Russia's steel industry managed to make up for the export sales missed in 2021–2023 by taking advantage of domestic demand growth and falling import. But nevertheless, the industry's sustainable development remains under pressure in both monetary and physical terms. A stronger role of the metal-intensive industries, including the machinery industry, in the economy could put them in a position to serve as key growth driver for the steel industry. These are the findings of the study titled Commercialization Outlook for Russian Steel: Development of Domestic Consumption and Search for New Markets, published by Yakov and Partners experts.

The Russian iron and steel industry, which contributes nearly 5% to the country's GDP, has faced a dramatic redesign of its export geography amid a fast-changing market environment. Russia exported 11 million tonnes less of steel in 2023 than it had in 2021. Having lost the high-margin markets in Europe and the United States, the key industry players were compelled to look to Asia, the Middle East, and Africa for new export opportunities. The problem is that the high logistics costs and lower prices in the Asian markets cut into the profit margin of the Russian steel exporters.

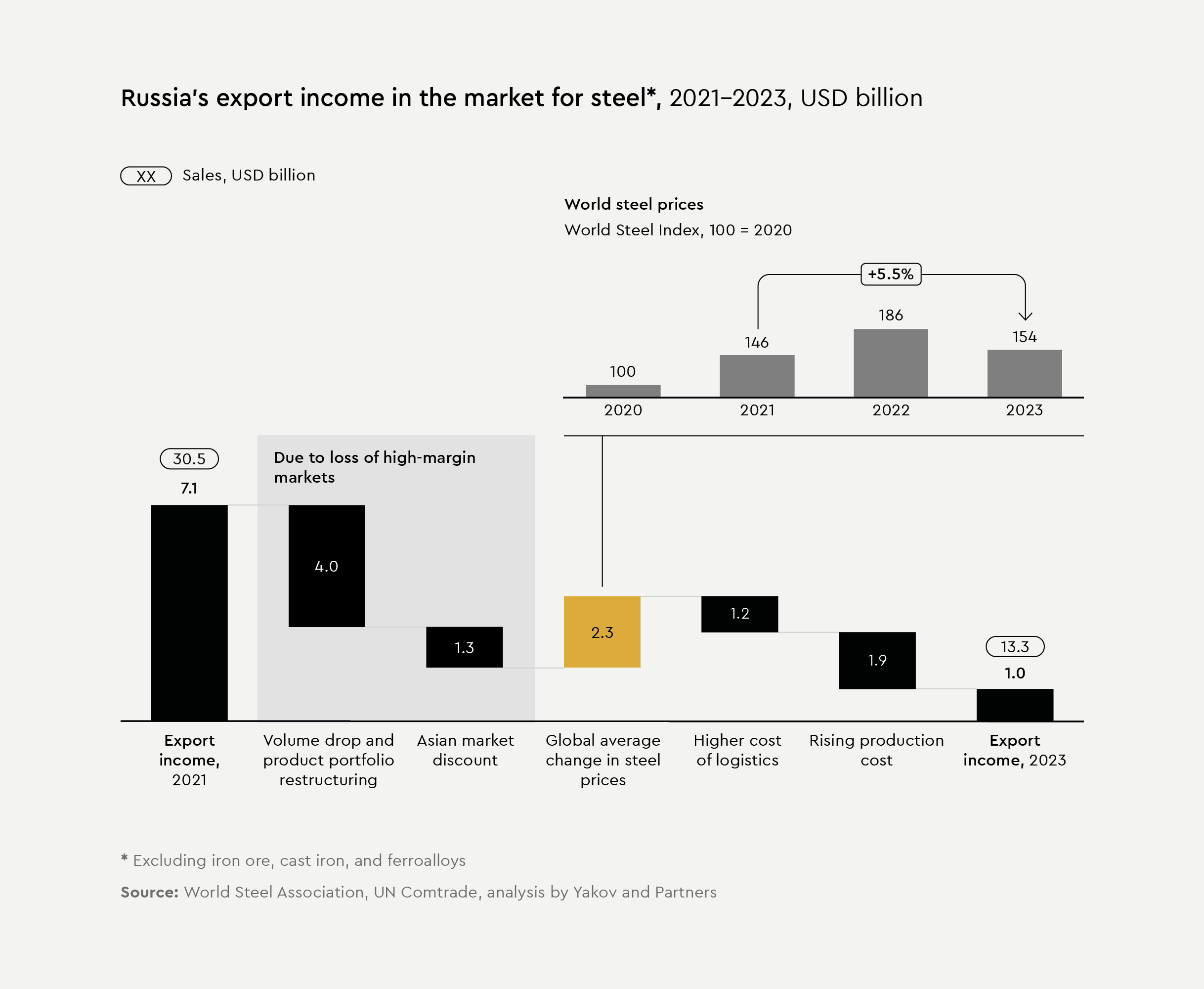

The loss of the high-margin markets, coupled with higher all-in costs, has led to a sevenfold drop in export income, fr om USD 7.1 billion to USD 1 billion. While export volumes shrank 35%, profitability of the exports is now reduced to less than 1/3 of its former value.

"The most substantial loss of export income – USD 5.3 billion vs 2021 – came with the volume drop and product portfolio restructuring on the back of the loss of highly profitable export destinations for Russia's steelmaking industry. Reduced export to the premium markets left Russian steel companies no choice but to sell their steel to customers in Asia, wh ere, as early as in 2021, the market prices were 20% to 25% lower across the product portfolio, compared to the US and Europe"

Nikita Natrusov, partner at Yakov and Partners

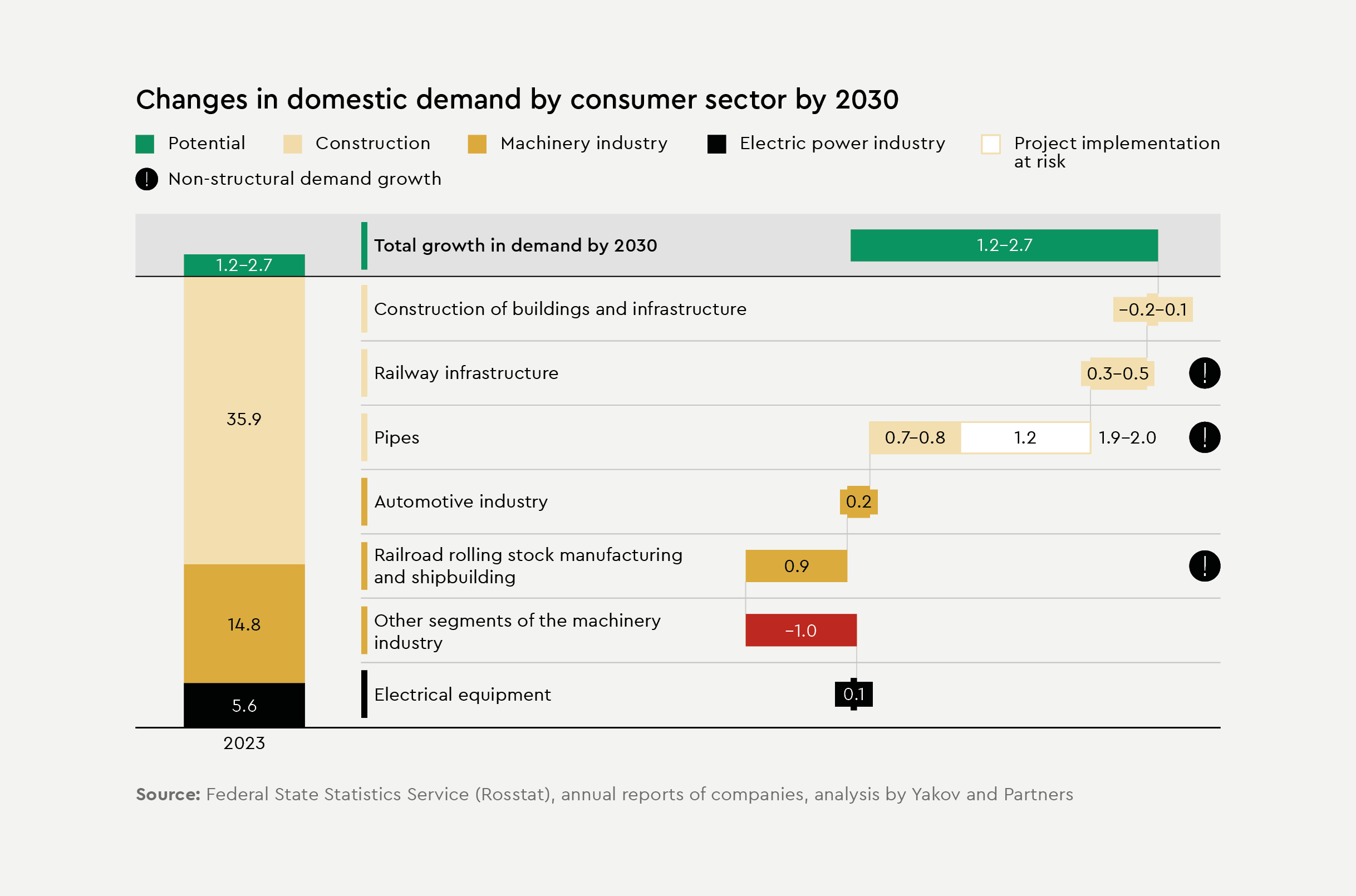

On the other hand, rising domestic consumption of steel in 2023 largely made up for the export revenue loss. Russia's domestic market for ferrous metals came to a total of 56.3 million tonnes last year. Of that amount, 35.9 million tonnes were consumed in the construction industry, including buildings, infrastructure, railways, and pipe manufacturing, 14.8 million tonnes in the machinery industry, including the automotive, railroad rolling stock manufacturing, shipbuilding, and other segments, and 5.6 million tonnes in the electric power industry.

In view of the current economic realities, the analysts foresee an increment of around 1.2–2.7 million tonnes in domestic steel consumption by 2030. Construction and mechanical engineering companies are likely to emerge as key consumers of steel in the next few years. Additionally, several major rail infrastructure projects are on their way that will require considerable amounts of steel. It must be noted, however, that many of those projects will not be systemic in nature, and so demand will decline in the respective segments by 2032.

The authors of the study further note that, in the current environment, characterized by decreasing profitability of steel sales and stagnant demand, steel industry players would be well advised to rethink their strategies with a focus on discovering new pockets of growth. International practice suggests that successful companies in this industry are never driven solely by external demand for steel products, but also take advantage of diversification opportunities as a way to secure the stability of income streams.

"Investments in steel market development, made possible by having both low value-added product manufacturers and end consumers within the same group of companies, offer a path toward more stable cash flows and more profitable commercialization"

Egor Bespiatov, director at Yakov and Partners

Following in the footsteps of the industrialized economies, the option is open for the steel companies to integrate machinery manufacturing assets into the larger fold of a group of companies, with a view to maximize profitability and make it less volatile. While the ferrous metals market shrunk nearly 30% between 2021 and the first half of 2024, the machinery industry showed robust growth: the output of motor vehicles and large-size electrical engineering equipment nearly doubled by unit count, and the output of freight cars climbed 40%. The other benefit, according to the analysts, is that, with companies created within the perimeter of the group, profit stays in the company and it is possible to keep all assets profitable. An average of 20% to 40% of the profit margin is lost per tonne of steel in 2024 when it is exported to Asia, as opposed to being used for machinery manufacturing.

"Growth in the machinery industry could provide a steady, albeit insignificant in terms of physical volume, rise in demand. Moreover, the machinery industry would stimulate the output of high-margin, special-purpose steel grades potentially exportable to industrializing nations. But the important point is that, unless steps are taken to improve operational efficiency and stabilize financial performance, the trend will persist in which business profitability will continue to decline and tax revenues will shrink"

Nikita Natrusov, partner at Yakov and Partners