European countries have launched active regulatory and financial interventions in an attempt to mitigate the fallout from the energy crisis. But the total cost of easing the energy crisis is likely to exceed EUR 1 trillion, or the EU will face a similar scale of GDP decline and the risk of a prolonged depression, according to a study by Yakov & Partners, “The European Energy Balance in the New Reality”.

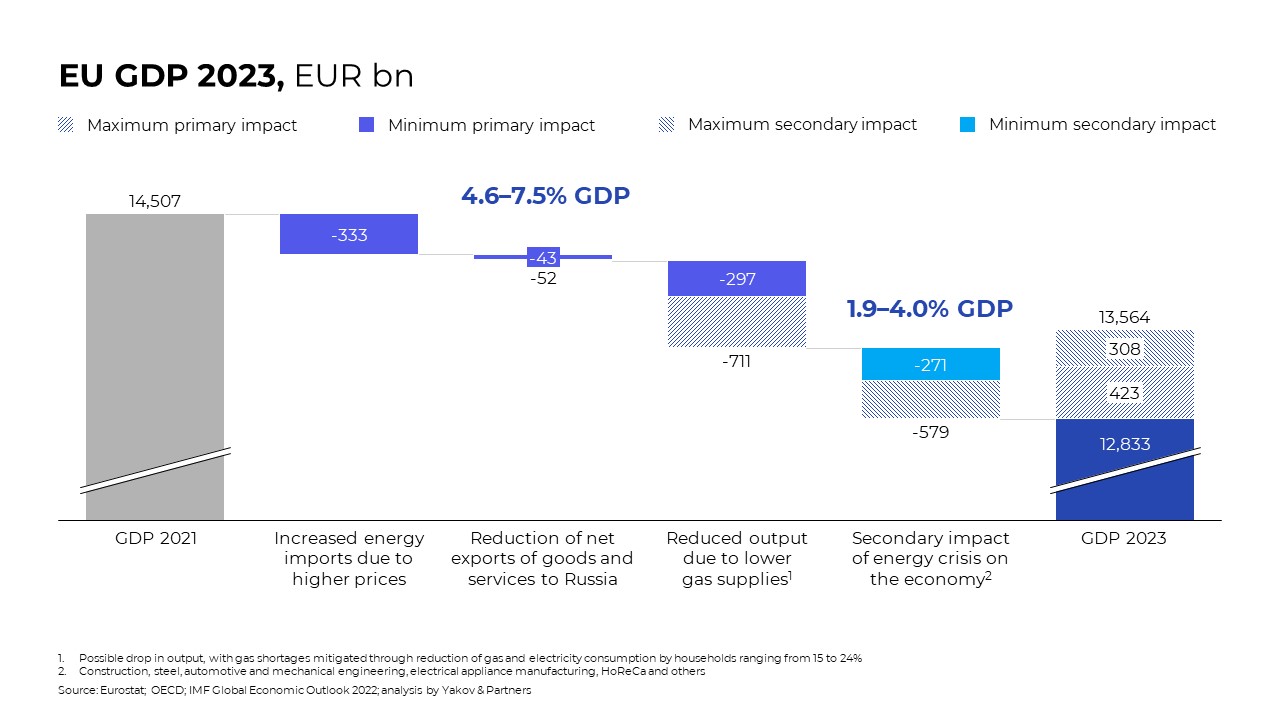

In 2023, European governments are also expected to continue their policy of manually managing the economy or to face a decline in GDP of 6.5% to 11.5% (EUR 0.9–1.7 trillion) caused by higher energy imports, lower production and exports, as well as secondary impacts on related industries. A crisis of this magnitude is likely to cause a rise in bankruptcies and a domino effect in the financial sector of the economy, a drop in consumer demand and a scaling back of investment programs by businesses, and to bring about an overall depression.

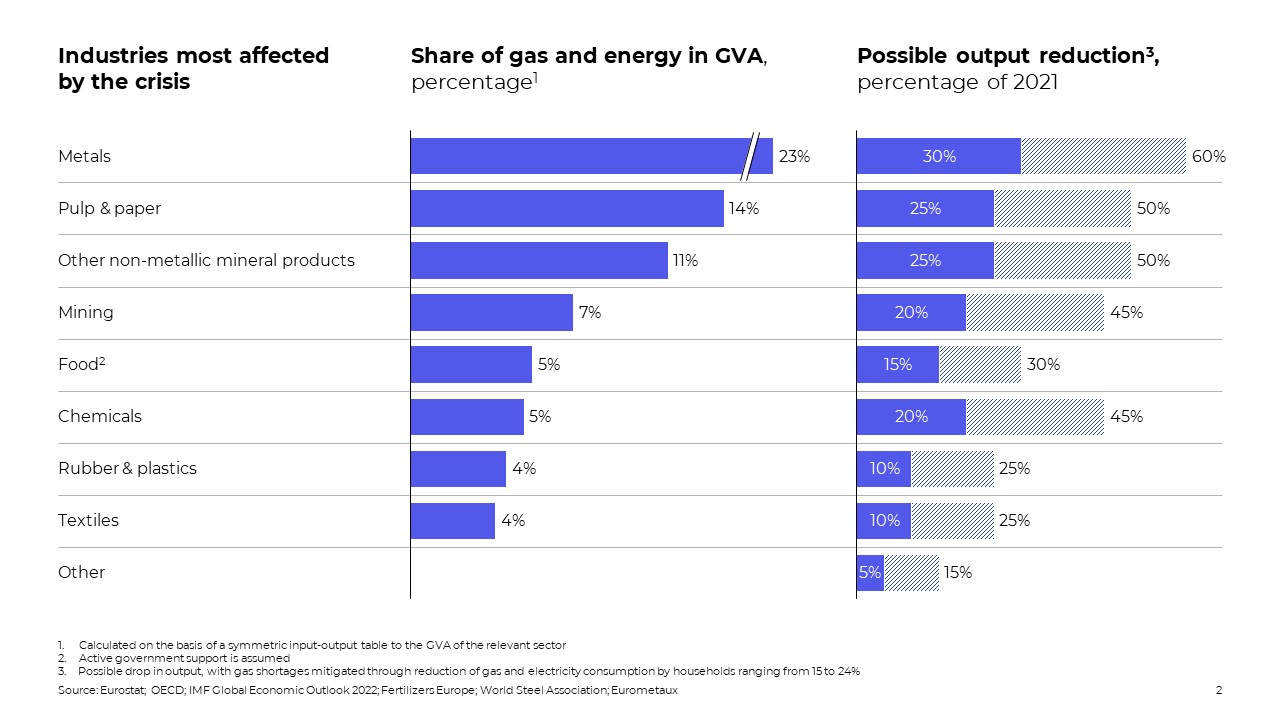

The authors of the study attribute the greatest adverse impact to the fact that a number of the most energy-intensive industries may become uncompetitive due to a shortage of gas and rising energy costs in general. Depending on how events unfold, these industries will have to cut production by 10–60% of their 2021 levels. GDP decline caused by higher energy prices and physical shortage of energy may exceed 1% as early as by the end of 2022.

Shutdown of businesses would, in turn, cause job cuts. In the food industry, the cuts could affect 1.4 million people, in the pulp & paper industry – 800,000 people, in metals and non-metallic mineral products – 600,000 people, respectively.

EU governments have already announced programs worth more than EUR 300 billion to mitigate this worst-case scenario, at least partially. However, as noted in the study, the projections for 2022–2023 are significantly higher. “Already today we are seeing double-digit inflation in Europe, closures of some industrial facilities, and higher debt service costs. Total EU expenditures on compensating businesses and households for gas costs, additional payments to employees of shut-down companies, investments to reduce energy dependence and other measures could total EUR 1–1.6 trillion in 2023. This is on par with potential GDP loss in the absence of an active crisis response, but should make it possible to avoid a domino effect and further weakening of the economy. At the same time, interventions would push up the budget deficit to EUR 2 trillion in annual terms, and the debt burden of the EU public sector to 100% of GDP,” – sums up Elena Kuznetsova, partner at Yakov & Partners and co-author of the report.

You can learn more about the findings of the “European Energy Balance in the New Reality” study here.