As 2022 has shown, global economy is pivoting fr om globalization to clusterization, and the trend will only accelerate. As Dr. Ngozi Okonjo-Iweala, Director-General of the WTO said at the Africa Adaptation Summit in Rotterdam, the outlook for global trade is bleak. The disruption of global supply chains in food, microelectronics, automotive components, energy, and many other industries, is forcing countries to consider technological sovereignty.

Although the pharmaceutical industry has largely escaped the disruptive changes of recent times, excessive specialization and, consequently, dependence on leading countries could hinder the growth of national economies and healthcare systems. For instance, the US accounts for 46% of the global pharmaceutical market, followed by China (8%), Japan (6.8%), and Germany (4.9%). Thus, the rest of the world accounts for less than 35% of the market.

The US lead is largely due to the focus of American companies on the development of original innovative drugs. Since 2008, US companies have conducted nearly 150,000 clinical trials. By comparison, Chinese companies conducted only 23,500 studies during the same period. These market realities create a certain imbalance in the current availability of medicines, and significantly lim it it in the future.

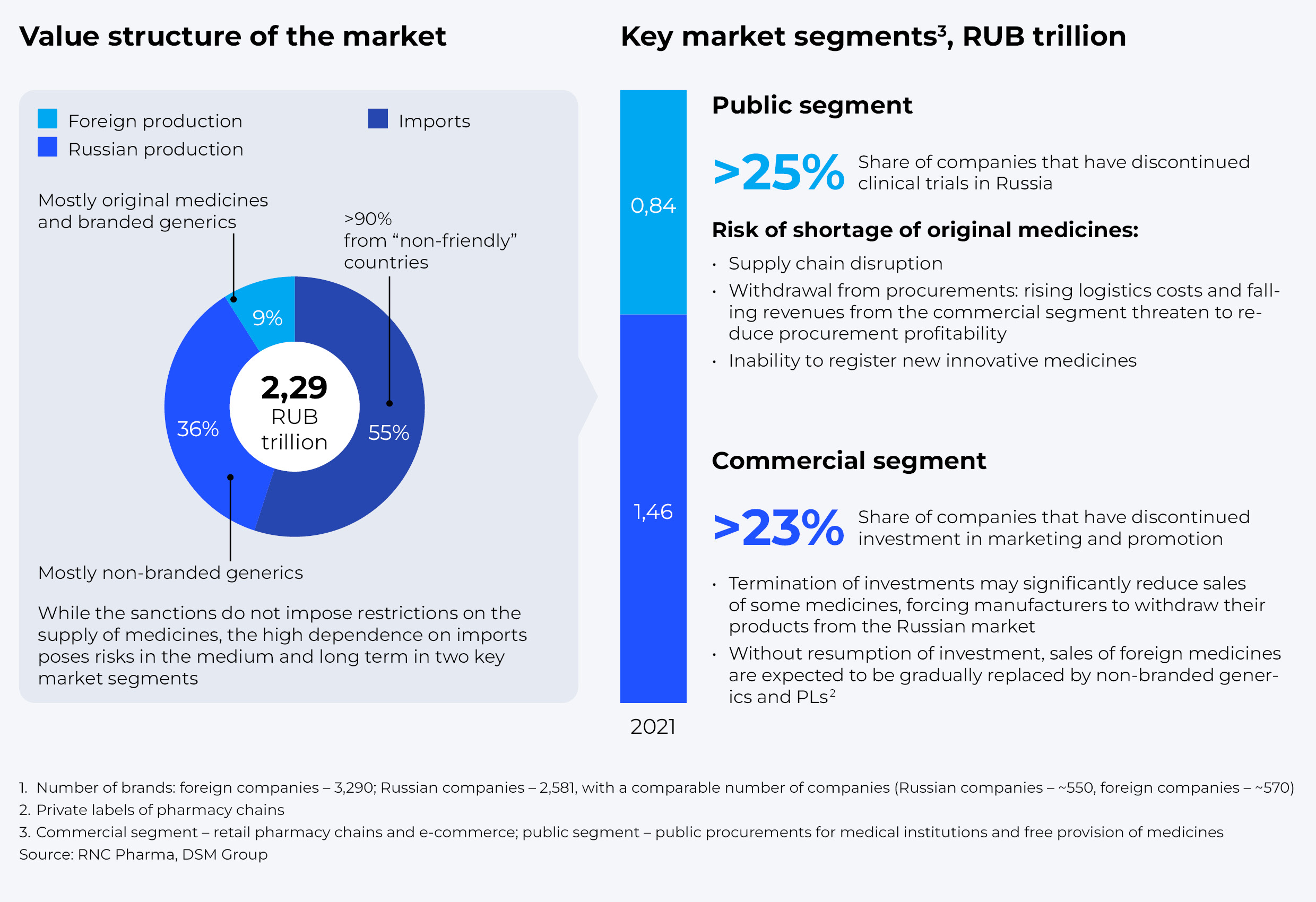

According to our estimates, in 2022 the Russian market will be worth around RUB 2.8-2.9 trillion. It is shared out by about 550 Russian and 570 foreign companies. At the same time, if we consider specific products, about 50% of the drugs are supplied from the so-called “unfriendly” countries.

The Russian drug market consists of two key segments: 1) retail pharmacy chains and e-commerce, and 2) public procurement for medical institutions and subsidized pharmaceutical provision. Combined, they amounted to about RUB 2.3 trillion last year. Despite the absence of direct restrictions, both segments are already facing numerous difficulties, as more than 10 companies from “unfriendly” countries, taking up more than a quarter of the market, have announced termination of clinical trials in Russia. That could entail a shortage of innovative original drugs in the medium-to-long term, as it would be impossible to register any of them. Besides, most of those producers have also discontinued investments into marketing and promotion, which might subsequently lead to complete withdrawal of drugs from the Russian market.

Given the trends, it is expected that about 300 innovative drugs for advanced therapy will fail to reach the Russian market over the next 10 years. This dictates the need to develop own production. At the same time, current macroeconomic context and national technological maturity open up opportunities for Russia to ramp up the development of own innovative pharmaceutical production.

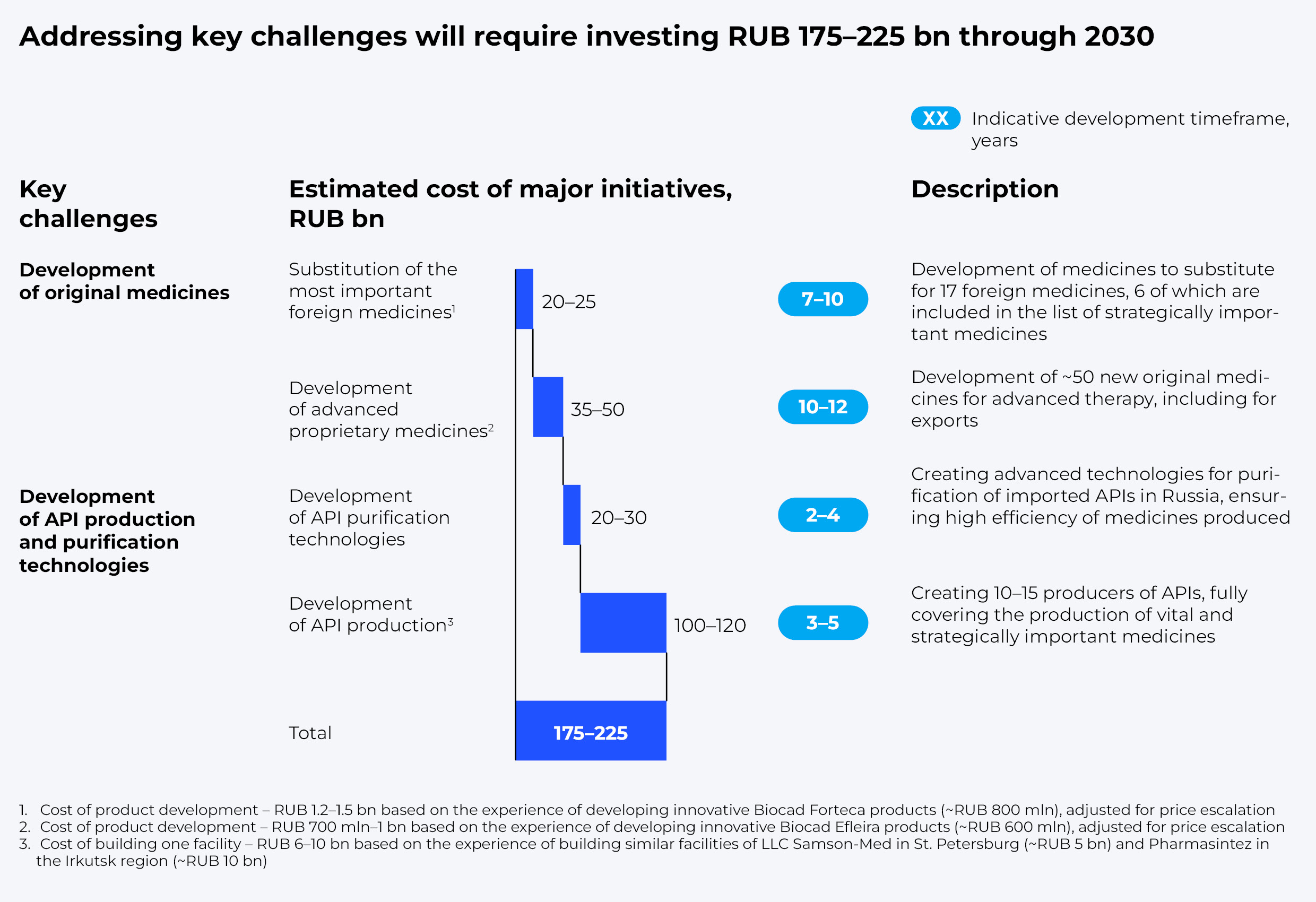

Pharmaceutical development in Russia will require addressing four key challenges across main value chain stages.

Development of Medicines

Most of the added value of original medicines is created at the stage of basic scientific research. Most research centers are located in the US and Europe and team up with major international pharmaceutical companies (Big Pharma), which actively invest in basic research on their own and with government support. And yet, even though Russia has its own research centers, its spending on basic research (as a share of GDP) is 3 to 11 times lower than that in Western countries.

As a result, the share of drugs with successfully completed preclinical trials in Russia is less than 3%, while the market share of original Russian drugs is less than 2%.

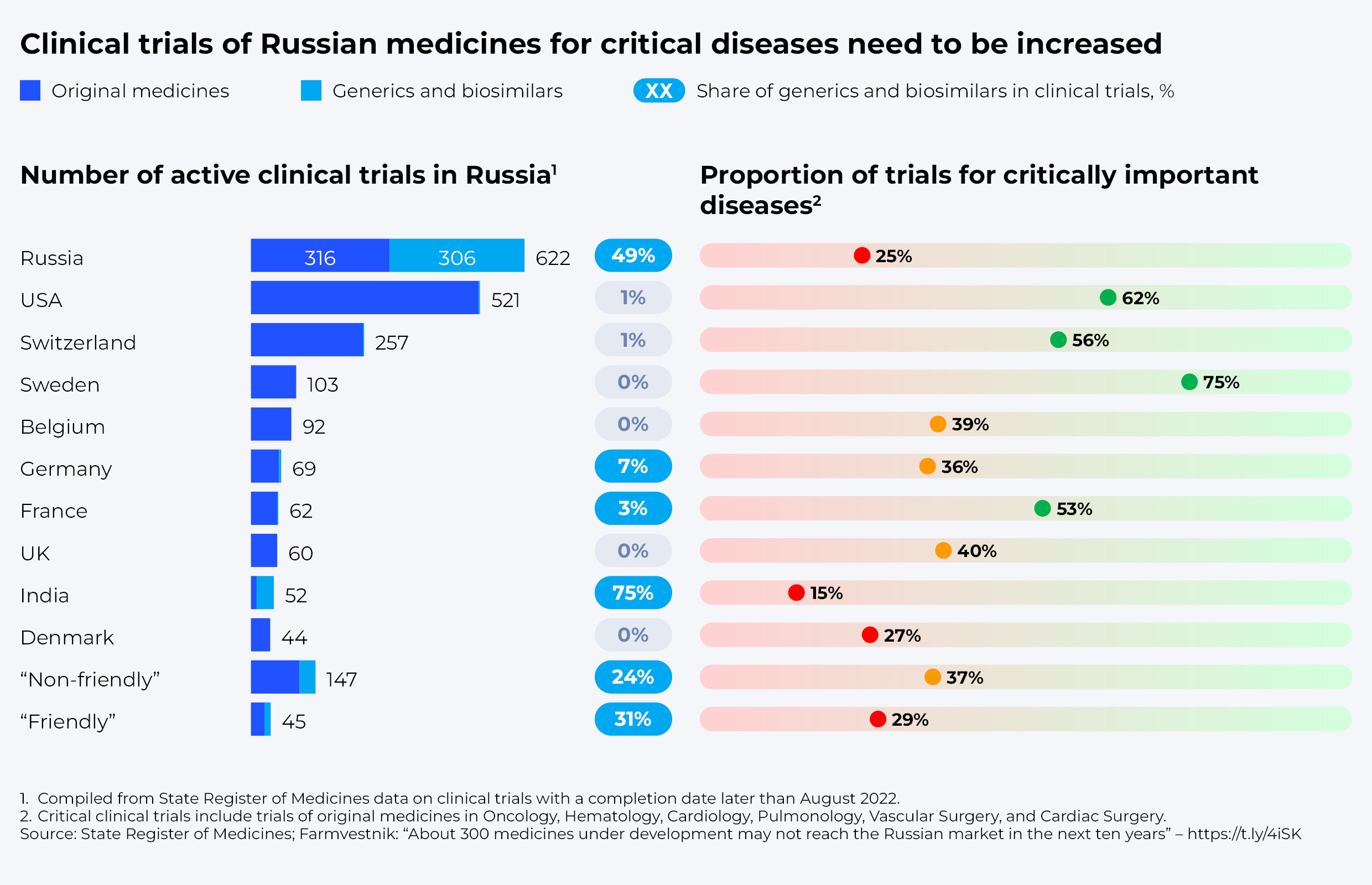

The insufficient focus of Russian companies on innovative advanced therapy drugs manifests itself in the structure of clinical trials conducted in this country. About 2,100 active clinical trials are currently under way in Russia, with completion scheduled beyond August 2022. Russian companies account for about 600 of those, while over 1,300 trials are being conducted by companies from the United States and other Western and “unfriendly” countries.

At the same time, about half of the trials conducted by Russian companies are aimed at registering generics and biosimilars (bioequivalence), and only 25% of original drug trials are aimed at treating critical illnesses, including oncology, cardiovascular diseases, etc. In comparison, 99% of research conducted by US companies deals with original drugs, more than 40% of which are original oncology drugs.

Yet, the traditional approach of large-scale public funding in Russia may not prove as effective. Even now, the share of federal funds in this industry is 1.5 times higher than in Western countries. Thus, it is necessary to develop other mechanisms to stimulate private investment in R&D.

The cost of research in Russia is significantly lower than in Western countries. That and a solid scientific base are conducive to a quick launch of import substitution and further expansion into new markets, which is a unique advantage.

Setting up a state-level mechanism to manage the development funnel in such a way as to provide the market with innovative drugs should be a vital step in addressing the challenges related to insufficient funding for basic research and limited focus on the development of own original drugs. This approach could be facilitated through a wider use of digital technologies in basic, preclinical, and clinical research, rigorous quality control and pharmacovigilance processes, as well as mandatory adjustment of incentives in accordance with national priorities. For example, in China, 53% of research focuses on oncology and prevention and treatment of cardiovascular diseases.

Production

Over the past ten years, Russia has been ramping up its own production capacity, not least through engaging foreign companies. The Association of International Pharmaceutical Manufacturers (AIPM) has estimated that during that period, foreign companies invested up to a trillion rubles in various localization projects in Russia.

Thirty pharmaceutical plants were commissioned between 2010– 2020, and 20 of them were built in cooperation with [AIPM members](https://www.contractpharma.com/issues/2022-03-01/view_features/russia-is-braced-for-a-new-localization-wave/). That roughly accounts for half of the 72 production sites operating [today](https://www.contractpharma.com/issues/2022-03-01/view_features/russia-is-braced-for-a-new-localization-wave/).

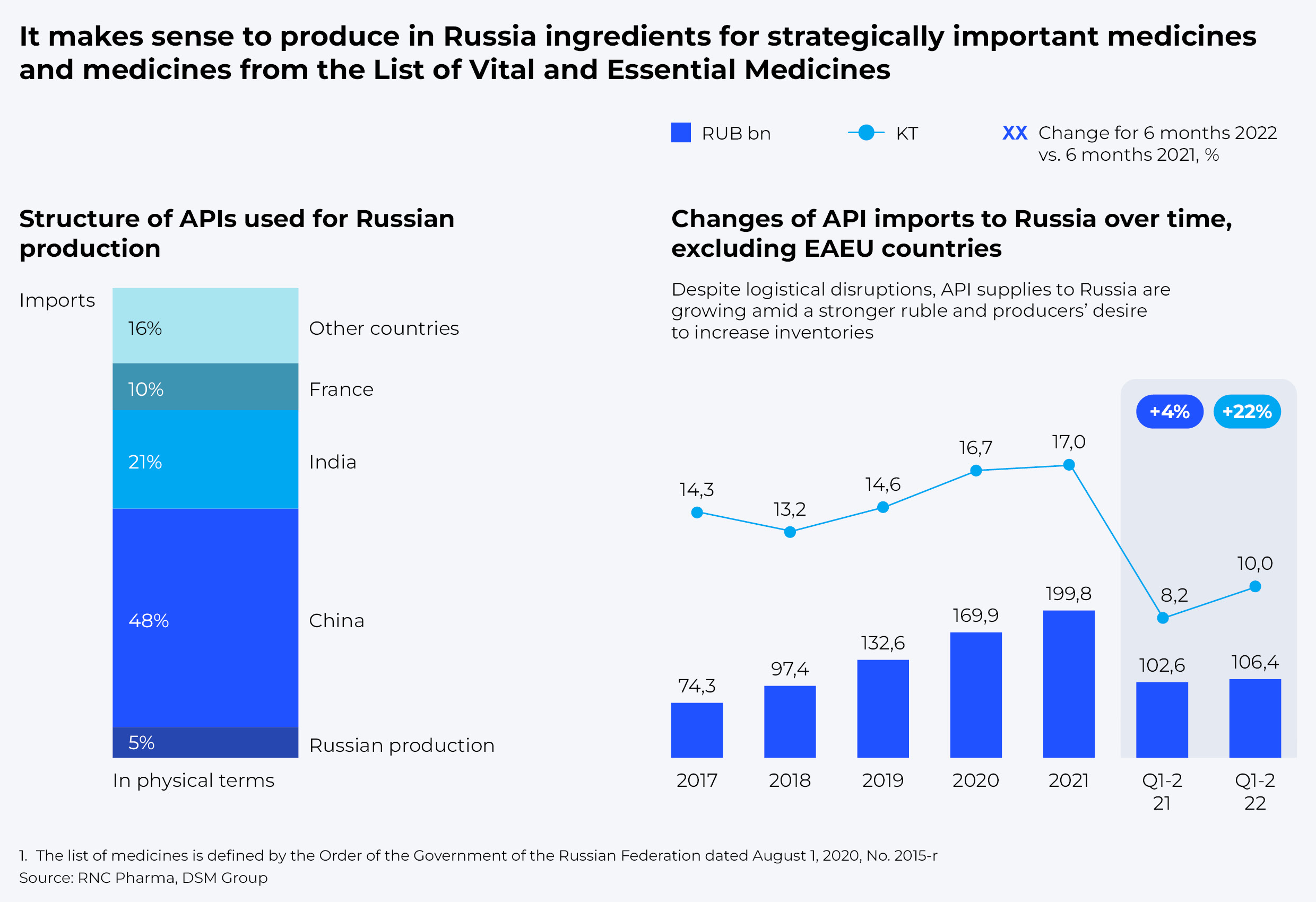

And yet, the domestic market is still 95% dependent on the imports of active pharmaceutical ingredients (APIs). High reliance on imported APIs also hinders national drug sovereignty. Although 69% of the APIs are imported from India and China, building up our own capacities could become an imperative in the medium term. Remarkably, despite logistical disruptions, API supplies to Russia are growing amid a stronger ruble and producers' desire to increase inventories to stave off possible risks.

Given the costs associated with launching new production capacities, total substitution of all imported APIs seems impractical. Yet, the first priority would be to achieve a full production cycle of strategically important medicines and those from the List of vital and essential medicines. Purification technologies and capabilities need to be developed for production of other medicines from imported raw materials.

According to our estimates, development of API purification technologies in Russia, which ensure high efficiency of produced drugs, may take from two to four years and require between RUB 20 and 30 billion in direct R&D investments. However, full-scale API production would require setting up 10 to 15 facilities to guarantee production of 100% of vital and essential medicines and strategically important drugs. That could take from three to five years and cost about RUB 100–120 billion.

Distribution

In terms of distribution, the most important criteria for bringing any particular drug to the market are guaranteed demand and a premium for the producer. Today, out of almost 5,900 drug brands registered in this country, only 2,581 are owned by Russian companies, which indicates a high market potential in terms of substitution. Even though more than 20 foreign drugs were replaced in 2021 alone, the share of domestic drugs in Russia is still rather small.

Taking into account the diminishing activity of foreign companies, it makes sense to work towards import substitution of medicines that hold leading positions in the public segment, especially those included in the list of strategically important ones.

At the same time, there are certain measures that could help develop the distribution segment of the market. First off, it is guaranteed demand for products at prices that could support profitable production – for instance, Russian producers could be given wider access to hospital procurement and subsidized pharmaceutical provision programs. This measure could significantly mitigate the risk of shortages of foreign drugs for the period of import substitution. Another major initiative could be regulatory support of exports, primarily through aligning EAEU GxP standards with those in other countries, including Asia, Latin America, the Middle East, and Africa.

Together, these measures could have a significant impact on the distribution structure, hence, the availability of medicines for citizens.

Perspectives and the way forward

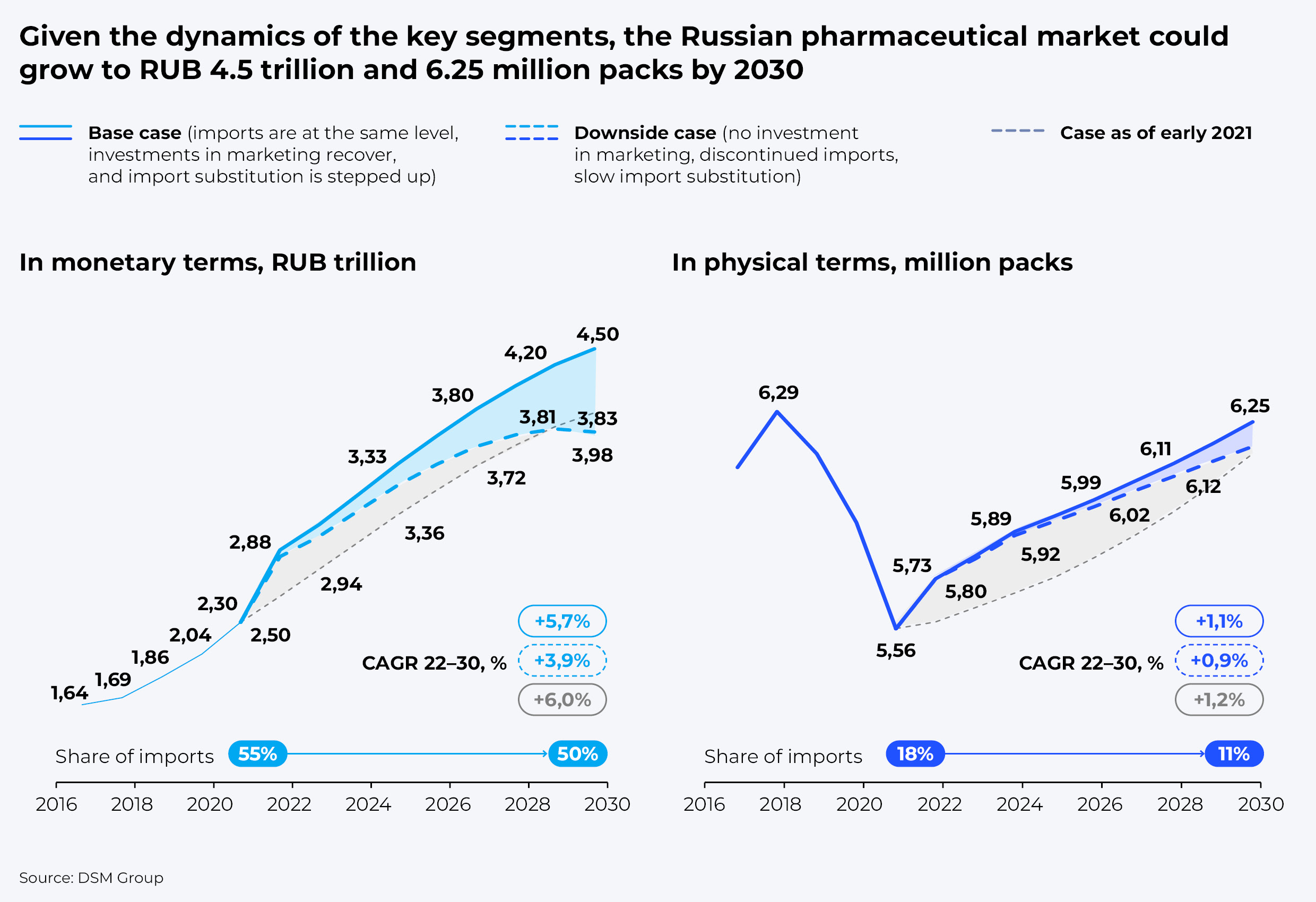

Given the dynamics of key segments, we expect the Russian pharmaceutical market to grow to RUB 4.5 trillion, or 6.25 billion packs by 2030 in the base-case scenario, and to RUB 3.9 trillion, or 6.12 billion packs in the downside scenario, respectively.

In monetary terms, the base case assumes an average annual market growth of 5.7%, providing imports remain at the same level, investments in marketing are renewed, and import substitution is stepped up. In the downside scenario, growth would not exceed 3.9%. In this scenario, according to our estimates, the Russian market will shift towards cheaper unbranded generics and biosimilars due to the gradual exit of foreign companies.

All in all, development of advanced therapy drugs and localization of the most significant ingredients, along with a number of supportive measures, could help reduce the share of imports to 50% by 2030. We estimate it could require RUB 175 to 225 billion in investments, with up to 80 billion provided by the state, which equals about half of the funds required for basic research and development.

Efforts towards achieving optimal growth could be organized into three workstreams:

• stimulating basic research into new types of advanced therapy drugs (cell and gene therapy, other biological products); • replacing critically important foreign drugs within the public segment; • jumpstarting production of APIs for vital and essential medicines and development of purification technologies for imported APIs.

Implementing a comprehensive program could take from 10 to 12 years, yet it should help bring down the dependence of the public segment on imports to less than 20%, increase the share of Russian and localized drugs to 75% or higher, and fully localize API production for oncology and other vital and essential medicines.

Required state support measures could be categorized into financial incentives and critical regulatory support:

• aligning GxP standards with those in “friendly” countries to facilitate exports of Russian medicines and imports of APIs; • introducing mandatory pharmacogenetic testing for citizens and adjustment of treatment standards; • accelerating transition to e-prescriptions and integrated health systems; • raising awareness of pharmacovigilance among medical professionals and patients; • catalyzing development of new drugs for advanced therapy, as well as substitution of critical imported medicines (e. g. oncology drugs); • encouraging the use of modern methods of basic and clinical research (digital technologies, quantum computing and modeling, bioprinting, etc.); • supporting the scaling-up of existing innovative productions to break into foreign markets, among other things.

The seven steps outlined above could help Russia become one of the industry leaders. However, the history of national development programs in the pharmaceutical industry suggests that success hinges on a flexible and agile approach to the interaction between industry players and the state. Close cooperation between government agencies and major domestic companies could help step up industry development in a way that would secure national drug sovereignty and lay the groundwork for promoting domestic drugs in foreign markets.