Yakov and Partners experts together with Business Russia have looked into the present and future of high-growth firms in the country. According to the study "High-growth firms. How to forge champions" conducted specifically for a forum organized by Business Russia and attended by the nation's leadership, the share of such companies increased by a factor of 1.4 between 2018 and 2023. And their contribution to economic growth surged 2.7-fold compared to the five-year period fr om 2013 to 2018.

"High-growth firms serve as growth engines for the Russian economy. They are large enough to make a notable impact on the economy yet not so large that they have exhausted their potential for growth. Over the past decade, the contribution made by such companies to the country's economic growth has been 17 times greater than that of traditional businesses, despite the fact that less than 2% of all enterprises in the economy are high-growth firms"

Nonna Kagramanyan, Vice President and Head of the Executive Committee at Business Russia

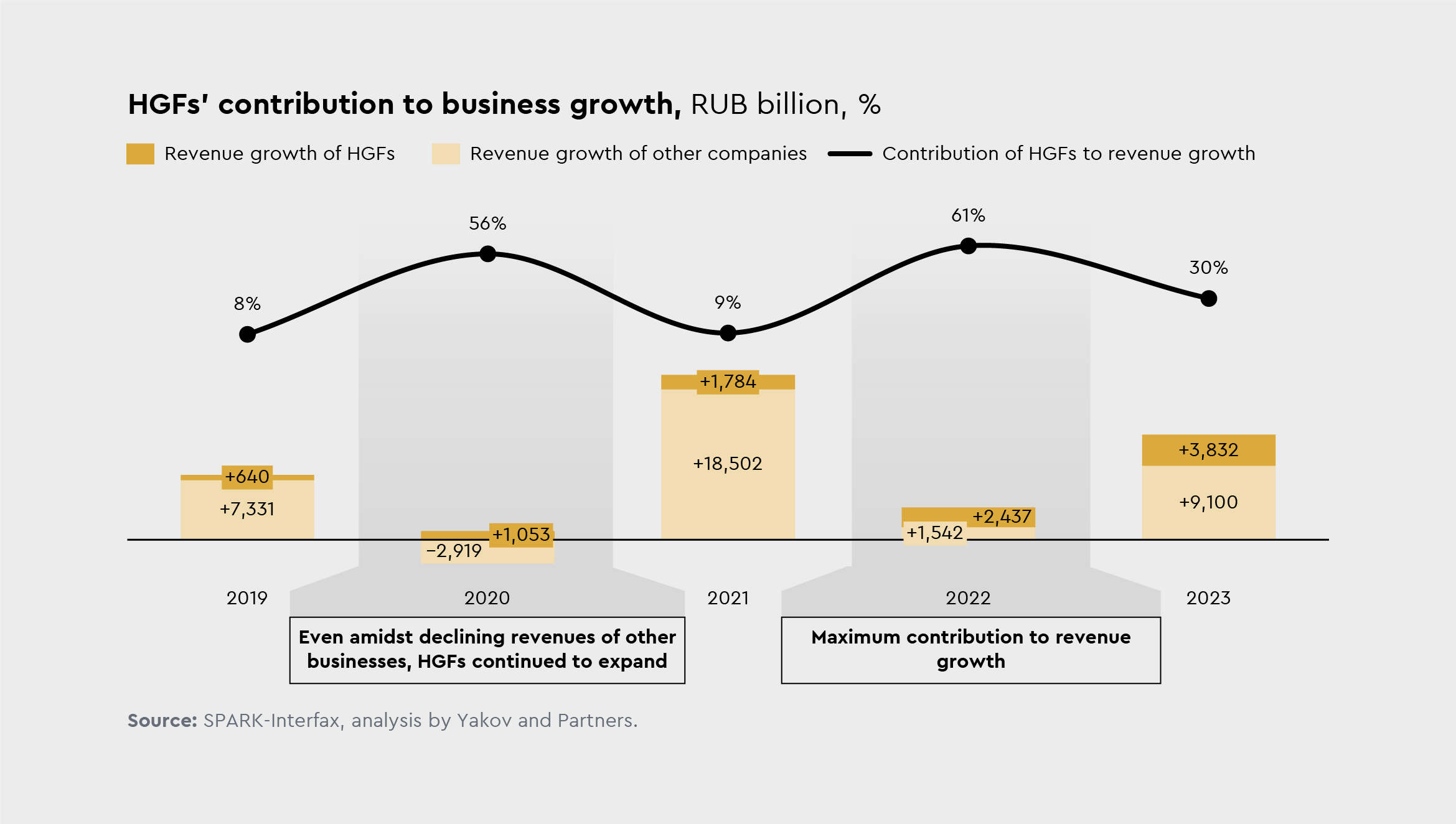

Drawing on data from 24,000 companies, the study revealed that high-growth firms have been driving about 23% of total revenue growth in various years, and during times of crisis, their impact surges, contributing over 50%. In addition to their direct economic impact, HGFs open up new opportunities, helping to make the world a better place: many of them uncover promising niches and develop alternative business models, thus expanding the horizons for other companies, consumers, and society as a whole, the experts say.

"We conducted over 40 in-depth interviews, which showed that the founders of high-growth firms are ambitious leaders who know how to achieve their goals despite the serious challenges they face. The key success factors they named are the ability to choose the right promising market, prompt decision-making, and a motivated, close-knit team"

Elena Kuznetsova, Director of Research Institute at Yakov and Partners

According to the authors of the study, swift decision-making and the ability to adapt to changing conditions and focus on unique products are essential for a high-growth firm's success. Most HGFs demonstrate sustained growth even in times of economic turbulence, carving out new niches and setting industry standards, which are followed by other companies in the market.

The study also looked at the sectoral distribution of high-growth firms: contrary to expectations, both the innovative fields and traditional sectors – from agriculture to transport – are witnessing the emergence of new promising players. It is also worth noting that thanks to their own investments in development and motivated teams, more than 70% of HGFs managed to thrive without any dependence on large businesses.

However, as highlighted by the authors, such companies face some major barriers to growth, with a lack of financing being the most crucial one. Analysis has shown that Russian HGFs borrow 5 to 38 times less on a long-term basis than their international peers do. With the interest rates so high, this is becoming a critical factor that prevents businesses from scaling up.

The SME and SME+ segment suffers the most from the financing squeeze: companies earning under RUB 5 to 10 billion in revenue (varies sector to sector) have the hardest time trying to take out loans. The chances of borrowing significantly improve once that threshold is passed, but they are still at least 10% lower than those of the major Russian businesses, the experts say.

"The persistent lack of financing compels firms to pursue business models that make borrowing unnecessary. This may be a good idea for individual businesses, but it’s not applicable on a national scale, since this approach leads to missed growth opportunities in the industries critically dependent on investment and working capital financing, such as manufacturing, construction, and infrastructure development. With the current cost of capital, the problem has sharply escalated: many companies have been forced to push back or abandon the investment projects that need to be financed by borrowing"

Egor Bespiatov, Partner at Yakov and Partners

However, removing or mitigating this barrier, as well as some other hurdles, including a shortage of workforce and competencies, will help HGFs become more numerous and realize their potential sooner. It is important to note that high-growth firms often thrive in new, yet-to-be-explored niches – they do not wrestle market ground from their rivals, the experts say.

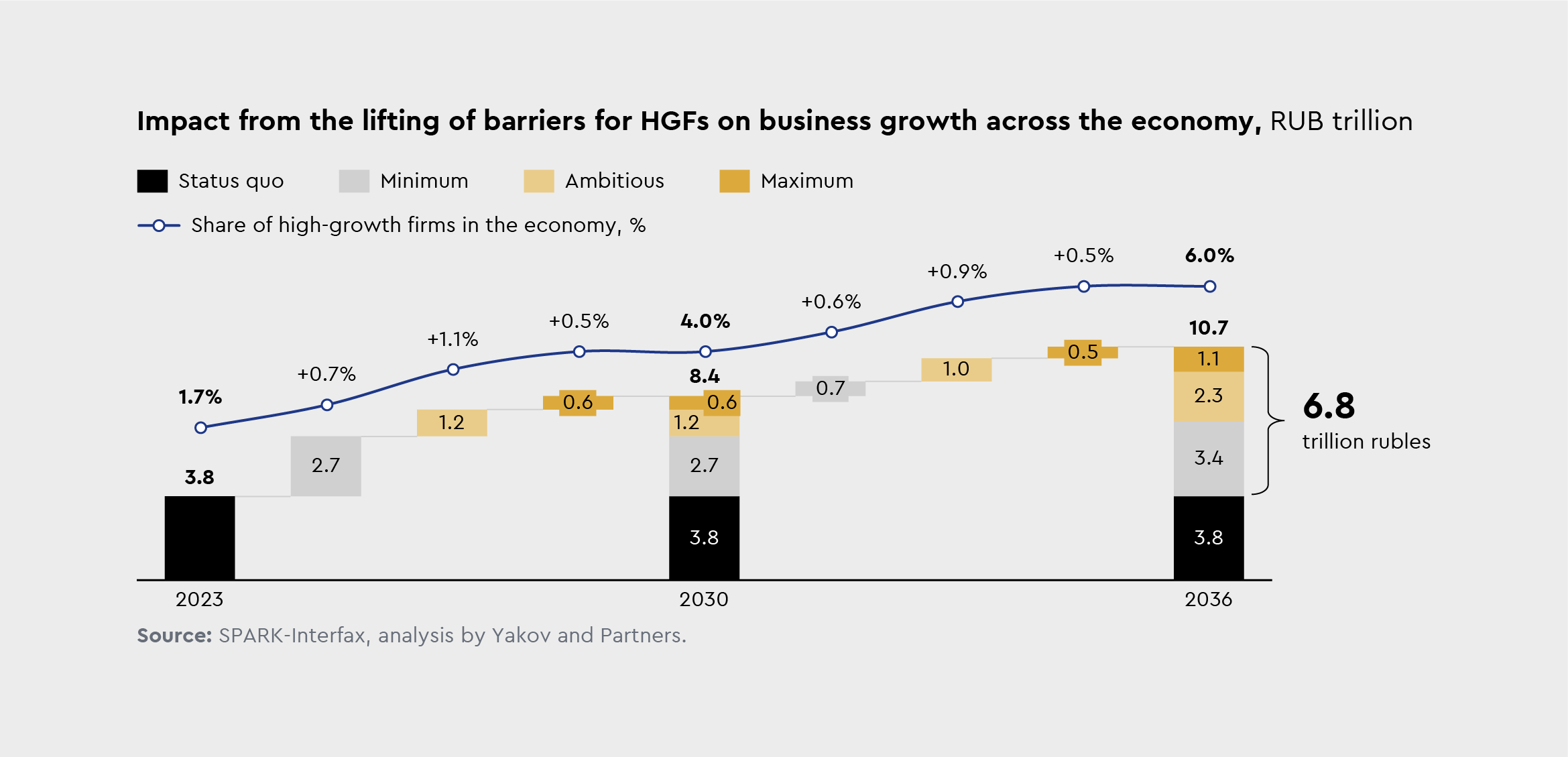

"Therefore, these companies directly contribute to GDP growth. We estimate that lifting the growth barriers for HGFs can have an economic impact of RUB 2.7 to 4.5 trillion in 2030, and RUB 3.4 to 6.8 trillion annually by 2036. On top of their considerable economic impact, high-growth firms are becoming places wh ere talent is forged, as they offer fast-track career advancement and engage young people in the creation of new solutions. We can confidently say that high-growth firms are truly the fulcrum of the Russian economy"

Igor Piun, Partner at Yakov and Partners