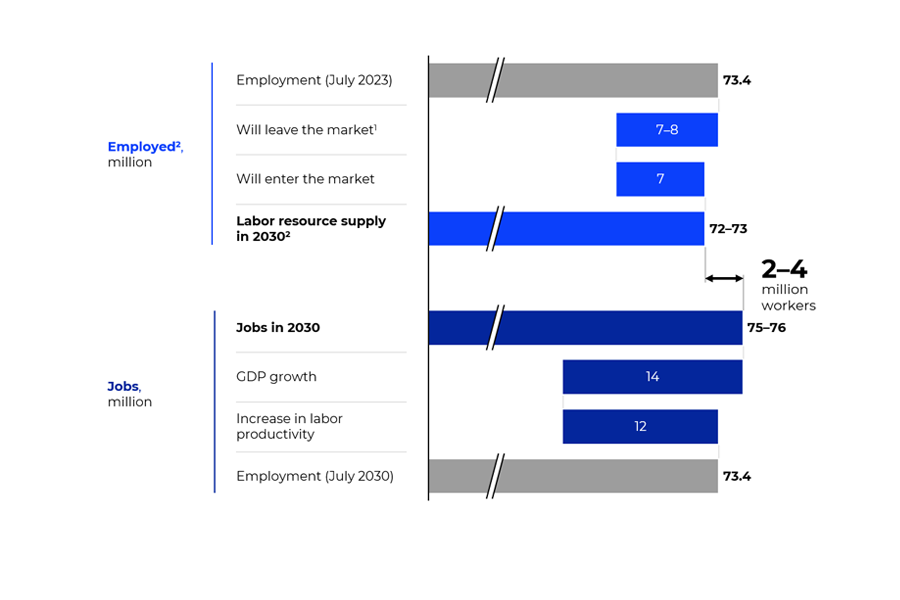

Forecasts indicate that the labor shortage will increase between now and 2030, and conventional approaches will not help to solve the problem. The authors of the study note that by 2030 the deficit could reach between 2 and 4 million people. Their forecast is based on the current level of employment and takes into account, on the one hand, demographic factors, including the number of retirements with due consideration for the pension reform and the supply of graduates from universities, colleges and schools to the labor market, and on the other, planned growth in GDP and labor productivity.

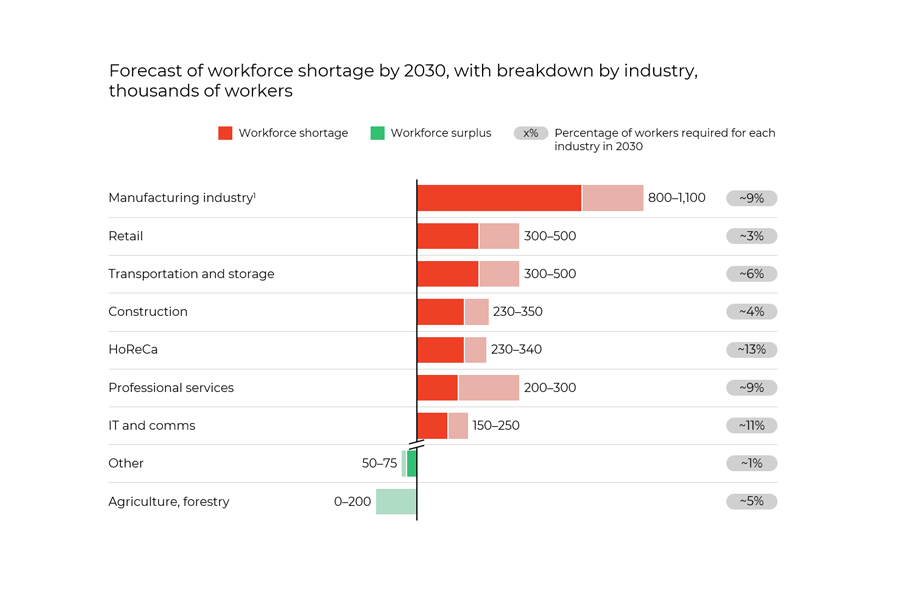

The shortage will hit the manufacturing sector, transport and retail hardest of all. Only in agriculture will it be possible to achieve a small surplus of workers if digitalization and labor productivity measures are implemented at an accelerated pace.

It is anticipated that up to 90% of the labor shortage will relate to semi-skilled workers, such as lathe and mill operators, and highly-skilled specialists – programmers, engineers, managers, etc. With this in mind, the authors note that the current structure of migration will not address the shortage.

In order to offset the shortage a broader range of tools will have to be applied. For example, solving the problem through labor productivity would require an average increase of 2.4% per year, which is twice what has been achieved over the past 10 years and higher than the Russian Ministry of Economic Development's forecast. Boosting salaries and poaching specialists are inevitable but will not in themselves resolve the overall shortage.

The authors note that if current trends continue, conventional tools will offset only half of the shortage – that is, approximately 1.1 million workers. To mitigate the adverse impact of the shortage on the economy and to implement development projects, business and government need to work hand in hand.

A shortage of workers on this scale creates risks for the economy, business and society as a whole, warn the study authors. For example, a shortage of labor resources could reduce potential GDP growth by 1–2% per year and spur on the inflation rate to 10%, while also undermining projects aimed at securing Russia's technological sovereignty and realigning the economy. For businesses, the workforce shortage could depress EBITDA by up to 5%.

To ensure that the economy has the workers it needs for accelerated development in these circumstances, the study authors propose a whole set of actions for both business and government: improve offers to staff, align the education system with the requirements of the labor market, develop joint programs between the government and employers to recruit people from difficult categories, repatriate workers and recruit qualified migrants, and expand and incentivize labor productivity programs.

"Not all companies have yet realized that the market has changed. No longer will there be queues of cheap specialists in response to every job ad. We are transiting to a market of expensive labor and staff shortages. Businesses will have to raise salaries and improve working conditions, boost labor productivity and build long-term partnerships with universities and colleges. The best workers will go to the employers that start doing these things first, while companies that fall behind risk losing their most qualified people. The government, for its part, could support employers who are quickest to start creating decent working conditions, investing in staff training, and recruiting candidates from hard-to-employ social groups. In addition, the government could adapt the education system to the demands of the labor market, offer repatriation programs for Russian-speaking specialists and for migrants with the most needed skills, and expand its support for labor productivity programs."